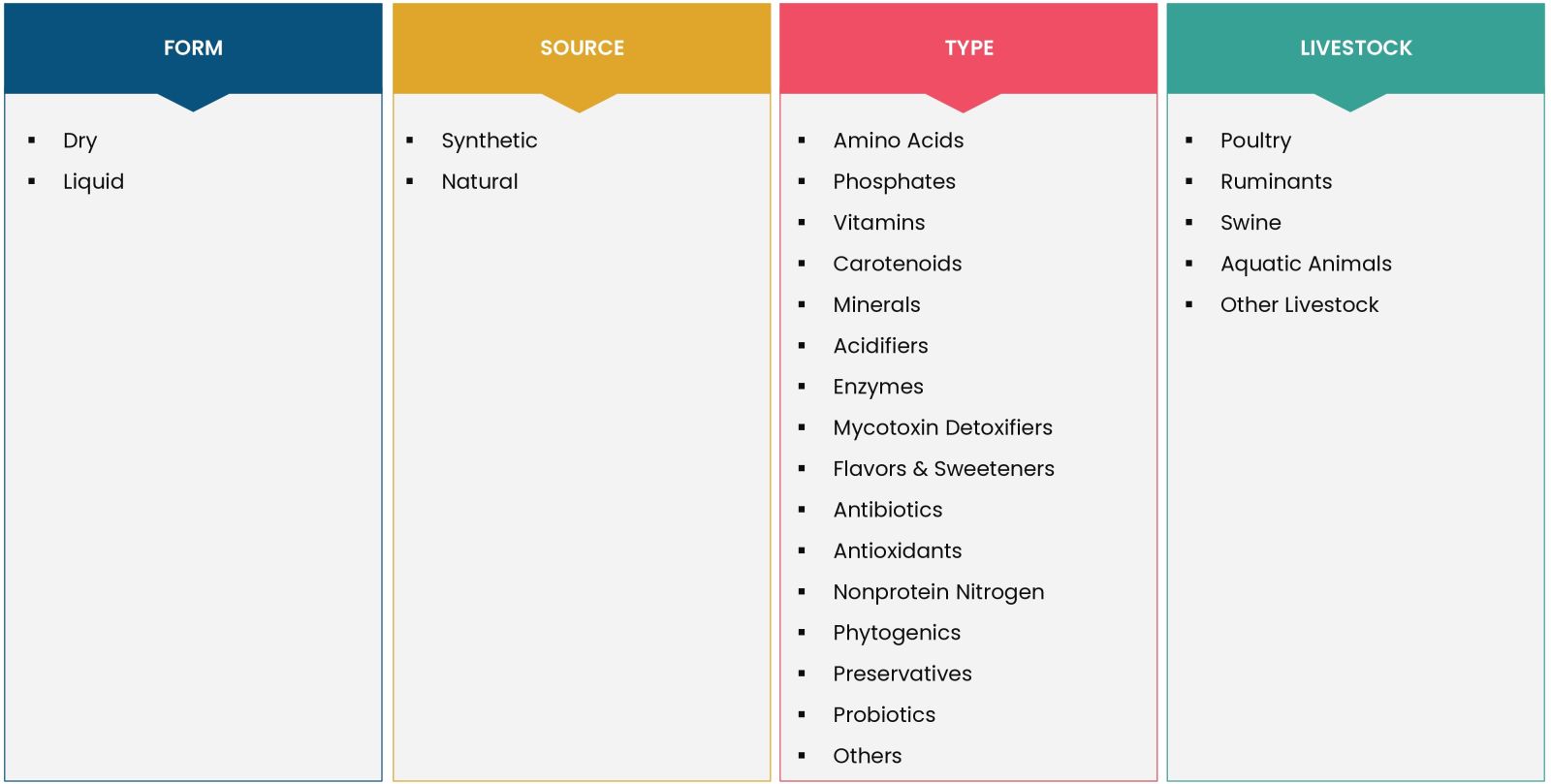

Feed Additives Market Size Analysis, By Form (Dry, Liquid), By Source (Synthetic, Natural), By Type (Amino Acids, Phosphates, Vitamins, Carotenoids, Minerals, Acidifiers, Enzymes, Mycotoxin Detoxifiers, Flavors & Sweeteners, Antibiotics, Antioxidants, Nonprotein Nitrogen, Phytogenics, Preservatives, Probiotics), By Livestock (Poultry {Broilers, Layers, Breeders}, Ruminants {Calf, Dairy, Beef}, Swine {Starters, Growers, Sows}, Aquatic Animals), and By Region; Global Insights & Forecast to 2030

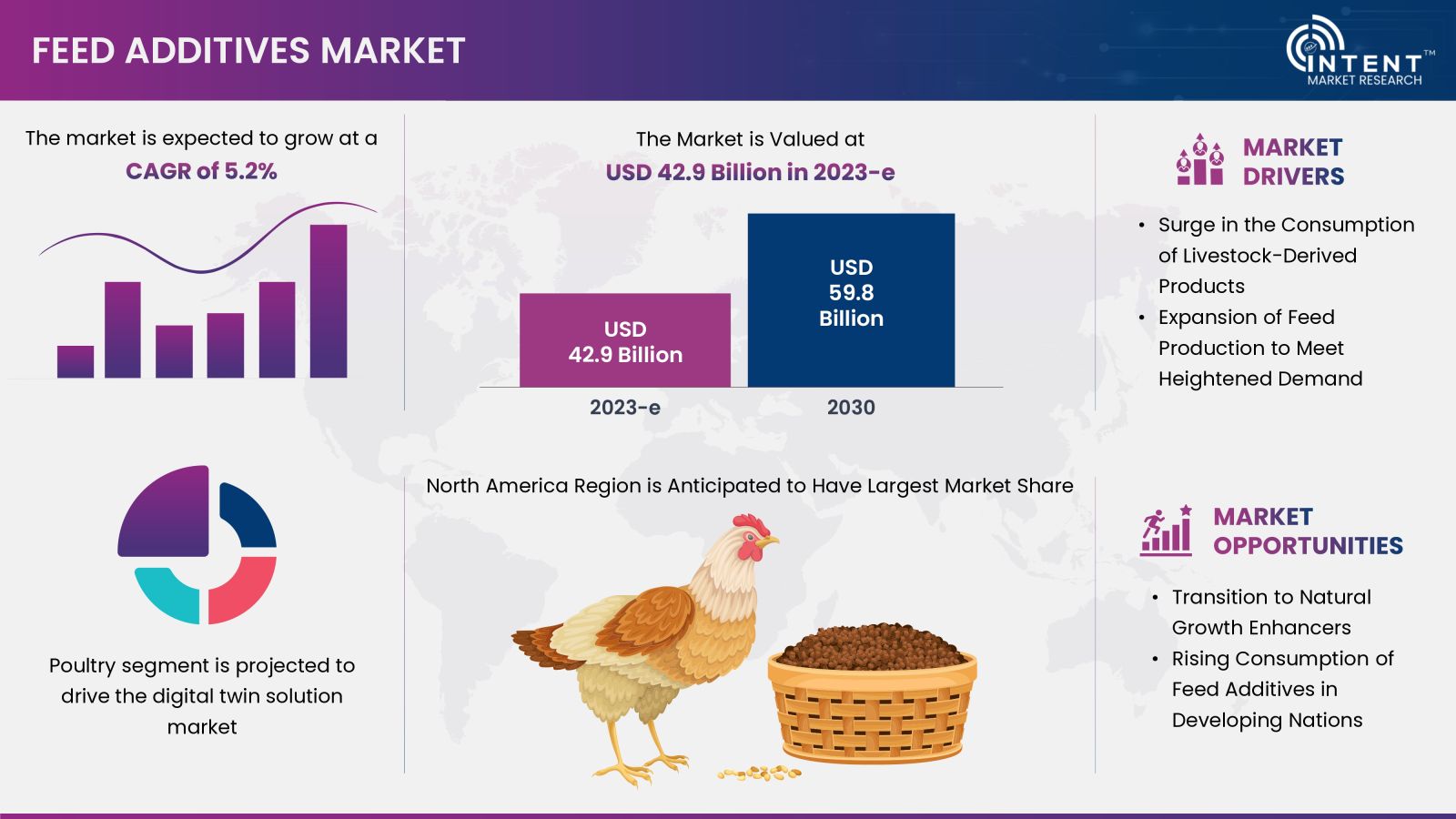

According to Intent Market Research, the feed additives market is expected to grow from USD 42.9 billion in 2023-e at a CAGR of 5.2% to touch USD 59.8 billion by 2030. The feed additives market is competitive, the prominent players in the global market include ADM, Ajinomoto, BASF, Cargill, Chr. Hansen, DSM, Evonik Industries, International Flavors & Fragrances, Novozymes, TEGASA, amongst others

Feed additives a crucial component in modern animal husbandry, continue to revolutionize livestock nutrition. These specific components, spanning from vitamins and minerals to probiotics and enzymes, are intricately mixed into animal feed to address the nutritional needs of a wide array of livestock species. In 2023, the feed additives market reflects a dynamic landscape shaped by global shifts in agriculture and consumer preferences.

Feed additives are employed globally in various livestock, including poultry, ruminants and swine. They serve multiple purposes, such as providing essential nutrients, enhancing feed palatability, improving growth performance, and optimizing feed utilization. Maintaining high health standards, especially for animals with significant growth, necessitates the use of appropriate additives. As industry standards rise and consumer awareness increases, there is a growing demand for natural and non-residual alternatives to conventional feed additives. Probiotics, prebiotics, enzymes, and herbs are emerging as viable alternatives supported by scientific research.

Growth of Feed Additives Market is fueled by the Consumption of Livestock-Derived Products

The increasing global demand for meat and livestock-derived products has a direct impact on the feed additives market. As more people incorporate animal products into their diets, there is a corresponding need for a higher volume and quality of animal feed to support livestock growth and production.

The global population's rising affluence and evolving dietary preferences have fueled an unprecedented surge in the consumption of livestock-derived products. As more people around the world incorporate meat and dairy into their diets, the demand for a consistent supply of high-quality animal feed has intensified. This surge is reshaping the feed additives market, prompting producers to adopt innovative approaches to meet the nutritional needs of a growing and diversified livestock population.

Dry Feed Additives offer Enhanced Nutrition and Improved Performance

Dry feed additives play a crucial role in enhancing the nutritional content and overall health of livestock and poultry. These additives, commonly available in powder or granular form, are specifically designed to be mixed into the animals' dry feed. This method offers convenience in handling, storage, and application. Dry feed additives encompass a diverse range of supplements, including vitamins, minerals, amino acids, and probiotics. They are formulated to address nutritional deficiencies, promote optimal growth, and support immune function in animals. The ease of incorporating these additives into existing feed formulations makes them a practical choice for farmers and feed manufacturers.

The Natural Sources Segment is Witness Significant Growth in the Forecast Period

Feed additives derived from natural sources encompass a diverse range of ingredients sourced from nature, including herbs, botanicals, minerals, and microorganisms. As consumers increasingly prioritize the quality and safety of food products, there is a high demand for additives sourced from natural origins. Regarded as healthier and less prone to introducing harmful chemicals into the food chain, natural feed additives are valued not only for safety but also for their substantial advantages. These include promoting animal health, fostering improved growth rates, and ensuring superior product quality.

Characterized by bioactive compounds that contribute to animal well-being, these natural alternatives play a crucial role in reducing dependence on antibiotics and synthetic chemicals. The rapid expansion of the natural sub-segment is driven by a growing awareness among livestock producers.

Crucial Role of Amino Acid in Promoting Animal Health and thus Maximizing Productivity

Amino acids play a pivotal role in the feed additive market, driving growth, productivity, and profitability in animal nutrition. Essential for protein synthesis, amino acids are crucial for promoting animal health, ensuring robust growth, and maximizing productivity. ADM, a global producer of amino acids, offers scientifically developed choices that enhance nutritional absorption, optimize feed efficiency, and support overall animal well-being. ADM's innovative approaches, including liquid lysine and encapsulated lysine technology, showcase a commitment to sustainability, safety, and efficiency, further establishing amino acids as indispensable components in advancing animal nutrition and feed additive solutions.

The Poultry Segment Holds the Largest Market Share in 2023

In 2023, the poultry segment hold the largest market share and is anticipated to maintain its dominance due to the rising demand for poultry meat. Comprising duck, chicken, turkey, and goose, major poultry species are led globally by chickens in terms of breeding. Feed additives play a crucial role in poultry farming by enhancing the nutritional content of feed, promoting growth, and maintaining poultry health. These additives contribute to disease prevention, improve feed efficiency, and ensure optimal performance, addressing the specific dietary needs of poultry for sustainable and productive farming practices.

North America Held a Significant Market Share During the Forecast Period

The expansion of the feed additive industry in North America is facilitated by the growing demand for meat, particularly in the US, along with the enforcement of rigorous meat quality regulations. The significance of North America, particularly the US, in the feed additive market is underscored by its role as the world's leading poultry producer and the second-largest exporter of poultry meat. The US poultry industry, being a major player in global poultry production and trade, heavily relies on feed additives to enhance production efficiency. Additionally, the poultry and egg industries in the US emerge as significant consumers of feed grains, highlighting the region's pivotal role in the feed additive market.

Key players in the feed additives market, such as Cargill, ADM, International Flavors & Fragrances, Evonik Industries, BASF, DSM, Ajinomoto, Novozymes, Chr. Hansen, and TEGASA, amongst others.

Feed Additives Market Coverage

The report provides key insights into the feed additives market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players and the competitive landscape within the market. The report offers the market size and forecasts for the feed additives market, in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 42.9 billion |

|

Forecast Revenue (2030) |

USD 59.8 billion |

|

CAGR (2024-2030) |

5.2% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Form (Dry, Liquid), By Source (Synthetic, Natural), By Type (Amino Acids {Lysine, Methionine, Threonine, Tryptophan, Other Amino Acids}, Phosphates {Monocalcium Phosphate, Dicalcium Phosphate}, Vitamins {Fat-Soluble Vitamins, Water-Soluble Vitamins}, Carotenoids {Astaxanthin, Canthaxanthin, Lutein, Beta Carotene}, Minerals {Potassium, Calcium, Phosphorus, Magnesium, Sodium, Iron, Zinc, Copper, Manganese, Other minerals}, Acidifiers {Propionic Acid, Formic Acid, Citric Acid, Lactic Acid, Sorbic Acid, Malic Acid, Benzoic Acid, Acetic Acid, Other Acidifiers}, Enzymes (Phytase, Carbohydrase, Protease, Other Enzymes), Mycotoxin Detoxifiers (Binders, Modifiers), Flavors & Sweeteners (Feed Flavors, Feed Sweeteners), Antibiotics (Tetracycline, Penicillin, Other Antibiotics), Antioxidants (Synthetic Antioxidants, Natural Antioxidants), Nonprotein Nitrogen (Urea, Ammonia, Other Nonprotein Nitrogen), Phytogenics (Essential Oils, Flavonoids, Saponins, Oleoresins, Other Phytogenics), Preservatives (Mold Inhibitors, Anticaking Agents), Probiotics (Lactobacilli, Bifidobacteria, Streptococcus Thermophilus, Yeast), By Livestock {Poultry [Broilers, Layers, Breeders], Ruminants {Calf, Dairy, Beef, Other Ruminants}, Swine {Starters, Growers, Sows}, Aquatic animals, Other Livestock) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

ADM, Ajinomoto, BASF, Cargill, Chr. Hansen, DSM, Evonik Industries, International Flavors & Fragrances, Novozymes, TEGASA |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.1.1.Surge in the Consumption of Livestock-Derived Products |

|

4.1.2.Expansion of Feed Production to Meet Heightened Demand |

|

4.1.3.Standardization of Meat Products Driven by Concerns Over Disease Outbreaks |

|

4.1.4.Escalating Global Interest in Naturally Sourced Feed and Additives |

|

4.1.5.Growing Consciousness Regarding the Quality of Animal Feed |

|

4.2. Market Growth Restraints |

|

4.2.1.Prohibition of Antibiotics in Various Countries |

|

4.2.2.Rigorous Regulatory Structures |

|

4.2.3.Fluctuating Prices of Raw Materials for Feed Additives |

|

4.3. Market Growth Opportunities |

|

4.3.1.Transition to Natural Growth Enhancers |

|

4.3.2.Rising Consumption of Feed Additives in Developing Nations |

|

4.4. PESTLE Analysis |

|

4.5. PORTER Analysis |

|

5.Market Outlook |

|

5.1.Overview (Industry Snapshot) |

|

5.2.Value Chain Analysis |

|

5.3.Supply Chain Analysis |

|

5.4.Technology Analysis |

|

5.5.Patent Analysis |

|

5.6.Trade Analysis |

|

5.7.Key Conferences and Events |

|

5.8.Trends |

|

5.9.Average Selling Price |

|

5.10. Regulatory Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1. Segment Synopsis |

|

6.2.By Form |

|

6.2.1.Dry |

|

6.2.2.Liquid |

|

6.3. By Source |

|

6.3.1.Synthetic |

|

6.3.2.Natural |

|

6.4. By Type |

|

6.4.1.Amino Acids |

|

6.4.1.1. Methionine |

|

6.4.1.2. Threonine |

|

6.4.1.3. Lysine |

|

6.4.1.4. Tryptophan |

|

6.4.1.5. Other Amino Acids |

|

6.4.2.Phosphates |

|

6.4.2.1. Monocalcium Phosphate |

|

6.4.2.2. Dicalcium Phosphate |

|

6.4.3.Vitamins |

|

6.4.3.1. Water-Soluble Vitamins |

|

6.4.3.2. Fat-Soluble Vitamins |

|

6.4.4.Carotenoids |

|

6.4.4.1. Canthaxanthin |

|

6.4.4.2. Lutein |

|

6.4.4.3. Astaxanthin |

|

6.4.4.4. Beta-carotene |

|

6.4.5.Minerals |

|

6.4.5.1. Potassium |

|

6.4.5.2. Phosphorus |

|

6.4.5.3. Calcium |

|

6.4.5.4. Sodium |

|

6.4.5.5. Magnesium |

|

6.4.5.6. Iron |

|

6.4.5.7. Zinc |

|

6.4.5.8. Copper |

|

6.4.5.9. Manganese |

|

6.4.5.10. Other minerals |

|

6.4.6.Acidifiers |

|

6.4.6.1. Formic Acid |

|

6.4.6.2. Propionic Acid |

|

6.4.6.3. Citric Acid |

|

6.4.6.4. Lactic Acid |

|

6.4.6.5. Malic Acid |

|

6.4.6.6. Sorbic Acid |

|

6.4.6.7. Benzoic Acid |

|

6.4.6.8. Acetic Acid |

|

6.4.6.9. Other Acidifiers |

|

6.4.7.Enzymes |

|

6.4.7.1. Carbohydrase |

|

6.4.7.2. Phytase |

|

6.4.7.3. Protease |

|

6.4.7.4. Other Enzymes |

|

6.4.8.Mycotoxin Detoxifiers |

|

6.4.8.1. Binders |

|

6.4.8.2. Modifiers |

|

6.4.9.Flavors & Sweeteners |

|

6.4.9.1. Feed Flavors |

|

6.4.9.2. Feed Sweeteners |

|

6.4.10.Antibiotics |

|

6.4.10.1.Tetracycline |

|

6.4.10.2.Penicillin |

|

6.4.10.3.Other antibiotics |

|

6.4.11.Antioxidants |

|

6.4.11.1.Synthetic Antioxidants |

|

6.4.11.2.Natural Antioxidants |

|

6.4.12.Nonprotein Nitrogen |

|

6.4.12.1.Urea |

|

6.4.12.2.Ammonia |

|

6.4.12.3.Other Nonprotein Nitrogen |

|

6.4.13.PHYTOGENICS |

|

6.4.13.1.Essential Oils |

|

6.4.13.2.Flavonoids |

|

6.4.13.3.Saponins |

|

6.4.13.4.Oleoresins |

|

6.4.13.5.Other Phytogenics |

|

6.4.14.Preservatives |

|

6.4.14.1.Mold Inhibitors |

|

6.4.14.2.Anticaking Agents |

|

6.4.15.Probiotics |

|

6.4.15.1.Lactobacilli |

|

6.4.15.2.Bifidobacteria |

|

6.4.15.3.Streptococcus Thermophilus |

|

6.4.15.4.Yeast |

|

6.4.16.Others |

|

6.5. By Livestock |

|

6.5.1.Poultry |

|

6.5.1.1. Broilers |

|

6.5.1.2. Layers |

|

6.5.1.3. Breeders |

|

6.5.2.Ruminants |

|

6.5.2.1. Calf |

|

6.5.2.2. Dairy |

|

6.5.2.3. Beef |

|

6.5.2.4. Other Ruminants |

|

6.5.3.Swine |

|

6.5.3.1. Starters |

|

6.5.3.2. Growers |

|

6.5.3.3. Sows |

|

6.5.4.Aquatic Animals |

|

6.5.5.Other Livestock |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Feed Additives Market Outlook 7.2.2.US |

|

7.2.2.1. US Feed Additives Market, By Form |

|

7.2.2.2. US Feed Additives Market, By Source |

|

7.2.2.3. US Feed Additives Market, By Type |

|

7.2.2.4. US Feed Additives Market, By Livestock |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above |

|

7.2.3.Canada |

|

7.3. Europe |

|

7.3.1.Europe Feed Additives Market Outlook |

|

7.3.1.1. Germany |

|

7.3.1.2. UK |

|

7.3.1.3. France |

|

7.3.1.4. Spain |

|

7.3.1.5. Italy |

|

7.3.1.6. Asia-Pacific |

|

7.3.2.Asia-Pacific Feed Additives Market Outlook |

|

7.3.2.1. China |

|

7.3.2.2. India |

|

7.3.2.3. Japan |

|

7.3.2.4. South Korea |

|

7.3.2.5. Australia |

|

7.4. Latin America |

|

7.4.1.Latin America Feed Additives Market Outlook |

|

7.4.1.1. Mexico |

|

7.4.1.2. Brazil |

|

7.5. Middle East & Africa |

|

7.5.1.Middle East & Africa Feed Additives Market Outlook |

|

7.5.1.1. Saudi Arabia |

|

7.5.1.2. UAE |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Volume Output Analysis |

|

8.3. Company Strategy Analysis |

|

8.4. Competitive Matrix |

|

9.Company Profiles |

|

9.1.Bentoli |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.Analyst Perception |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above |

|

9.2.Cargill |

|

9.3.Chr. Hansen |

|

9.4.ADM |

|

9.5.BASF |

|

9.6.International Flavors & Fragrances |

|

9.7.Evonik Industries |

|

9.8.DSM |

|

9.9.Novozymes |

|

9.10. Tegasa |

Let us connect with you TOC

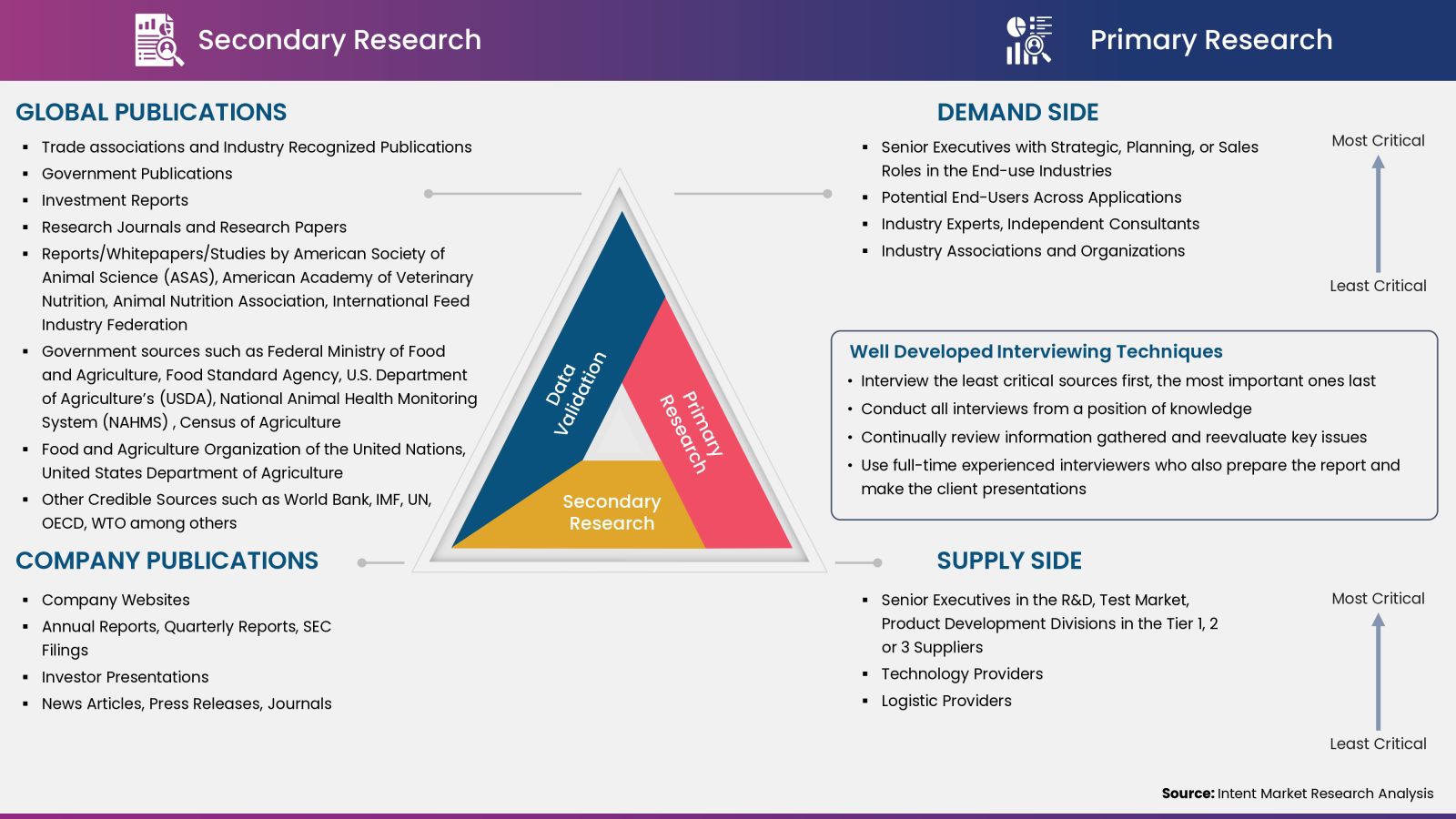

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

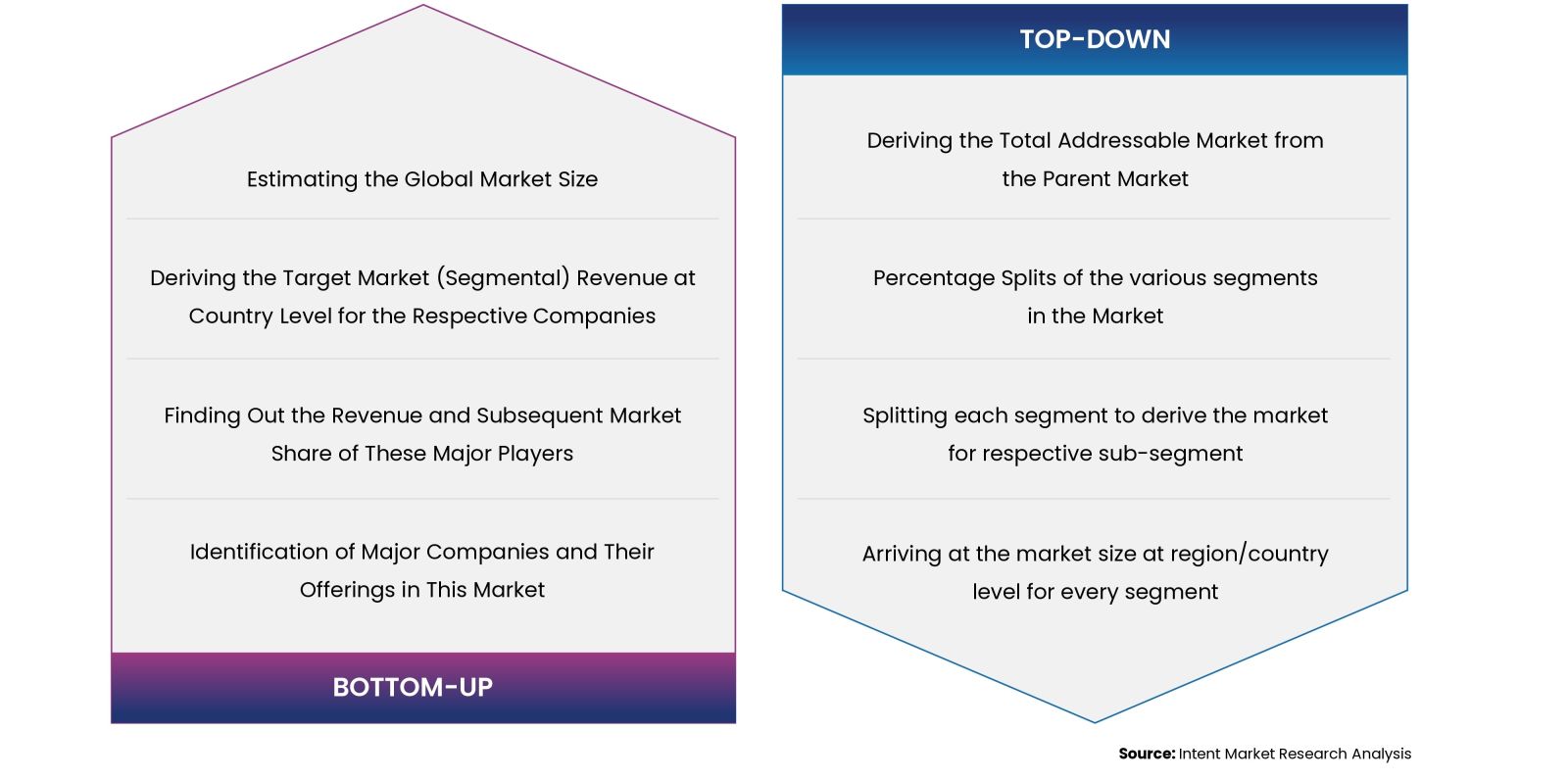

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats