According to Intent Market Research, the On-Orbit Satellite Servicing Market is expected to grow from USD 1.6 billion in 2023-e at a CAGR of 19.7% to touch USD 5.4 billion by 2030. The on-orbit satellite servicing market is competitive, the prominent players in the global market include Airbus, Altius Space Machines (Voyager Space Holdings), Astroscale Holdings, ClearSpace, Infinite Orbits, Maxar Technologies, Orbit Fab, Red Wire Space, SpaceLogistics (Northrop Grumman), and Thales Alenia Space.

As per Intent Market Research, the on-orbit satellite servicing Market was valued at USD 1.6 billion in 2023-e and will surpass USD 5.4 billion by 2030; growing at a CAGR of 19.7% during 2024 - 2030.

Technological advances in automation and robotics are anticipated to provide significant growth opportunities for the on-orbit satellite servicing market.

Need for Minimizing the Capital Cost of Aging Assets

Advances in satellite communications technology have led to a significant increase in throughput delivered through high throughput satellite (HTS) systems. Increasing launches HTS systems has significantly impacted satellite capacity pricing. The satellite industry has experienced a downturn in the price of bandwidth which further affected the revenue generated by the aging satellite assets. Thus, there’s an increasing need for minimizing the capital cost of the aging assets among the operators which is further driving the demand for on-orbit satellite services.

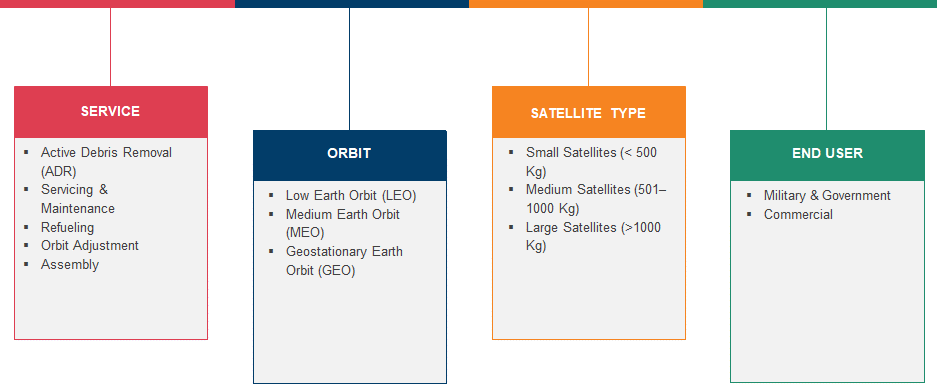

Segment Analysis

Emerging Need for Active Debris Removal (ADR) is Driving the On-Orbit Satellite Servicing Market

There’s an emerging need for space debris cleanup owing to the expanding satellite constellations and commercial activity especially in Low Earth Orbit (LEO). According to the European Space Agency (ESA), till November 2022, there were about 32,680 debris objects that are regularly tracked by Space Surveillance Networks and maintained in their catalogue. The debris in LEO are prone for collisions and it is imperative to safeguard satellites.

Increasing number of companies partnering with on-orbit servicing companies for such LEO-specific debris cleaning services will boost the market growth. For instance, in May 2023, ClearSpace, a Swiss-based on-orbit servicing startup contracted with Arianespace (France) to launch its first debris removal mission to capture and deorbit a 100 kg piece of space debris in 2026 in LEO. Thus, active debris removal (ADR) is anticipated to have a significant market share.

Increasing Low Earth Orbit (LEO) Satellites Launches is Driving the Segment Growth

LEO satellites are often SmallSats and CubeSats which are utilized for several applications including communication, weather forecasting, navigation, and imaging, among others. In recent years, there has been a significant rise in LEO satellite launches. This can be attributed to factors such as the growing adoption of reusable launch vehicles, the rise in computing power, and the privatization of the space industry. For instance, in September 2023 Lockheed Martin launched 10 LEO satellites for low-latency communication in support of the Space Development Agency's (SDA) Tranche 0 Transport Layer (T0TL) mission. Thus, increasing LEO satellites launches is driving the segment growth.

High Capital Cost of Large Satellites Drives the Demand for On-Orbit Satellite Services

Large satellites are generally considered satellites weighing more than 1,000 kg. Large satellites are very powerful and used in several applications including communication relay, weather forecasting, navigation (GPS), broadcasting, scientific research, and earth observation. The majority of the large satellites are found in geostationary orbit. The capital cost associated with the large satellites are very high and there’s an increasing demand for on-orbit satellite services. Increasing number of large satellite launches are driving the market. For instance, in July 2023, SpaceX launched Jupiter-3 on a Falcon Heavy which is one of the largest private communications satellite.

Growing Number of Commercial Satellite Launches is Driving the Demand for On-Orbit Satellite Services

In recent years, there has been tremendous growth in commercial satellite launches. The growing number of private companies entering the satellite operations is one of the key drivers for the growth of the on-orbit satellite services market. The market is growing due to a rising demand for satellite internet, increased telecom capacity, resolution of commercially available imagery and other services. According to the Satellite Industry Association (SIA), a total of 1,713 commercial satellites were deployed during 2021, an increase by more than 40% compared to 2020. Thus, growing number of commercial satellite launches is driving the demand for on-orbit satellite services.

Regional Analysis

High Government Spending is Driving the North America On-Orbit Satellite Servicing Market

North America is the leading region in on-orbit satellite servicing market owing to high government spending. The US is a leading country in space expenditure, with NASA's budget for the fiscal year 2023 accounting for over USD 25 billion. Moreover, the US government has proposed a budget of USD 27.2 billion for NASA's 2024 fiscal year, indicating a 7.1% increase from 2023 levels.

The governments in the region are actively investing in on-orbit satellite servicing. In November 2023, US Senate passed the Orbital Sustainability (ORBITS) Act, a bill to establish a demonstration program to reduce the amount of space junk in orbit. In addition, in September 2023, Rogue Space Systems, an on-orbit servicing services startup, received additional US government funding to develop core technologies. Thus, North America holds the largest market share in on-orbit satellite services owing to the high government spending.

On-Orbit Satellite Servicing Market is Highly Competitive

In the on-orbit satellite servicing market, key players include satellite manufacturers and service providers. The market is still in nascent stage and the companies are actively seeking funding in the form of contracts and partnerships. The companies heavily spending on research & development and are actively launching innovative technologies to cater to the market. The market is highly competitive with the presence of few dominant global players and significant numbers of startups. Notable companies include Airbus, Altius Space Machines (Voyager Space Holdings), Astroscale Holdings, ClearSpace, Infinite Orbits, Maxar Technologies, Orbit Fab, Red Wire Space, SpaceLogistics (Northrop Grumman), and Thales Alenia Space.

Following are the key developments in the on-orbit satellite servicing market:

- In January 2024, Orion Space Solutions completed a Critical Design Review (CDR) on the Tetra-5 program for the US Space Force. This is anticipated to demonstrate autonomous rendezvous, proximity operations and docking (RPOD) for on-orbit refueling.

- In December 2023, Orbit Fab, came into partnership with Space Machines Company (SMC) for more efficient docking hardware to SMC’s orbital transfer vehicle.

On-Orbit Satellite Servicing Market Coverage

The report provides key insights into the on-orbit satellite servicing market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.6 billion |

|

Forecast Revenue (2030) |

USD 5.4 billion |

|

CAGR (2024-2030) |

19.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Service (Active Debris Removal (ADR), Servicing & Maintenance, Refueling, Orbit Adjustment, Assembly), By Orbit (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Earth Orbit (GEO)), By Satellite Type (Small Satellites (< 500 Kg), Medium Satellites (501–1000 Kg), Large Satellites (>1000 Kg)), and By End-user (Military & Government, Commercial) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, India, Japan, South Korea, Australia), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

Airbus, Altius Space Machines (Voyager Space Holdings), Astroscale Holdings, ClearSpace, Infinite Orbits, Maxar Technologies, Orbit Fab, Red Wire Space, SpaceLogistics (Northrop Grumman), and Thales Alenia Space |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Upsurge in Satellite Launches |

|

4.1.2.Need for Minimizing the Capital Cost of Aging Assets |

|

4.1.3.Increasing Privatization of Satellite Services |

|

4.2.Market Growth Restraints |

|

4.2.1. Concerns for its Military Applications such as System Destruction, Disruption, and Espionage |

|

4.2.2.Complex Regulatory Environment |

|

4.3.Market Growth Opportunities |

|

4.3.1.Technological Advances in Automation and Robotics |

|

4.4.Porter’s Five Forces |

|

4.5.PESTLE Analysis |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Regulatory Framework |

|

5.3.Technology Analysis |

|

5.4.Patent Analysis |

|

5.5.Startup Ecosystem |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Service |

|

6.2.1.Active Debris Removal (ADR) |

|

6.2.2.Servicing & Maintenance |

|

6.2.3.Refueling |

|

6.2.4.Orbit Adjustment |

|

6.2.5.Assembly |

|

6.3.By Orbit |

|

6.3.1.Low Earth Orbit (LEO) |

|

6.3.2.Medium Earth Orbit (MEO) |

|

6.3.3.Geostationary Earth Orbit (GEO) |

|

6.4.By Satellite Type |

|

6.4.1.Small Satellites (< 500 Kg) |

|

6.4.2.Medium Satellites (501–1000 Kg) |

|

6.4.3.Large Satellites (>1000 Kg) |

|

6.5.By End-user |

|

6.5.1.Military & Government |

|

6.5.2.Commercial |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America On-Orbit Satellite Servicing Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US On-Orbit Satellite Servicing Market, By Service |

|

7.2.2.2.US On-Orbit Satellite Servicing Market, By Orbit |

|

7.2.2.3.US On-Orbit Satellite Servicing Market, By Satellite Type |

|

7.2.2.4.US On-Orbit Satellite Servicing Market, By End-user |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.3.Europe |

|

7.3.1.Europe On-Orbit Satellite Servicing Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Italy |

|

7.3.6.Spain |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific On-Orbit Satellite Servicing Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America On-Orbit Satellite Servicing Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Mexico |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa On-Orbit Satellite Servicing Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

7.6.4.South Africa |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Airbus |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.2.Altius Space Machines (Voyager Space Holdings) |

|

9.3.Astroscale |

|

9.4.ClearSpace |

|

9.5.Infinite Orbits |

|

9.6.Maxar Technologies |

|

9.7.Orbit Fab |

|

9.8.Red Wire Space |

|

9.9.SpaceLogistics (Northrop Grumman) |

|

9.10. Thales Alenia Space |

Let us connect with you TOC

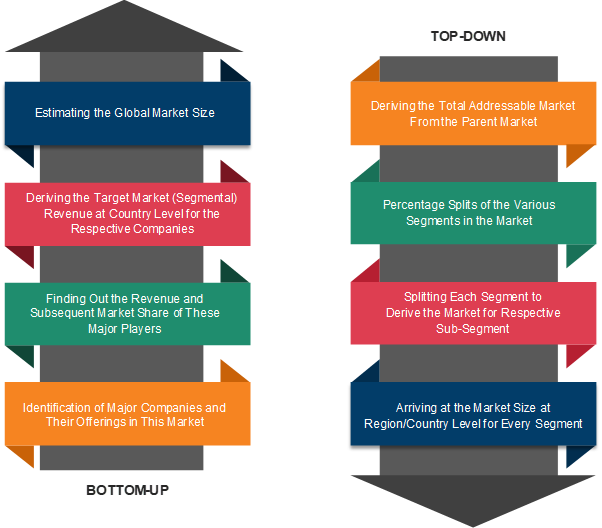

On-Orbit Satellite Servicing Market Methodology

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats