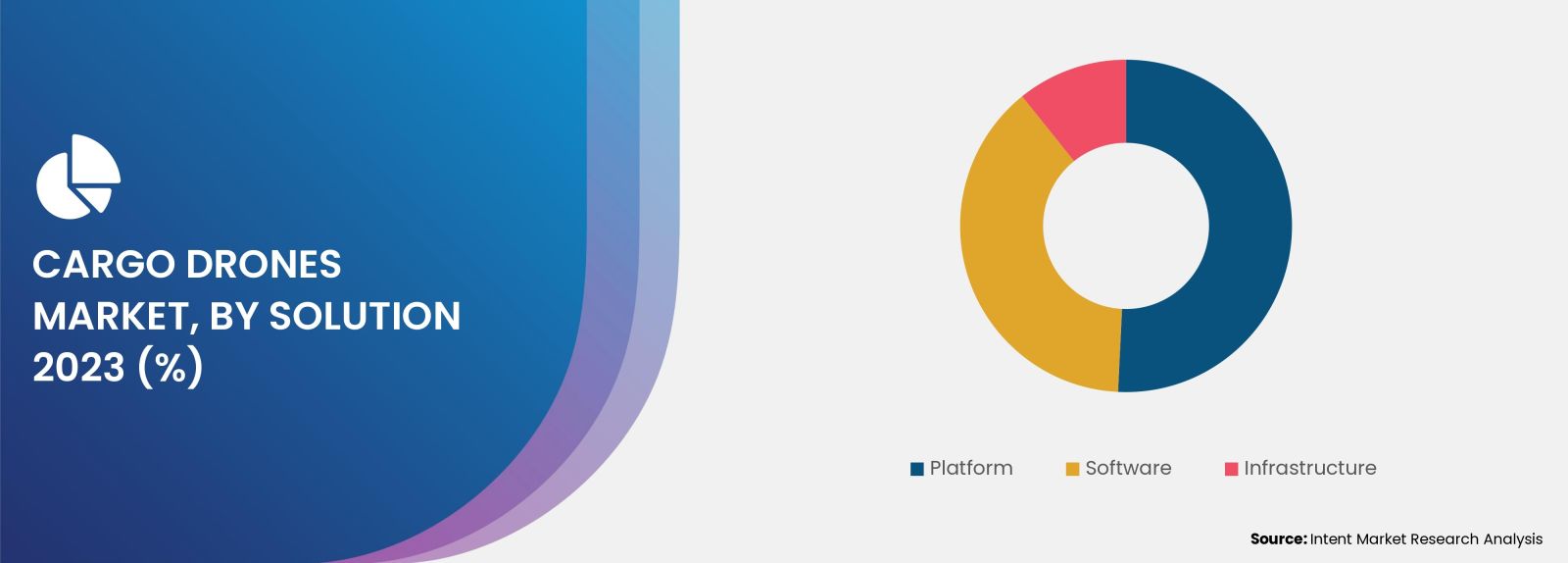

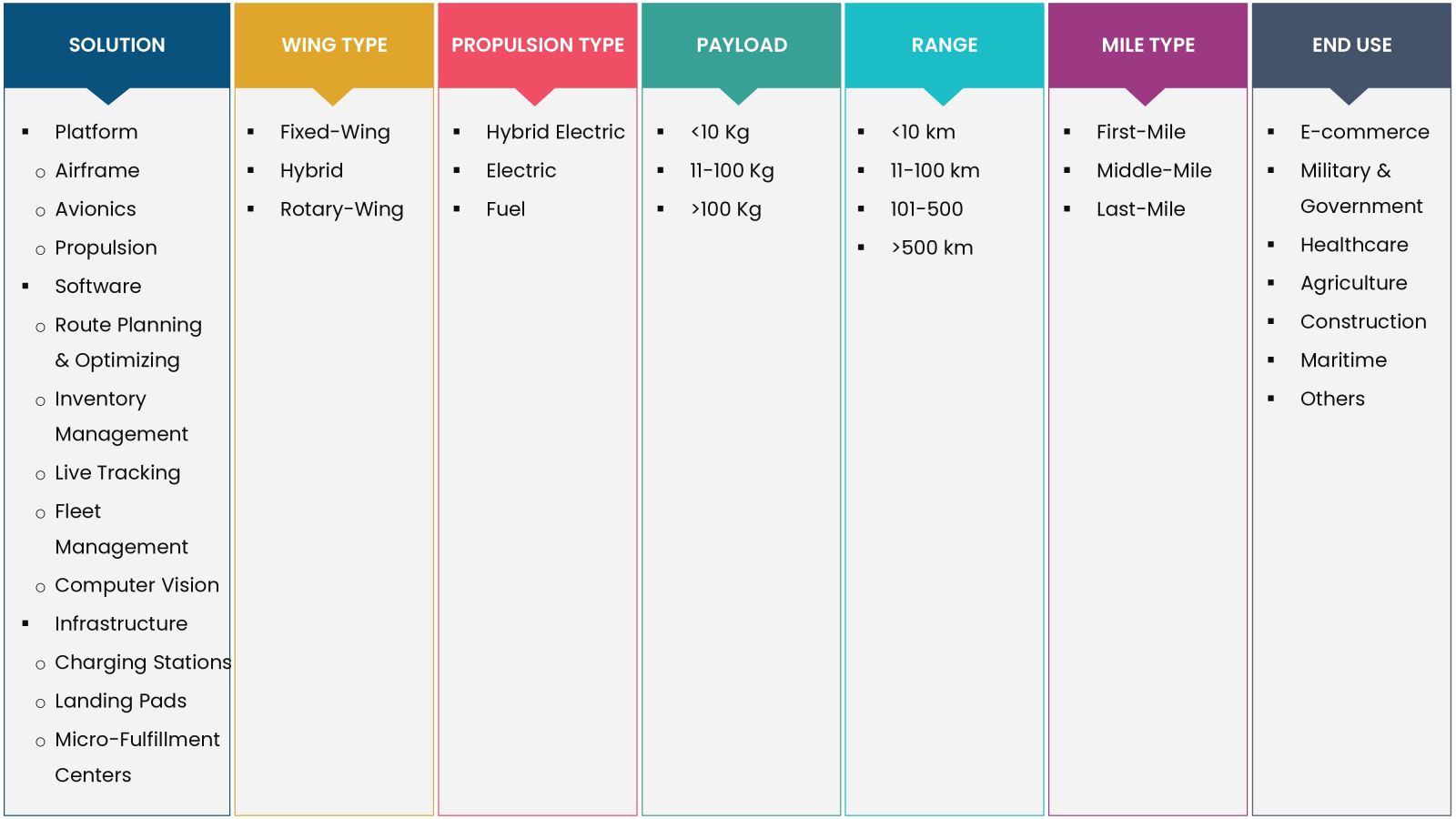

Cargo Drones Market Research Report By Solution (Platform (Airframe, Avionics, Propulsion), Software (Route Planning & Optimizing, Inventory Management, Live Tracking, Fleet Management, Computer Vision), Infrastructure (Charging Stations, Landing Pads, Micro-Fulfillment Centers)), By Drone Type (Fixed-Wing, Hybrid, Rotary-Wing), By Propulsion Type (Hybrid, Electric, Fuel), By Payload (<10 Kg, 11-100 Kg, >100 Kg), By Range (<10 km, 11-100 km, 101-500 km, >500 km), By Mile Type (First-Mile, Middle-Mile, Last-Mile), By End Use (E-Commerce, Military & Government, Healthcare, Agriculture, Construction, Maritime), and By Region; Global Insights & Forecast (2024 – 2030)

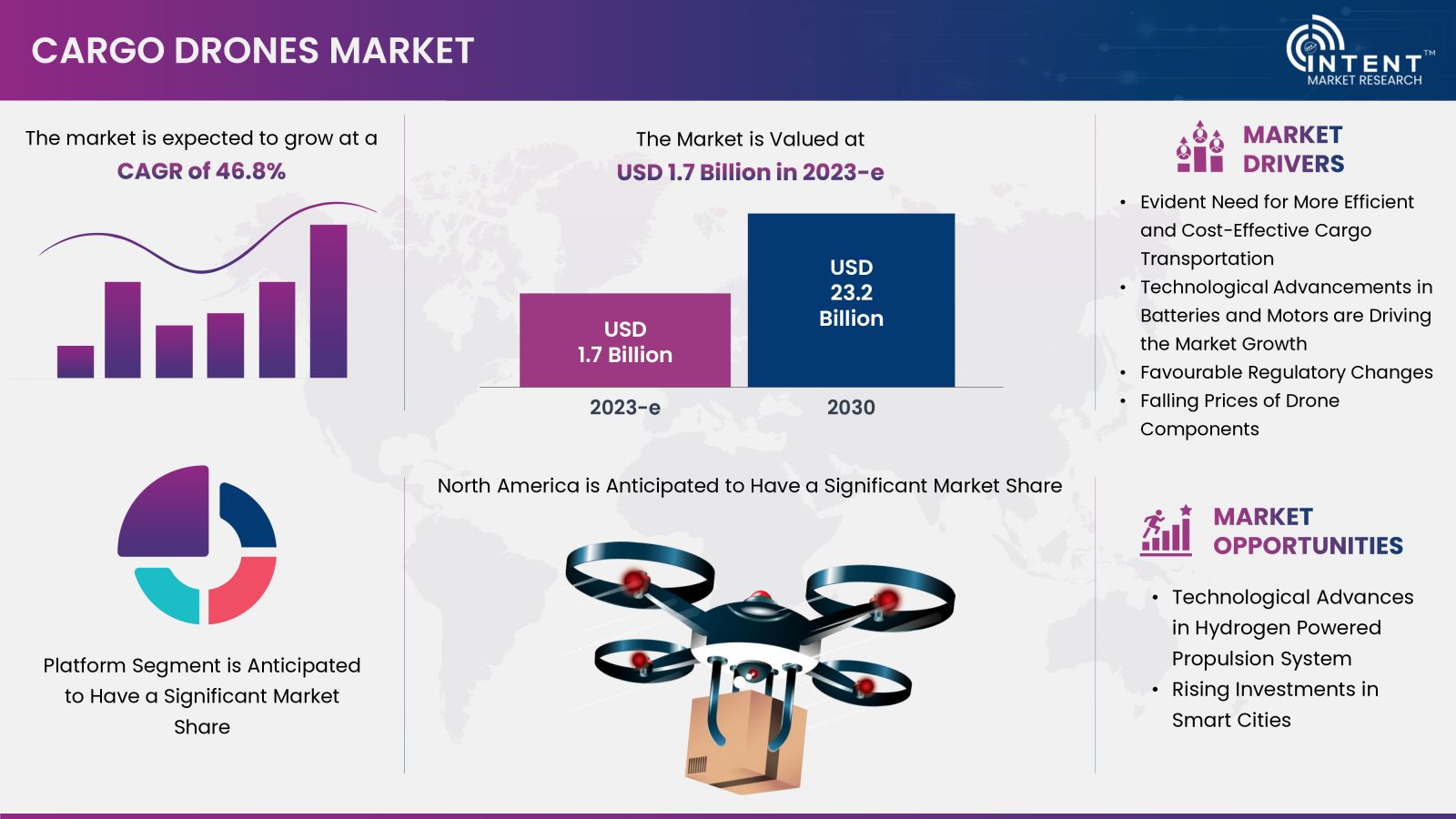

According to Intent Market Research, the Cargo Drones Market is expected to grow from USD 1.7 billion in 2023-e at a CAGR of 46.8% to touch USD 23.2 billion by 2030. The cargo drones market is competitive, the prominent players in the global market include Airbus, Boeing, Dronamics, Dufour Aerospace, Ehang, Elroy Air, Natilus, Sabrewing Aircraft Company, Silent Arrow, and Volocopter.

Cargo drones are Unmanned Aerial Vehicles (UAVs) that are used to transport payloads from one place to another. Cargo drones are used in several applications including intra-firm warehouse deliveries, last-mile supply chain delivery, truck and ship loading/offloading, and intra- and intercity delivery. The industries are actively investing and adopting cargo drones to enhance their logistical operations.

Evident Need for More Efficient and Cost-Effective Cargo Transportation

Cargo or freight transportation, although crucial, can be both expensive and complex within the supply chain. In recent years, there has been a rise in costs associated with freight transportation. This can be associated with several factors including inefficient cargo ships, limited supply of commodities, shipping container shortage globally, rising road congestion, and escalated consumer demand.

Cargo drones have become increasingly popular due to their low running costs, environmental friendliness, and impressive fuel efficiency. For instance, in February 2023, Ameriflight (US), a cargo airline company signed a letter of intent to purchase 35 VTOL air cargo drones from Sabrewing Aircraft (US). The agreement is for Rhaegal-A aircraft, also known as Alpha. This robust shift in the adoption of cargo drones for more efficient and cost-effective cargo transportation is driving the market growth.

Segment Analysis

Continuous Advancements in Avionics and Autonomous Technologies is Driving the Market

Recent advancements in drones in autonomous flight, composite materials, next-generation batteries, extended flight times, and increasing payload capacities are driving the demand for cargo drones. Autonomous aircraft can operate without a pilot and can reduce accidents, alleviate driver shortages, save gas, and improve productivity. There have been several developments in autonomous technology in recent years that are further driving the market. For instance, in July 2023, Reliable Robotics (US), an autonomous aviation company, received approval from the FAA certification process for autonomous aircraft. Thus, advances in avionics and autonomous technologies are anticipated to provide significant opportunities for the cargo drone market growth.

High Energy Efficiency of Fixed-Wing Drones Augments the Segment Growth

Fixed-wing drones can withstand long endurance flights as they are energy efficient. They use less energy since their lift is generated passively. In addition, they can cover a large area and also have faster flight speeds in comparison to rotary-winged drones. They also have a higher payload capacity, enabling them to carry heavier equipment. Owing to these characteristics, they are widely used in long cargo flights. The fixed-wing drones are increasingly being used for cargo transport in disaster management, maritime deliveries, military applications, and agriculture applications. Thus, the fixed-wing drone segment is growing at a significant pace in the cargo drones market.

The Electric Segment is Driven by Technological Advancements in Batteries

In recent years, there have been significant advancements in battery technology that have transformed the use of electric-powered aircraft and automobiles. The batteries now have improved specific energy and energy density, offer longer lifetimes, and have increased safety. The fully electric propulsion systems are greener alternatives to the traditional fuel-powered propulsion systems. Companies are increasingly investing in battery technologies for fully electric propulsion cargo drones. For instance, in December 2023, HEISHA (China), a drone dock technology provider, launched a T200 drone battery-swapping solution. Thus, the fully electric segment is expected to secure a substantial market share.

Increasing Demand for Heavy Payload Capacity Cargo Drones

There’s an increasing demand for heavy payload capacity cargo drones. As technology continues to evolve, companies are launching higher payload capacity cargo drones to meet the demand. For instance, in October 2023, FlyingBasket (Italy), launched the FB3, a heavy cargo drone for commercial use with 100 kg payload capacity. A high payload capacity of >100 kg finds its application in several industries including maritime, construction, and military & government applications. Thus, increasing developments in improving the payload capacity are driving the market growth.

Advances in Battery Technology are Expected to Provide Significant Growth Opportunities for Cargo Drones with >500 km Range

There’s an increasing demand for long-range cargo drones owing to a need for efficient and affordable parcel transportation over long distances. Long-range autonomous drones can help in the transportation of medicines and parcels to difficult-to-reach places. Currently, long-range autonomous delivery vehicles are capable of a marginal payload. However, advances in battery technologies are anticipated to extend the range and payload capacity of the delivery vehicles. Thus, the need for long-range autonomous drones is expected to drive segment growth during the forecast period.

Increasing Investment in Autonomous Last-Mile Delivery Infrastructure Development is Driving Market Growth

Drone delivery services are revolutionizing the way goods are transported. As drone technology continues to evolve and regulations are more accommodating, cargo drones are making deliveries more efficient, cost-effective, and environment-friendly. Several researches have shown that the last mile of package deliveries using drones uses less energy and creates fewer emissions than conventional means.

The logistics and transportation industry is among the industries that are actively adopting drones to enhance their last-mile delivery operations further. For instance, in October 2023, Amazon announced that it is anticipating starting drone delivery operations in Italy, the UK, and a 3rd location in the US by late 2024. Thus, the last-mile segment is anticipated to grow at a significant rate.

Growing E-Commerce Industry is Driving the Market Growth

The way people shop has changed dramatically as a result of the increasing use of smartphones and 5G, and e-commerce is now a significant sector in both the B2C and B2B markets. E-commerce platforms are being used by a growing number of companies, from small startups to large multinationals, to reach customers across the globe. According to the US International Trade Administration (ITA), global B2C e-commerce revenue is expected to grow to USD 5.5 trillion by 2027 at a steady 14.4% CAGR. In e-commerce, cargo drones can be implemented into all parts of the supply chain including the first mile, middle mile, and last mile. Advances in the avionics and automation for the use of drones in logistics have made it lucrative for the adoption in e-commerce. Thus, the growing e-commerce industry is driving the cargo drones market growth.

Regional Analysis

Increasing Number of Drone Startups is Anticipated to Provide Lucrative Growth Opportunities in the Asia-Pacific

Asia-Pacific has a huge potential in cargo drones owing to the robust growth in economies and rising focus on drone infrastructure development. In recent years, there has been an exponential number of drone manufacturing startups in the Asia-Pacific region. For instance, in January 2024, Ziyan, a Chinese-based startup, launched the Grey Whale G1 cargo drone. In addition, India has seen a surge in drone start-ups in recent years. According to the India Brand Equity Foundation, the number of drone start-ups in India has surged by 34.4% between August 2021 and February 2022 totaling about 220 drone startups by February 2022.

In recent years there has been a strong increase in smart city infrastructure spending in the region. The accommodating regulatory changes for the inclusion of cargo drones among key countries such as China, Japan, and South Korea are anticipated to provide significant growth opportunities. Thus, Asia-Pacific is anticipated to be among the fastest-growing regions in the cargo drones market.

Cargo Drones Market is Highly Competitive with Increasing Number of Start-ups

Companies operating within the cargo drones market are primarily drone manufacturers and autonomous vehicle manufacturers, infrastructure developers, service providers, and software developers. The companies are expanding their product portfolios with the growing demand for delivery bots and drones. The cargo drones market is highly competitive with few big global players competing with an increasing number of startups entering the market. The key companies in the market are Airbus, Boeing, Dronamics, Dufour Aerospace, Ehang, Elroy Air, Natilus, Sabrewing Aircraft Company, Silent Arrow, and Volocopter, among others.

Following are some key developments in the cargo drones market:

- In November 2023, Matternet received the US FAA Type Certification Amendment for its M2 drone delivery system.

- In September 2023, Traverse Aero Corporation launched Orca, the company’s new flagship autonomous eVTOL cargo drone.

- In September 2023, Skyports Drone Services (London) came into partnership with Equinor (Norway) to conduct a new trial program with electric drones from Swoop Aero, delivering supplies and other cargo to off-shore drilling platforms in the North Sea.

Cargo Drones Market Coverage

The report provides key insights into the cargo drones market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.7 billion |

|

Forecast Revenue (2030) |

USD 23.2 billion |

|

CAGR (2024-2030) |

46.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Solution (Platform (Airframe, Avionics, Propulsion), Software (Route Planning & Optimizing, Inventory Management, Live Tracking, Fleet Management, Computer Vision), Infrastructure (Charging Stations, Landing Pads, Micro-Fulfillment Centers)), By Drone Type (Fixed-Wing, Hybrid, Rotary-Wing), By Propulsion Type (Hybrid, Electric, Fuel), By Payload (<10 Kg, 11-100 Kg, >100 Kg), By Range (<10 km, 11-100 km, 101-500 km, >500 km), By Mile Type (First-Mile, Middle-Mile, Last-Mile), By End Use (E-Commerce, Military & Government, Healthcare, Agriculture, Construction, Maritime) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, India, Japan, South Korea, Australia), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

Airbus, Boeing, Dronamics, Dufour Aerospace, Ehang, Elroy Air, Natilus, Sabrewing Aircraft Company, Silent Arrow, and Volocopter |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Evident Need for More Efficient and Cost-Effective Cargo Transportation |

|

4.1.2.Technological Advancements in Batteries and Motors |

|

4.1.3.Favorable Regulatory Changes |

|

4.1.4.Falling Prices of Drone Components |

|

4.2.Market Growth Restraints |

|

4.2.1.Lack of Skilled Drone Operators |

|

4.2.2.Safety & Security Issues |

|

4.2.3.Vulnerability of Drones to Weather Changes |

|

4.3.Market Growth Opportunities |

|

4.3.1.Technological Advances in Advanced Drone Propulsion System |

|

4.3.2.Rising Investments in Smart Cities |

|

4.4.Porter’s Five Forces |

|

4.5.PESTLE Analysis |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Regulatory Framework |

|

5.3.Technology Analysis |

|

5.4.Patent Analysis |

|

5.5.Startup Ecosystem |

|

6.Market Segment Outlook |

|

6.1.Segment Synopsis |

|

6.2.By Solution (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.2.1.By Platform |

|

6.2.1.1.Airframe |

|

6.2.1.2.Propulsion |

|

6.2.1.3.Avionics |

|

6.2.2.Software |

|

6.2.2.1.Live Tracking |

|

6.2.2.2.Optimed Route Planning |

|

6.2.2.3.Inventory Management |

|

6.2.2.4.Fleet Management |

|

6.2.2.5.Others |

|

6.2.3.Infrastructure |

|

6.2.3.1.Charging Stations |

|

6.2.3.2.Landing Pads |

|

6.2.3.3.Micro-Fulfillment Centers |

|

6.3.By Wing Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.3.1.Fixed-Wing |

|

6.3.2.Rotary-Wing |

|

6.3.3.Hybrid |

|

6.4.By Propulsion Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.4.1. Hybrid Electric |

|

6.4.2. Electric |

|

6.4.3.Fuel |

|

6.5.By Payload (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.5.1.<10 Kg |

|

6.5.2. 11-100 Kg |

|

6.5.3. >100 Kg |

|

6.6.By Range (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.6.1. <10 km |

|

6.6.2. 11-100 km |

|

6.6.3. 101-500 km |

|

6.6.4. >500 km |

|

6.7.By Mile Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.7.1. First-Mile |

|

6.7.2.Middle-Mile |

|

6.7.3.Last-Mile |

|

6.8.By End Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.8.1.E-commerce |

|

6.8.2.Military & Government |

|

6.8.3.Healthcare |

|

6.8.4.Agriculture |

|

6.8.5.Construction |

|

6.8.6.Maritime |

|

6.8.7.Others |

|

7.Regional Outlook |

|

7.1.Global Market Synopsis |

|

7.2.North America (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.2.1.North America Cargo Drones Servicing Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Cargo Drones Servicing Market, By Solution |

|

7.2.2.2.US Cargo Drones Servicing Market, By Wing Type |

|

7.2.2.3.US Cargo Drones Servicing Market, By Propulsion Type |

|

7.2.2.4.US Cargo Drones Servicing Market, By Payload |

|

7.2.2.5.US Cargo Drones Servicing Market, By Range |

|

7.2.2.6.US Cargo Drones Servicing Market, By Mile Type |

|

7.2.2.7.US Cargo Drones Servicing Market, By End User |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.3.Europe (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.3.1.Europe Cargo Drones Servicing Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Italy |

|

7.3.6.Spain |

|

7.4.Asia-Pacific (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.4.1.Asia-Pacific Cargo Drones Servicing Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.5.1.Latin America Cargo Drones Servicing Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Mexico |

|

7.6.Middle East & Africa (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.6.1.Middle East & Africa Cargo Drones Servicing Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

7.6.4.South Africa |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Airbus |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.2.Boeing |

|

9.3.Dronamics |

|

9.4.Dufour Aerospace |

|

9.5.Ehang |

|

9.6.Elroy Air |

|

9.7.Natilus |

|

9.8.Sabrewing Aircraft Company |

|

9.9.Silent Arrow |

|

9.10.Volocopter |

Let us connect with you TOC

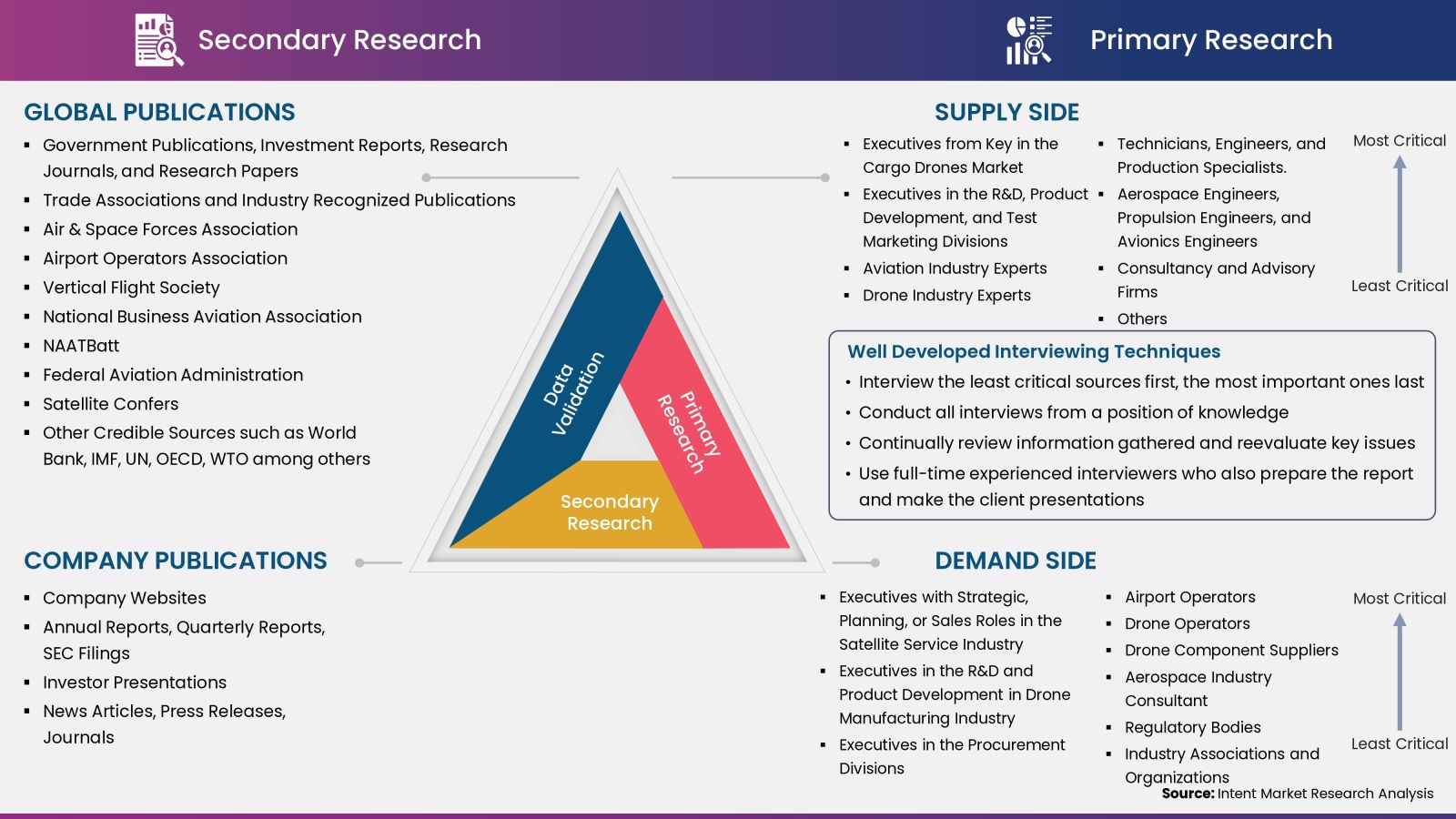

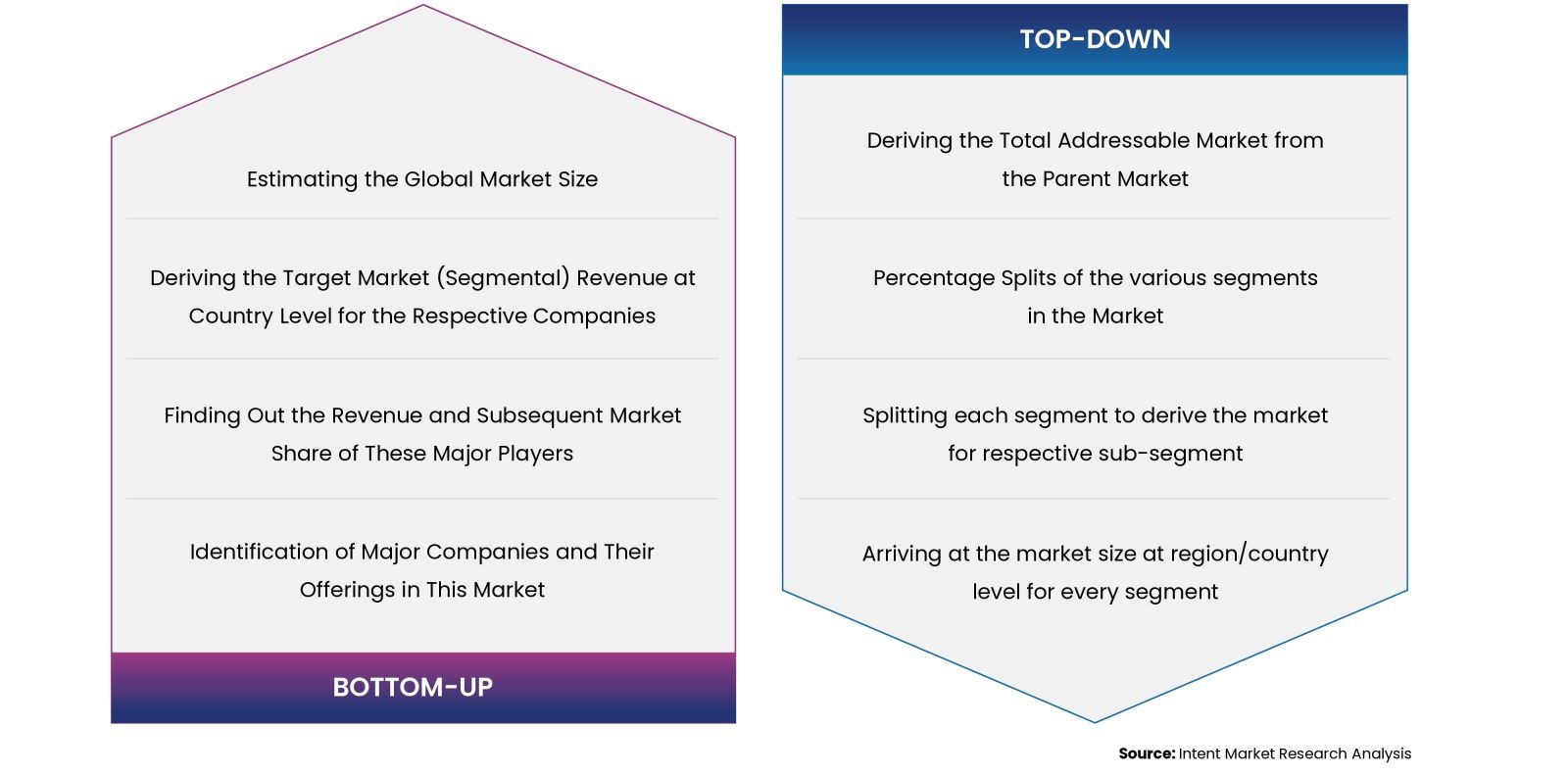

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats