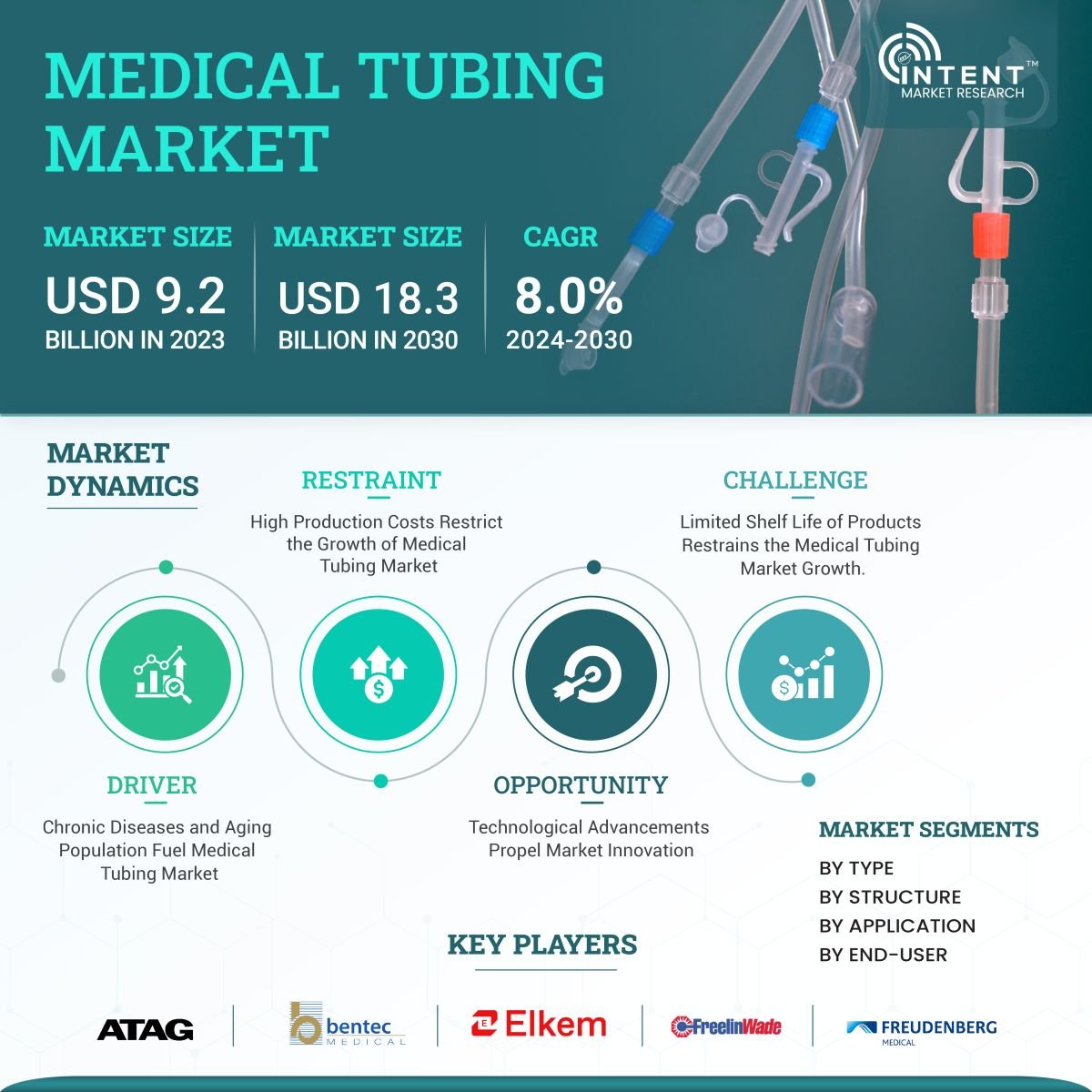

According to Intent Market Research, the Medical Tubing Market is expected to grow from USD 9.2 billion in 2023-e at a CAGR of 8.0% to touch USD 18.3 billion by 2030. Some prominent players in the global medical tubing market are ATAG, Bentec Medical, Elkem, Freelin-Wade, Freudenberg Medical, Imperative Care, Lubrizol, MDC Industries, NewAge Industries, Nordson Medical, RAUMEDIC, Saint-Gobain, Spectrum Plastics Group, TE Connectivity, Tekni-Plex, Teknor Apex, Teleflex, Vention Medical and Zeus Industrial Products.

As per Intent Market Research, the Medical Tubing Market was valued at USD 9.2 billion in 2023-e and will surpass USD 18.3 billion by 2030; growing at a CAGR of 8.0% during 2024 - 2030. Rising demand for minimally invasive procedures is driving the need for medical tubing in procedures propelling the market growth.

Medical tubing is a hollow cylindrical tube used to transfer liquids or gases. Medical tubing is primarily made of silicone, polyethylene, Polyvinyl Chloride (PVC), nylon, and Thermoplastic Elastomer (TPE), it is safe to use. It is used in various medical applications to transport fluids, gases, or other substances within the human body or between medical devices. These tubes are designed to meet specific medical and regulatory standards, ensuring safety and compatibility with biological systems.

Medical Tubing Market Dynamics

Rising Demand for Minimally Invasive Procedures is Driving The Medical Tubing Market

The medical tubing market is witnessing significant growth due to the increasing demand for minimally invasive procedures. As per the article 'Microelectronic Catheter for Minimally Invasive Surgery of the Future,' published in January 2022, catheters are significantly important for minimally invasive surgery due to easy procedures for the removal of blood clots, the insertion of implants, or the targeted administration of drugs, and are intended to be particularly gentle for patients. These procedures, known for their shortened recovery times and reduced risks, often necessitate specialized medical tubing to enhance precision and efficacy, contributing to the growth of the medical tubing market.

Technological Advancements Are Expected to Drive the Medical Tubing Market During The Forecast Period

Increasing launches of advanced medical tubing solutions with the latest technological features are expected to offer prominent growth opportunities for medical tubing manufacturers. The market is growing significantly with advancements in polymers and biocompatible materials, offering enhanced safety and versatile applications. Modern technologies like 3D printing for patient-specific anatomy and antimicrobial tubing are reducing infection risks in medical tubes, popular in Endoscopy and Laparoscopy. The continuous evolution of these materials is expected to drive their adoption across the healthcare industry.

On February 2, 2022, Zeus announced a new product called PTFE Sub-Lite-Wall multi-lumen tubing with new features such as high structural integrity, improved planarity, high lubricity, and superior dielectric strength. It is also biocompatible with an operating temperature of 260°C (500°F). Such novel launches are expected to drive the medical tubing market during the forecast period.

Medical Tubing Market Segment Insights

Rising Demand For PVC based Medical Tubings in Versatile Applications is Fueling the Market

PVC grade medical tubing accounted for the major share in 2023. The PVC can be sterilized using methods such as irradiation and ethylene oxide sterilization. The increasing use of sterile, disposable medical devices has increased the demand for PVC-based medical devices. All these factors are driving the growth of the medial tubing market

Source: Intent Market Research Analysis

Demand for Braided Tubing is Rising Owing To Its Durability & Strength

Braided tubing, which features a reinforced structure, is a major segment of medical tubing. This tubing is reinforced with a braided pattern of material (often metal or another polymer) to increase strength and durability while maintaining flexibility. The dominance of this segment is due to its important role in applications where the tubing must withstand pressure without collapsing or kinking, such as catheter and endoscopic applications thereby driving the medical tubing market.

Bulk Disposable Tubing Is Expected to Occupy a Dominant Position During The Forecast Period

Based on application, the bulk disposable tubing segment led the market, accounting for a major revenue share in 2023. Bulk disposable tubing equipment includes urological products, surgical instruments, syringes, and needles. The focus on preventing the spread of infection from one patient to another is expected to drive the growth of the segment during the forecast period.

Increasing Adoption of Medical Tubing in Hospitals & Clinics is Sustaining the Medical Tubing Market

The medical tubing market is experiencing substantial growth, driven by its widespread utilization in hospitals and clinics. The high demand is attributed to the tubing's critical role in various medical applications, enhancing patient care and supporting medical procedures. These are used to administer fluids, medications, or nutrients to patients through intravenous (IV) lines. Medical tubing is integral in endoscopic and laparoscopic surgeries, providing a conduit for instruments and facilitating minimally invasive procedures.

In clinics, medical tubing is crucial for dialysis procedures. It facilitates the movement of blood to and from the dialysis machine, playing a pivotal role in the treatment of patients with kidney problems. The use of catheters and drainage tubes can be used for various purposes including urinary catheters and surgical drainage systems.

Regional Insights

The Presence of Key Players is Stimulating The North American Market Growth

North America is the market leader, accounting for a major share in 2023. Factors such as technological advances, rising healthcare costs, and government policies are expected to increase market demand. For instance, as per the National Health Expenditure Data (NHE), in 2021, health spending in the US surged by 8.4% to USD 900 billion compared to 2020, with Medicaid spending experiencing a 9.2% increase to USD 734 billion. Additionally, the medical tubing market in North America is propelled by key manufacturers such as Bentec Medical, Spectrum Plastics Group, Hitachi Cable America, and NewAge Industries.

Competitive Landscape

Key Players Are Expanding Their Production Capacity to Sustain in the Competitive Environment

Manufacturers are pursuing various strategies such as acquisitions, mergers, joint ventures, new product development, and geographic expansion to increase market penetration and respond to the changing technology needs of various end-use industries. For instance, in February 2023, Freudenberg expanded its production of medical tubing to Massachusetts, aiming to cater to customers in the Eastern United States by offering customized solutions.

Some prominent players in the global medical tubing market are ATAG, Bentec Medical, Elkem, Freelin-Wade, Freudenberg Medical, Imperative Care, Lubrizol, MDC Industries, NewAge Industries, Nordson Medical, RAUMEDIC, Saint-Gobain, Spectrum Plastics Group, TE Connectivity, Tekni-Plex, Teknor Apex, Teleflex, Vention Medical and Zeus Industrial Products.

Medical Tubing Market Coverage

The report provides key insights into the medical tubing market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The analysis focuses on market drivers, restraints, and opportunities, and examines key players and the competitive landscape within the medical tubing market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 9.2 billion |

|

Forecast Revenue (2030) |

USD 18.3 billion |

|

CAGR (2024-2030) |

8.0% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Type (Polyvinyl Chloride (PVC), Polyethylene, Polyurethane, Silicone & Others), By Structure (Single Lumen, Co-Extruded, Multi Lumen & Braided Tubing), By Application (Bulk Disposable Tubing, Catheters, Drug Delivery Systems & Others), By End-user (Hospitals and Clinics, Home Healthcare, Diagnostic and Imaging Centers & Ambulatory Surgical Centers) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

ATAG, Bentec Medical, Elkem, Freelin-Wade., Freudenberg Medical, Imperative Care, Lubrizol, MDC Industries, NewAge Industries, Nordson Medical, RAUMEDIC, Saint-Gobain, Spectrum Plastics Group, TE Connectivity, Tekni-Plex, Teknor Apex, Teleflex, Vention Medical and Zeus Industrial Products |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Medical Tubing Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Medical Tubing Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. Medical Tubing Market Outlook |

|

5.1. Growth Prospect & Opportunity Mapping |

|

5.2 Industry Value Chain Analysis |

|

5.3.Technology Analysis |

|

5.4 Regulatory Landscape |

|

5.5. Porter’s Five Forces analysis |

|

5.6. Reimbursement Scenario |

|

5.7. Pricing Analysis |

|

5.8 PESTLE Analysis |

|

5.9. Covid-19 Impact Analysis |

|

6. Global Medical Tubing Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

6.1 Type |

|

6.1.1 Polyvinyl Chloride (PVC) |

|

6.1.2 Polyethylene |

|

6.1.3 Polyurethane |

|

6.1.4 Silicone |

|

6.1.5 Others |

|

6.2 Structure |

|

6.2.1 Single Lumen |

|

6.2.2 Co-Extruded |

|

6.2.3 Multi Lumen |

|

6.2.4 Braided Tubing |

|

6.3 Application |

|

6.3.1 Bulk Disposable Tubing |

|

6.3.2 Drug Delivery Systems |

|

6.3.3 Catheters |

|

6.3.4 Others |

|

6.4 End-User |

|

6.4.1 Hospitals and Clinics |

|

6.4.2 Home Healthcare |

|

6.4.3 Diagnostic and Imaging Centers |

|

6.4.4 Ambulatory Surgical Centers |

|

6.5 Region |

|

6.5.1 North America |

|

6.5.2 Europe |

|

6.5.3 Asia-Pacific |

|

6.5.4 Latin America |

|

6.5.5 Middle East and Africa |

|

7. North America Medical Tubing Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

7.1 Type |

|

7.1.1 Polyvinyl Chloride (PVC) |

|

7.1.2 Polyethylene |

|

7.1.3 Polyurethane |

|

7.1.4 Silicone |

|

7.1.5 Others |

|

7.2 Structure |

|

7.2.1 Single Lumen |

|

7.2.2 Co-Extruded |

|

7.2.3 Multi Lumen |

|

7.2.4 Braided Tubing |

|

7.3 Application |

|

7.3.1 Bulk Disposable Tubing |

|

7.3.2 Catheters |

|

7.3.3 Drug Delivery Systems |

|

7.3.4 Others |

|

7.4 End-User |

|

7.4.1 Hospitals and Clinics |

|

7.4.2 Home Healthcare |

|

7.4.3 Diagnostic and Imaging Centers |

|

7.4.4 Ambulatory Surgical Centers |

|

7.5 Country |

|

7.5.1 US |

|

7.5.1.1 Type |

|

7.5.1.1.1 Polyvinyl Chloride (PVC) |

|

7.5.1.1.2 Polyethylene |

|

7.5.1.1.3 Polyurethane |

|

7.5.1.1.4 Silicone |

|

7.5.1.1.5 Others |

|

7.5.1.2 Structure |

|

7.5.1.2.1 Single Lumen |

|

7.5.1.2.2 Co-Extruded |

|

7.5.1.2.3 Multi Lumen |

|

7.5.1.2.4 Braided Tubing |

|

7.5.1.3 Application |

|

7.5.1.3.1 Bulk Disposable Tubing |

|

7.5.1.3.2 Catheters |

|

7.5.1.3.3 Drug Delivery Systems |

|

7.5.1.3.4 Others |

|

7.5.1.4 End-User |

|

7.5.1.4.1 Hospitals and Clinics |

|

7.5.1.4.2 Home Healthcare |

|

7.5.1.4.3 Diagnostic and Imaging Centers |

|

7.5.1.4.4 Ambulatory Surgical Centers |

|

7.5.2 Canada |

|

7.5.2.1 Type |

|

7.5.2.1.1 Polyvinyl Chloride (PVC) |

|

7.5.2.1.2 Polyethylene |

|

7.5.2.1.3 Polyurethane |

|

7.5.2.1.4 Silicone |

|

7.5.2.1.5 Others |

|

7.5.2.2 Structure |

|

7.5.2.2.1 Single Lumen |

|

7.5.2.2.2 Co-Extruded |

|

7.5.2.2.3 Multi Lumen |

|

7.5.2.2.4 Braided Tubing |

|

7.5.2.3 Application |

|

7.5.2.3.1 Bulk Disposable Tubing |

|

7.5.2.3.2 Catheters |

|

7.5.2.3.3 Drug Delivery Systems |

|

7.5.2.3.4 Others |

|

7.5.2.4 End-User |

|

7.5.2.4.1 Hospitals and Clinics |

|

7.5.2.4.2 Home Healthcare |

|

7.5.2.4.3 Diagnostic and Imaging Centers |

|

7.5.2.4.4 Ambulatory Surgical Centers |

|

8. Europe Market Medical Tubing Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

8.1 Type |

|

8.1.1 Polyvinyl Chloride (PVC) |

|

8.1.2 Polyethylene |

|

8.1.3 Polyurethane |

|

8.1.4 Silicone |

|

8.1.5 Others |

|

8.2 Structure |

|

8.2.1 Single Lumen |

|

8.2.2 Co-Extruded |

|

8.2.3 Multi Lumen |

|

8.2.4 Braided Tubing |

|

8.3 Application |

|

8.3.1 Bulk Disposable Tubing |

|

8.3.2 Catheters |

|

8.3.3 Drug Delivery Systems |

|

8.3.4 Others |

|

8.4 End-User |

|

8.4.1 Hospitals and Clinics |

|

8.4.2 Home Healthcare |

|

8.4.3 Diagnostic and Imaging Centers |

|

8.4.4 Ambulatory Surgical Centers |

|

8.5 Country |

|

8.5.1 UK |

|

8.5.1.1 Type |

|

8.5.1.1.1 Polyvinyl Chloride (PVC) |

|

8.5.1.1.2 Polyethylene |

|

8.5.1.1.3 Polyurethane |

|

8.5.1.1.4 Silicone |

|

8.5.1.1.5 Others |

|

8.5.1.2 Structure |

|

8.5.1.2.1 Single Lumen |

|

8.5.1.2.2 Co-Extruded |

|

8.5.1.2.3 Multi Lumen |

|

8.5.1.2.4 Braided Tubing |

|

8.5.1.3 Application |

|

8.5.1.3.1 Bulk Disposable Tubing |

|

8.5.1.3.2 Catheters |

|

8.5.1.3.3 Drug Delivery Systems |

|

8.5.1.3.4 Others |

|

8.5.1.4 End-User |

|

8.5.1.4.1 Hospitals and Clinics |

|

8.5.1.4.2 Home Healthcare |

|

8.5.1.4.3 Diagnostic and Imaging Centers |

|

8.5.1.4.4 Ambulatory Surgical Centers |

|

8.5.2 France |

|

8.5.2.1 Type |

|

8.5.2.1.1 Polyvinyl Chloride (PVC) |

|

8.5.2.1.2 Polyethylene |

|

8.5.2.1.3 Polyurethane |

|

8.5.2.1.4 Silicone |

|

8.5.2.1.5 Others |

|

8.5.2.2 Structure |

|

8.5.2.2.1 Single Lumen |

|

8.5.2.2.2 Co-Extruded |

|

8.5.2.2.3 Multi Lumen |

|

8.5.2.2.4 Braided Tubing |

|

8.5.2.3 Application |

|

8.5.2.3.1 Bulk Disposable Tubing |

|

8.5.2.3.2 Catheters |

|

8.5.2.3.3 Drug Delivery Systems |

|

8.5.2.3.4 Others |

|

8.5.2.4 End-User |

|

8.5.2.4.1 Hospitals and Clinics |

|

8.5.2.4.2 Home Healthcare |

|

8.5.2.4.3 Diagnostic and Imaging Centers |

|

8.5.2.4.4 Ambulatory Surgical Centers |

|

8.5.3 Germany |

|

8.5.3.1 Type |

|

8.5.3.1.1 Polyvinyl Chloride (PVC) |

|

8.5.3.1.2 Polyethylene |

|

8.5.3.1.3 Polyurethane |

|

8.5.3.1.4 Silicone |

|

8.5.3.1.5 Others |

|

8.5.3.2 Structure |

|

8.5.3.2.1 Single Lumen |

|

8.5.3.2.2 Co-Extruded |

|

8.5.3.2.3 Multi Lumen |

|

8.5.3.2.4 Braided Tubing |

|

8.5.3.3 Application |

|

8.5.3.3.1 Bulk Disposable Tubing |

|

8.5.3.3.2 Catheters |

|

8.5.3.3.3 Drug Delivery Systems |

|

8.5.3.3.4 Others |

|

8.5.3.4 End-User |

|

8.5.3.4.1 Hospitals and Clinics |

|

8.5.3.4.2 Home Healthcare |

|

8.5.3.4.3 Diagnostic and Imaging Centers |

|

8.5.3.4.4 Ambulatory Surgical Centers |

|

8.5.4 Italy |

|

8.5.4.1 Type |

|

8.5.4.1.1 Polyvinyl Chloride (PVC) |

|

8.5.4.1.2 Polyethylene |

|

8.5.4.1.3 Polyurethane |

|

8.5.4.1.4 Silicone |

|

8.5.4.1.5 Others |

|

8.5.4.2 Structure |

|

8.5.4.2.1 Single Lumen |

|

8.5.4.2.2 Co-Extruded |

|

8.5.4.2.3 Multi Lumen |

|

8.5.4.2.4 Braided Tubing |

|

8.5.4.3 Application |

|

8.5.4.3.1 Bulk Disposable Tubing |

|

8.5.4.3.2 Catheters |

|

8.5.4.3.3 Drug Delivery Systems |

|

8.5.4.3.4 Others |

|

8.5.4.4 End-User |

|

8.5.4.4.1 Hospitals and Clinics |

|

8.5.4.4.2 Home Healthcare |

|

8.5.4.4.3 Diagnostic and Imaging Centers |

|

8.5.4.4.4 Ambulatory Surgical Centers |

|

9. Asia-Pacific Medical Tubing Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

9.1 Type |

|

9.1.1 Polyvinyl Chloride (PVC) |

|

9.1.2 Polyethylene |

|

9.1.3 Polyurethane |

|

9.1.4 Silicone |

|

9.1.5 Others |

|

9.2 Structure |

|

9.2.1 Single Lumen |

|

9.2.2 Co-Extruded |

|

9.2.3 Multi Lumen |

|

9.2.4 Braided Tubing |

|

9.3 Application |

|

9.3.1 Bulk Disposable Tubing |

|

9.3.2 Catheters |

|

9.3.3 Drug Delivery Systems |

|

9.3.4 Others |

|

9.4 End-User |

|

9.4.1 Hospitals and Clinics |

|

9.4.2 Home Healthcare |

|

9.4.3 Diagnostic and Imaging Centers |

|

9.4.4 Ambulatory Surgical Centers |

|

9.5 Country |

|

9.5.1 China |

|

9.5.1.1 Type |

|

9.5.1.1.1 Polyvinyl Chloride (PVC) |

|

9.5.1.1.2 Polyethylene |

|

9.5.1.1.3 Polyurethane |

|

9.5.1.1.4 Silicone |

|

9.5.1.1.5 Others |

|

9.5.1.2 Structure |

|

9.5.1.2.1 Single Lumen |

|

9.5.1.2.2 Co-Extruded |

|

9.5.1.2.3 Multi Lumen |

|

9.5.1.2.4 Braided Tubing |

|

9.5.1.3 Application |

|

9.5.1.3.1 Bulk Disposable Tubing |

|

9.5.1.3.2 Catheters |

|

9.5.1.3.3 Drug Delivery Systems |

|

9.5.1.3.4 Others |

|

9.5.1.4 End-User |

|

9.5.1.4.1 Hospitals and Clinics |

|

9.5.1.4.2 Home Healthcare |

|

9.5.1.4.3 Diagnostic and Imaging Centers |

|

9.5.1.4.4 Ambulatory Surgical Centers |

|

9.5.2 Japan |

|

9.5.2.1 Type |

|

9.5.2.1.1 Polyvinyl Chloride (PVC) |

|

9.5.2.1.2 Polyethylene |

|

9.5.2.1.3 Polyurethane |

|

9.5.2.1.4 Silicone |

|

9.5.2.1.5 Others |

|

9.5.2.2 Structure |

|

9.5.2.2.1 Single Lumen |

|

9.5.2.2.2 Co-Extruded |

|

9.5.2.2.3 Multi Lumen |

|

9.5.2.2.4 Braided Tubing |

|

9.5.2.3 Application |

|

9.5.2.3.1 Bulk Disposable Tubing |

|

9.5.2.3.2 Catheters |

|

9.5.2.3.3 Drug Delivery Systems |

|

9.5.2.3.4 Others |

|

9.5.2.4 End-User |

|

9.5.2.4.1 Hospitals and Clinics |

|

9.5.2.4.2 Home Healthcare |

|

9.5.2.4.3 Diagnostic and Imaging Centers |

|

9.5.2.4.4 Ambulatory Surgical Centers |

|

9.5.3 India |

|

9.5.3.1 Type |

|

9.5.3.1.1 Polyvinyl Chloride (PVC) |

|

9.5.3.1.2 Polyethylene |

|

9.5.3.1.3 Polyurethane |

|

9.5.3.1.4 Silicone |

|

9.5.3.1.5 Others |

|

9.5.3.2 Structure |

|

9.5.3.2.1 Single Lumen |

|

9.5.3.2.2 Co-Extruded |

|

9.5.3.2.3 Multi Lumen |

|

9.5.3.2.4 Braided Tubing |

|

9.5.3.3 Application |

|

9.5.3.3.1 Bulk Disposable Tubing |

|

9.5.3.3.2 Catheters |

|

9.5.3.3.3 Drug Delivery Systems |

|

9.5.3.3.4 Others |

|

9.5.3.4 End-User |

|

9.5.3.4.1 Hospitals and Clinics |

|

9.5.3.4.2 Home Healthcare |

|

9.5.3.4.3 Diagnostic and Imaging Centers |

|

9.5.3.4.4 Ambulatory Surgical Centers |

|

9.5.4 South Korea |

|

9.5.4.1 Type |

|

9.5.4.1.1 Polyvinyl Chloride (PVC) |

|

9.5.4.1.2 Polyethylene |

|

9.5.4.1.3 Polyurethane |

|

9.5.4.1.4 Silicone |

|

9.5.4.1.5 Others |

|

9.5.4.2 Structure |

|

9.5.4.2.1 Single Lumen |

|

9.5.4.2.2 Co-Extruded |

|

9.5.4.2.3 Multi Lumen |

|

9.5.4.2.4 Braided Tubing |

|

9.5.4.3 Application |

|

9.5.4.3.1 Bulk Disposable Tubing |

|

9.5.4.3.2 Catheters |

|

9.5.4.3.3 Drug Delivery Systems |

|

9.5.4.3.4 Others |

|

9.5.4.4 End-User |

|

9.5.4.4.1 Hospitals and Clinics |

|

9.5.4.4.2 Home Healthcare |

|

9.5.4.4.3 Diagnostic and Imaging Centers |

|

9.5.4.4.4 Ambulatory Surgical Centers |

|

10. Latin America Medical Tubing Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

10.1 Type |

|

10.1.1 Polyvinyl Chloride (PVC) |

|

10.1.2 Polyethylene |

|

10.1.3 Polyurethane |

|

10.1.4 Silicone |

|

10.1.5 Others |

|

10.2 Structure |

|

10.2.1 Single Lumen |

|

10.2.2 Co-Extruded |

|

10.2.3 Multi Lumen |

|

10.2.4 Braided Tubing |

|

10.3 Application |

|

10.3.1 Bulk Disposable Tubing |

|

10.3.2 Catheters |

|

10.3.3 Drug Delivery Systems |

|

10.3.4 Others |

|

10.4 End-User |

|

10.4.1 Hospitals and Clinics |

|

10.4.2 Home Healthcare |

|

10.4.3 Diagnostic and Imaging Centers |

|

10.4.4 Ambulatory Surgical Centers |

|

10.5 Country |

|

10.5.1 Brazil |

|

10.5.1.1 Type |

|

10.5.1.1.1 Polyvinyl Chloride (PVC) |

|

10.5.1.1.2 Polyethylene |

|

10.5.1.1.3 Polyurethane |

|

10.5.1.1.4 Silicone |

|

10.5.1.1.5 Others |

|

10.5.1.2 Structure |

|

10.5.1.2.1 Single Lumen |

|

10.5.1.2.2 Co-Extruded |

|

10.5.1.2.3 Multi Lumen |

|

10.5.1.2.4 Braided Tubing |

|

10.5.1.3 Application |

|

10.5.1.3.1 Bulk Disposable Tubing |

|

10.5.1.3.2 Catheters |

|

10.5.1.3.3 Drug Delivery Systems |

|

10.5.1.3.4 Others |

|

10.5.1.4 End-User |

|

10.5.1.4.1 Hospitals and Clinics |

|

10.5.1.4.2 Home Healthcare |

|

10.5.1.4.3 Diagnostic and Imaging Centers |

|

10.5.1.4.4 Ambulatory Surgical Centers |

|

10.5.2 Mexico |

|

10.5.2.1 Type |

|

10.5.2.1.1 Polyvinyl Chloride (PVC) |

|

10.5.2.1.2 Polyethylene |

|

10.5.2.1.3 Polyurethane |

|

10.5.2.1.4 Silicone |

|

10.5.2.1.5 Others |

|

10.5.2.2 Structure |

|

10.5.2.2.1 Single Lumen |

|

10.5.2.2.2 Co-Extruded |

|

10.5.2.2.3 Multi Lumen |

|

10.5.2.2.4 Braided Tubing |

|

10.5.2.3 Application |

|

10.5.2.3.1 Bulk Disposable Tubing |

|

10.5.2.3.2 Catheters |

|

10.5.2.3.3 Drug Delivery Systems |

|

10.5.2.3.4 Others |

|

10.5.2.4 End-User |

|

10.5.2.4.1 Hospitals and Clinics |

|

10.5.2.4.2 Home Healthcare |

|

10.5.2.4.3 Diagnostic and Imaging Centers |

|

10.5.2.4.4 Ambulatory Surgical Centers |

|

10.5.3 Argentina |

|

10.5.3.1 Type |

|

10.5.3.1.1 Polyvinyl Chloride (PVC) |

|

10.5.3.1.2 Polyethylene |

|

10.5.3.1.3 Polyurethane |

|

10.5.3.1.4 Silicone |

|

10.5.3.1.5 Others |

|

10.5.3.2 Structure |

|

10.5.3.2.1 Single Lumen |

|

10.5.3.2.2 Co-Extruded |

|

10.5.3.2.3 Multi Lumen |

|

10.5.3.2.4 Braided Tubing |

|

10.5.3.3 Application |

|

10.5.3.3.1 Bulk Disposable Tubing |

|

10.5.3.3.2 Catheters |

|

10.5.3.3.3 Drug Delivery Systems |

|

10.5.3.3.4 Others |

|

10.5.3.4 End-User |

|

10.5.3.4.1 Hospitals and Clinics |

|

10.5.3.4.2 Home Healthcare |

|

10.5.3.4.3 Diagnostic and Imaging Centers |

|

10.5.3.4.4 Ambulatory Surgical Centers |

|

11. Middle East & Africa Medical Tubing Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

11.1 Type |

|

11.1.1 Polyvinyl Chloride (PVC) |

|

11.1.2 Polyethylene |

|

11.1.3 Polyurethane |

|

11.1.4 Silicone |

|

11.1.5 Others |

|

11.2 Structure |

|

11.2.1 Single Lumen |

|

11.2.2 Co-Extruded |

|

11.2.3 Multi Lumen |

|

11.2.4 Braided Tubing |

|

11.3 Application |

|

11.3.1 Bulk Disposable Tubing |

|

11.3.2 Catheters |

|

11.3.3 Drug Delivery Systems |

|

11.3.4 Others |

|

11.4 End-User |

|

11.4.1 Hospitals and Clinics |

|

11.4.2 Home Healthcare |

|

11.4.3 Diagnostic and Imaging Centers |

|

11.4.4 Ambulatory Surgical Centers |

|

11.5 Country |

|

11.5.1 United Arab Emirates |

|

11.5.1.1 Type |

|

11.5.1.1.1 Polyvinyl Chloride (PVC) |

|

11.5.1.1.2 Polyethylene |

|

11.5.1.1.3 Polyurethane |

|

11.5.1.1.4 Silicone |

|

11.5.1.1.5 Others |

|

11.5.1.2 Structure |

|

11.5.1.2.1 Single Lumen |

|

11.5.1.2.2 Co-Extruded |

|

11.5.1.2.3 Multi Lumen |

|

11.5.1.2.4 Braided Tubing |

|

11.5.1.3 Application |

|

11.5.1.3.1 Bulk Disposable Tubing |

|

11.5.1.3.2 Catheters |

|

11.5.1.3.3 Drug Delivery Systems |

|

11.5.1.3.4 Others |

|

11.5.1.4 End-User |

|

11.5.1.4.1 Hospitals and Clinics |

|

11.5.1.4.2 Home Healthcare |

|

11.5.1.4.3 Diagnostic and Imaging Centers |

|

11.5.1.4.4 Ambulatory Surgical Centers |

|

11.5.2 Saudi Arabia |

|

11.5.2.1 Type |

|

11.5.2.1.1 Polyvinyl Chloride (PVC) |

|

11.5.2.1.2 Polyethylene |

|

11.5.2.1.3 Polyurethane |

|

11.5.2.1.4 Silicone |

|

11.5.2.1.5 Others |

|

11.5.2.2 Structure |

|

11.5.2.2.1 Single Lumen |

|

11.5.2.2.2 Co-Extruded |

|

11.5.2.2.3 Multi Lumen |

|

11.5.2.2.4 Braided Tubing |

|

11.5.2.3 Application |

|

11.5.2.3.1 Bulk Disposable Tubing |

|

11.5.2.3.2 Catheters |

|

11.5.2.3.3 Drug Delivery Systems |

|

11.5.2.3.4 Others |

|

11.5.2.4 End-User |

|

11.5.2.4.1 Hospitals and Clinics |

|

11.5.2.4.2 Home Healthcare |

|

11.5.2.4.3 Diagnostic and Imaging Centers |

|

11.5.2.4.4 Ambulatory Surgical Centers |

|

11.5.3 South Africa |

|

11.5.3.1 Type |

|

11.5.3.1.1 Polyvinyl Chloride (PVC) |

|

11.5.3.1.2 Polyethylene |

|

11.5.3.1.3 Polyurethane |

|

11.5.3.1.4 Silicone |

|

11.5.3.1.5 Others |

|

11.5.3.2 Structure |

|

11.5.3.2.1 Single Lumen |

|

11.5.3.2.2 Co-Extruded |

|

11.5.3.2.3 Multi Lumen |

|

11.5.3.2.4 Braided Tubing |

|

11.5.3.3 Application |

|

11.5.3.3.1 Bulk Disposable Tubing |

|

11.5.3.3.2 Catheters |

|

11.5.3.3.3 Drug Delivery Systems |

|

11.5.3.3.4 Others |

|

11.5.3.4 End-User |

|

11.5.3.4.1 Hospitals and Clinics |

|

11.5.3.4.2 Home Healthcare |

|

11.5.3.4.3 Diagnostic and Imaging Centers |

|

11.5.3.4.4 Ambulatory Surgical Centers |

|

11.5.4 Rest of Middle East & Africa |

|

11.5.4.1 Type |

|

11.5.4.1.1 Polyvinyl Chloride (PVC) |

|

11.5.4.1.2 Polyethylene |

|

11.5.4.1.3 Polyurethane |

|

11.5.4.1.4 Silicone |

|

11.5.4.1.5 Others |

|

11.5.4.2 Structure |

|

11.5.4.2.1 Single Lumen |

|

11.5.4.2.2 Co-Extruded |

|

11.5.4.2.3 Multi Lumen |

|

11.5.4.2.4 Braided Tubing |

|

11.5.4.3 Application |

|

11.5.4.3.1 Bulk Disposable Tubing |

|

11.5.4.3.2 Catheters |

|

11.5.4.3.3 Drug Delivery Systems |

|

11.5.4.3.4 Others |

|

11.5.4.4 End-User |

|

11.5.4.4.1 Hospitals and Clinics |

|

11.5.4.4.2 Home Healthcare |

|

11.5.4.4.3 Diagnostic and Imaging Centers |

|

11.5.4.4.4 Ambulatory Surgical Centers |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.3 Emerging players operating in the market |

|

12.4 Product Benchmarking |

|

12.5 Company Profiles (Manufacturers of Medical Tubing) |

|

12.5.1 ATAG SpA |

|

12.5.1.1 Company Synopsis |

|

12.5.1.2 Company Financials |

|

12.5.1.3 Product/ Service Portfolio |

|

12.5.1.4 Recent Developments |

|

12.5.2 Bentec Medical |

|

12.5.3 Elkem ASA |

|

12.5.4 Freelin-Wade |

|

12.5.5 Freudenberg Medical |

|

12.5.6 Imperative Care |

|

12.5.7 Lubrizol |

|

12.5.8 MDC Industries |

|

12.5.9 NewAge Industries |

|

12.5.10 Nordson Medical |

|

12.5.11 RAUMEDIC AG |

|

12.5.12 Saint-Gobain Performance Plastics |

|

12.5.13 Spectrum Plastics |

|

12.5.14 TE Connectivity |

|

12.5.15 Tekni-Plex |

|

12.5.16 Teknor Apex |

|

12.5.17 Teleflex Incorporated |

|

12.5.18 Vention Medical |

|

12.5.19 Zeus Industrial Products |

|

12.6 Company Profiles (Demand Side) |

|

12.6.1 Abbott |

|

12.6.1.1 Company Synopsis |

|

12.6.1.2 Company Financials |

|

12.6.1.3 Product/ Service Portfolio |

|

12.6.1.4 Recent Developments |

|

12.6.2 Becton & Dickinson |

|

12.6.3 Boston Scientific |

|

12.6.4 GE Drug Delivery Systems |

|

12.6.5 Johnson & Johnson |

|

13. Analyst Recommendations |

Let us connect with you TOC

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats