Controlled-release Fertilizers Market Analysis, By Type (Slow-release Fertilizers, Nitrogen Stabilizers, Coated & Encapsulated Fertilizers), By Composition (Organic, Synthetic), By Form (Liquid, Granule, Powder), By Mode of Application (Foliar, Fertigation, Soil), By End-use (Agriculture, Non-agriculture) and By Region; Global Insights & Forecast (2024 - 2030)

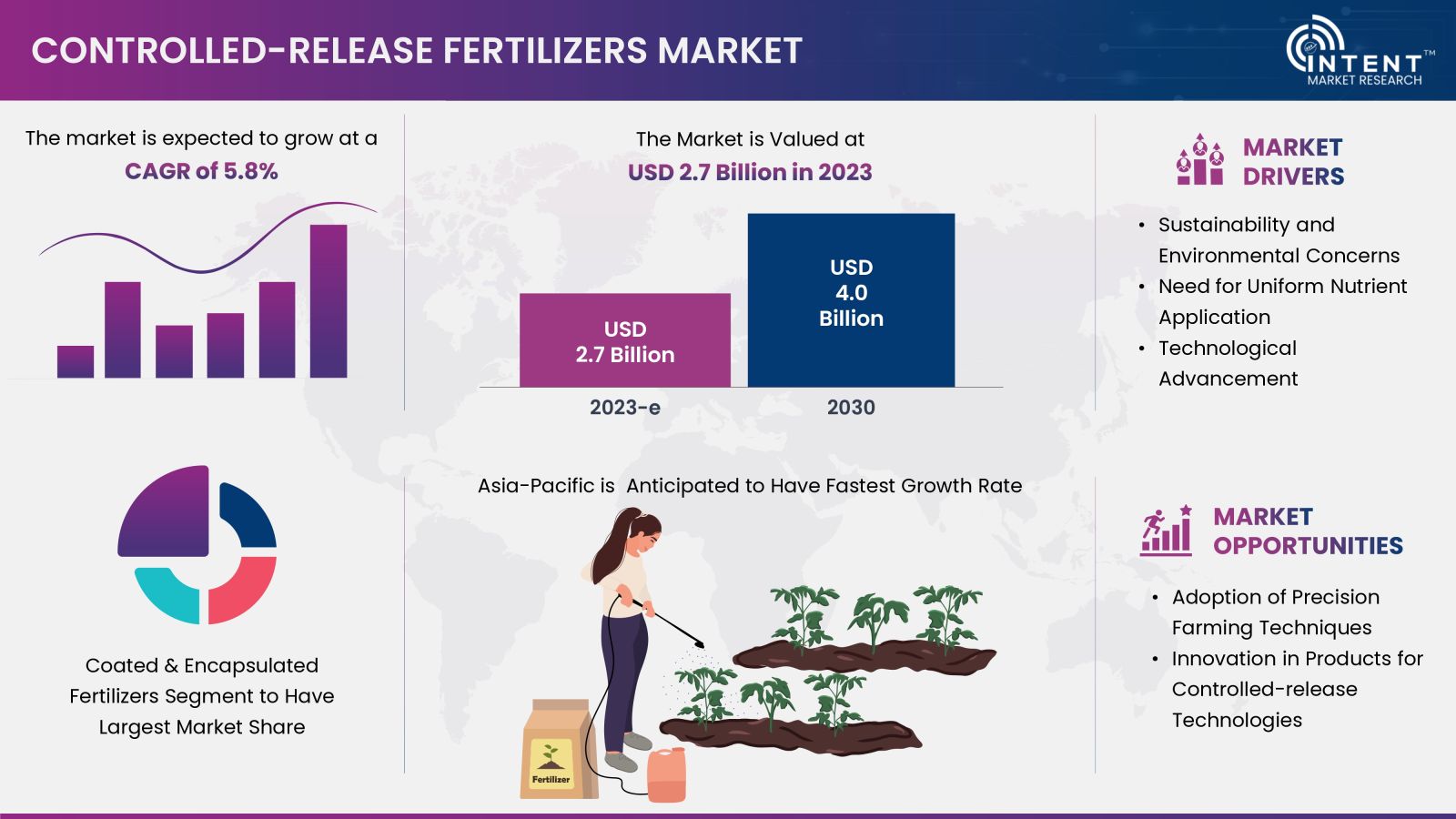

The Controlled-release Fertilizers (CRF) Market is expected to grow from USD 2.7 billion in 2023-e to USD 4.0 billion by 2030, at a CAGR of 5.8% during the forecast period. CRF is a competitive market, the prominent players in the global market include COMPO EXPERT, Haifa, Helena Chemicals, ICL, Kingenta, Koch, Mosaic, Nufarm, Nutrien, ScottsMiracle-Gro, SQM, and Yara. Sustainability and environmental concerns is fueling the growth of Controlled-release Fertilizers market

The use of controlled-release fertilizers in agriculture industry improve both crop productivity and address environmental issues. Through slow nutrient release, these fertilizers reduce environmental impact and encourage sustainability. Sustainability and environmental concerns, growing world population, rising food prices and technological advancements in agriculture industry is boosting the growth of this market. As these factors keep connecting and changing, the market for controlled-release fertilizers is expected to grow steadily in the coming years.

Controlled-release Fertilizers Market Dynamics

Sustainability and Environmental Concerns will Drive the Market

Demand for controlled-release fertilizers has surged as a result of growing awareness of and concerns about sustainability and its impact on the environment. These fertilizers support sustainable farming methods, lessen environmental pollution, and minimize nutrient runoff. Fertilizer use in agriculture has been attributed for the significant rise in food, feed, and fiber production.

Despite this, plants do not absorb a substantial amount of nutrients from added fertilizer. Through nitrification, volatilization, or leaching, these nutrients are lost. As controlled-release fertilizers (CRF) are made to synchronize the release of nutrients by plant requirements, they can be used to mitigate the issues caused by these losses. By using CRF to directly or indirectly delay desired plant growth phases, crop yields can be raised in an environmentally friendly way.

Lack of Awareness among Farmers is Hindering the Use of Controlled-release Fertilizers

One of the biggest barriers to the widespread use of CRF is a lack of farmer knowledge. There is still a lack of knowledge among farmers regarding the advantages and appropriate usage of CRF, which makes it more difficult to incorporate into conventional farming methods. This ignorance is a result of both the complicated makeup of these fertilizers and a lack of thorough educational initiatives. The full potential of CRF can only be realized by bridging this information gap because knowledgeable farmers are better able to make sustainable decisions.

Controlled-release Fertilizers Market Segment Insights

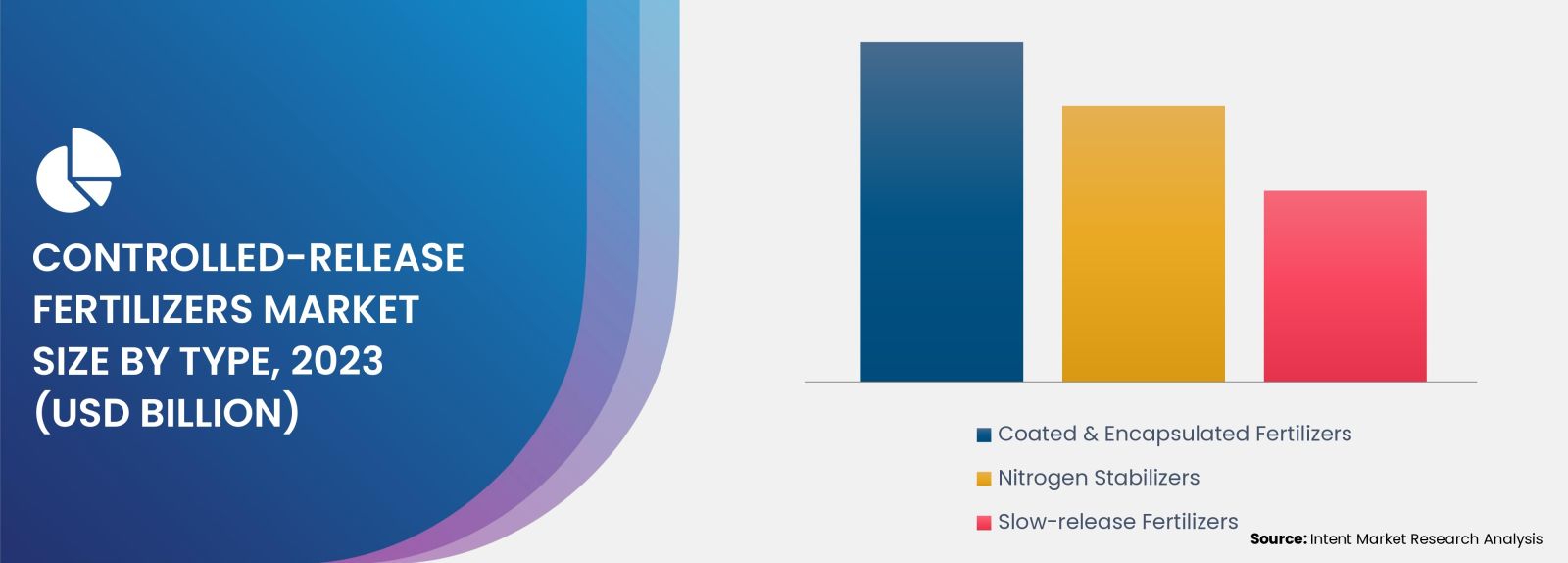

CRF Market Growth is Driven by the Coated & Encapsulated Fertilizers Segment

In 2023, coated & encapsulated CRF hold the largest market. Its widespread availability and adoption in both developed and developing economies is responsible for this segment's substantial market share. The primary drivers of the growth of the coated & encapsulated fertilizers market are factors like the rising demand for high-value crops and the expanding global production of fertilizer and urea products.

Rising Adoption of Precision Agriculture Techniques is Growing the Demand for Synthetic Fertilizers

In the CRF market, synthetic fertilizers are anticipated to make up the largest share. Industrially produced or extracted from minerals, synthetic fertilizers are inorganic substances created by humans. The demand for synthetic fertilizers is being driven by the growing use of precision agriculture techniques, which maximize crop yields and resource efficiency through precise nutrient application.

Enhanced Crop Yields and Resource Efficiency is boosting Soil Segment

Soil as a mode of application serves as a pivotal driver for the burgeoning growth of CRF market. This technique maximizes plant uptake and reduces waste by guaranteeing targeted and continuous nutrient delivery straight to the root zone. Enhanced crop yields and resource efficiency are promoted by increased agricultural efficiency brought about by the smooth integration of CRF into the soil. This application method is in line with precision farming techniques and provides a sustainable way to address nutrient deficiencies with less negative environmental effects.

Granule Fertilizers are Paving the Way for Uniform Nutrient Distribution

Granular fertilizers guarantee uniform nutrient distribution throughout the field, encouraging balanced plant growth and reducing the frequency of application. The labor and operating expenses related to frequent fertilization are also decreased by this method. Granular CRF also lessens the chance of nutrient pollution in water bodies, which promotes environmental sustainability.

Non-agriculture Segment within the End-use is Driving Market Growth

Throughout the forecast period, the non-agriculture segment is expected to hold the largest market share. This can be linked to the non-agricultural sectors' increasing need for CRFs due to rising purchasing power and environmental concerns. Different non-agricultural segments, such as turf & ornamental, nurseries & greenhouse contribute significantly to the growth of CRF market. In the field of turf & ornamental, CRF guarantees a consistent supply of nutrients for lush lawns and colorful ornamental plants, improving the overall appearance. The exact nutrient release provided by CRF helps nurseries and greenhouse operations maximize plant growth in regulated settings.

Asia-Pacific is Poised for Significant Market Growth in the Forecast period

In 2023, the global market for CRFs was led by the Asia-Pacific region. China was the country that consumed the largest amount of CRFs globally, with India and Japan following closely behind. In these countries, the demand for CRF is anticipated to rise more quickly in the upcoming years than that for conventional fertilizers.

Major Industry Players are Enhancing their Positions by Actively Launching Controlled-release Fertilizers

CRF market is characterized by intense competition due to the presence of numerous international and domestic players. The CRF market, in particular, is dominated by key players such as COMPO EXPERT, Haifa, Helena Chemicals, ICL, Kingenta, Koch, Mosaic, Nufarm, Nutrien, ScottsMiracle-Gro, SQM and Yara. These industry leaders primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of market players is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In September 2023, ICL introduced the industry-first Biodegradable CRF Technology, eqo.x. The first product to offer a CRF coating for urea is Eqo. x release technology.

- In September, 2023 Sollio Agriculture opened CRF Agritech, a new facility in St. Thomas, Ontario, that produces controlled-release fertilizers.

- In August 2021, to produce fertilizer crops with a low carbon footprint at Yara's plant in Porsgrunn, Norway, Yara International ASA partnered with Nel Hydrogen Electrolyser. Through the PILOT-E presentation, this plan was approved by Innovation Norway, Enova, and the Research Council of Norway.

Controlled-release Fertilizers Market Coverage

The report provides key insights into the controlled-release fertilizers market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players and the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 2.7 billion |

|

Forecast Revenue (2030) |

USD 4.0 billion |

|

CAGR (2024-2030) |

5.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Type (Slow-release Fertilizers (Urea Formaldehyde, Urea Isobytyraldehyde, Urea Acetaldehyde, Others), Nitrogen Stabilizers (Nitrification Inhibitors, Urease Inhibitors), Coated & Encapsulated Fertilizers (Sulfur Coated, Polymer Coated, Sulfur Polymer Coated, Others)), By Composition (Organic, Synthetic), By Form (Liquid, Granule, Powder), By Mode of Application (Foliar, Fertigation, Soil, Others), By End-use (Agriculture (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), Non-agriculture (Turf & Ornamental, Nurseries & Greenhouse, Others)) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

COMPO EXPERT, Haifa, Helena Chemicals, ICL, Kingenta, Koch, Mosaic, Nufarm, Nutrien, ScottsMiracle-Gro, SQM, Yara |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.1.1. Sustainability and environmental concerns |

|

4.1.2. Need for uniform nutrient application |

|

4.1.3. Technological advancement in agriculture |

|

4.2. Market Growth Restraints |

|

4.2.1. Lack of awareness among farmers |

|

4.2.2. Complexity of application and manufacturing of Controlled-release fertilizers(CRFs) |

|

4.3. Market Growth Opportunities |

|

4.3.1. Innovation in products for controlled-release technologies |

|

4.3.2. Precision farming techniques for managing nutrients specific to individual crops |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Technology Trends |

|

5.3. Patent Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

6.1. Segment Synopsis |

|

6.2. By Type |

|

6.2.1. By Slow-release Fertilizers |

|

6.2.1.1.Urea Formaldehyde |

|

6.2.1.2.Urea Isobytyraldehyde |

|

6.2.1.3.Urea Acetaldehyde |

|

6.2.1.4.Others |

|

6.2.2. By Nitrogen Stabilizers |

|

6.2.2.1.Nitrification Inhibitors |

|

6.2.2.2.Urease Inhibitors |

|

6.2.3. By Coated & Encapsulated Fertilizers |

|

6.2.3.1.Sulfur Coated |

|

6.2.3.2.Polymer Coated |

|

6.2.3.3.Sulfur Polymer Coated |

|

6.2.3.4.Others |

|

6.3. By Composition |

|

6.3.1. Organic |

|

6.3.2. Synthetic |

|

6.4. By Form |

|

6.4.1. Liquid |

|

6.4.2. Granule |

|

6.4.3. Powder |

|

6.5. By Mode of Application |

|

6.5.1. Foliar |

|

6.5.2. Fertigation |

|

6.5.3. Soil |

|

6.5.4. Others |

|

6.6. By End-use |

|

6.6.1. By Agriculture |

|

6.6.1.1.Cereals & Grains |

|

6.6.1.2.Fruits & Vegetables |

|

6.6.1.3.Oilseeds & Pulses |

|

6.6.1.4.Others |

|

6.6.2. By Non-agriculture |

|

6.6.2.1.Nurseries & Greenhouse |

|

6.6.2.2.Turf & Ornamental |

|

6.6.2.3.Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Controlled-release Fertilizers Market Outlook |

|

7.2.2. US |

|

7.2.2.1.US Controlled-release Fertilizers Market, By Type |

|

7.2.2.2.US Controlled-release Fertilizers Market, By Composition |

|

7.2.2.3.US Controlled-release Fertilizers Market, By Form |

|

7.2.2.4.US Controlled-release Fertilizers Market, By Mode of Application |

|

7.2.2.5.US Controlled-release Fertilizers Market, By End-use |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.2.4. Mexico |

|

7.3. Europe |

|

7.3.1. Europe Controlled-release Fertilizers Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Spain |

|

7.3.6. Italy |

|

7.4. Asia-Pacific |

|

7.4.1. Asia-Pacific Controlled-release Fertilizers Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.4.6. Australia |

|

7.5. Latin America |

|

7.5.1. Latin America Controlled-release Fertilizers Market Outlook |

|

7.5.2. Brazil |

|

7.5.3. Argentina |

|

7.6. Middle East & Africa |

|

7.6.1. Middle East & Africa Controlled-release Fertilizers Market Outlook |

|

7.6.2. Saudi Arabia |

|

7.6.3. UAE |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Controlled-release Fertilizers Companies |

|

9.1.1. COMPO EXPERT |

|

9.1.1.1.Company Synopsis |

|

9.1.1.2.Company Financials |

|

9.1.1.3.Product/Service Portfolio |

|

9.1.1.4.Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2. Haifa |

|

9.1.3. Helena Chemicals |

|

9.1.4. ICL |

|

9.1.5. Kingenta |

|

9.1.6. Koch |

|

9.1.7. Mosaic |

|

9.1.8. Nufarm |

|

9.1.9. Nutrien |

|

9.1.10. ScottsMiracle-Gro |

|

9.1.11. SQM |

|

9.1.12. Yara |

Let us connect with you TOC

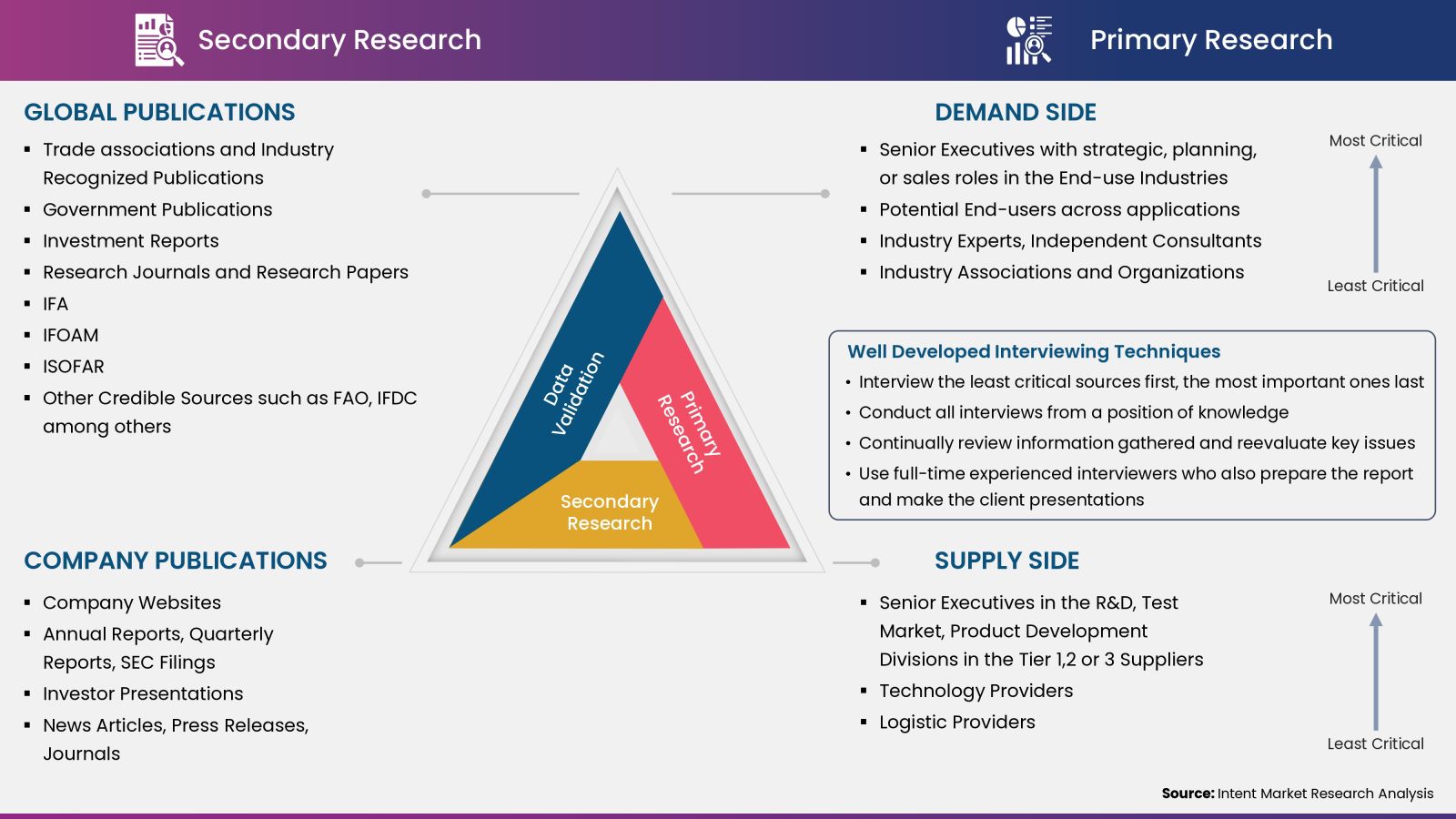

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

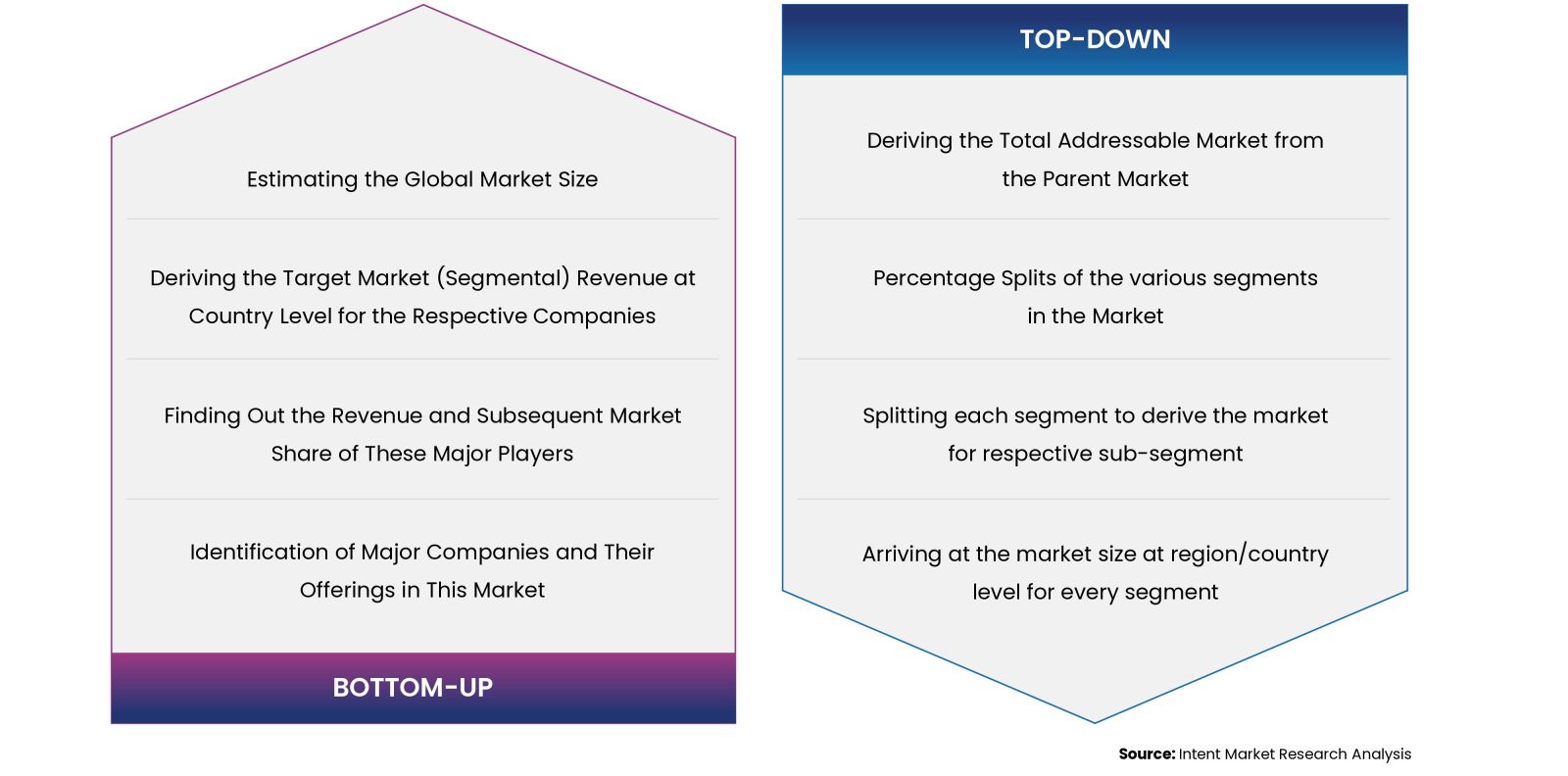

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

%20Market-01.jpg)

Available Formats