The Plasma Fractionation Market is expected to grow from USD 31.7 billion in 2023-e to USD 50.1 billion by 2030, at a CAGR of 7.8%.

As per Intent Market Research, the Plasma Fractionation Market was valued at USD 31.7 billion in 2023-e and will surpass USD 50.1 billion by 2030; growing at a CAGR of 7.8% during 2024 - 2030. The market thrives due to the increasing prevalence of respiratory diseases and alpha-1-antitrypsin deficiency.

Plasma fractionation is the process of separating the various components of blood plasma. The process involves breaking plasma into individual proteins, or plasma fractions, which can be used to create various plasma protein therapies. Plasma-derived immunoglobulins are giving a new narrative to healthcare across of many autoimmune inflammatory diseases. The market growth is driven mainly by factors such as the growing use of immunoglobulins in various therapeutic areas, strategic expansion of plasma collection centers/inventories by market players, and the growing prevalence of respiratory diseases and Alpha-1 antitrypsin deficiency (AATD).

Plasma fractionation has long captivated the interest of both researchers and industrialists. The therapeutic capabilities of blood plasma in addressing and managing immunodeficiency diseases have significantly propelled market expansion. Cryo precipitation and ethanol fractionation stand out as primary processes in the separation of therapeutic protein components from whole blood within plasma fractionation equipment.

Government Strategies for Increasing Regional Self-Sufficiency in Plasma Fractionation is an Opportunity Towards Market Growth

Governments are bolstering regional self-sufficiency in plasma fractionation by implementing policies to enhance domestic plasma collection, investing in state-of-the-art fractionation facilities, and fostering partnerships with key industry players. Incentives for increased plasma donations, streamlined regulatory processes, and financial support for infrastructure development are pivotal components of these strategies. By prioritizing local capacity building and collaboration, governments aim to reduce dependency on external sources, ensuring a stable and self-sustaining supply of plasma-derived products for national healthcare needs.

To meet the increasing demand for plasma-derived products, leading companies in the market have undertaken numerous research & development initiatives to introduce novel plasma-derived therapies. Moreover, these key industry players are actively involved in acquiring and establishing new plasma collection centers, aiming to enhance the accessibility of plasma for the development of innovative products.

For instance, in December 2021, Grifols Canada Therapeutics acquired its inaugural plasma donation center in Canada through a share purchase agreement with Prometic Plasma Resources. The acquisition aligns with Grifols' global strategy to promote self-sufficiency in plasma and hemoderivatives. Notably, Grifols had previously invested in plasma fractionation and purification facilities in Canada in 2020, emphasizing its commitment to fostering a comprehensive and self-reliant plasma infrastructure in the country. As a result, the strategic endeavors of major companies such as M&A, partnerships are anticipated to propel the growth of the global plasma fractionation market.

Lucrative Growth Prospects Forecasted for Immunoglobulin in the Plasma Fractionation Market

The utilization of immunoglobulin in a range of disorders, including primary and secondary immune deficiencies, autoimmune diseases, and inflammatory conditions, is fueling substantial growth within this segment. The article published by “National Library of Medicine” titled “Efficacy and safety of intravenous immunoglobulin for treating refractory livedoid vasculopathy” in May 2022 highlighted intravenous immunoglobulin (IVIG) as one of the top three monotherapies employed in Livedoid Vasculopathy (LV), demonstrating its safety and efficacy in treating rare diseases.

The increasing prevalence of rare and autoimmune diseases, coupled with a global upswing in immunology research, is a pivotal driver for the burgeoning growth observed in this segment. Notably, data from the National Organization for Rare Disorders in December 2022 estimates that 7,000 to 10,000 rare diseases affect humans, with only a fraction having any available treatment. Despite affecting fewer than 200,000 individuals each, these rare diseases collectively impact an estimated 30 million people in the US alone. This surge in rare diseases is a key catalyst for the segment's expansion.

A research study published in January 2022 in the National Library of Medicine titled “Acquired hemophilia A (AHA): underreported, underdiagnosed, undertreated medical condition” sheds light on Acquired Hemophilia A (AHA), a severe and rare bleeding disorder affecting only 1-1.5 per million persons annually. AHA, characterized by the sudden appearance of autoantibodies, is typically observed in old age. This rise in autoimmune diseases is expected to escalate the demand for immunoglobulin-based treatments, propelling the growth of the plasma fractionation market.

Source: Intent Market Research Analysis

Market players are actively engaged in developing innovative drugs and exploring new therapeutic avenues for existing medications. A notable collaboration between Sanofi and IGM Biosciences in March 2022 exemplifies this trend, focusing on creating, developing, manufacturing, and commercializing immunoglobulin antibody agonists for oncology and immunology/inflammation targets.

Consequently, growing research & development efforts in the field of immunoglobulins are significantly contributing to the growth trajectory of this segment. The anticipated surge in rare and autoimmune diseases, coupled with intensified global research in immunology, is expected to propel the immunoglobulin segment's growth over the forecast period.

Adoption of Plasma Proteins in Neurology Procedures Drives the Segment Growth

The surge in global demand for products in response to the escalating burden of immunodeficiency and autoimmune diseases propelled this growth. The prevalent use of plasma proteins, including coagulation factors and immunoglobulins, in diverse treatment procedures for neurological conditions contributed to the segment's expansion. Additionally, ongoing development and clinical trials for various plasma-based proteins designed for applications in neurology further underpin the projected growth of this segment in the forecast period.

Hospitals and Clinics Have Attained a Prominent Position due to the Robust Demand for Plasma Products

The hospitals & clinics sector held the highest share in the plasma fractionation market. This growth is fueled by the rising global preference for plasma-derived therapies. Numerous private hospitals, equipped with advanced infrastructure and technology, have embraced these therapies, especially for patients with rare immunodeficiency diseases. Hospitals & clinics heavily rely on a stable supply of these plasma-derived therapies to address diverse patient needs, emphasizing the integral connection between plasma fractionation and healthcare institutions in ensuring access to life-saving treatments.

North America Holds a Significant Market Share Owing to the Presence of Major Companies in the Region

North America drives the plasma fractionation market, positioning itself as the dominant force in the global market throughout the forecast period. The substantial market share in plasma fractionation is attributed to the presence of major companies at the forefront for developing and introducing technologically advanced plasma-derived therapies and products, thereby fostering positive growth in the region. Additionally, the US, hosting the highest number of plasma fractionation centers, plays a pivotal role in the overall expansion of the market.

The Key Players are Highly Competitive to Capture the Major Market Share

The market is characterized by intense competition due to the presence of numerous international and domestic players. The plasma fractionation market, in particular, is dominated by key players such as ADMA Biologics, Bharat Serum Vaccines, CSL, Emergent BioSolutions, Grifols, Intas Pharmaceuticals, Japan Blood Products, Kamada, Kedrion, LFB, Octapharma, Prothya Biosolutions, Sanquin, SK Plasma, and Takeda Pharmaceutical amongst others.

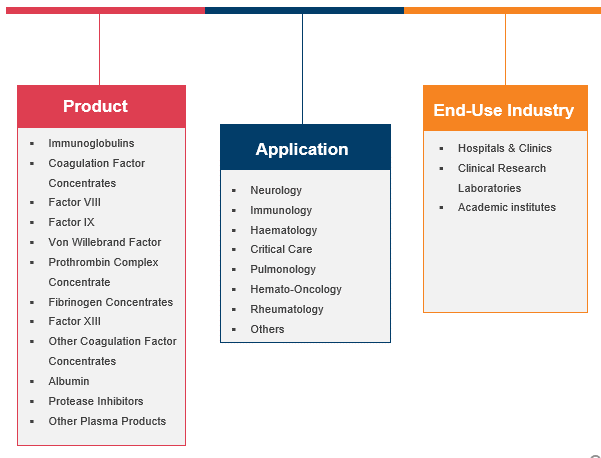

Plasma Fractionation Market Coverage

The report provides key insights into the plasma fractionation market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players and the competitive landscape within the market. The report offers the market size and forecasts for the plasma fractionation market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 31.7 billion |

|

Forecast Revenue (2030) |

USD 50.1 billion |

|

CAGR (2024-2030) |

7.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Product (Immunoglobulins {Intravenous Immunoglobulins, Subcutaneous Immunoglobulins, Others}, Coagulation Factor Concentrates, Factor VIII, Factor IX, Von Willebrand Factor, Prothrombin Complex Concentrate, Fibrinogen Concentrates, Factor XIII, Other Coagulation Factor Concentrates, Albumin, Protease Inhibitors, Others), By Application (Neurology, Immunology, Hematology, Critical care, Pulmonology, Hemato-Oncology, Rheumatology, Others), By End-use Industries (Hospitals and Clinics, Clinical Research Laboratories, Academic Institutes) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

ADMA Biologics, Bharat Serum Vaccines, CSL, Emergent BioSolutions, Grifols, Intas Pharmaceuticals, Japan Blood Products, Kamada, Kedrion, LFB, Octapharma, Prothya Biosolutions, Sanquin, SK Plasma, and Takeda Pharmaceutical amongst others |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Increase in Number of Plasma Collection Centers |

|

4.1.2.Increasing Use of Immunoglobulins in Therapeutic Areas |

|

4.1.3.Rise in Prevalence of Respiratory Diseases |

|

4.2.Market Growth Restraints |

|

4.2.1.Limited Reimbursements for Plasma-Based Products |

|

4.2.2.Negative Impact Caused by Recombinant Alternatives |

|

4.3.Market Growth Opportunities |

|

4.3.1.Increase in Regional Self-Sufficiency in Plasma Fractionation |

|

4.3.2.Technological Advancements in Plasma Fractionation Techniques |

|

4.3.3.Growing Adoption of Intravenous Immunoglobulin (IVIG) Therapy |

|

4.4.Pestle Analysis |

|

4.5.Porter’s Five Forces Analysis |

|

5.Market Outlook |

|

5.1.Overview (Industry Snapshot) |

|

5.2.Technology Analysis |

|

5.3.Supply Chain Analysis |

|

5.4.Value Chain Analysis |

|

5.5.Regulatory Analysis |

|

5.6.Ecosystem Analysis |

|

5.7.Patent Analysis |

|

5.8.Trade Analysis |

|

5.9.Trends/Disruptions |

|

5.10. Key Conference and Events |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Product |

|

6.2.1.Immunoglobulins Monoclonal Antibodies |

|

6.2.1.1.Intravenous Immunoglobulins |

|

6.2.1.2.Subcutaneous Immunoglobulins |

|

6.2.1.3.Other Immunoglobulins |

|

6.2.2.Coagulation Factor Concentrates |

|

6.2.3.Factor VIII |

|

6.2.4.Factor IX |

|

6.2.5.Von Willebrand Factor |

|

6.2.6.Prothrombin Complex Concentrate |

|

6.2.7.Fibrinogen Concentrates |

|

6.2.8.Factor XIII |

|

6.2.9.Other Coagulation Factor Concentrates |

|

6.2.10. Albumin |

|

6.2.11. Protease Inhibitors |

|

6.2.12. Others |

|

6.3.By Application |

|

6.3.1.Neurology |

|

6.3.2.Hematology |

|

6.3.3.Immunology |

|

6.3.4.Pulmonology |

|

6.3.5.Critical Care |

|

6.3.6.Hemato-Oncology |

|

6.3.7.Rheumatology |

|

6.3.8.Others |

|

6.4.By End-use Industry |

|

6.4.1.Hospitals & Clinics |

|

6.4.2.Clinical Research Laboratories |

|

6.4.3.Academic Institutes |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Plasma Fractionation Market Outlook |

|

7.2.1.1.US Plasma Fractionation Market, By Product |

|

7.2.1.2.US Plasma Fractionation Market, By Application |

|

7.2.1.3.US Plasma Fractionation Market, By End-use Industry |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.2.Canada |

|

7.3.Europe |

|

7.3.1.Europe Plasma Fractionation Market Outlook |

|

7.3.1.1.Germany |

|

7.3.1.2.UK |

|

7.3.1.3.France |

|

7.3.1.4.Spain |

|

7.3.1.5.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Plasma Fractionation Market Outlook |

|

7.4.1.1.China |

|

7.4.1.2.India |

|

7.4.1.3.Japan |

|

7.4.1.4.South Korea |

|

7.4.1.5.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Plasma Fractionation Market Outlook |

|

7.5.1.1.Mexico |

|

7.5.1.2.Brazil |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Plasma Fractionation Market Outlook |

|

7.6.1.1.Saudi Arabia |

|

7.6.1.2.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Volume Output Analysis |

|

8.3.Company Strategy Analysis |

|

8.4.Competitive Matrix |

|

9.Company Profiles |

|

9.1.ADMA Biologics |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.Analyst Perception |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.2.Bharat Serum Vaccines |

|

9.3.CSL |

|

9.4.Emergent BioSolutions |

|

9.5.Grifols |

|

9.6.Intas Pharmaceuticals |

|

9.7.Japan Blood Products |

|

9.8.Kamada |

|

9.9.Kedrion |

|

9.10. LFB |

|

9.11. Octapharma |

|

9.12. Prothya Biosolutions |

|

9.13. Sanquin |

|

9.14. SK Plasma |

|

9.15. Takeda Pharmaceutical |

Let us connect with you TOC

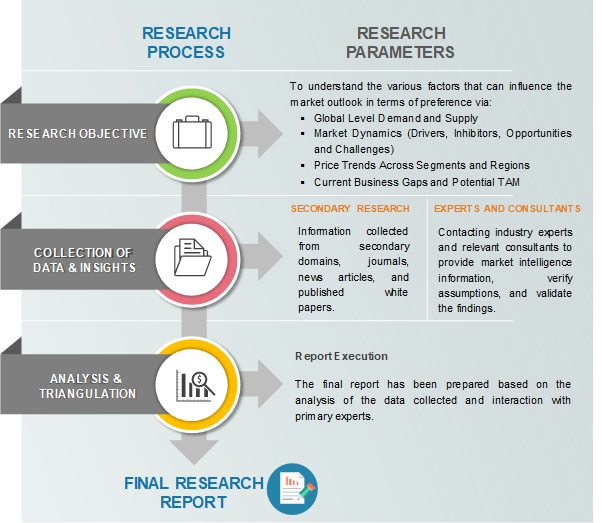

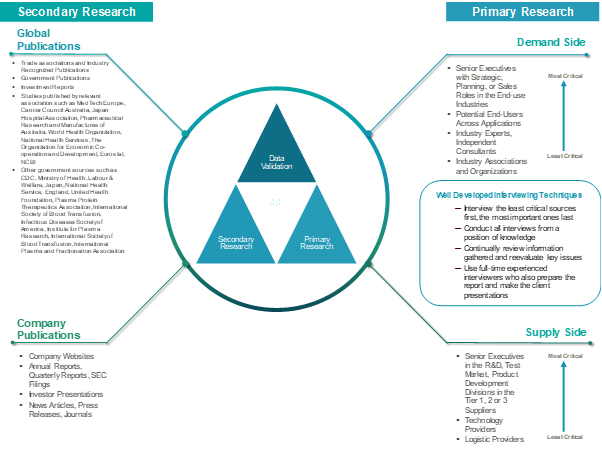

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats