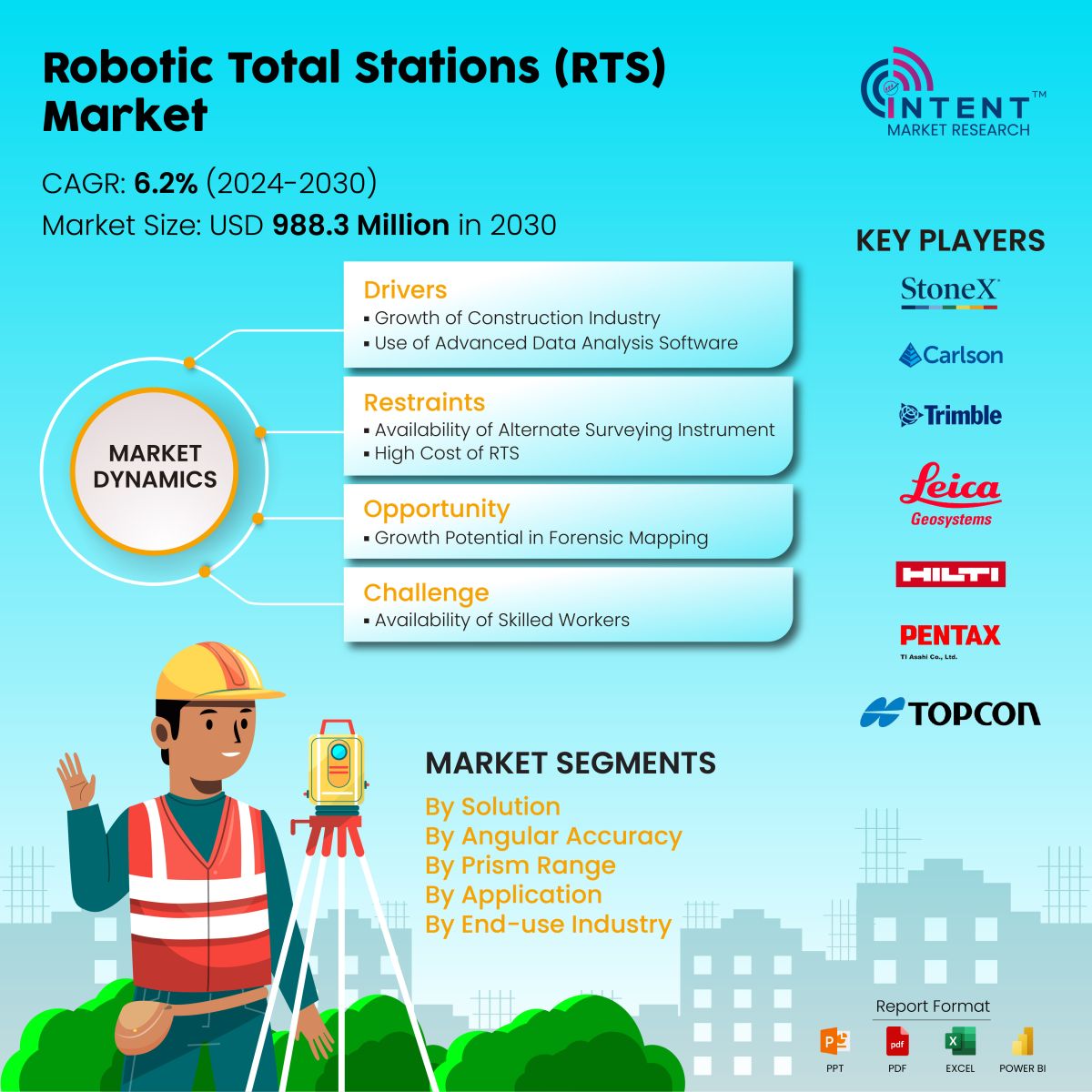

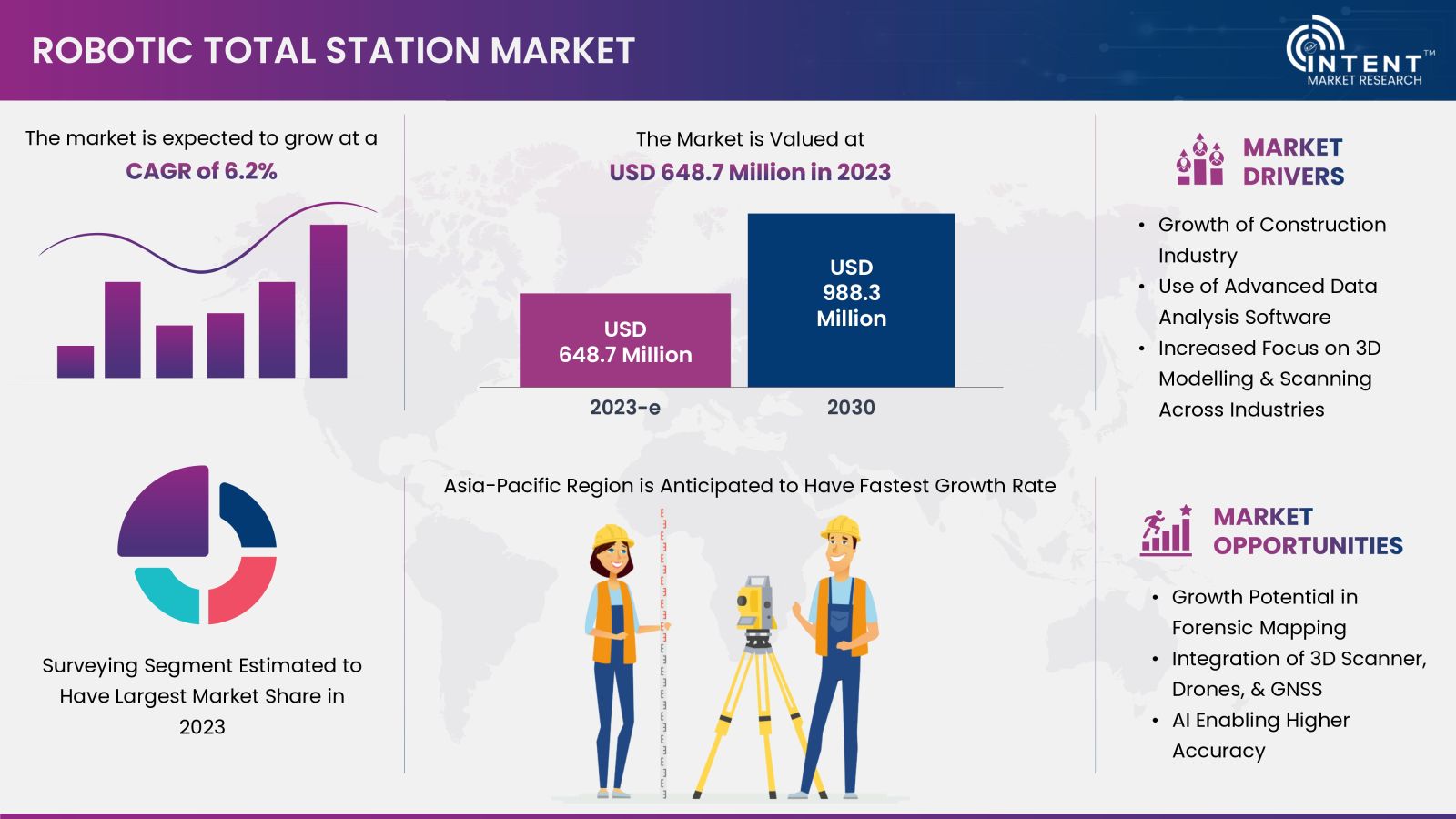

According to Intent Market Research, Robotic Total Stations Market is expected to grow from USD 648.7 million at a CAGR of 6.2% to touch USD 988.3 billion by 2030. The robotic total stations market is competitive, the prominent players include Carlson, Changzhou Dadi Surveying, Hilti, Leica Geosystems, Pentax Surveying, South Surveying, Stonex, Suzhou Foif, Topcon, Trimble, among others. The growth of this market is attributed to the factors such as growth of the construction industry, use of advanced data analysis software, and increased focus on 3D modeling & scanning across industries such as mining, and transportation.

Click here to: Get FREE Sample Pages of this Report

Robotic total stations can be used for forensic mapping such as to collect crash scene evidence, thereby offering new growth opportunities to the market stakeholders. The expected challenge to market growth during the forecast period stems from a shortage of skilled workers and the availability of alternative surveying instruments.

Construction Industry is Driving the Robotic Total Stations Market Growth

Globally, there is a rising investment trend in the construction industry, with substantial funds directed towards projects such as smart cities, highways, and airports. These areas witness significant investments from both government and private entities. Countries such as China and India have disclosed their plans to build over 500 and 100 smart cities respectively. Consequently, India's plan to invest over USD 12 billion in constructing 72 new airports by 2025, particularly in green-field projects, is significantly influencing the construction industry growth.

In 2022, Europe’s total investment in construction touched at USD 1,457.4 billion, as per the European Construction Industry Federation (FIEC), up by 2% compared to 2021. The growing investment in the construction sector is driving the demand for the robotic total station for land surveying, construction layout, and monitoring deformation.

Key Findings of the Robotic Total Stations Market Study

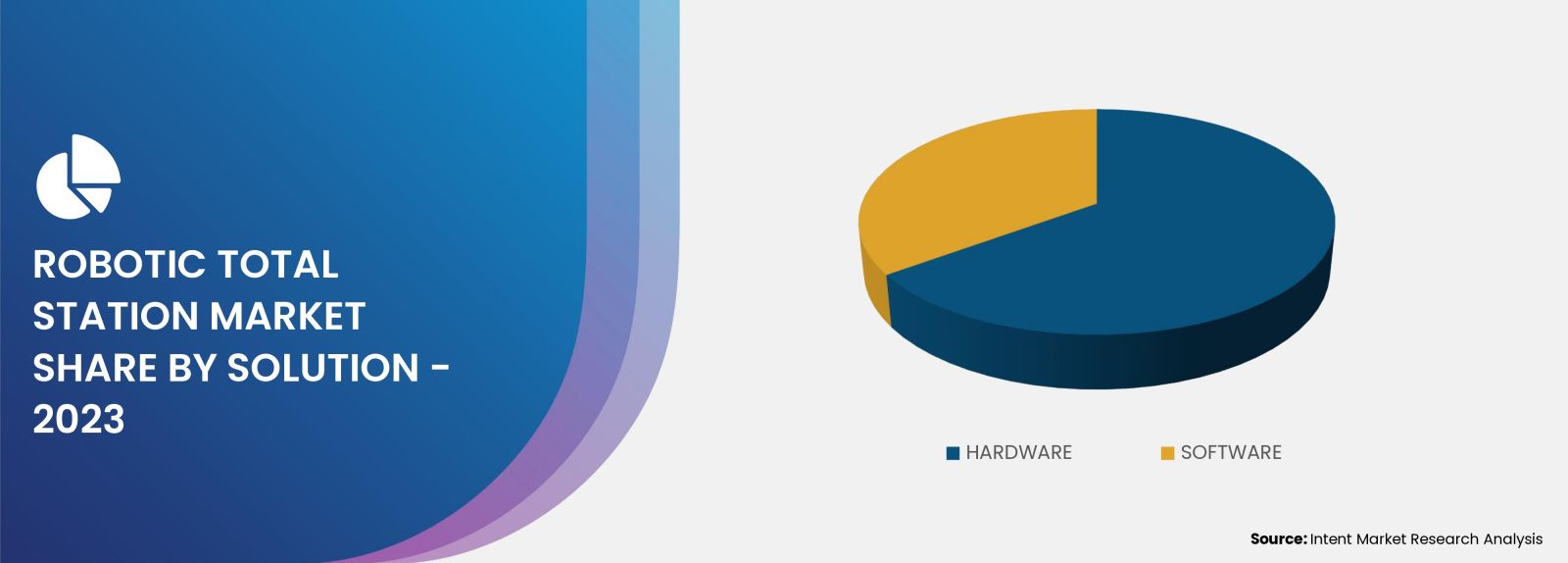

Hardware Segment Expected to Grow With a Significant CAGR from 2024 To 2030

Based on the solution, the robotic total stations market is segmented into hardware and software. In 2023, the hardware segment has recorded a significant share of the market. During the forecast period, the same segment is expected to register a significant CAGR, pertaining to the higher accuracy offered by the RTS.

Electronic distance measurement, theodolite, robotic control unit, motorized drives are some of the important hardware assembled in RTS. The growing adoption of RTS across different industries have promoted the demand for RTS thereby, driving the share of hardware segment.

High Demand for Higher Angular Accuracy RTS to Boost Market Growth

The high accuracy of RTS is expected to minimize downtime, unexpected costs and delays that may affect the project timeline. In February 2020, Leica Geosystems announced its new RTS named as Leica Nova TS60. It is considered as the most accurate, incorporating DynamicLock and AutoHeight features.

Higher angular accuracy allows RTS to capture fine details in angles, ensuring that survey measurements are more precise and reliable. Surveyors can achieve high-resolution surveys with greater detail and accuracy in the angular measurements.

Players Developing Higher Prism Ranges for Distinct Applications

Robotic total stations covers several ranges of prisms including up to 3,500 m; 3,501 m to 5,000 m; 5,001 m to 6,000 m; and 6,001 m and above. Leica Geosystems, Topcon, and Trimble are the top companies offering RTS with various ranges. As of 2023, only a few players of the market is offering a prism range of over 6,000 meters. Leica Nova MS50, the world’s first multi-station offers a prism range of 10,000 meters.

A robotic total station with a prism range above 6,000 meters are widely used in various applications where surveying and measurement tasks require long-distance measurements. These applications includes large-scale construction projects, infrastructure projects like highways, tunnels, and railways and geodetic surveys.

Surveying is the Most Preferred Application

Robotic total stations market is segmented into surveying and mapping, excavation, engineering & construction applications. In 2023, the surveying & mapping segment accounted for a significant share of the market. RTS instruments offer high precision in angle and distance measurements, ensuring accurate and reliable data for surveying and mapping tasks.

RTS is commonly employed for topographic mapping to capture detailed information about the natural and man-made features of a landscape. The instrument's high angular accuracy and electronic distance measurement contribute to the creation of accurate topographic maps.

High Demand for RTS from the Construction Sector

The construction industry accrued the highest demand for RTS in the market, pertaining to several applications from the industry. RTS is used to precisely position building elements such as foundations, columns, walls, and other structural components based on architectural and engineering design plans. It helps in establishing the correct grades and contours for the construction site.

RTS assists in verifying the accuracy and alignment of constructed elements, ensuring that they adhere to design specifications. It helps monitor tolerances and ensures that structures are built within specified limits.

Asia-Pacific Expected to Offer Huge Potential for Growth

Asia-Pacific robotic total stations market has recorded a significant share of the market in 2023. The presence of China, the world’s largest construction market, and other developing countries such as India, has driven the regional growth in 2023. China and India are the leading countries that are heavily investing in their infrastructure development.

To continue its growth trajectory, India is expected to double its infrastructure spending during 2024-2030. In addition, the Chinese government is increasing its spending on the country’s infrastructure projects by USD 1.8 trillion year-on-year to aid provinces in recovering from the COVID-19 growth fall.

Key players operating in the global robotic total stations market are Carlson, Changzhou Dadi Surveying, Hilti, Leica Geosystems, Pentax Surveying, South Surveying, Stonex, Suzhou Foif, Topcon, Trimble, among others. The presence of large number of players have substantially fragmented the market and the same trend is expected to continue during the forecasted period.

These players are launching new products to increase their market share. For instance, in January 2022, Topcon has announced its latest scanning robotic total station GTL-1200. It combines the power of a robotic total station with a best-in-class laser scanner, enabling users to perform digital layout and capture high-resolution 3D scans, all with a single setup.

Click here to: Get your custom research report today

Robotic Total Stations Market Coverage

The report provides key insights into the robotic total stations market, and it focuses on technological developments, trends, and initiatives taken by the government. Within this sector, the analysis delves into market drivers, restraints, opportunities, and other pertinent factors. The report thoroughly evaluates the key players and the competitive landscape.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 648.7 million |

|

Forecast Revenue (2030) |

USD 988.3 million |

|

CAGR (2024-2030) |

6.2% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

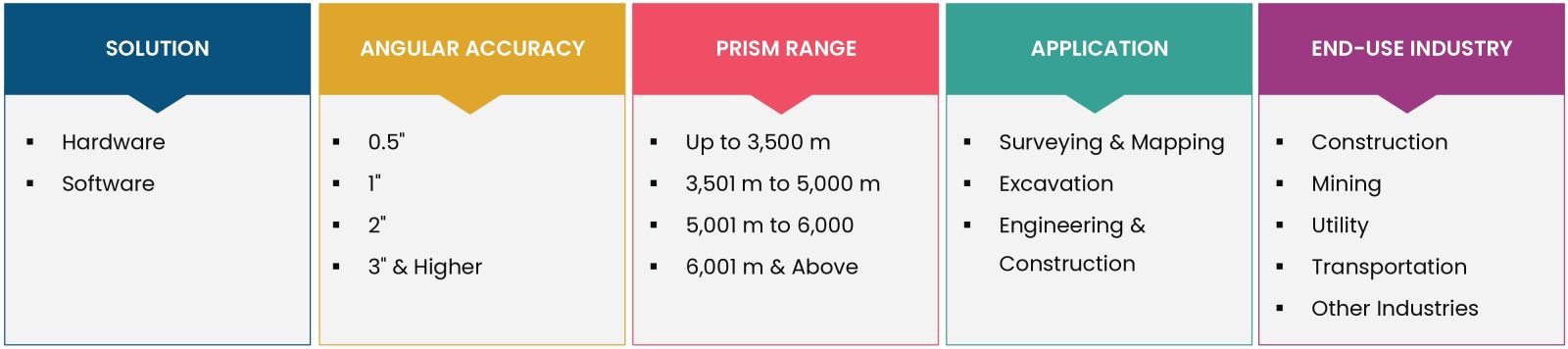

Robotic Total Stations Market By Solution (Software, Hardware); By Angular Accuracy (0.5", 1", 2", 3" and Higher); By Prism Range (Up to 3,500 m, 3,501 m to 5,000 m, 5,001 m to 6,000, 6,001 m); By Application (Surveying and Mapping, Excavation, Engineering & Construction); By End-use Industry (Construction, Mining, Utilities, Transportation, Other Industries) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America and Middle East & Africa |

|

Competitive Landscape |

Carlson, Changzhou Dadi Surveying, Hilti, Leica Geosystems, Pentax Surveying, South Surveying, Stonex, Suzhou Foif, Topcon, Trimble, among others. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

|

|

1.1.Market Definition |

|

|

|

1.2.Scope of the Study |

|

|

|

1.3.Key Stakeholders of the Market |

|

|

|

2.Research Methodology |

|

|

|

2.1.Research Approach |

|

|

|

2.2.Data Collection |

|

|

|

2.3.Market Assessment |

|

|

|

2.4.Assumptions and Limitations for the Study |

|

|

|

3.Executive Summary |

|

|

|

4.Market Dynamics |

|

|

|

4.1.Drivers |

|

|

|

|

4.1.1.Growth of Construction Industry |

|

|

|

4.1.2. Use of Advanced Data Analysis Software |

|

|

|

4.1.3. Increased focus on 3D Modelling and Scanning Across Industries |

|

|

4.2.Restraints |

|

|

|

4.2.1.Availability of Alternate Surveying Instrument |

|

|

|

4.2.2.High Cost of Robotic Total Stations |

|

|

|

4.3.Opportunities |

|

|

|

4.3.1.Growth Potential in Forensic Mapping |

|

|

|

4.4.Threats or Challenges |

|

|

|

4.4.1.Availability of Skilled Workers |

|

|

|

4.5.Trends |

|

|

|

4.5.1.Integration of Advanced Tech Such as 3D Scanner, Drones, and GNSS |

|

|

|

4.5.2.AI Integration to Achieve Higher Accuracy |

|

|

|

5.Market Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

|

|

|

5.1 Market Size by Solution |

|

|

|

5.1.1 Hardware |

|

|

|

5.1.2 Software |

|

|

|

5.2 Market Size by Angular Accuracy |

|

|

|

5.2.1 0.5" |

|

|

|

5.2.2 1" |

|

|

|

5.2.3 2" |

|

|

|

5.2.4 3" and Higher |

|

|

|

5.3 Market Size by Prism Range |

|

|

|

5.3.1 Up to 3500 m |

|

|

|

5.3.2 3501 m to 5000 m |

|

|

|

5.3.3 5001 m to 6000 |

|

|

|

5.3.4 6001 m and Above |

|

|

|

5.4 Market Size by Application |

|

|

|

5.4.1 Surveying and Mapping |

|

|

|

5.4.2 Excavation |

|

|

|

5.4.3 Engineering and Construction |

|

|

|

5.5 Market Size by End-use Industry |

|

|

|

5.5.1 Construction |

|

|

|

5.5.2 Mining |

|

|

|

5.5.3 Utility |

|

|

|

5.5.4 Transportation |

|

|

|

5.5.5 Other Industries (Law Enforcement and Agriculture) |

|

|

6. Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

|

|

6.1 North America |

|

|

|

6.1.1.U.S. |

|

|

|

6.1.2.Canada |

|

|

|

6.2.Asia-Pacific |

|

|

|

6.2.1.China |

|

|

|

6.2.2.Japan |

|

|

|

6.2.3.South Korea |

|

|

|

6.2.4.India |

|

|

|

6.3.Europe |

|

|

|

6.3.1.U.K. |

|

|

|

6.3.2.Germany |

|

|

|

6.3.3.France |

|

|

|

6.3.4.Italy |

|

|

|

6.4.Latin America |

|

|

|

6.5.Middle East and Africa |

|

|

|

7. Competitive Landscape |

|

|

|

7.1.Market Share Analysis |

|

|

|

7.2.Key Market Growth Strategies |

|

|

|

7.3.Company Strategy Analysis |

|

|

|

7.4.Competitive Benchmarking |

|

|

|

8. Company Profile |

|

|

|

8.1.Leica Geosystems |

|

|

|

8.2.Topcon |

|

|

|

8.3.Trimble |

|

|

|

8.4.Pentax Surveying |

|

|

|

8.5.Carlson Software |

|

|

|

8.6.Stonex Srl |

|

|

|

8.7.SUZHOU FOIF CO. |

|

|

|

8.8.Hilti |

|

|

|

8.9.South Surveying and Mapping Technology Co. |

|

|

|

8.10. Changzhou Dadi Surveying Science and Technology Co. |

|

|

|

9. Appendix |

|

|

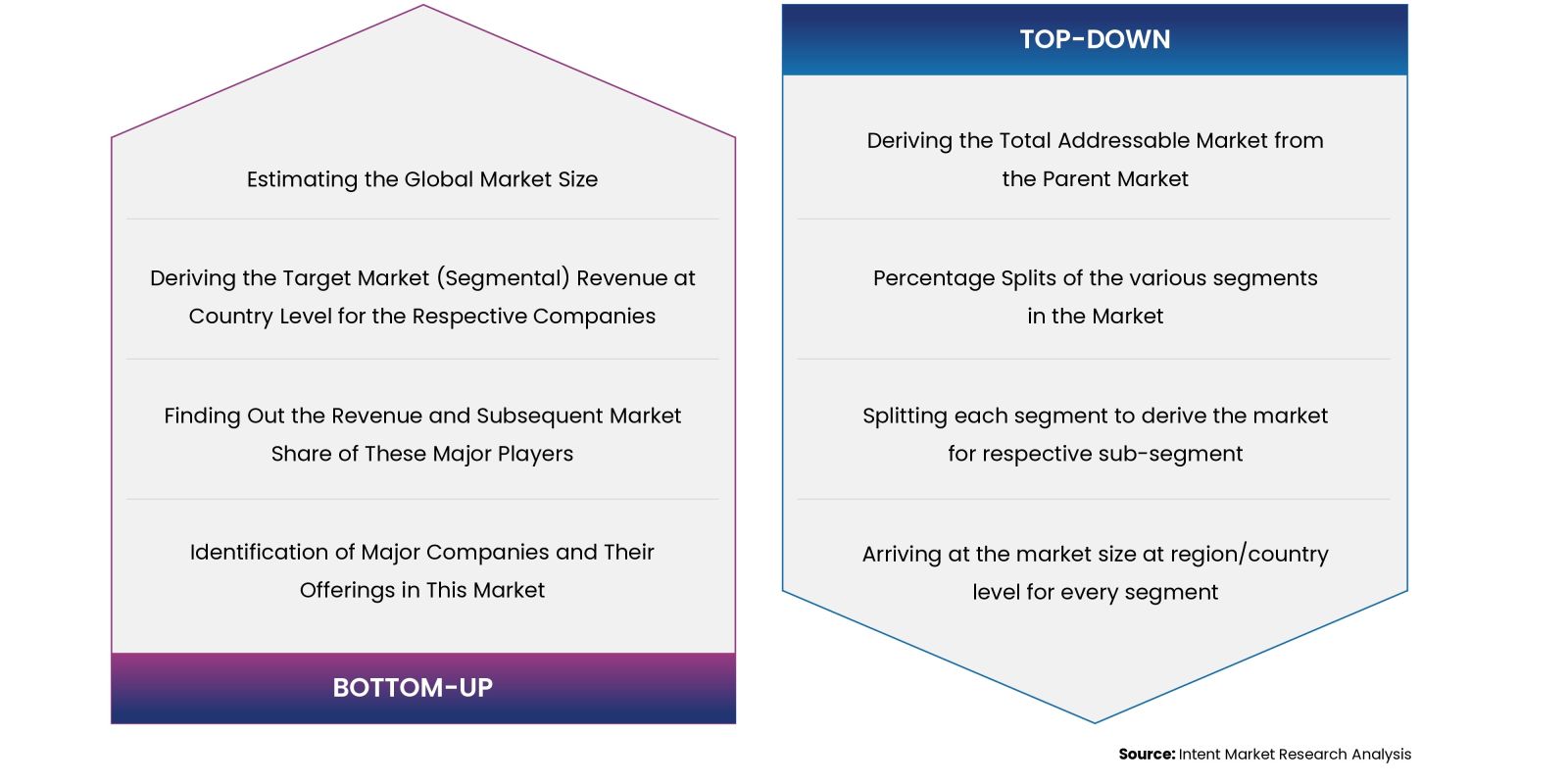

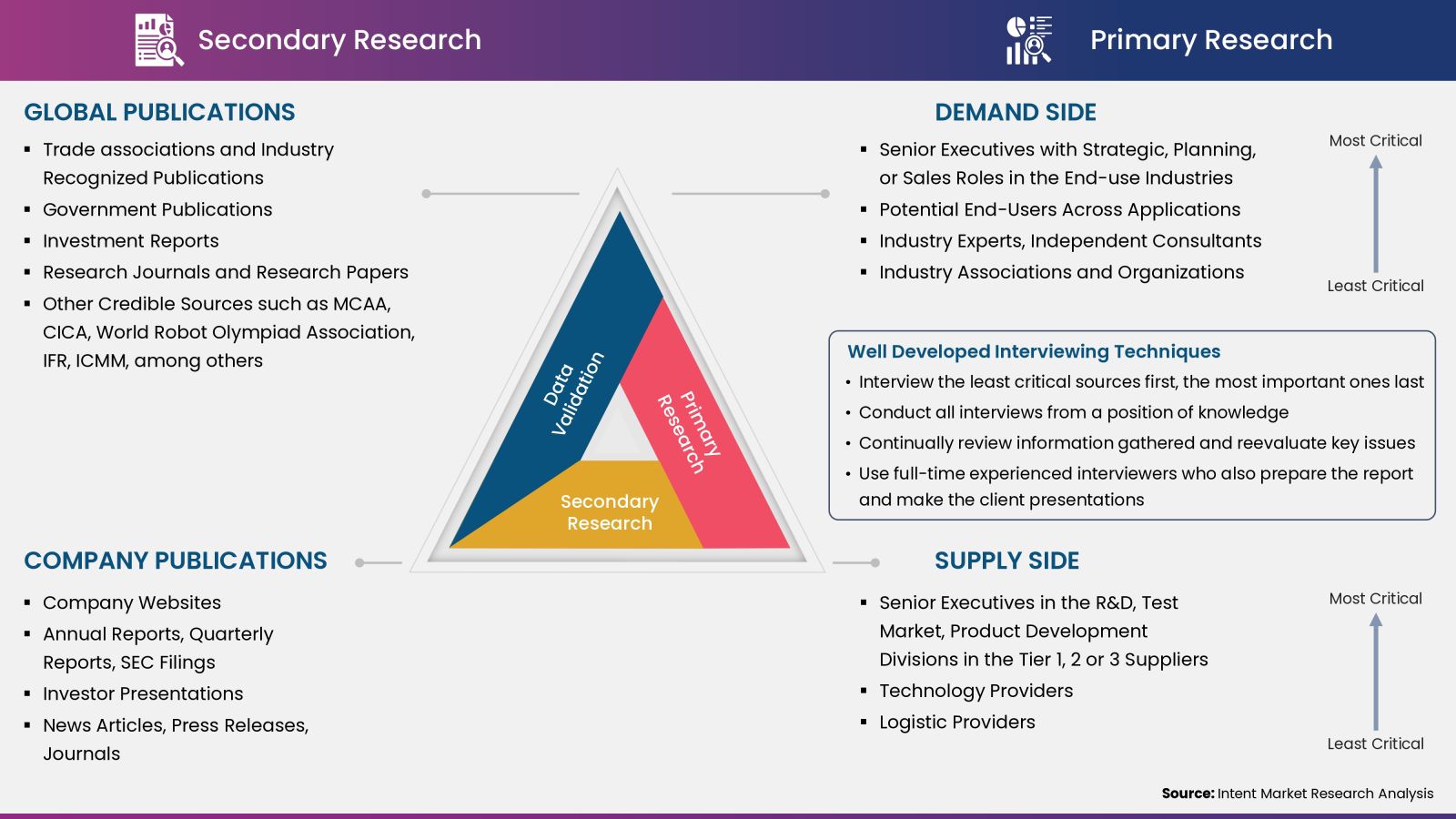

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.