sales@intentmarketresearch.com

+1 463-583-2713

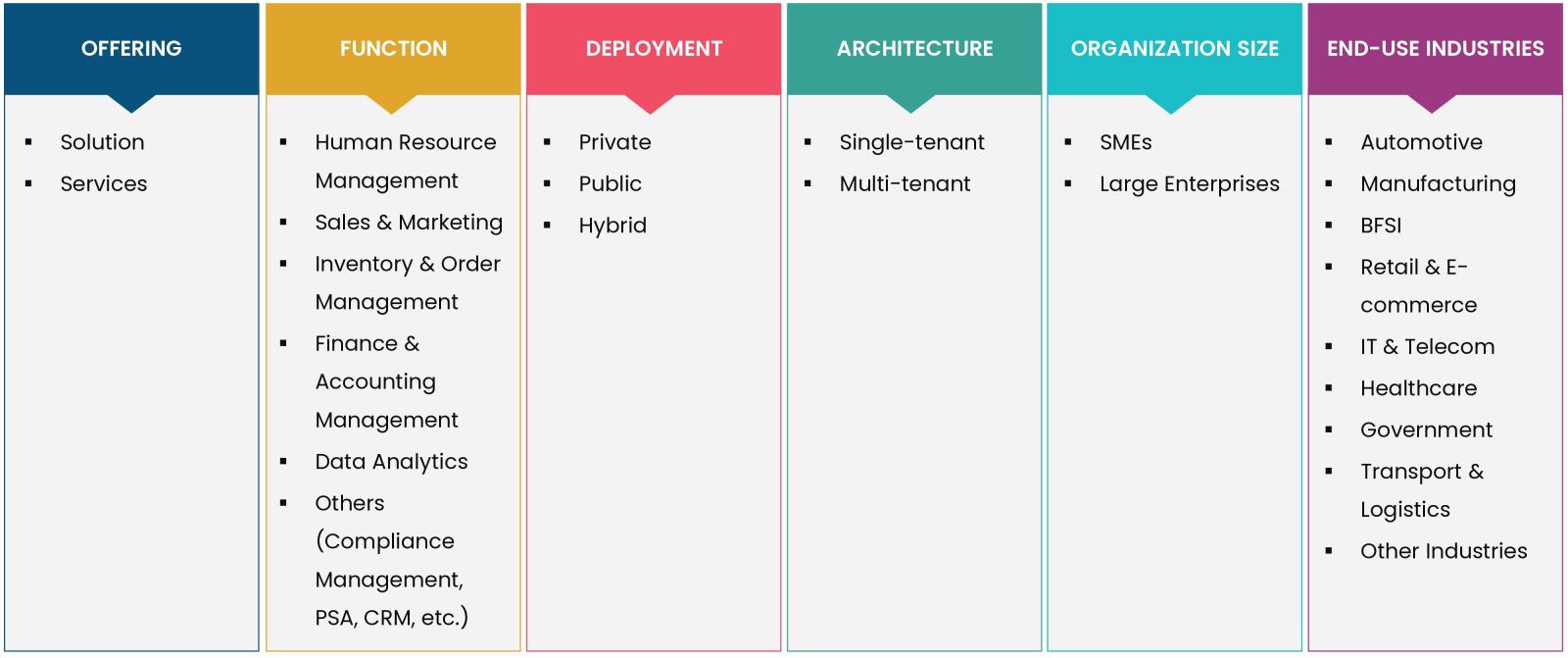

Cloud ERP Market By Offering (Solution, Services); By Function (Human Resource Management, Sales & Marketing, Inventory & Order Management, Finance & Accounting Management, Data Analytics); By Deployment (Public, Private, Hybrid); By Architecture (Single-tenant, Multi-tenant); By Organization Size (SMEs, Large Enterprises); By End-use Industry (IT & Telecom, Retail & E-commerce, Manufacturing, BFSI, Transport & Logistics, Automotive, Healthcare, Government) and By Region; Global Insights & Forecast (2024 - 2030)

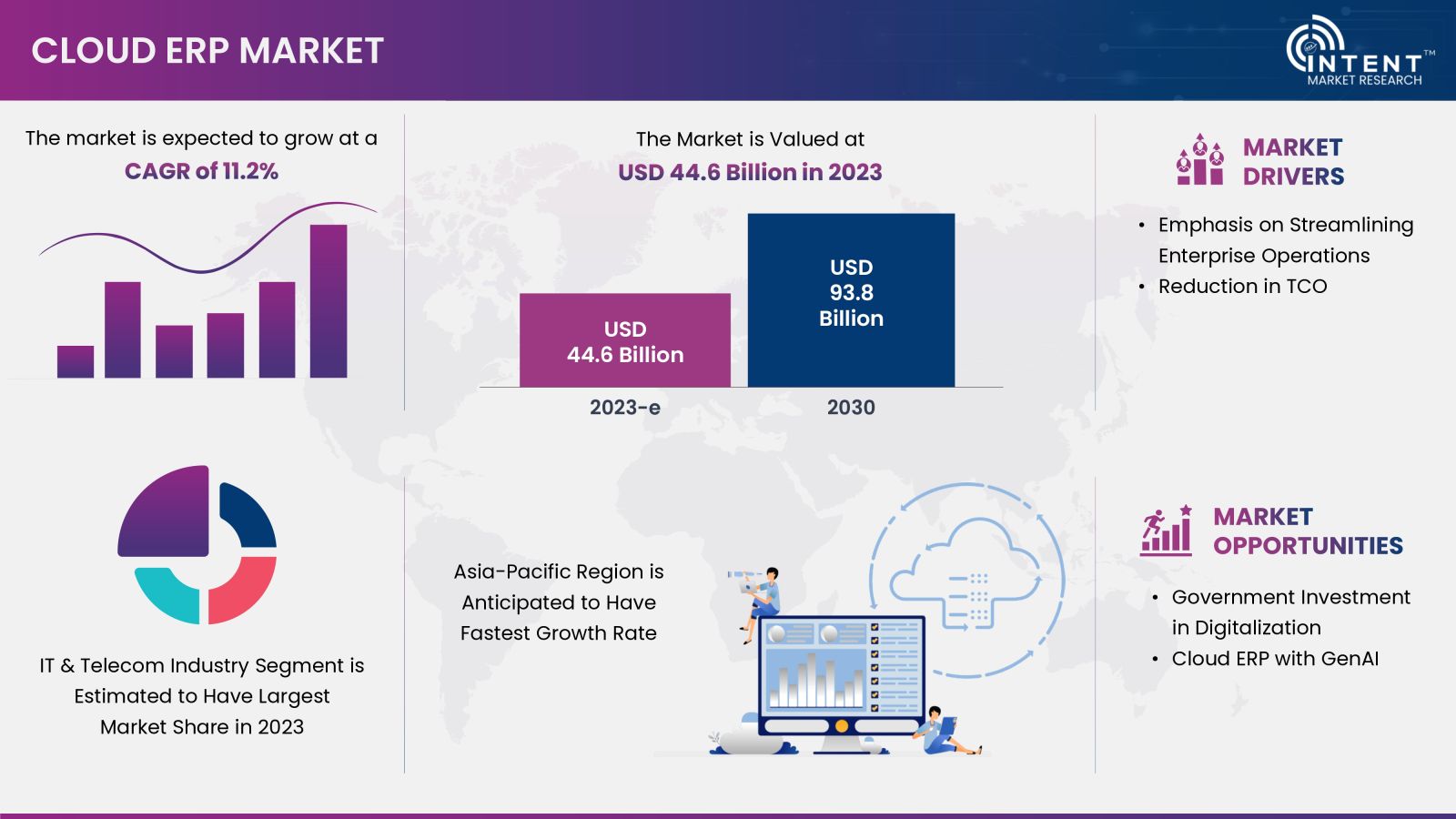

According to Intent Market Research, the Cloud ERP Market is expected to grow from USD 44.6 billion in 2023-e at a CAGR of 11.2% to touch USD 93.8 billion by 2030. The Cloud ERP is a competitive market; where the prominent players include AWS, IFS, Infor, Microsoft, Oracle, Salesforce, SAP, Unit4, Workday, and Zoho, among others. Additionally, Acumatica, Brightpearl, Dassault systemes, Dolibarr, ECI Software, Epicor, Odoo, QAD, Sage, and Xero are the emerging companies in the market.

Cloud ERP is an enterprise resource planning (ERP) system that runs on a vendor’s cloud platform as opposed to an on-premises network, allowing organizations to access over the internet. ERP software integrates and automates essential financial and operational business functions and provides a single source of data, including inventory, order, and supply chain management, and helps with procurement, production, distribution, and fulfillment.

Cloud ERP offers benefits such as lower capital expenditure, scalability, rapid deployment & implementation, and reduced implementation complexity. Cloud ERP solutions are continually evolving, and businesses of all sizes can leverage these benefits to gain a competitive edge, improve efficiency, and drive innovation in their operations.

Emphasis on Streamlining Enterprise Operations is Driving the Cloud ERP Market

Organizations are increasingly recognizing the need for efficient and integrated business processes, and cloud-based ERP solutions provide a comprehensive platform to address these demands. Cloud ERP integrates various business processes such as finance, human resources, supply chain, and customer relationship management into a unified platform, fostering seamless data flow and collaboration.

Cloud ERP systems provide real-time data and analytics, enabling organizations to gain insights into their operations promptly. This allows for better-informed decisions and improved responsiveness to changing market conditions. Also, it allows businesses to stay current with technological advancements, fostering innovation and helping them maintain a competitive advantage in the market.

Cloud ERP Market Segment Insights

Rapid Adoption of ERP Software Driving the Segmental Growth

Cloud ERP software solutions offer a unified platform that integrates and automates various business processes, providing a more efficient and seamless workflow. It operates on a subscription or pay-per-use model, eliminating the need for significant upfront investments in hardware and infrastructure. This cost-effective approach makes ERP accessible to a broader range of businesses.

Cloud ERP providers handle software updates and maintenance, ensuring that organizations always have access to the latest features and security enhancements without the need for manual intervention. It also provides scalability, allowing organizations to easily scale their ERP systems up or down based on business growth or fluctuations in demand. The rapid adoption of ERP software, coupled with the advantages offered by cloud-based solutions, is driving the cloud ERP market's growth.

Greater Visibility Helps Inventory & Order Management to Grow Rapidly

Cloud ERP provides real-time visibility into inventory levels, locations, and status. Businesses can make informed decisions about replenishment, reducing the risk of stock-outs and overstock situations. Cloud ERP consolidates inventory data into a centralized system accessible from anywhere. This centralization reduces data silos, improves data accuracy, and ensures that all stakeholders have access to the most up-to-date information.

Implementing cloud ERP for inventory and order management helps businesses achieve greater operational efficiency, reduce costs, and enhance customer satisfaction by ensuring accurate and timely order fulfillment. The real-time visibility and automation features provided by cloud ERP contribute to better decision-making and streamlined processes across the supply chain.

Public Cloud Segment to Capture Major Share in 2023

Public cloud providers typically operate on a pay-per-use or subscription-based pricing model. Organizations only pay for the computing resources they consume, leading to cost savings compared to traditional on-premises infrastructure. Public cloud platforms offer on-demand resources that can be scaled up or down based on business needs. This scalability allows organizations to handle varying workloads and respond quickly to changing demands.

Public cloud providers handle maintenance tasks, software updates, and security patches. This relieves organizations of the operational burden associated with maintaining on-premises infrastructure. Public cloud providers often offer a range of advanced technologies, including artificial intelligence (AI), machine learning, analytics, and Internet of Things (IoT) services. Organizations can leverage these innovations without significant upfront investments. The public cloud segment is expected to grab a major share of the market in 2023.

Single-tenant Architecture Expected to Grow with Higher CAGR

In a single-tenant environment, resources such as servers, storage, and network infrastructure are exclusively dedicated to a single customer. This isolation reduces the risk of unauthorized access or data leakage compared to multi-tenant environments. Single-tenant architectures allow organizations to customize the infrastructure to meet their specific requirements. This level of control is beneficial for businesses with unique performance, security, or integration needs.

Organizations can scale resources based on their specific needs in a single-tenant environment. This flexibility is particularly important for businesses experiencing variable workloads or sudden increases in demand. Single-tenant architectures enable organizations to have dedicated and isolated backup systems. This enhances disaster recovery capabilities and reduces the risk of data loss in case of a failure. In industries such as BFSI, and defense, where data security is critical, single-tenant architecture is expected to grow rapidly in coming years.

Easy Capital Inflow Helps Large Enterprises to Top the Segment

Large enterprises often have significant financial resources, allowing them to make substantial investments in cloud ERP solutions. They can afford the upfront costs associated with implementation and customization, as well as ongoing subscription fees. Large enterprises typically have complex and multifaceted business processes. Cloud ERP vendors that offer comprehensive and scalable solutions are better positioned to meet the diverse needs of large organizations.

Scalability is crucial for large enterprises that experience growth or fluctuations in demand. Cloud ERP solutions that can seamlessly scale to accommodate increased data, users, and transactions are preferred by organizations with dynamic requirements. This, in turn, helps to drive the share of large enterprises in 2023.

IT & Telecom Industry Sees Growing Adoption of Cloud ERP Solutions

The IT & telecom industry often experiences dynamic workloads due to project-based work, seasonal demand, or rapid growth. Cloud ERP allows organizations to scale resources up or down based on demand, ensuring optimal performance and resource utilization. IT & telecom companies may have varied deployment needs, ranging from on-premises to hybrid or fully cloud-based solutions. Cloud ERP providers offer flexible deployment models, allowing organizations to choose the approach that best suits their requirements.

The cloud delivery platform offers IT & telecom services over any network, such as fixed, mobile, and worldwide coverage. Their services can be accessed by any end-user-connected device such as desktops, smartphones, and televisions. With the emergence of 5G, the market is further expected to grow in favor IT & telecom industry.

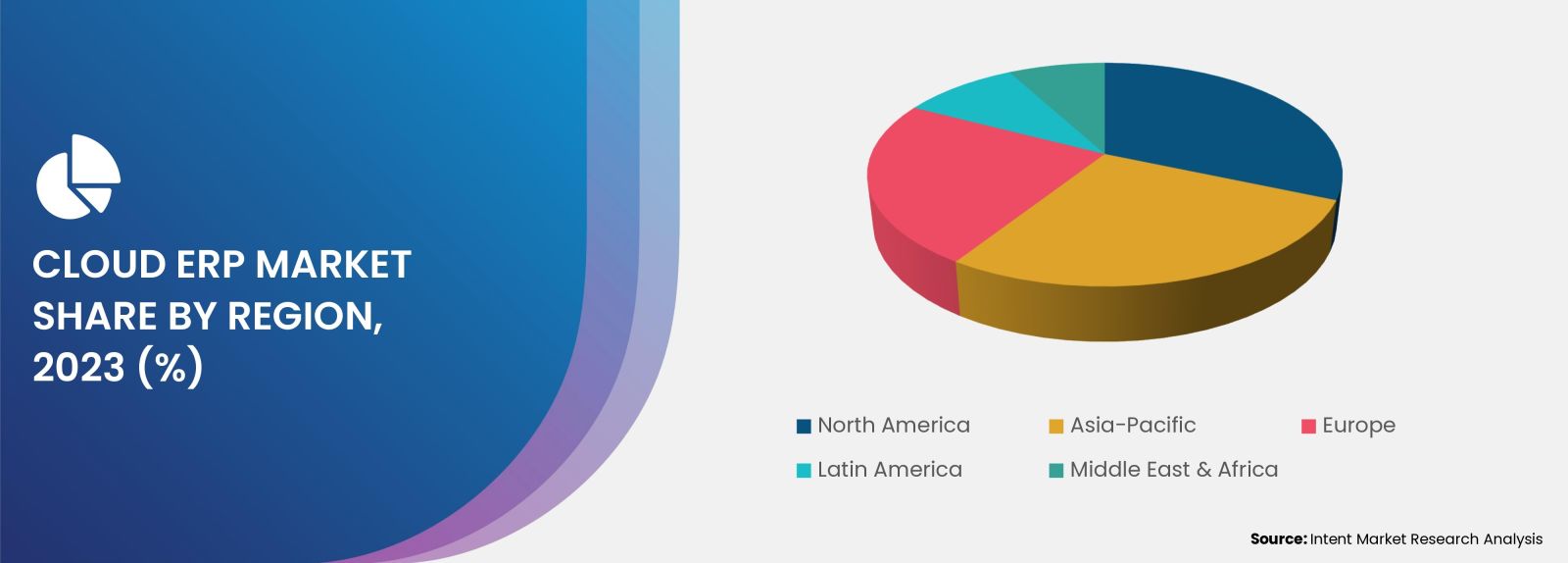

Asia-Pacific to Grow Exponentially over the Forecast Period

Many countries in the Asia-Pacific are actively pursuing digital transformation initiatives to enhance productivity, efficiency, and competitiveness. Cloud ERP plays a crucial role in this transformation by providing a modern and integrated approach to managing business processes.

The overall adoption of cloud technologies is on the rise in the APAC region. Organizations are recognizing the benefits of cloud-based solutions, including cost savings, scalability, and accessibility, which are driving the adoption of cloud ERP. SMEs in the Asia-Pacific region are increasingly adopting cloud ERP solutions. Cloud ERP provides SMEs with the opportunity to access advanced technology without the need for significant upfront investments, making it more feasible for smaller businesses. The region is expected to show stronger growth in the coming years.

Major Industry Players are Enhancing their Market Positions By Adopting Several Growth Strategies

Major players operating in the global cloud ERP market are AWS, IFS, Infor, Microsoft, Oracle, Salesforce, SAP, Unit4, Workday, Zoho, among others. Additionally, Acumatica, Brightpearl, Dassault systemes, Dolibarr, ECI Software, Epicor, Odoo, QAD, Sage, Xero are the emerging companies in the market.

To tap the potential share of the market, major players have started adopting strategies such as new product launches, mergers & acquisitions, and partnership & collaboration. Some of the significant developments are mentioned below

- In November 2023, AWS and SoftwareOne, a global provider of end-to-end software and cloud technology solutions, announced a new collaborative initiative to help customers transition to RISE with SAP on an AWS cloud environment.

- In August 2023, IFS, the global cloud enterprise software company, announced that Tele2, the leading Swedish integrated telecommunications services provider, is set to implement the latest version of IFS Cloud to enable Tele2 for further improvements of its core operations and to enhance more possibilities within their 5G offering.

Cloud ERP Market Coverage

The report provides key insights into the cloud ERP market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting market growth. It analyses key players as well as the competitive landscape within the global market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 44.6 billion |

|

Forecast Revenue (2030) |

USD 93.8 billion |

|

CAGR (2024-2030) |

11.2% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments. |

|

Segments Covered |

By Offering (Solution, Services); By Function (Human Resource Management, Sales & Marketing, Inventory & Order Management, Finance & Accounting Management, Data Analytics, Others); By Deployment (Public, Private, Hybrid); By Architecture (Single-tenant, Multi-tenant); By Organization Size (SMEs, Large Enterprises); By End-use Industry (IT & Telecom, Retail & E-commerce, Manufacturing, BFSI, Transport & Logistics, Automotive, Healthcare, Government, Other Industries) |

|

Regional Analysis |

North America (US, Canada), Asia-Pacific (China, Japan, South Korea, India), Europe (Germany, France, UK, Italy), Latin America and Middle East & Africa. |

|

Competitive Landscape |

AWS, IFS, Infor, Microsoft, Oracle, Salesforce, SAP, Unit4, Workday, and Zoho, Acumatica, Brightpearl, Dassault systemes, Dolibarr, ECI Software, Epicor, Odoo, QAD, Sage, and Xero among others |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions & Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.Emphasis on streamlining enterprise operations |

|

4.1.2.Reduction in TCO |

|

4.2.Restraints |

|

4.2.1.Regulatory compliance |

|

4.2.2.Legacy systems |

|

4.3.Opportunities |

|

4.3.1. Government Investment in Digitalization |

|

4.4.Challenges |

|

4.4.1.Data Security |

|

4.4.2.Vendor Lock-in |

|

4.5.Trends |

|

4.5.1.Cloud ERP with GenAI |

|

5.Market Outlook |

|

5.1.Subscription Model |

|

5.2.Regulatory Analysis: GDPR, HIPPA, SEC Rule 17a-4(f), etc. |

|

5.3.Technology Analysis: AI, ML, Big Data, 5G, RPA, etc. |

|

5.4.PESTLE Analysis |

|

5.5.PORTER's Five Forces Analysis |

|

5.6.Case Studies |

|

6.Market Size by Offering (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

6.1.Solution |

|

6.2.Services |

|

7.Market Size by Function (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

7.1.Human Resource Management |

|

7.2.Sales & Marketing |

|

7.3.Inventory & Order Management |

|

7.4.Finance & Accounting Management |

|

7.5.Data Analytics |

|

7.6.Other Functions (Compliance Management, PSA, and CRM.) |

|

8.Market Size by Deployment (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

8.1.Public |

|

8.2.Private |

|

8.3.Hybrid |

|

9.Market Size by Architecture (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

9.1.Single Tenant |

|

9.2.Multi-tenant |

|

10.Market Size by Organization Size (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

10.1. SMEs |

|

10.2. Large Enterprises |

|

11.Market Size by End-use Industries (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

11.1. Automotive |

|

11.2. Manufacturing |

|

11.3. BFSI |

|

11.4. Retail & E-commerce |

|

11.5. IT & Telecom |

|

11.6. Healthcare |

|

11.7. Government |

|

11.8. Transport & Logistics |

|

11.9. Other Industries |

|

12.Regional Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

12.1. North America |

|

12.1.1. US |

|

12.1.1.1. US Market Outlook by Offering |

|

12.1.1.2. US Market Outlook by Function |

|

12.1.1.3. US Market Outlook by Deployment |

|

12.1.1.4. US Market Outlook by Architecture |

|

12.1.1.5. US Market Outlook by Organization Size |

|

12.1.1.6. US Market Outlook by End-use Industries |

|

Note: Similar Cross-segmentation for each country will be covered as shown above |

|

12.1.2. Canada |

|

12.2. Asia-Pacific |

|

12.2.1. China |

|

12.2.2. Japan |

|

12.2.3. South Korea |

|

12.2.4. India |

|

12.3. Europe |

|

12.3.1. UK |

|

12.3.2. Germany |

|

12.3.3. France |

|

12.3.4. Italy |

|

12.4. Latin America |

|

12.5. Middle East & Africa |

|

13.Competitive Landscape |

|

13.1. Market Share Analysis |

|

13.2. Key Market Growth Strategies |

|

13.3. Company Strategy Analysis |

|

13.4. Competitive Benchmarking |

|

14.Company Profile |

|

14.1. AWS |

|

14.2. IFS |

|

14.3. Infor |

|

14.4. Microsoft |

|

14.5. Oracle |

|

14.6. Salesforce |

|

14.7. SAP |

|

14.8. Unit4 |

|

14.9. Workday |

|

14.10. Zoho |

|

15.Start-ups |

|

15.1. Acumatica |

|

15.2. Brightpearl |

|

15.3. Dassault systemes |

|

15.4. Dolibarr |

|

15.5. ECI Software |

|

15.6. Epicor |

|

15.7. Odoo |

|

15.8. QAD |

|

15.9. Sage |

|

15.10. Xero |

|

16.Appendix |

Let us connect with you TOC

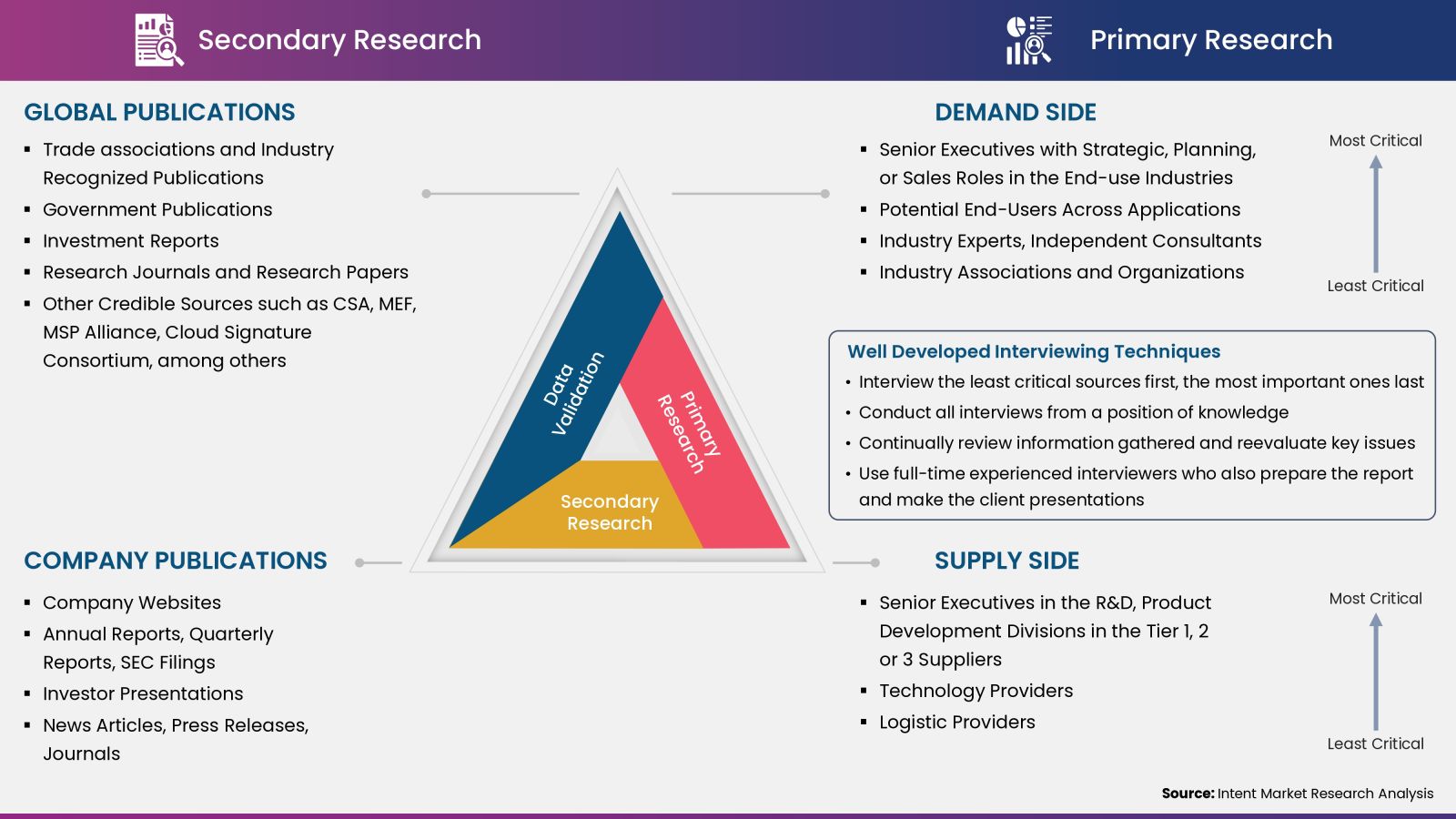

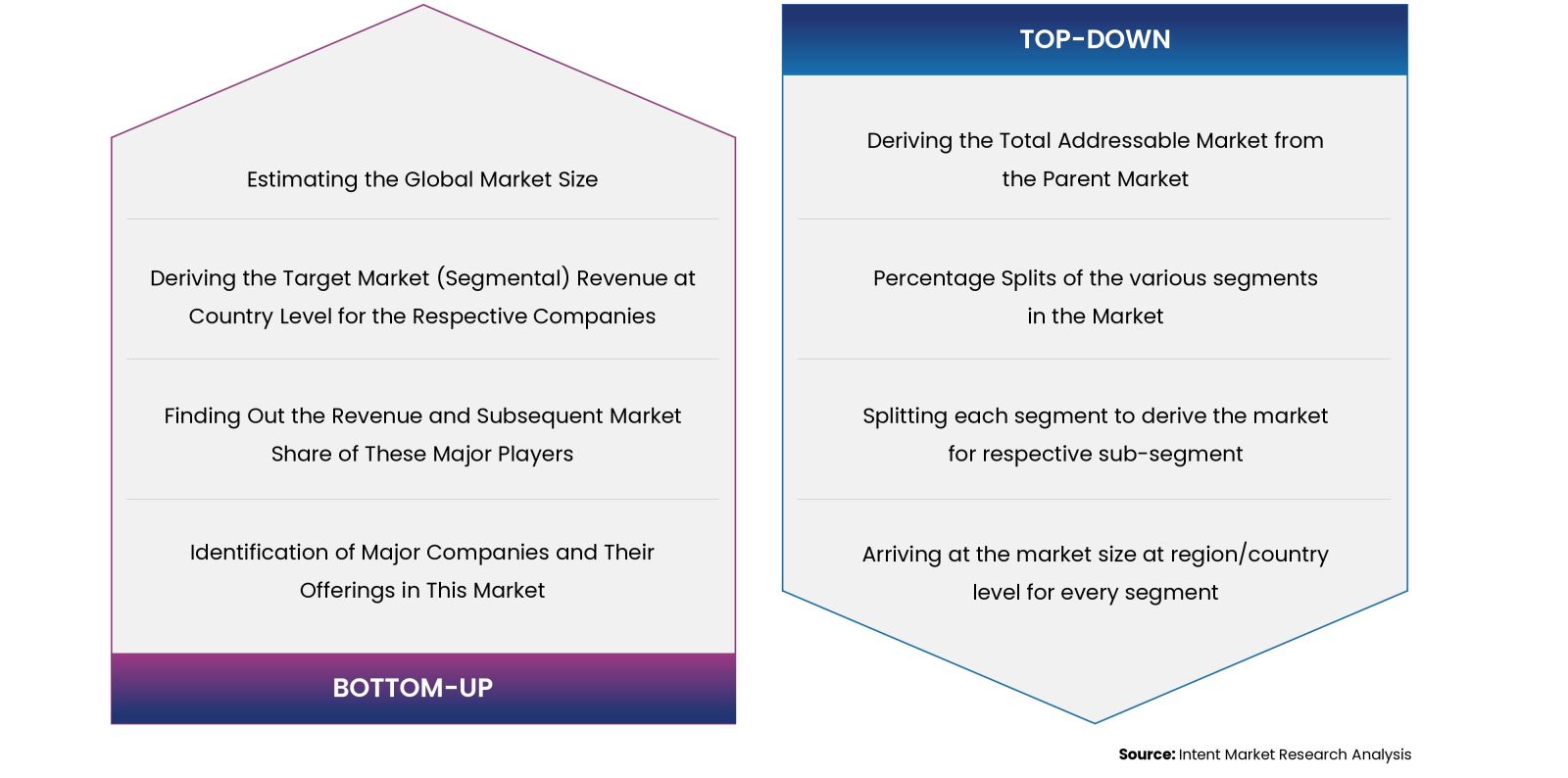

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats