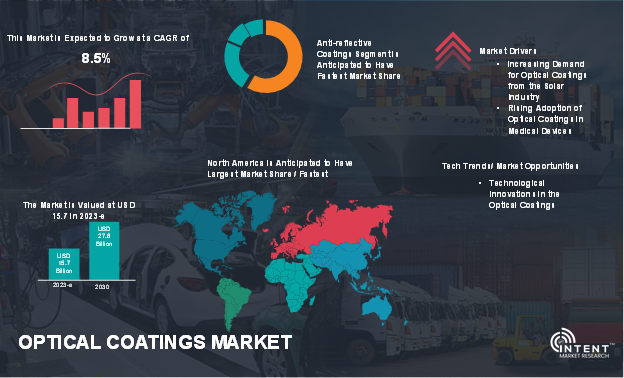

According to Intent Market Research, the Optical Coatings Market is expected to grow from USD 15.7 billion in 2023-e at a CAGR of 8.5% to touch USD 27.8 billion by 2030. The optical coatings is competitive market, the prominent players in the global market include Abrisa Technologies (HEF), Alluxa, Beneq, Carl Zeiss, Coherent, DuPont, G&H Technologies, Inrad Optics, Newport, Reynard, Schott, SunDensity, Viavi Solutions, and VSP.

As per Intent Market Research, the optical coatings Market was valued at USD 15.7 billion in 2023-e and will surpass USD 27.8 billion by 2030; growing at a CAGR of 8.5% during 2024 - 2030. Increasing demand for optical coatings from the automotive industry is driving the market growth.

The optical coatings market is expected to grow significantly due to the ability of optical coatings to reduce the amount of light reflected from optical surfaces to improve visibility and reduce glare of the optical component. Optical coatings refer to thin material layers applied to optical components such as lenses, mirrors, and filters.

Their purpose is to improve performance by altering how these components interact with light. The coatings are crafted to manage the reflection, transmission, and absorption of light across various wavelengths. The demand for optical coatings continues to grow due to their application of various industries, thereby driving ongoing research and development in this space.

Optical Coatings Market Dynamics

Growing Demand for Optical Coatings from the Solar Industry will Drive the Market

The rise in the demand for clean and sustainable energy and the increasing application of reflecting coatings in green buildings to retain heat and lower energy usage is driving the optical coatings market. The development of advanced coatings applied on the solar panel is contributing to generating clean energy compared to traditional approaches. For instance, in 2020, SunDensity, a research & development startup in optical and photonics developed a Nano-optical coating for solar panels' glass surface that increases energy output by up to 20% and greatly improves photovoltaic solar cells' and sensors' power output to speed up the production of clean power.

Source: Intent Market Research Analysis

Fluctuation in Price and Supply of Raw Material May Hinder its Adoption in Various Industries

Many raw materials, including oxides, metals, and fluorides, are used in the optical coating manufacturing process. Optical coatings use extremely erratic and volatile raw materials, which have a significant effect on changes in the prices of metals and oxides, including copper, silver, titanium dioxide, gold, and indium. The availability and cost of raw materials, particularly metals and oxides, are quite variable, and an increase in their cost harms the production costs associated with creating optical coatings. For instance, the average cost of iron oxide in the US was 0.75 USD per kilogram in 2022, a sharp drop from the 1.58 USD per kilogram average in 2018.

Optical Coatings Market Segment Insights

Anti-Reflective Coatings Segment Held Major Revenue Share in the Optical Coatings Market

Anti-reflective coatings have a major revenue share owing to growing demand from diverse industrial applications, including solar, construction, automotive, and others. Thin-film optical coatings with numerous layers of coatings with varying refractive indices between each layer are known as anti-reflective coatings. Each layer's thickness is intended to produce self-extinguishing interference for light beams that are reflected off the surface.

This makes it appropriate for usage on glass and plastic substrates in magnifying lenses, display screens, camera lenses, and eyewear. For instance, in November 2021, VSP Optics launched TechShield, which is an anti-reflective coating. TechShield AR Coatings, which offer superior quality and innovation to eye care professionals, now give patients increased clarity, smudge resistance, scratch resistance, and cleanability.

Metal Oxide Compounds Segment Held the Major Share in Optical Coatings Market

Metal oxide compounds are largely used to alter the light transmission property and can act as a filter in optics. Metal oxide derivatives are utilized in anti-reflective coatings to improve light transmission via lenses and optical components and lessen surface reflections. A typical transparent conductive coating used in optoelectronic devices, such as touchscreens and solar cells commonly uses indium tin oxide which is a metal oxide that retains optical transparency while offering electrical conductivity.

Vacuum Deposition Segment to Boost the Optical Coatings Market

Vacuum deposition offers various advantages, such as precise thickness, uniformity, strong adhesion to the substrate, and minimizing the addition of contamination from the atmosphere. For the production of optical coatings, vacuum deposition is a commonly employed method. The technique includes applying thin material sheets to a substrate under vacuum. Several optical applications can benefit from this very precise approach, which also provides control over film composition, thickness, and structure.

Companies in this market are collaborating to develop innovative products to sustain their position in the market. For instance, in October 2020, SDC Technologies, a company specializing in abrasion-resistant coating solutions, acquired COTEC GmbH. Through this acquisition, SDC builds its creation and production of superior MLD (molecular layer deposition) and PVD (physical vapor deposition) materials for hydrophobic, oleo phobic, and anti-reflective coatings for displays, precision optics, ophthalmic, and automotive industries.

Electronics and Semiconductors are Expected to hold Major Market Share

The widespread application of optical coatings in various electronic devices, especially in scenarios where the passage of light through optical surfaces is crucial, has become prevalent. Optical anti-reflective coatings, employed in devices like cell phones and tablet screens, serve multiple purposes such as enhancing readability in direct sunlight and mitigating glare on consumer screens. This increased usage of semiconductor devices has contributed to increased demand for optical coatings.

For instance, according to a report published by SIA, the total sales of semiconductor sales was USD 412.3 billion in 2019 and sales rose 6.8% in 2020 to USD 440.4 billion, mostly as a result of the COVID-19 pandemic's spurring demand. Furthermore, according to WSTS, in the third quarter of 2023, global semiconductor sales came to a total of 134.7 billion dollars, up 6.3 % from the second quarter and down 4.5 % from the third quarter of 2022.

North America Dominated the Optical Coatings Market over the Forecast Period

North America held the largest market share in the optical coatings market. The regional growth can be attributed to the presence of major centers of manufacturing for small- and mid-sized medical equipment businesses, as well as a strong presence of software development, instrumentation, microelectronics, and biotechnology, which will eventually increase demand for optical coatings in the medical devices sector.

Major market players are acquiring small companies to strengthen their position in the market. For instance, in May 2023, Beneq announces the research partnership with Lung Pien Vacuum Industry. To develop and launch an atomic layer deposition (ALD) product. As a result of this acquisition, Beneq, and Lung Pien will work together to actively develop and promote ALD coating technology, which will be used on premium curved lenses for the Taiwanese optical market. For the most difficult designs, ALD technology offers consistent conformal thin film layers, which makes it perfect for high-end optical applications.

Major Industry Players are Actively Developing Optical Coatings Platforms

The market is characterized by intense competition due to the presence of numerous international and domestic players. The optical coatings market, in particular, is dominated by key players such as Abrisa Technologies (HEF), Alluxa, Beneq, Carl Zeiss, Coherent, DuPont, G&H Group, Inrad Optics, Newport, Reynard, Schott, SunDensity, Viavi Solutions, and VSP among others. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of market players is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In July 2023, G&H Group, a provider of photonics and precision optics systems, revealed that it has acquired Artemis Optical, a pioneer in cutting-edge thin-film coating technology. Through this acquisition, G&H's product line is further improved, and new avenues for vertical integration and cross-selling of improved combined capabilities are opened up.

- In July 2020, Schott AG and Lumus Vision announced their strategic research partnership to design and develop optical devices. As part of this collaboration, Lumus is in charge of the commercialization and optical design research and development for the reflecting waveguides whereas using its global production network and premium optical glass melting technology, SCHOTT is primarily focused on producing the optical coating solutions.

Optical Coatings Market Coverage

The report provides key insights into the optical coatings market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market. The report offers the market size and forecasts for the optical coatings market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 15.7 billion |

|

Forecast Revenue (2030) |

USD 27.8 billion |

|

CAGR (2024-2030) |

8.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Coating Type (Optical Filter Coatings, Anti-Reflective Coatings, Transparent Conductive Coatings, Mirror Coatings, Beam Splitter Coatings, Dielectric Coatings, Polarizing Coatings, Hydrophobic Coatings, Others), By Coating Material (Metal Oxide Compounds, Fluoride Compounds, Others), By Technology (Chemical Vapor Deposition, Ion-Beam Sputtering, Plasma Sputtering, Atomic Layer Deposition, Sub-Wavelength Structured Surfaces, Magnetron Sputtering, Others), By End-use Industry (Aerospace & Defense, Automotive, Electronics & Semiconductors, Telecommunications, Healthcare, Solar, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

Abrisa Technologies (HEF), Alluxa, Beneq, Carl Zeiss, Coherent, DuPont, G&H Technologies, Inrad Optics, Newport, Reynard, Schott, SunDensity, Viavi Solutions, and VSP |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Increasing demand for optical coatings from solar industry |

|

4.1.2.Rising adoption of optical coatings in medical devices |

|

4.2.Market Growth Restraints |

|

4.2.1.Fluctuation in price and availability of raw materials |

|

4.3.Market Growth Opportunities |

|

4.3.1.Technological innovations in optical coatings |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Technology Trends |

|

5.3.Patent Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Coating Type |

|

6.2.1.Optical Filter Coatings |

|

6.2.2.Anti-reflective Coatings |

|

6.2.3.Transparent Conductive Coatings |

|

6.2.4.Mirror Coatings |

|

6.2.5.Beam Splitter Coatings |

|

6.2.6.Dielectric Coatings |

|

6.2.7.Polarizing Coatings |

|

6.2.8.Hydrophobic and Oleophobic Coatings |

|

6.3.By Coating Material |

|

6.3.1.Metal Oxide Compounds |

|

6.3.2.Fluoride Compounds |

|

6.3.3.Others |

|

6.4.By Technology |

|

6.4.1.Vacuum Deposition |

|

6.4.2.Chemical Vapor Deposition |

|

6.4.3.Ion-beam Sputtering |

|

6.4.4.Atomic Layer Deposition |

|

6.4.5.Sub-wavelength Structured Surface |

|

6.4.6.Magnetron Sputtering |

|

6.4.7.Others |

|

6.5.By End-use |

|

6.5.1.Aerospace & Defense |

|

6.5.2.Automotive |

|

6.5.3.Electronics & semiconductors |

|

6.5.4.Telecommunications |

|

6.5.5.Healthcare |

|

6.5.6.Solar |

|

6.5.7.Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Optical Coatings Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Optical Coatings Market, By Type |

|

7.2.2.2.US Optical Coatings Market, By Coating Material |

|

7.2.2.3.US Optical Coatings Market, By Technology |

|

7.2.2.4.US Optical Coatings Market, By End-use Industry |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.2.4.Mexico |

|

7.3.Europe |

|

7.3.1.Europe Optical Coatings Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Optical Coatings Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Optical Coatings Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Argentina |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Optical Coatings Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Optical Coatings Companies (Supply-Side) |

|

9.1.1.Abrisa Technologies (HEF) |

|

9.1.1.1.Company Synopsis |

|

9.1.1.2.Company Financials |

|

9.1.1.3.Product/Service Portfolio |

|

9.1.1.4.Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2.Alluxa |

|

9.1.3.Beneq |

|

9.1.4.Carl Zeiss |

|

9.1.5.Coherent |

|

9.1.6.DuPont |

|

9.1.7.G&H Technologies |

|

9.1.8.Inrad Optics |

|

9.1.9.Newport |

|

9.1.10. Reynard |

|

9.1.11. Schott |

|

9.1.12. Sun Density |

|

9.1.13. Viavi Solutions |

|

9.1.14. VSP |

|

9.1.15. Shell |

Let us connect with you TOC

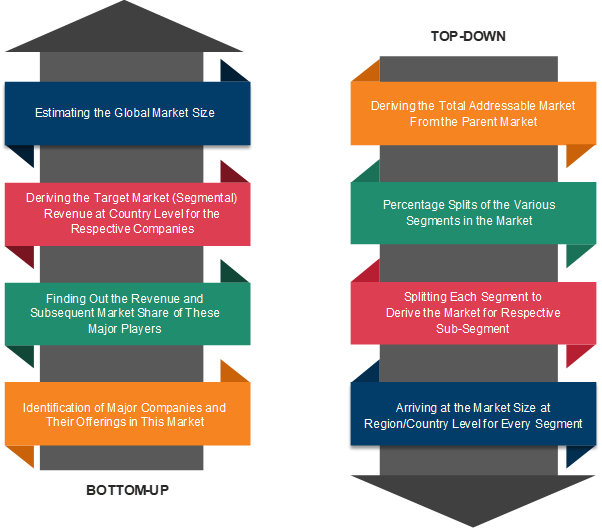

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats