Computer Numerical Control (CNC) Market By Machine Type (Lathe Machines, Milling Machines, Laser Machines, Grinding Machines, Welding Machines, Winding Machines), By Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), By Axis Type (2Axis, 3 Axis, 4 Axis, 5 Axis, Multi-Axis), By End-use Industry (Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial) and Region; Global Insights & Forecasts (2024 - 2030)

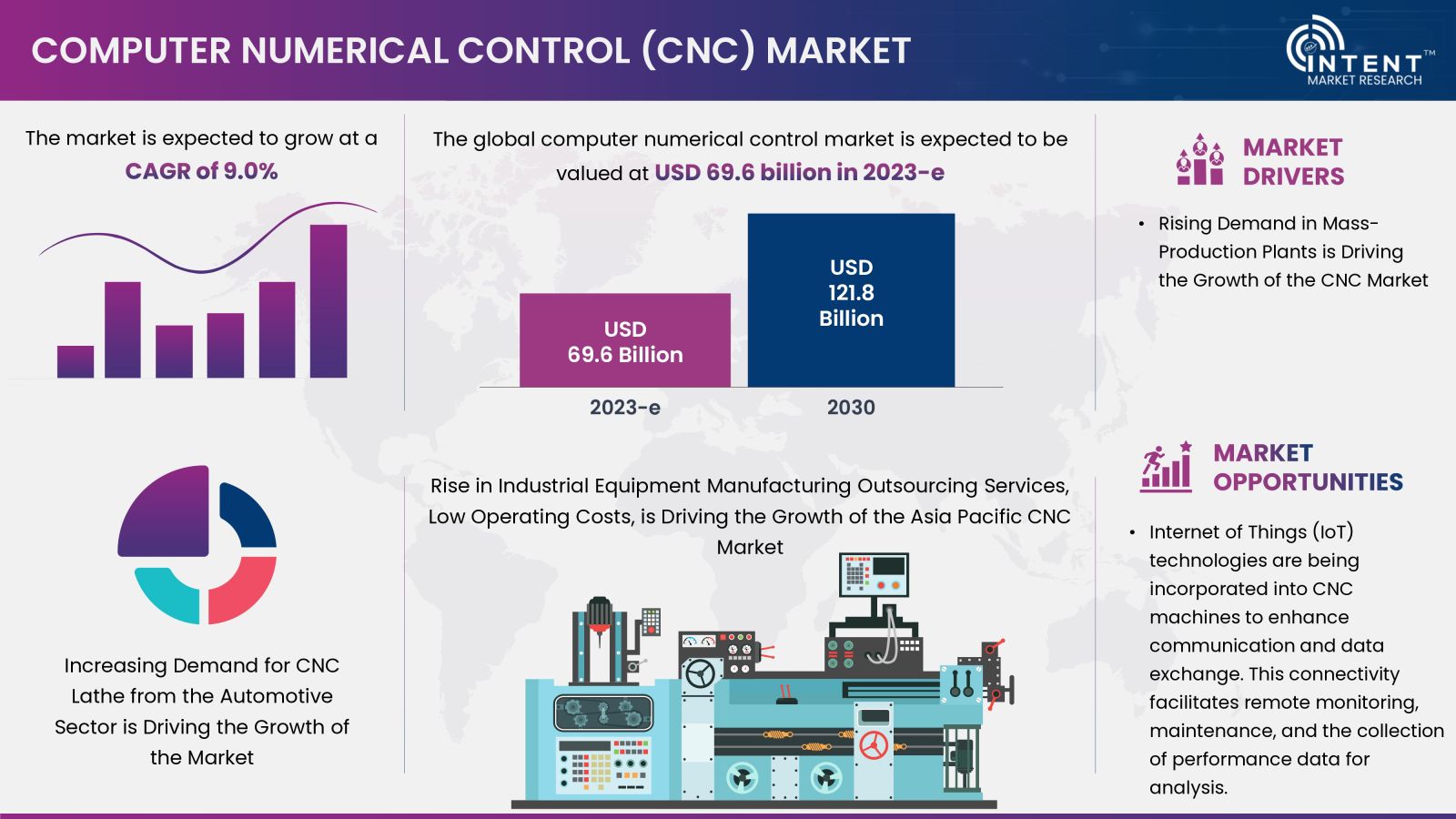

According to Intent Market Research, the computer numerical control Market is expected to grow from USD 69.6 billion in 2023-e at a CAGR of 9.0% to touch USD 121.8 billion by 2030. The computer numerical control Market is competitive where the prominent players include DMG Mori Seiki, Fanuc, GF Machining Solutions, Haas Automation, Hassay Savage, Mazak, Okuma, Protolabs, Siemens, and TRUMPF.

Computer Numerical Control (CNC), refers to the automated control of machining tools and 3D printers using computer commands. Instead of manual control or conventional machining processes, CNC systems rely on coded instructions to dictate the movement and operation of the machine. These instructions, often in the form of G-code, tell the machine how to move, turn, and shape the material. CNC technology is widely used in manufacturing for its precision, efficiency, and ability to produce complex and intricate parts.

CNC Market Dynamics

Rising Demand in Mass-Production Plants is Driving the Growth of the CNC Market

CNC systems are becoming increasingly popular in manufacturing industries as they produce highly precise parts and components. Additionally, the various processes used in CNC to produce standardized components using machine tools such as CAD and CAM are fully compatible. Additionally, the use of CNC in manufacturing facilities has a direct impact on reducing costs while significantly increasing productivity and product quality. As a result, these CNC capabilities have influenced the development of industrial fields such as automotive, aerospace, and military, indicating profitable market potential for CNC machines.

CNC Market Segment Insights

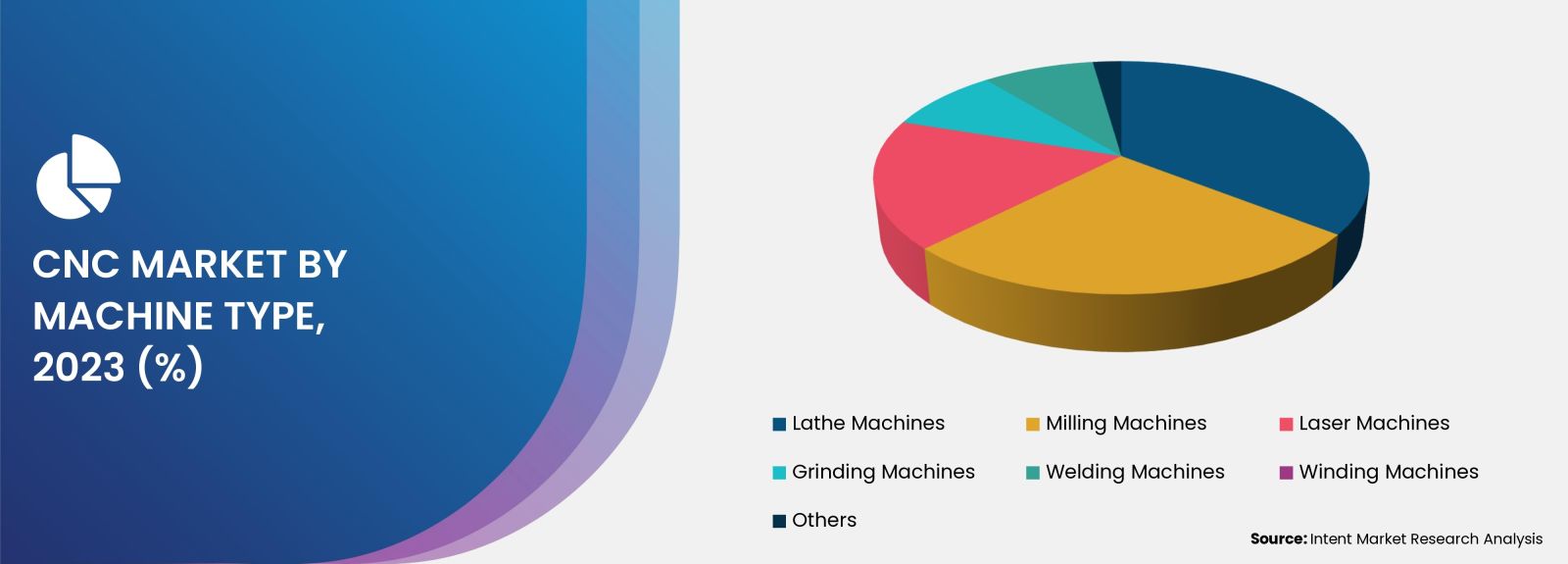

Increasing Demand for CNC Lathes From the Automotive Sector is Driving the Growth of the Market

The CNC lathe machine segment accounted for the largest market share in 2023. Increasing demand from the automotive sector is driving the lath machine segment growth. This demand is driven by the need to manufacture custom parts and prototyping applications such as cylinder heads, gearboxes, and starter motors. Additionally, the division is expected to benefit from technological advancements in existing HE CNC lathe systems. Integration of new features for diverse applications is expected to contribute positively to the segment growth.

The Adoption of CNC Machines by Large Enterprises is Driven by the Ability to Handle Complex Manufacturing Tasks

Large enterprises use CNC machines because they offer precision, efficiency, and automation in manufacturing processes. These machines produce highly accurate and precise components, ensuring consistency in the manufacturing process. CNC machines are reprogrammed quickly to switch between different tasks or produce various components. Their adoption by large enterprises is driven by the need for increased precision, efficiency, automation, and the ability to handle complex manufacturing tasks.

Increasing Applications of 3-axis Configurations in Milling, Drilling, and Cutting are Driving the CNC Market Growth

3-axis CNC machines are widely used in various industries as in a 3-axis CNC machine, the movements are controlled simultaneously to create precise cuts and shapes from the material. The configuration is suitable for a wide range of applications, including milling, drilling, and cutting. For more advanced operations and increased flexibility, CNC machines are to be upgraded to include additional axes, such as 4-axis or 5-axis configurations. These extra axes enable the machine to tilt or rotate, allowing for more complex machining tasks. But for many standard machining tasks, a 3-axis CNC machine is both practical and cost-effective.

Rising Demand for Fully Automated and Turnkey CNC Machines in the Industrial Sector is Driving the Market Growth

The introduction of CNC machines in the industrial sector is driven by the goal of increasing automation and improving efficiency. These machines perform complex manufacturing tasks with minimal human intervention, increasing productivity and reducing production time. The industrial segment also includes various manufacturing industries such as packaging, electronics, and medicine. Rising demand for fully automated turnkey CNC machines aimed at clearing production backlog from 2020 is expected to drive the growth of the segment during the forecast period.

Regional Insights

Rise in Industrial Equipment Manufacturing Outsourcing Services, Low Operating Costs, is Augmenting the Asia-Pacific CNC Market

Asia-Pacific is projected to witness significant market growth with sale of computer numerically controlled machines getting double by 2030. The region has seen significant technological advances that have contributed to the widespread use of CNC machines. The market demand is attributed to the rise in industrial equipment manufacturing outsourcing services, low operating costs, and an abundance of low-cost raw materials.

Additionally, the region experienced rapid industrialization and significant expansion of manufacturing industries. Countries such as China, Japan, South Korea, and Taiwan have become global manufacturing centers. Demand for CNC machines has increased significantly due to the need for efficient and accurate manufacturing processes in various industries such as automotive, aerospace, electronics, and medical devices.

Competitive Landscape

The CNC machines market is characterized by a few established manufacturers and several small-scale regional manufacturers. Companies such as Fanuc, DMG, and Okama are investing aggressively in research & development efforts to introduce new, innovative, high-precision machine tools and enter into different application segments as part of the efforts to retain existing customers while attracting new ones.

For instance, in February 2021, CITIZEN MACHINERY announced the launch of a Sliding Headstock Type Automatic CNC Lathe machine named Cincom L32 XII. Cincom L32 XII features enable to perform complex shapes machining such as implants used in medical treatment as well as simultaneously perform multiple functions. Some of the prominent players in the global computer numerical control machines market include DMG Mori Seiki, Fanuc, GF Machining Solutions, Haas Automation, Hassay Savage, Mazak, Okuma, Protolabs, Siemens, and TRUMPF.

CNC Market Coverage

The report provides key insights into the CNC market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector, the analysis delves into market drivers, restraints, opportunities, and other pertinent factors. The report also scrutinizes key players and the competitive landscape in the CNC market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 69.6 billion |

|

Forecast Revenue (2030) |

USD 121.8 billion |

|

CAGR (2024-2030) |

9.0% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Machine Type (Lathe Machines, Milling Machines, Laser Machines, Grinding Machines, Welding Machines, Winding Machines, Others), By Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), By Axis Type (2Axis, 3 Axis, 4 Axis, 5 Axis, Multi-Axis), By End-use Industry (Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

DMG Mori Seiki, Fanuc, GF Machining Solutions, Haas Automation, Hassay Savage, Mazak, Okuma, Protolabs, Siemens and TRUMPF |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and CNC Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. CNC Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. CNC Market Outlook |

|

5.1. Industry Value Chain Analysis |

|

5.2.Technological Overview |

|

5.3.Case Study |

|

5.4.Regulatory Framework |

|

5.5. PESTEL Analysis |

|

5.6.Porter's Five Forces analysis |

|

5.7.Pricing Analysis |

|

5.8. Trade Analysis |

|

6. Global CNC Market Segmentation (Market Size and Forecast: USD billion, 2024 – 2030) |

|

6.1 Machine Type |

|

6.1.1 Lathe Machines |

|

6.1.2 Milling Machines |

|

6.1.3 Laser Machines |

|

6.1.4 Grinding Machines |

|

6.1.5 Welding Machines |

|

6.1.6 Winding Machines |

|

6.1.7 Others |

|

6.2 Organization Size |

|

6.2.1 Small and Medium Enterprises (SMEs) |

|

6.2.2 Large Enterprises |

|

6.3 Axis Type |

|

6.3.1. 2 Axis |

|

6.3.2. 3 Axis |

|

6.3.3. 4 Axis |

|

6.3.4. 5 Axis |

|

6.3.5 Multi-Axis |

|

6.4 End-Use Industry |

|

6.4.1Automotive |

|

6.4.2 Aerospace & Defense |

|

6.4.3 Construction Equipment |

|

6.4.4 Power & Energy |

|

6.4.5 Industrial |

|

6.4.6 Others |

|

6.5 Geography |

|

6.5.1 North America |

|

6.5.2 Europe |

|

6.5.3 Asia-Pacific |

|

6.5.4 Latin America |

|

6.5.5 Middle East and Africa |

|

7. North America CNC Market Segmentation (Market Size and Forecast: USD billion, 2024 – 2030) |

|

7.1 Machine Type |

|

7.1.1 Lathe Machines |

|

7.1.2 Milling Machines |

|

7.1.3 Laser Machines |

|

7.1.4 Grinding Machines |

|

7.1.5 Welding Machines |

|

7.1.6 Winding Machines |

|

7.1.7 Others |

|

7.2 Organization Size |

|

7.2.1 Small and Medium Enterprises (SMEs) |

|

7.2.2Large Enterprises |

|

7.3 Axis Type |

|

7.3.12 Axis |

|

7.3.23 Axis |

|

7.3.3 4 Axis |

|

7.3.4 5 Axis |

|

7.3.5 Multi-Axis |

|

7.4 End-Use Industry |

|

7.4.1Automotive |

|

7.4.2 Aerospace & Defense |

|

7.4.3 Construction Equipment |

|

7.4.4 Power & Energy |

|

7.4.5 Industrial |

|

7.4.6 Others |

|

7.5 Country |

|

7.5.1 United States |

|

7.5.1.1 Machine Type |

|

7.5.1.1.1 Lathe Machines |

|

7.5.1.1.2 Milling Machines |

|

7.5.1.1.3 Laser Machines |

|

7.5.1.1.4 Grinding Machines |

|

7.5.1.1.5 Welding Machines |

|

7.5.1.1.6 Winding Machines |

|

7.5.1.1.7 Others |

|

7.5.1.2 Organization Size |

|

7.5.1.2.1 Small and Medium Enterprises (SMEs) |

|

7.5.1.2.2Large Enterprises |

|

7.5.1.3 Axis Type |

|

7.5.1.3.12 Axis |

|

7.5.1.3.23 Axis |

|

7.5.1.3.3 4 Axis |

|

7.5.1.3.45 Axis |

|

7.5.1.3.5 Multi Axis |

|

7.5.1.4 End-Use Industry |

|

7.5.1.4.1Automotive |

|

7.5.1.4.2 Aerospace & Defense |

|

7.5.1.4.3 Construction Equipment |

|

7.5.1.4.4 Power & Energy |

|

7.5.1.4.5 Industrial |

|

7.5.1.4.6 Others |

|

7.5.2 Canada |

|

7.5.2.1 Machine Type |

|

7.5.2.1.1 Lathe Machines |

|

7.5.2.1.2 Milling Machines |

|

7.5.2.1.3 Laser Machines |

|

7.5.2.1.4 Grinding Machines |

|

7.5.2.1.5 Welding Machines |

|

7.5.2.1.6 Winding Machines |

|

7.5.2.1.7 Others |

|

7.5.2.2 Organization Size |

|

7.5.2.2.1 Small and Medium Enterprises (SMEs) |

|

7.5.2.2.2Large Enterprises |

|

7.5.2.3 Axis Type |

|

7.5.2.3.12 Axis |

|

7.5.2.3.23 Axis |

|

7.5.2.3.3 4 Axis |

|

7.5.2.3.45 Axis |

|

7.5.2.3.5 Multi Axis |

|

7.5.2.4 End-Use Industry |

|

7.5.2.4.1 Automotive |

|

7.5.2.4.2 Aerospace & Defense |

|

7.5.2.4.3 Construction Equipment |

|

7.5.2.4.4 Power & Energy |

|

7.5.2.4.5 Industrial |

|

7.5.2.4.6 Others |

|

8. Europe Market CNC Segmentation (Market Size and Forecast: USD billion, 2024 – 2030) |

|

8.1 Machine Type |

|

8.1.1 Lathe Machines |

|

8.1.2 Milling Machines |

|

8.1.3 Laser Machines |

|

8.1.4 Grinding Machines |

|

8.1.5 Welding Machines |

|

8.1.6 Winding Machines |

|

8.1.8 Others |

|

8.2 Organization Size |

|

8.2.1 Small and Medium Enterprises (SMEs) |

|

8.2.2Large Enterprises |

|

8.3 Axis Type |

|

8.3.12 Axis |

|

8.3.23 Axis |

|

8.3.3 4 Axis |

|

8.3.4 5 Axis |

|

8.3.5 Multi-Axis |

|

8.4 End-Use Industry |

|

8.4.1Automotive |

|

8.4.2 Aerospace & Defense |

|

8.4.3 Construction Equipment |

|

8.4.4 Power & Energy |

|

8.4.5 Industrial |

|

8.4.6 Others |

|

8.5 Country |

|

8.5.1 United Kingdom |

|

8.5.1.1 Machine Type |

|

8.5.1.1.1 Lathe Machines |

|

8.5.1.1.2 Milling Machines |

|

8.5.1.1.3 Laser Machines |

|

8.5.1.1.4 Grinding Machines |

|

8.5.1.1.5 Welding Machines |

|

8.5.1.1.6 Winding Machines |

|

8.5.1.1.8 Others |

|

8.5.1.2 Organization Size |

|

8.5.1.2.1 Small and Medium Enterprises (SMEs) |

|

8.5.1.2.2Large Enterprises |

|

8.5.1.3 Axis Type |

|

8.5.1.3.12 Axis |

|

8.5.1.3.23 Axis |

|

8.5.1.3.3 4 Axis |

|

8.5.1.3.45 Axis |

|

8.5.1.3.5 Multi Axis |

|

8.5.1.4 End-Use Industry |

|

8.5.1.4.1Automotive |

|

8.5.1.4.2 Aerospace & Defense |

|

8.5.1.4.3 Construction Equipment |

|

8.5.1.4.4 Power & Energy |

|

8.5.1.4.5 Industrial |

|

8.5.1.4.6 Others |

|

8.5.2 Germany |

|

8.5.2.1 Machine Type |

|

8.5.2.1.1 Lathe Machines |

|

8.5.2.1.2 Milling Machines |

|

8.5.2.1.3 Laser Machines |

|

8.5.2.1.4 Grinding Machines |

|

8.5.2.1.5 Welding Machines |

|

8.5.2.1.6 Winding Machines |

|

8.5.2.1.8 Others |

|

8.5.2.2 Organization Size |

|

8.5.2.2.1 Small and Medium Enterprises (SMEs) |

|

8.5.2.2.2Large Enterprises |

|

8.5.2.3 Axis Type |

|

8.5.2.3.12 Axis |

|

8.5.2.3.23 Axis |

|

8.5.2.3.3 4 Axis |

|

8.5.2.3.45 Axis |

|

8.5.2.3.5 Multi Axis |

|

8.5.2.4 End-Use Industry |

|

8.5.2.4.1Automotive |

|

8.5.2.4.2 Aerospace & Defense |

|

8.5.2.4.3 Construction Equipment |

|

8.5.2.4.4 Power & Energy |

|

8.5.2.4.5 Industrial |

|

8.5.2.4.6 Others |

|

8.5.3 France |

|

8.5.3.1 Machine Type |

|

8.5.3.1.1 Lathe Machines |

|

8.5.3.1.2 Milling Machines |

|

8.5.3.1.3 Laser Machines |

|

8.5.3.1.4 Grinding Machines |

|

8.5.3.1.5 Welding Machines |

|

8.5.3.1.6 Winding Machines |

|

8.5.3.1.8 Others |

|

8.5.3.2 Organization Size |

|

8.5.3.2.1 Small and Medium Enterprises (SMEs) |

|

8.5.3.2.2Large Enterprises |

|

8.5.3.3 Axis Type |

|

8.5.3.3.12 Axis |

|

8.5.3.3.23 Axis |

|

8.5.3.3.3 4 Axis |

|

8.5.3.3.45 Axis |

|

8.5.3.3.5 Multi Axis |

|

8.5.3.4 End-Use Industry |

|

8.5.3.4.1Automotive |

|

8.5.3.4.2 Aerospace & Defense |

|

8.5.3.4.3 Construction Equipment |

|

8.5.3.4.4 Power & Energy |

|

8.5.3.4.5 Industrial |

|

8.5.3.4.6 Others |

|

8.5.4 Italy |

|

8.5.4.1 Machine Type |

|

8.5.4.1.1 Lathe Machines |

|

8.5.4.1.2 Milling Machines |

|

8.5.4.1.3 Laser Machines |

|

8.5.4.1.4 Grinding Machines |

|

8.5.4.1.5 Welding Machines |

|

8.5.4.1.6 Winding Machines |

|

8.5.4.1.8 Others |

|

8.5.4.2 Organization Size |

|

8.5.4.2.1 Small and Medium Enterprises (SMEs) |

|

8.5.4.2.2Large Enterprises |

|

8.5.4.3 Axis Type |

|

8.5.4.3.12 Axis |

|

8.5.4.3.23 Axis |

|

8.5.4.3.3 4 Axis |

|

8.5.4.3.45 Axis |

|

8.5.4.3.5 Multi Axis |

|

8.5.4.4 End-Use Industry |

|

8.5.4.4.1Automotive |

|

8.5.4.4.2 Aerospace & Defense |

|

8.5.4.4.3 Construction Equipment |

|

8.5.4.4.4 Power & Energy |

|

8.5.4.4.5 Industrial |

|

8.5.4.4.6 Others |

|

9. Asia-Pacific CNC Market Segmentation (Market Size and Forecast: USD billion, 2024 – 2030) |

|

9.1 Machine Type |

|

9.1.1 Lathe Machines |

|

9.1.2 Milling Machines |

|

9.1.3 Laser Machines |

|

9.1.4 Grinding Machines |

|

9.1.5 Welding Machines |

|

9.1.6 Winding Machines |

|

9.1.7 Others |

|

9.2 Organization Size |

|

9.2.1 Small and Medium Enterprises (SMEs) |

|

9.2.2Large Enterprises |

|

9.3 Axis Type |

|

9.3.12 Axis |

|

9.3.23 Axis |

|

9.3.3 4 Axis |

|

9.3.4 5 Axis |

|

9.3.5 Multi-Axis |

|

9.4 End-Use Industry |

|

9.4.1Automotive |

|

9.4.2 Aerospace & Defense |

|

9.4.3 Construction Equipment |

|

9.4.4 Power & Energy |

|

9.4.5 Industrial |

|

9.4.6 Others |

|

9.5 Country |

|

9.5.1 China |

|

9.5.1.1 Machine Type |

|

9.5.1.1.1 Lathe Machines |

|

9.5.1.1.2 Milling Machines |

|

9.5.1.1.3 Laser Machines |

|

9.5.1.1.4 Grinding Machines |

|

9.5.1.1.5 Welding Machines |

|

9.5.1.1.6 Winding Machines |

|

9.5.1.1.7 Others |

|

9.5.1.2 Organization Size |

|

9.5.1.2.1 Small and Medium Enterprises (SMEs) |

|

9.5.1.2.2Large Enterprises |

|

9.5.1.3 Axis Type |

|

9.5.1.3.12 Axis |

|

9.5.1.3.23 Axis |

|

9.5.1.3.3 4 Axis |

|

9.5.1.3.45 Axis |

|

9.5.1.3.5 Multi Axis |

|

9.5.1.4 End-Use Industry |

|

9.5.1.4.1Automotive |

|

9.5.1.4.2 Aerospace & Defense |

|

9.5.1.4.3 Construction Equipment |

|

9.5.1.4.4 Power & Energy |

|

9.5.1.4.5 Industrial |

|

9.5.1.4.6 Others |

|

9.5.2 Japan |

|

9.5.2.1 Machine Type |

|

9.5.2.1.1 Lathe Machines |

|

9.5.2.1.2 Milling Machines |

|

9.5.2.1.3 Laser Machines |

|

9.5.2.1.4 Grinding Machines |

|

9.5.2.1.5 Welding Machines |

|

9.5.2.1.6 Winding Machines |

|

9.5.2.1.7 Others |

|

9.5.2.2 Organization Size |

|

9.5.2.2.1 Small and Medium Enterprises (SMEs) |

|

9.5.2.2.2Large Enterprises |

|

9.5.2.3 Axis Type |

|

9.5.2.3.12 Axis |

|

9.5.2.3.23 Axis |

|

9.5.2.3.3 4 Axis |

|

9.5.2.3.45 Axis |

|

9.5.2.3.5 Multi Axis |

|

9.5.2.4 End-Use Industry |

|

9.5.2.4.1Automotive |

|

9.5.2.4.2 Aerospace & Defense |

|

9.5.2.4.3 Construction Equipment |

|

9.5.2.4.4 Power & Energy |

|

9.5.2.4.5 Industrial |

|

9.5.2.4.6 Others |

|

9.5.3 India |

|

9.5.3.1 Machine Type |

|

9.5.3.1.1 Lathe Machines |

|

9.5.3.1.2 Milling Machines |

|

9.5.3.1.3 Laser Machines |

|

9.5.3.1.4 Grinding Machines |

|

9.5.3.1.5 Welding Machines |

|

9.5.3.1.6 Winding Machines |

|

9.5.3.1.7 Others |

|

9.5.3.2 Organization Size |

|

9.5.3.2.1 Small and Medium Enterprises (SMEs) |

|

9.5.3.2.2Large Enterprises |

|

9.5.3.3 Axis Type |

|

9.5.3.3.12 Axis |

|

9.5.3.3.23 Axis |

|

9.5.3.3.3 4 Axis |

|

9.5.3.3.45 Axis |

|

9.5.3.3.5 Multi Axis |

|

9.5.3.4 End-Use Industry |

|

9.5.3.4.1Automotive |

|

9.5.3.4.2 Aerospace & Defense |

|

9.5.3.4.3 Construction Equipment |

|

9.5.3.4.4 Power & Energy |

|

9.5.3.4.5 Industrial |

|

9.5.3.4.6 Others |

|

9.5.4 South Korea |

|

9.5.4.1 Machine Type |

|

9.5.4.1.1 Lathe Machines |

|

9.5.4.1.2 Milling Machines |

|

9.5.4.1.3 Laser Machines |

|

9.5.4.1.4 Grinding Machines |

|

9.5.4.1.5 Welding Machines |

|

9.5.4.1.6 Winding Machines |

|

9.5.4.1.7 Others |

|

9.5.4.2 Organization Size |

|

9.5.4.2.1 Small and Medium Enterprises (SMEs) |

|

9.5.4.2.2Large Enterprises |

|

9.5.4.3 Axis Type |

|

9.5.4.3.12 Axis |

|

9.5.4.3.23 Axis |

|

9.5.4.3.3 4 Axis |

|

9.5.4.3.45 Axis |

|

9.5.4.3.5 Multi Axis |

|

9.5.4.4 End-Use Industry |

|

9.5.4.4.1Automotive |

|

9.5.4.4.2 Aerospace & Defense |

|

9.5.4.4.3 Construction Equipment |

|

9.5.4.4.4 Power & Energy |

|

9.5.4.4.5 Industrial |

|

9.5.4.4.6 Others |

|

10. Latin America CNC Market Segmentation (Market Size and Forecast: USD billion, 2024 – 2030) |

|

10.1 Machine Type |

|

10.1.1 Lathe Machines |

|

10.1.2 Milling Machines |

|

10.1.3 Laser Machines |

|

10.1.4 Grinding Machines |

|

10.1.5 Welding Machines |

|

10.1.6 Winding Machines |

|

10.1.7 Others |

|

10.2 Organization Size |

|

10.2.1 Small and Medium Enterprises (SMEs) |

|

10.2.2Large Enterprises |

|

10.3 Axis Type |

|

10.3.12 Axis |

|

10.3.23 Axis |

|

10.3.3 4 Axis |

|

10.3.4 5 Axis |

|

10.3.5 Multi-Axis |

|

10.4 End-Use Industry |

|

10.4.1Automotive |

|

10.4.2 Aerospace & Defense |

|

10.4.3 Construction Equipment |

|

10.4.4 Power & Energy |

|

10.4.5 Industrial |

|

10.4.6 Others |

|

10.5 Country |

|

10.5.1Brazil |

|

10.5.1.1 Machine Type |

|

10.5.1.1.1 Lathe Machines |

|

10.5.1.1.2 Milling Machines |

|

10.5.1.1.3 Laser Machines |

|

10.5.1.1.4 Grinding Machines |

|

10.5.1.1.5 Welding Machines |

|

10.5.1.1.6 Winding Machines |

|

10.5.1.1.7 Others |

|

10.5.1.2 Organization Size |

|

10.5.1.2.1 Small and Medium Enterprises (SMEs) |

|

10.5.1.2.2Large Enterprises |

|

10.5.1.3 Axis Type |

|

10.5.1.3.12 Axis |

|

10.5.1.3.23 Axis |

|

10.5.1.3.3 4 Axis |

|

10.5.1.3.45 Axis |

|

10.5.1.3.5 Multi Axis |

|

10.5.1.4 End-Use Industry |

|

10.5.1.4.1Automotive |

|

10.5.1.4.2 Aerospace & Defense |

|

10.5.1.4.3 Construction Equipment |

|

10.5.1.4.4 Power & Energy |

|

10.5.1.4.5 Industrial |

|

10.5.1.4.6 Others |

|

10.5.2 Mexico |

|

10.5.2.1 Machine Type |

|

10.5.2.1.1 Lathe Machines |

|

10.5.2.1.2 Milling Machines |

|

10.5.2.1.3 Laser Machines |

|

10.5.2.1.4 Grinding Machines |

|

10.5.2.1.5 Welding Machines |

|

10.5.2.1.6 Winding Machines |

|

10.5.2.1.7 Others |

|

10.5.2.2 Organization Size |

|

10.5.2.2.1 Small and Medium Enterprises (SMEs) |

|

10.5.2.2.2Large Enterprises |

|

10.5.2.3 Axis Type |

|

10.5.2.3.12 Axis |

|

10.5.2.3.23 Axis |

|

10.5.2.3.3 4 Axis |

|

10.5.2.3.45 Axis |

|

10.5.2.3.5 Multi Axis |

|

10.5.2.4 End-Use Industry |

|

10.5.2.4.1Automotive |

|

10.5.2.4.2 Aerospace & Defense |

|

10.5.2.4.3 Construction Equipment |

|

10.5.2.4.4 Power & Energy |

|

10.5.2.4.5 Industrial |

|

10.5.2.4.6 Others |

|

10.5.3 Argentina |

|

10.5.3.1 Machine Type |

|

10.5.3.1.1 Lathe Machines |

|

10.5.3.1.2 Milling Machines |

|

10.5.3.1.3 Laser Machines |

|

10.5.3.1.4 Grinding Machines |

|

10.5.3.1.5 Welding Machines |

|

10.5.3.1.6 Winding Machines |

|

10.5.3.1.7 Others |

|

10.5.3.2 Organization Size |

|

10.5.3.2.1 Small and Medium Enterprises (SMEs) |

|

10.5.3.2.2Large Enterprises |

|

10.5.3.3 Axis Type |

|

10.5.3.3.12 Axis |

|

10.5.3.3.23 Axis |

|

10.5.3.3.3 4 Axis |

|

10.5.3.3.45 Axis |

|

10.5.3.3.5 Multi Axis |

|

10.5.3.4 End-Use Industry |

|

10.5.3.4.1Automotive |

|

10.5.3.4.2 Aerospace & Defense |

|

10.5.3.4.3 Construction Equipment |

|

10.5.3.4.4 Power & Energy |

|

10.5.3.4.5 Industrial |

|

10.5.3.4.6 Others |

|

11. Middle East & Africa CNC Market Segmentation (Market Size and Forecast: USD billion, 2024 – 2030) |

|

11.1 Machine Type |

|

11.1.1 Lathe Machines |

|

11.1.2 Milling Machines |

|

11.1.3 Laser Machines |

|

11.1.4 Grinding Machines |

|

11.1.5 Welding Machines |

|

11.1.6 Winding Machines |

|

11.1.7 Others |

|

11.2 Organization Size |

|

11.2.1 Small and Medium Enterprises (SMEs) |

|

11.2.2Large Enterprises |

|

11.3 Axis Type |

|

11.3.12 Axis |

|

11.3.23 Axis |

|

11.3.3 4 Axis |

|

11.3.4 5 Axis |

|

11.3.5 Multi-Axis |

|

11.4 End-Use Industry |

|

11.4.1Automotive |

|

11.4.2 Aerospace & Defense |

|

11.4.3 Construction Equipment |

|

11.4.4 Power & Energy |

|

11.4.5 Industrial |

|

11.4.6 Others |

|

11.5 Country |

|

11.5.1United Arab Emirates |

|

11.5.1.1 Machine Type |

|

11.5.1.1.1 Lathe Machines |

|

11.5.1.1.2 Milling Machines |

|

11.5.1.1.3 Laser Machines |

|

11.5.1.1.4 Grinding Machines |

|

11.5.1.1.5 Welding Machines |

|

11.5.1.1.6 Winding Machines |

|

11.5.1.1.7 Others |

|

11.5.1.2 Organization Size |

|

11.5.1.2.1 Small and Medium Enterprises (SMEs) |

|

11.5.1.2.2Large Enterprises |

|

11.5.1.3 Axis Type |

|

11.5.1.3.12 Axis |

|

11.5.1.3.23 Axis |

|

11.5.1.3.3 4 Axis |

|

11.5.1.3.45 Axis |

|

11.5.1.3.5 Multi Axis |

|

11.5.1.4 End-Use Industry |

|

11.5.1.4.1Automotive |

|

11.5.1.4.2 Aerospace & Defense |

|

11.5.1.4.3 Construction Equipment |

|

11.5.1.4.4 Power & Energy |

|

11.5.1.4.5 Industrial |

|

11.5.1.4.6 Others |

|

11.5.2 Saudi Arabia |

|

11.5.2.1 Machine Type |

|

11.5.2.1.1 Lathe Machines |

|

11.5.2.1.2 Milling Machines |

|

11.5.2.1.3 Laser Machines |

|

11.5.2.1.4 Grinding Machines |

|

11.5.2.1.5 Welding Machines |

|

11.5.2.1.6 Winding Machines |

|

11.5.2.1.7 Others |

|

11.5.2.2 Organization Size |

|

11.5.2.2.1 Small and Medium Enterprises (SMEs) |

|

11.5.2.2.2Large Enterprises |

|

11.5.2.3 Axis Type |

|

11.5.2.3.12 Axis |

|

11.5.2.3.23 Axis |

|

11.5.2.3.3 4 Axis |

|

11.5.2.3.45 Axis |

|

11.5.2.3.5 Multi Axis |

|

11.5.2.4 End-Use Industry |

|

11.5.2.4.1Automotive |

|

11.5.2.4.2 Aerospace & Defense |

|

11.5.2.4.3 Construction Equipment |

|

11.5.2.4.4 Power & Energy |

|

11.5.2.4.5 Industrial |

|

11.5.2.4.6 Others |

|

11.5.3 South Africa |

|

11.5.3.1 Machine Type |

|

11.5.3.1.1 Lathe Machines |

|

11.5.3.1.2 Milling Machines |

|

11.5.3.1.3 Laser Machines |

|

11.5.3.1.4 Grinding Machines |

|

11.5.3.1.5 Welding Machines |

|

11.5.3.1.6 Winding Machines |

|

11.5.3.1.7 Others |

|

11.5.3.2 Organization Size |

|

11.5.3.2.1 Small and Medium Enterprises (SMEs) |

|

11.5.3.2.2Large Enterprises |

|

11.5.3.3 Axis Type |

|

11.5.3.3.12 Axis |

|

11.5.3.3.23 Axis |

|

11.5.3.3.3 4 Axis |

|

11.5.3.3.45 Axis |

|

11.5.3.3.5 Multi Axis |

|

11.5.3.4 End-Use Industry |

|

11.5.3.4.1Automotive |

|

11.5.3.4.2 Aerospace & Defense |

|

11.5.3.4.3 Construction Equipment |

|

11.5.3.4.4 Power & Energy |

|

11.5.3.4.5 Industrial |

|

11.5.3.4.6 Others |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.3 Product Benchmarking |

|

12.4 Emerging Players operating in the Market |

|

12.5 Company Profiles |

|

12.5.1 DMG Mori Seiki |

|

12.5.1.1 Company Synopsis |

|

12.5.1.2 Company Financials |

|

12.5.1.3 Product/ Service Portfolio |

|

12.5.1.4 Recent Developments |

|

12.5.2 Fanuc |

|

12.5.3 GF Machining Solutions |

|

12.5.4 Haas Automation |

|

12.5.5 Hassay Savage |

|

12.5.6 Mazak |

|

12.5.7 Okuma |

|

12.5.8 Protolabs |

|

12.5.9 Siemens |

|

12.5.10 TRUMPF |

|

12.6 Company Profiles (Demand Side) |

|

12.6.1BMW |

|

12.6.1.1 Company Synopsis |

|

12.6.1.2 Company Financials |

|

12.6.1.3 Product/ Service Portfolio |

|

12.6.1.4 Recent Developments |

|

12.6.2 Boeing |

|

12.6.3 Medtronic |

|

12.6.4 Samsung Electronics |

|

12.6.5 Kennametal |

|

13. Analyst Recommendations |

Let us connect with you TOC

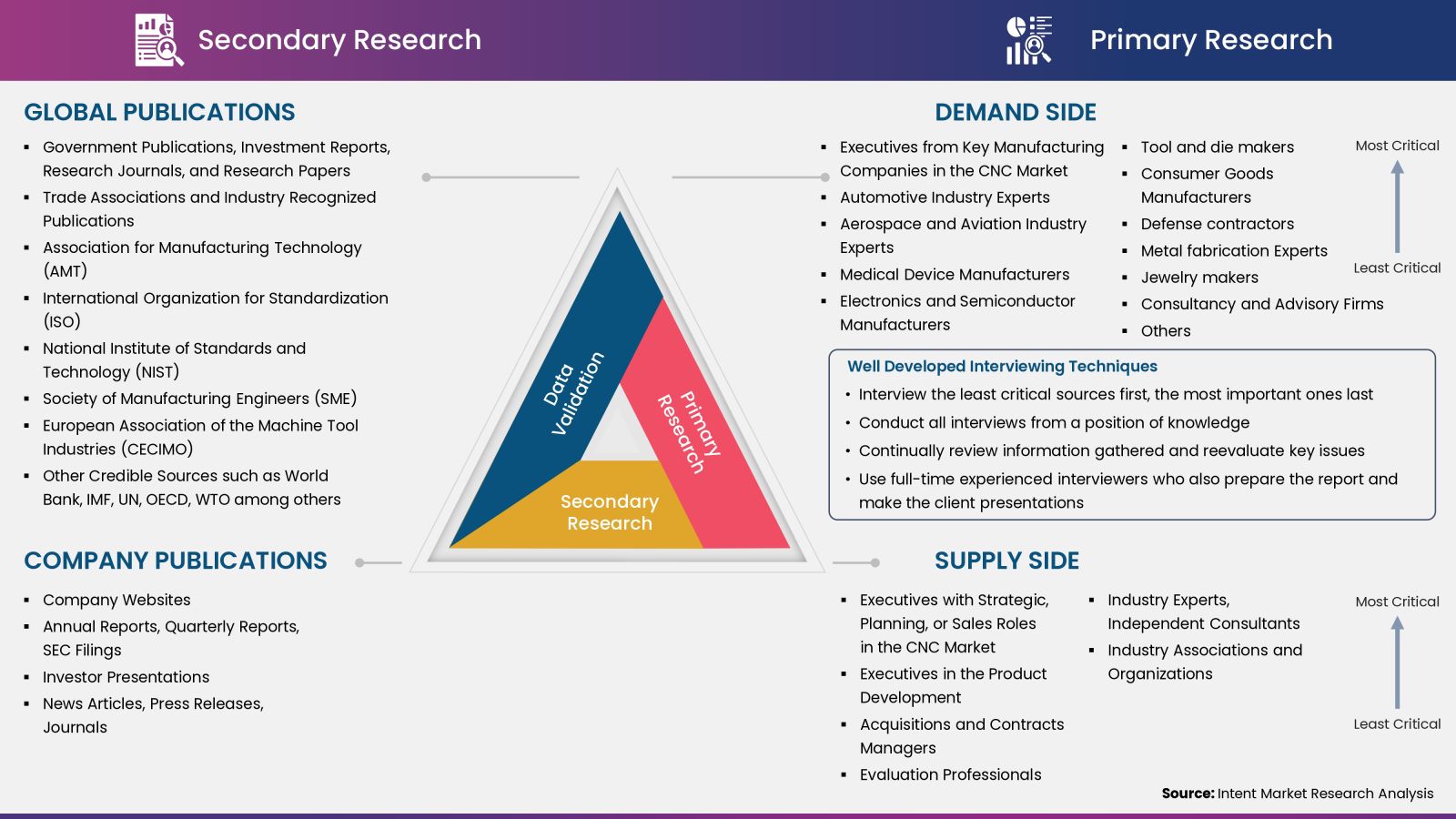

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. We also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to increase the accuracy of the numbers further and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

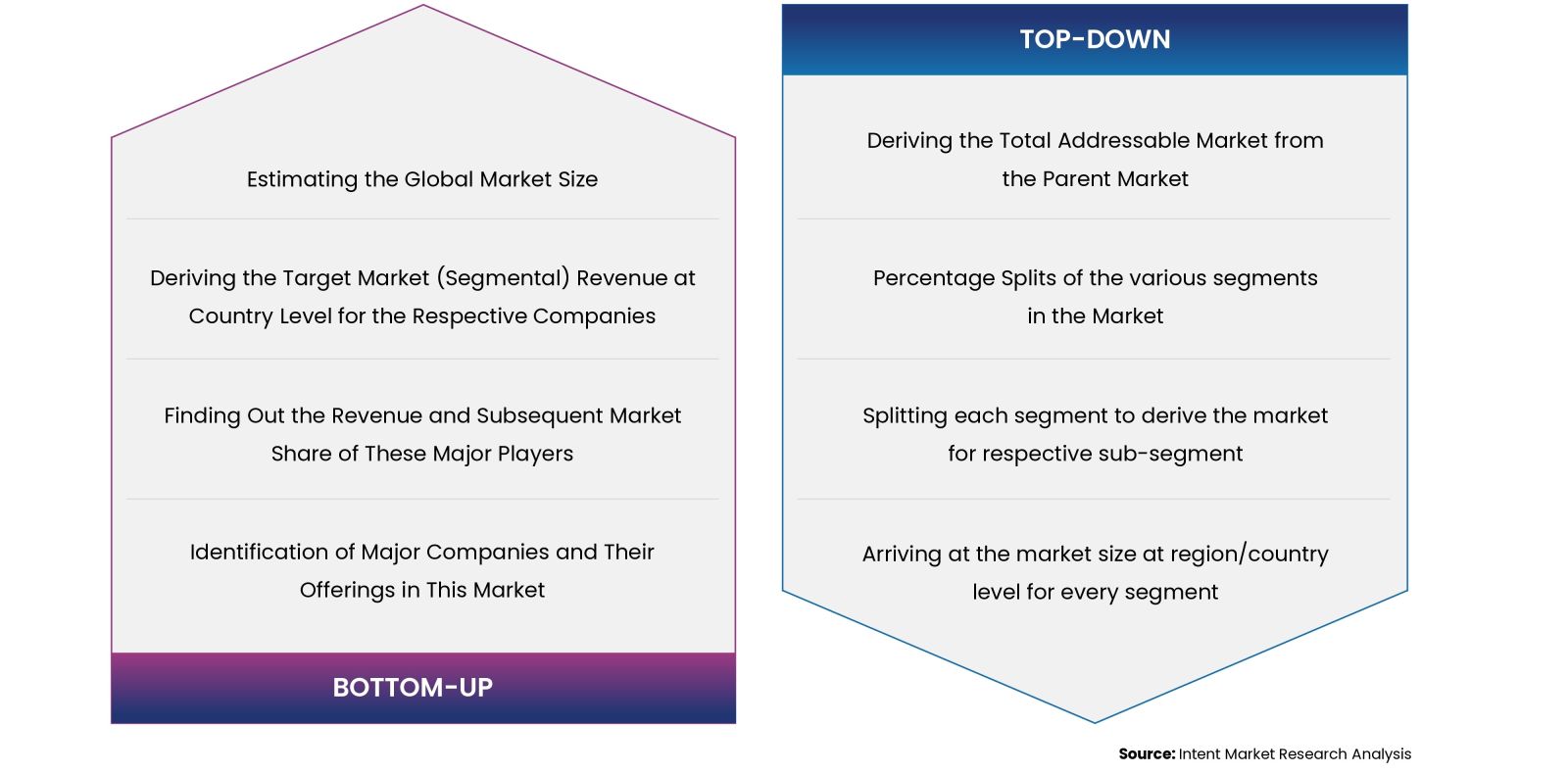

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats