sales@intentmarketresearch.com

+1 463-583-2713

Robotic Total Stations Market to reach USD 988.3 Million in 2030, at a CAGR of 6.2%

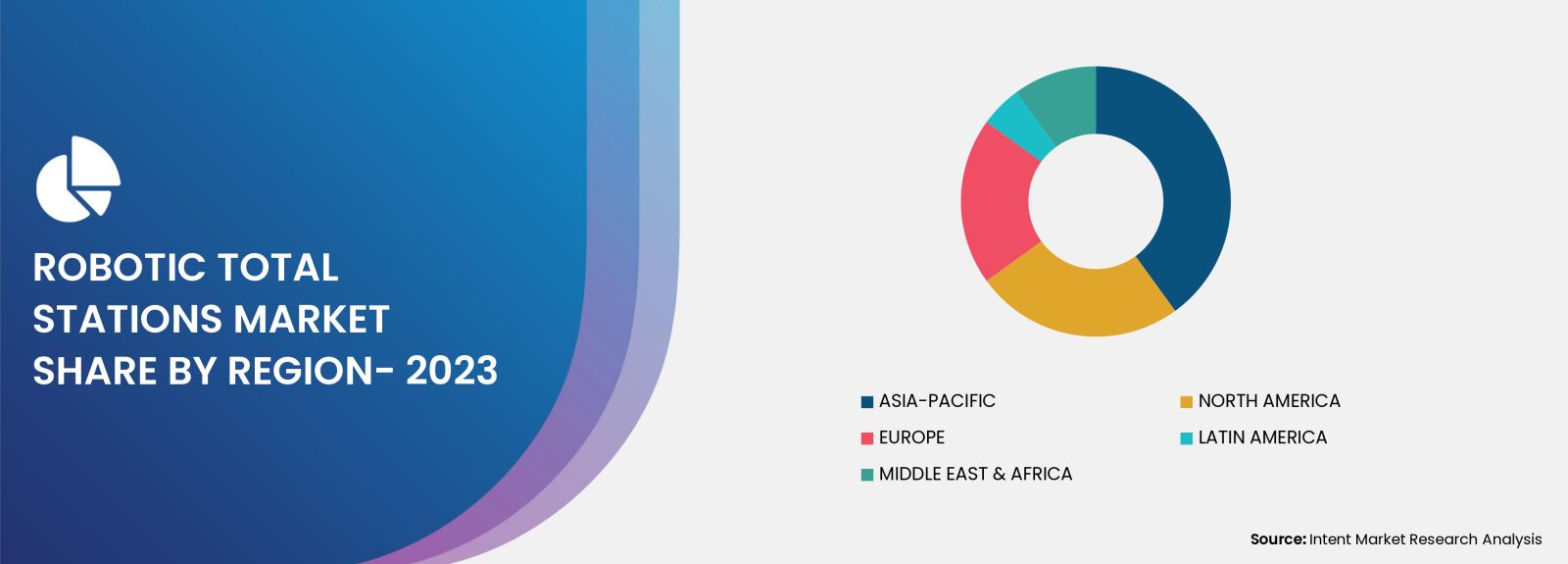

The Robotic Total Stations (RTS) Market stood at USD 648.7 million in 2023-e, and is projected to grow at a CAGR of 6.2% through 2030 to reach USD 988.3 Million. The construction industry is experiencing substantial growth globally, propelled by increased investments from private entities and robust support from regional governments. This positive trend has significantly influenced the demand for the robotic total stations market in 2023. Robotic total stations prove valuable in forensic mapping for incidents such as fires and road accidents. The data gathered by these stations can undergo thorough analysis using mapping software, providing detailed insights into the incident.

Based on the solution, the hardware segment will capture a significant share of the robotic total stations market in 2023. High demand from the end-use industry such as construction and transportation are expected driving factors of the segmental growth.

Robotic total station is widely used in industries such as construction, mining, utilities, and transportation. The robotic total stations are widely used for surveying and mapping for vertical and horizontal angles and the distance between the robotic total stations and a particular target point in the construction industry. In the mining industry, a robotic total station is used to check elevation, calculate infrastructure dimension, and check the fixing of installations.

North America has seen significant investments in infrastructure projects, including road construction, bridges, and urban development. The need for accurate surveying and layout in these projects drives the demand for high-precision instruments like RTS. The construction industry in North America has been growing, driven by residential, commercial, and industrial projects. RTS is widely used for construction layout, quality control, and monitoring, contributing to its demand. In May 2023, the US government has announced over USD 220 billion, for infrastructure projects across the US.

Major players operating in the global robotic total stations market are Carlson, Changzhou Dadi Surveying, Hilti, Leica Geosystems, Pentax Surveying, South Surveying, Stonex, Suzhou Foif, Topcon, Trimble, among others. The global robotic total stations market is a partially fragmented market with the presence of several small and medium-sized players specifically from China.

The top players in the market are adopting strategies such as new product launches to improve their market share. For instance, in September 2022, Trimble introduced its innovative robotic total stations Trimble Ri. The instrument's flexibility and upgradeability makes high-end total station technology more accessible and sets a new scalability standard for use across the construction industry.

Available Formats