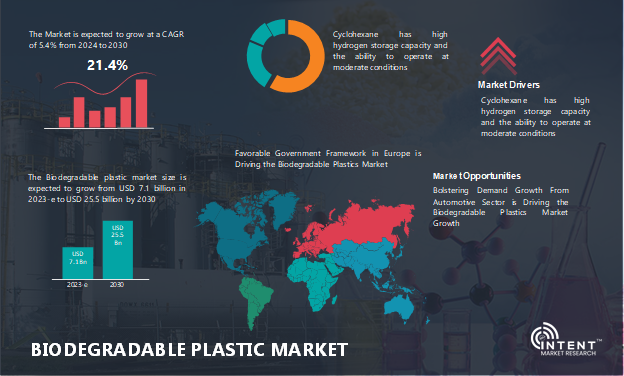

According to Intent Market Research, the Biodegradable Plastic Market is expected to grow from USD 7.1 billion in 2023-e at a CAGR of 21.4% to touch USD 25.5 billion by 2030. Increasing awareness among the public about the harmful effects of plastic waste is driving the growth of the biodegradable plastics market. Some of the companies operating in this market include BASF, Biome Technologies, Cargill, Danimer Scientific, Eastman Chemical, FKuR Kunststoff, Futerro, NatureWorks, Novamont, Plantic Technologies, PTT MCC Biochem, Synbra Technology, Total Corbion and Trineso.

As per Intent Market Research, the Biodegradable Plastic Market was valued at USD 7.1 billion in 2023-e and will surpass USD 25.5 billion by 2030; growing at a CAGR of 21.4% during 2024 - 2030. Increasing awareness among the public about the harmful effects of plastic waste, is driving the biodegradable plastics market growth.

Biodegradable plastics are a type of polymer material that are designed to decompose through the action of microorganisms such as bacteria or fungi, into natural substances such as biomass, carbon dioxide, and water under certain conditions. Unlike conventional plastics that persist in the environment for long periods, biodegradable plastics aim to lessen environmental impact by breaking down into non-toxic components over time. The key feature of biodegradable plastics is their natural degradation process which contributes to reducing plastic pollution and environmental harm.

Biodegradable Plastic Market Dynamics

Rising Demand from Automotive Sector is Boost the Biodegradable Plastics Market

Biodegradable plastic has become a popular material for use in automotive interiors. Components of the vehicle interior, such as mats, carpeting, and upholstery, are well suited for biodegradable PLA use. The automotive industry is experiencing rapid growth, driven by factors such as increasing demand for passenger vehicles among the middle class, urbanization, and the adoption of fuel-efficient vehicle technologies. According to the National Automobile Dealers Association (NADA), new light-vehicle sales are expected to increase by 3.4% in 2022 compared to 2020. As automotive vehicle production and growth prospects continue to rise, the demand for biodegradable plastic is also increasing.

Increasing Demand from the Personal Care & Cosmetic Industry is Propelling the Biodegradable Plastics Market

The rising demand for sustainable products in the cosmetics industry will have positive impact on bioplastic market growth. Biodegradable plastics in cosmetics are typically used for packaging purposes. Cosmetic companies are increasingly adopting biodegradable plastics as an alternative to traditional, non-biodegradable plastics for packaging their products. The aim is to reduce the environmental impact associated with the disposal of cosmetic packaging. This trend is fueled by rising demand and consumer awareness.

Biodegradable Plastic Market Segment Insights

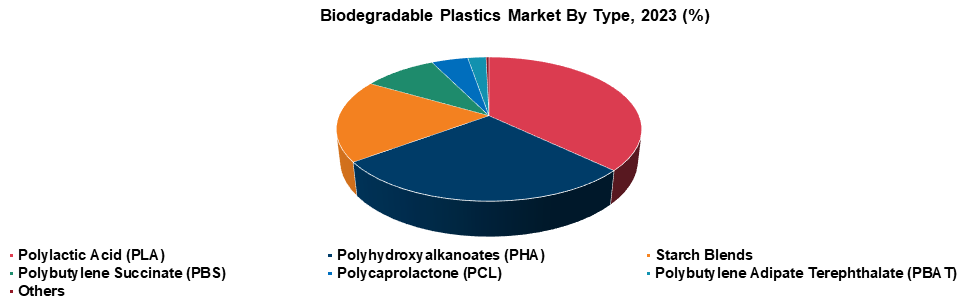

The Increasing Popularity of Polylactic Acid (PLA) in Various Sectors is Driving the Biodegradable Plastics Market

The PLA segment is expected to hold the largest share of the global biodegradable plastics market over the forecast period. This is due to its increasing use in various end-use industries such as consumer goods and packaging. The segment's revenue growth is expected to receive a significant boost from high growth rates and new investments for PLA production in the US and Europe.

PLA is derived from bio-based resources and is advertised as an eco-friendly material. It is relatively cost-effective and has many attractive mechanical properties compared to other biodegradable polymers. PLA is used to produce clear and opaque rigid plastics for disposable goods, packaging, bottles, and durable goods, as well as fibers and films for various purposes.

Source: Intent Market Research Analysis

Source: Intent Market Research Analysis

Shifting Consumer Inclination towards Eco-friendly Packaging is driving the Biodegradable Plastics Market Growth

The packaging industry is projected to hold the largest revenue share in the global biodegradable plastics market. The increasing preference of consumers towards eco-friendly products has resulted in greater use of biodegradable plastics in packaging, such as water and juice bottles, bakery goods, processed food, dried snacks, candies, and meat trays. Strict regulations on plastic usage have led to a surge in demand for biodegradable plastic in the packaging sector. Biodegradable plastics are used in both rigid and flexible packaging. Companies in the packaging industry are investing in research & development to create more sustainable packaging solutions to reduce their carbon footprint.

The greater sustainability offered by biodegradable packaging solutions has made them increasingly popular. The development of biodegradable plastics with superior barrier and thermal properties is expected to make them an ideal material for packaging drinks, food, and non-food items. Many multinational companies in sectors such as consumer-packaged goods, retail, and food service are widely utilizing biodegradable plastics to meet the growing demand for biodegradable packaging for food cutlery, fresh produce, and compostable bags. E-commerce giants are also shifting towards biodegradable packaging for online goods and food delivery services, which is expected to drive market growth during the forecast period.

Regional Insights

Favorable Government Framework in Europe will Drive the Market Growth

Europe is expected to hold the major market share in the global biodegradable plastics market. This is due to the increasing demand for plastics in various industries, including packaging, agriculture, consumer goods, and textiles. The European Commission recognizes the essential role of bioplastics in the bioeconomy, and how they can accelerate the transition to a circular economy. Favorable policies, availability of subsidies, and various initiatives promoting the use of biodegradable plastics in the region is expected to boost the market growth.

The growing awareness among consumers about eco-friendly products is also driving demand for biodegradable plastics across various end-use industries in Europe. The EU's introduction of the Single-Use Plastics Directive in 2019, for instance, has resulted in the prohibition of single-use plastic products. This ban is expected to have a positive impact on the market for biodegradable plastics in the region. Additionally, Europe is allocating funds and resources for research & development activities, which are expected to support market growth.

Competitive Landscape

Novel Product Launches are the Major Strategy Adopted by the Key Players for Biodegradable Plastics Market Growth

The biodegradable plastics market is moderately fragmented with several key players operating at both global and regional levels. These players are constantly engaged in developing new products and forming strategic alliances to expand their respective product portfolios and gain a strong foothold in the global market. Some of the companies operating in this market include BASF, Biome Technologies, Cargill, Danimer Scientific, Eastman Chemical, FKuR Kunststoff, Futerro, NatureWorks, Novamont, Plantic Technologies, PTT MCC Biochem, Synbra Technology, Total Corbion and Trineso.

Biodegradable Plastic Market Coverage

The report provides key insights into the biodegradable plastic market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector, the analysis delves into market drivers, restraints, opportunities, and other pertinent factors. The report also scrutinizes key players and the competitive landscape in the biodegradable plastics market.

Report Scope

|

Report Features |

Description |

|

Market Value (2023-e) |

USD 7.1 billion |

|

Forecast Revenue (2030) |

USD 25.5 billion |

|

CAGR (2024-2030) |

21.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

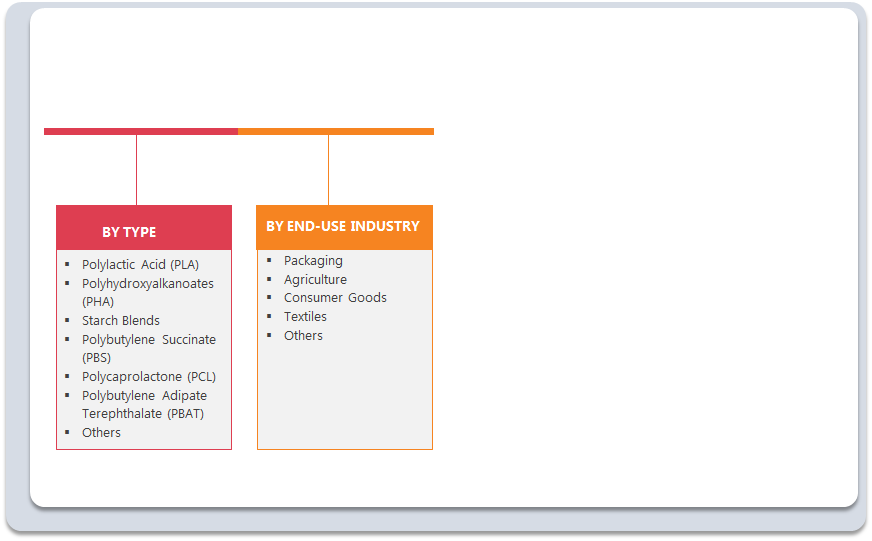

Segments Covered |

By Type (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends, Polybutylene Succinate (PBS), Polycaprolactone (PCL), Polybutylene Adipate Terephthalate (PBAT), Others) and End-use Industry (Packaging, Agriculture, Consumer Goods, Textiles , Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

BASF, Biome Technologies, Cargill, Danimer Scientific, Eastman Chemical, FKuR Kunststoff, Futerro, NatureWorks, Novamont , Plantic Technologies, PTT MCC Biochem, Synbra Technology, Total Corbion and Trineso |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Biodegradable Plastic Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Biodegradable Plastic Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. Biodegradable Plastic Market Outlook |

|

5.1. Investment Analysis |

|

5.2.Technological Developments |

|

5.3.Consumer Behaviour Analysis |

|

5.4.Regulatory Framework |

|

5.5.Industry Value Chain Analysis |

|

5.6.Porter's Five Forces analysis |

|

5.7.Pricing Analysis |

|

5.8.Patent Analysis |

|

5.9.Case Study |

|

6. Global Biodegradable Plastic Market Segmentation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1 Type |

|

6.1.1 Polylactic Acid (PLA) |

|

6.1.2 Polyhydroxyalkanoates (PHA) |

|

6.1.3 Starch Blends |

|

6.1.4 Polybutylene Succinate (PBS) |

|

6.1.5 Polycaprolactone (PCL) |

|

6.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

6.1.7 Others |

|

6.2 End-Use Industry |

|

6.2.1 Packaging |

|

6.2.2 Agriculture |

|

6.2.3 Consumer Goods |

|

6.2.4 Textiles |

|

6.2.5 Others |

|

6.3 Geography |

|

6.3.1 North America |

|

6.3.2 Europe |

|

6.3.3 Asia-Pacific |

|

6.3.4 Latin America |

|

6.3.5 Middle East and Africa |

|

7. North America Biodegradable Plastic Market Segmentation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1 Type |

|

7.1.1 Polylactic Acid (PLA) |

|

7.1.2 Polyhydroxyalkanoates (PHA) |

|

7.1.3 Starch Blends |

|

7.1.4 Polybutylene Succinate (PBS) |

|

7.1.5 Polycaprolactone (PCL) |

|

7.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

7.1.7 Others |

|

7.2 End-Use Industry |

|

7.2.1 Packaging |

|

7.2.2 Agriculture |

|

7.2.3 Consumer Goods |

|

7.2.4 Textiles |

|

7.2.5 Others |

|

7.3 Country |

|

7.3.1 United States |

|

7.3.1.1 Type |

|

7.3.1.1.1 Polylactic Acid (PLA) |

|

7.3.1.1.2 Polyhydroxyalkanoates (PHA) |

|

7.3.1.1.3 Starch Blends |

|

7.3.1.1.4 Polybutylene Succinate (PBS) |

|

7.3.1.1.5 Polycaprolactone (PCL) |

|

7.3.1.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

7.3.1.1.7 Others |

|

7.3.1.2 End-Use Industry |

|

7.3.1.2.1 Packaging |

|

7.3.1.2.2 Agriculture |

|

7.3.1.2.3 Consumer Goods |

|

7.3.1.2.4 Textiles |

|

7.3.1.2.5 Others |

|

7.3.2 Canada |

|

7.3.2.1 Type |

|

7.3.2.1.1 Polylactic Acid (PLA) |

|

7.3.2.1.2 Polyhydroxyalkanoates (PHA) |

|

7.3.2.1.3 Starch Blends |

|

7.3.2.1.4 Polybutylene Succinate (PBS) |

|

7.3.2.1.5 Polycaprolactone (PCL) |

|

7.3.2.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

7.3.2.1.7 Others |

|

7.3.2.2 End-Use Industry |

|

7.3.2.2.1 Packaging |

|

7.3.2.2.2 Agriculture |

|

7.3.2.2.3 Consumer Goods |

|

7.3.2.2.4 Textiles |

|

7.3.2.2.5 Others |

|

8. Europe Market Biodegradable Plastic Segmentation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1 Type |

|

8.1.1 Polylactic Acid (PLA) |

|

8.1.2 Polyhydroxyalkanoates (PHA) |

|

8.1.3 Starch Blends |

|

8.1.4 Polybutylene Succinate (PBS) |

|

8.1.5 Polycaprolactone (PCL) |

|

8.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

8.1.7 Others |

|

8.2 End-Use Industry |

|

8.2.1 Packaging |

|

8.2.2 Agriculture |

|

8.2.3 Consumer Goods |

|

8.2.4 Textiles |

|

8.2.5 Others |

|

8.3 Country |

|

8.3.1 United Kingdom |

|

8.3.1.1 Type |

|

8.3.1.1.1 Polylactic Acid (PLA) |

|

8.3.1.1.2 Polyhydroxyalkanoates (PHA) |

|

8.3.1.1.3 Starch Blends |

|

8.3.1.1.4 Polybutylene Succinate (PBS) |

|

8.3.1.1.5 Polycaprolactone (PCL) |

|

8.3.1.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

8.3.1.1.7 Others |

|

8.3.1.2 End-Use Industry |

|

8.3.1.2.1 Packaging |

|

8.3.1.2.2 Agriculture |

|

8.3.1.2.3 Consumer Goods |

|

8.3.1.2.4 Textiles |

|

8.3.1.2.5 Others |

|

8.3.2 Germany |

|

8.3.2.1 Type |

|

8.3.2.1.1 Polylactic Acid (PLA) |

|

8.3.2.1.2 Polyhydroxyalkanoates (PHA) |

|

8.3.2.1.3 Starch Blends |

|

8.3.2.1.4 Polybutylene Succinate (PBS) |

|

8.3.2.1.5 Polycaprolactone (PCL) |

|

8.3.2.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

8.3.2.1.7 Others |

|

8.3.2.2 End-Use Industry |

|

8.3.2.2.1 Packaging |

|

8.3.2.2.2 Agriculture |

|

8.3.2.2.3 Consumer Goods |

|

8.3.2.2.4 Textiles |

|

8.3.2.2.5 Others |

|

8.3.3 France |

|

8.3.3.1 Type |

|

8.3.3.1.1 Polylactic Acid (PLA) |

|

8.3.3.1.2 Polyhydroxyalkanoates (PHA) |

|

8.3.3.1.3 Starch Blends |

|

8.3.3.1.4 Polybutylene Succinate (PBS) |

|

8.3.3.1.5 Polycaprolactone (PCL) |

|

8.3.3.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

8.3.3.1.7 Others |

|

8.3.3.2 End-Use Industry |

|

8.3.3.2.1 Packaging |

|

8.3.3.2.2 Agriculture |

|

8.3.3.2.3 Consumer Goods |

|

8.3.3.2.4 Textiles |

|

8.3.3.2.5 Others |

|

8.3.4 Italy |

|

8.3.4.1 Type |

|

8.3.4.1.1 Polylactic Acid (PLA) |

|

8.3.4.1.2 Polyhydroxyalkanoates (PHA) |

|

8.3.4.1.3 Starch Blends |

|

8.3.4.1.4 Polybutylene Succinate (PBS) |

|

8.3.4.1.5 Polycaprolactone (PCL) |

|

8.3.4.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

8.3.4.1.7 Others |

|

8.3.4.2 End-Use Industry |

|

8.3.4.2.1 Packaging |

|

8.3.4.2.2 Agriculture |

|

8.3.4.2.3 Consumer Goods |

|

8.3.4.2.4 Textiles |

|

8.3.4.2.5 Others |

|

9. Asia-Pacific Biodegradable Plastic Market Segmentation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1 Type |

|

9.1.1 Polylactic Acid (PLA) |

|

9.1.2 Polyhydroxyalkanoates (PHA) |

|

9.1.3 Starch Blends |

|

9.1.4 Polybutylene Succinate (PBS) |

|

9.1.5 Polycaprolactone (PCL) |

|

9.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

9.1.7 Others |

|

9.2 End-Use Industry |

|

9.2.1 Packaging |

|

9.2.2 Agriculture |

|

9.2.3 Consumer Goods |

|

9.2.4 Textiles |

|

9.2.5 Others |

|

9.3 Country |

|

9.3.1 China |

|

9.3.1.1 Type |

|

9.3.1.1.1 Polylactic Acid (PLA) |

|

9.3.1.1.2 Polyhydroxyalkanoates (PHA) |

|

9.3.1.1.3 Starch Blends |

|

9.3.1.1.4 Polybutylene Succinate (PBS) |

|

9.3.1.1.5 Polycaprolactone (PCL) |

|

9.3.1.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

9.3.1.1.7 Others |

|

9.3.1.2 End-Use Industry |

|

9.3.1.2.1 Packaging |

|

9.3.1.2.2 Agriculture |

|

9.3.1.2.3 Consumer Goods |

|

9.3.1.2.4 Textiles |

|

9.3.1.2.5 Others |

|

9.3.2 Japan |

|

9.3.2.1 Type |

|

9.3.2.1.1 Polylactic Acid (PLA) |

|

9.3.2.1.2 Polyhydroxyalkanoates (PHA) |

|

9.3.2.1.3 Starch Blends |

|

9.3.2.1.4 Polybutylene Succinate (PBS) |

|

9.3.2.1.5 Polycaprolactone (PCL) |

|

9.3.2.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

9.3.2.1.7 Others |

|

9.3.2.2 End-Use Industry |

|

9.3.2.2.1 Packaging |

|

9.3.2.2.2 Agriculture |

|

9.3.2.2.3 Consumer Goods |

|

9.3.2.2.4 Textiles |

|

9.3.2.2.5 Others |

|

9.3.3 India |

|

9.3.3.1 Type |

|

9.3.3.1.1 Polylactic Acid (PLA) |

|

9.3.3.1.2 Polyhydroxyalkanoates (PHA) |

|

9.3.3.1.3 Starch Blends |

|

9.3.3.1.4 Polybutylene Succinate (PBS) |

|

9.3.3.1.5 Polycaprolactone (PCL) |

|

9.3.3.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

9.3.3.1.7 Others |

|

9.3.3.2 End-Use Industry |

|

9.3.3.2.1 Packaging |

|

9.3.3.2.2 Agriculture |

|

9.3.3.2.3 Consumer Goods |

|

9.3.3.2.4 Textiles |

|

9.3.3.2.5 Others |

|

9.3.4 South Korea |

|

9.3.4.1 Type |

|

9.3.4.1.1 Polylactic Acid (PLA) |

|

9.3.4.1.2 Polyhydroxyalkanoates (PHA) |

|

9.3.4.1.3 Starch Blends |

|

9.3.4.1.4 Polybutylene Succinate (PBS) |

|

9.3.4.1.5 Polycaprolactone (PCL) |

|

9.3.4.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

9.3.4.1.7 Others |

|

9.3.4.2 End-Use Industry |

|

9.3.4.2.1 Packaging |

|

9.3.4.2.2 Agriculture |

|

9.3.4.2.3 Consumer Goods |

|

9.3.4.2.4 Textiles |

|

9.3.4.2.5 Others |

|

10. Latin America Biodegradable Plastic Market Segmentation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1 Type |

|

10.1.1 Polylactic Acid (PLA) |

|

10.1.2 Polyhydroxyalkanoates (PHA) |

|

10.1.3 Starch Blends |

|

10.1.4 Polybutylene Succinate (PBS) |

|

10.1.5 Polycaprolactone (PCL) |

|

10.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

10.1.7 Others |

|

10.2 End-Use Industry |

|

10.2.1 Packaging |

|

10.2.2 Agriculture |

|

10.2.3 Consumer Goods |

|

10.2.4 Textiles |

|

10.2.5 Others |

|

10.3 Country |

|

10.3.1 Brazil |

|

10.3.1.1 Type |

|

10.3.1.1.1 Polylactic Acid (PLA) |

|

10.3.1.1.2 Polyhydroxyalkanoates (PHA) |

|

10.3.1.1.3 Starch Blends |

|

10.3.1.1.4 Polybutylene Succinate (PBS) |

|

10.3.1.1.5 Polycaprolactone (PCL) |

|

10.3.1.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

10.3.1.1.7 Others |

|

10.3.1.2 End-Use Industry |

|

10.3.1.2.1 Packaging |

|

10.3.1.2.2 Agriculture |

|

10.3.1.2.3 Consumer Goods |

|

10.3.1.2.4 Textiles |

|

10.3.1.2.5 Others |

|

10.3.2 Mexico |

|

10.3.2.1 Type |

|

10.3.2.1.1 Polylactic Acid (PLA) |

|

10.3.2.1.2 Polyhydroxyalkanoates (PHA) |

|

10.3.2.1.3 Starch Blends |

|

10.3.2.1.4 Polybutylene Succinate (PBS) |

|

10.3.2.1.5 Polycaprolactone (PCL) |

|

10.3.2.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

10.3.2.1.7 Others |

|

10.3.2.2 End-Use Industry |

|

10.3.2.2.1 Packaging |

|

10.3.2.2.2 Agriculture |

|

10.3.2.2.3 Consumer Goods |

|

10.3.2.2.4 Textiles |

|

10.3.2.2.5 Others |

|

10.3.3 Argentina |

|

10.3.3.1 Type |

|

10.3.3.1.1 Polylactic Acid (PLA) |

|

10.3.3.1.2 Polyhydroxyalkanoates (PHA) |

|

10.3.3.1.3 Starch Blends |

|

10.3.3.1.4 Polybutylene Succinate (PBS) |

|

10.3.3.1.5 Polycaprolactone (PCL) |

|

10.3.3.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

10.3.3.1.7 Others |

|

10.3.3.2 End-Use Industry |

|

10.3.3.2.1 Packaging |

|

10.3.3.2.2 Agriculture |

|

10.3.3.2.3 Consumer Goods |

|

10.3.3.2.4 Textiles |

|

10.3.3.2.5 Others |

|

11. Middle East & Africa Biodegradable Plastic Market Segmentation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

11.1 Type |

|

11.1.1 Polylactic Acid (PLA) |

|

11.1.2 Polyhydroxyalkanoates (PHA) |

|

11.1.3 Starch Blends |

|

11.1.4 Polybutylene Succinate (PBS) |

|

11.1.5 Polycaprolactone (PCL) |

|

11.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

11.1.7 Others |

|

11.2 End-Use Industry |

|

11.2.1 Packaging |

|

11.2.2 Agriculture |

|

11.2.3 Consumer Goods |

|

11.2.4 Textiles |

|

11.2.5 Others |

|

11.3 Country |

|

11.3.1United Arab Emirates |

|

11.3.1.1 Type |

|

11.3.1.1.1 Polylactic Acid (PLA) |

|

11.3.1.1.2 Polyhydroxyalkanoates (PHA) |

|

11.3.1.1.3 Starch Blends |

|

11.3.1.1.4 Polybutylene Succinate (PBS) |

|

11.3.1.1.5 Polycaprolactone (PCL) |

|

11.3.1.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

11.3.1.1.7 Others |

|

11.3.1.2 End-Use Industry |

|

11.3.1.2.1 Packaging |

|

11.3.1.2.2 Agriculture |

|

11.3.1.2.3 Consumer Goods |

|

11.3.1.2.4 Textiles |

|

11.3.1.2.5 Others |

|

11.3.2 South Africa |

|

11.3.2.1 Type |

|

11.3.2.1.1 Polylactic Acid (PLA) |

|

11.3.2.1.2 Polyhydroxyalkanoates (PHA) |

|

11.3.2.1.3 Starch Blends |

|

11.3.2.1.4 Polybutylene Succinate (PBS) |

|

11.3.2.1.5 Polycaprolactone (PCL) |

|

11.3.2.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

11.3.2.1.7 Others |

|

11.3.2.2 End-Use Industry |

|

11.3.2.2.1 Packaging |

|

11.3.2.2.2 Agriculture |

|

11.3.2.2.3 Consumer Goods |

|

11.3.2.2.4 Textiles |

|

11.3.2.2.5 Others |

|

11.3.3 Saudi Arabia |

|

11.3.3.1 Type |

|

11.3.3.1.1 Polylactic Acid (PLA) |

|

11.3.3.1.2 Polyhydroxyalkanoates (PHA) |

|

11.3.3.1.3 Starch Blends |

|

11.3.3.1.4 Polybutylene Succinate (PBS) |

|

11.3.3.1.5 Polycaprolactone (PCL) |

|

11.3.3.1.6 Polybutylene Adipate Terephthalate (PBAT) |

|

11.3.3.1.7 Others |

|

11.3.3.2 End-Use Industry |

|

11.3.3.2.1 Packaging |

|

11.3.3.2.2 Agriculture |

|

11.3.3.2.3 Consumer Goods |

|

11.3.3.2.4 Textiles |

|

11.3.3.2.5 Others |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.3 Product Benchmarking |

|

12.4 Company Profiles (Manufacturers of Biodegradable Plastic) |

|

12.4.1 BASF |

|

12.4.1.1 Company Synopsis |

|

12.4.1.2 Company Financials |

|

12.4.1.3 Product/ Service Portfolio |

|

12.4.1.4 Recent Developments |

|

12.4.2 Biome Technologies |

|

12.4.3 Cargill |

|

12.4.4 Danimer Scientific |

|

12.4.5 Eastman Chemical |

|

12.4.6 FKuR Kunststoff |

|

12.4.7 Futerro |

|

12.4.8 NatureWorks |

|

12.4.9 Novamont |

|

12.4.10 Plantic Technologies |

|

12.4.11 PTT MCC Biochem |

|

12.4.12 Synbra Technology |

|

12.5 Company Profiles (Demand Side) |

|

12.5.1Dell |

|

12.5.1.1 Company Synopsis |

|

12.5.1.2 Company Financials |

|

12.5.1.3 Product/ Service Portfolio |

|

12.5.1.4 Recent Developments |

|

12.5.2 Unilever |

|

12.5.3 L’Oréal |

|

12.5.4 Ford |

|

12.5.5 P&G |

|

13. Appendix |

Let us connect with you TOC

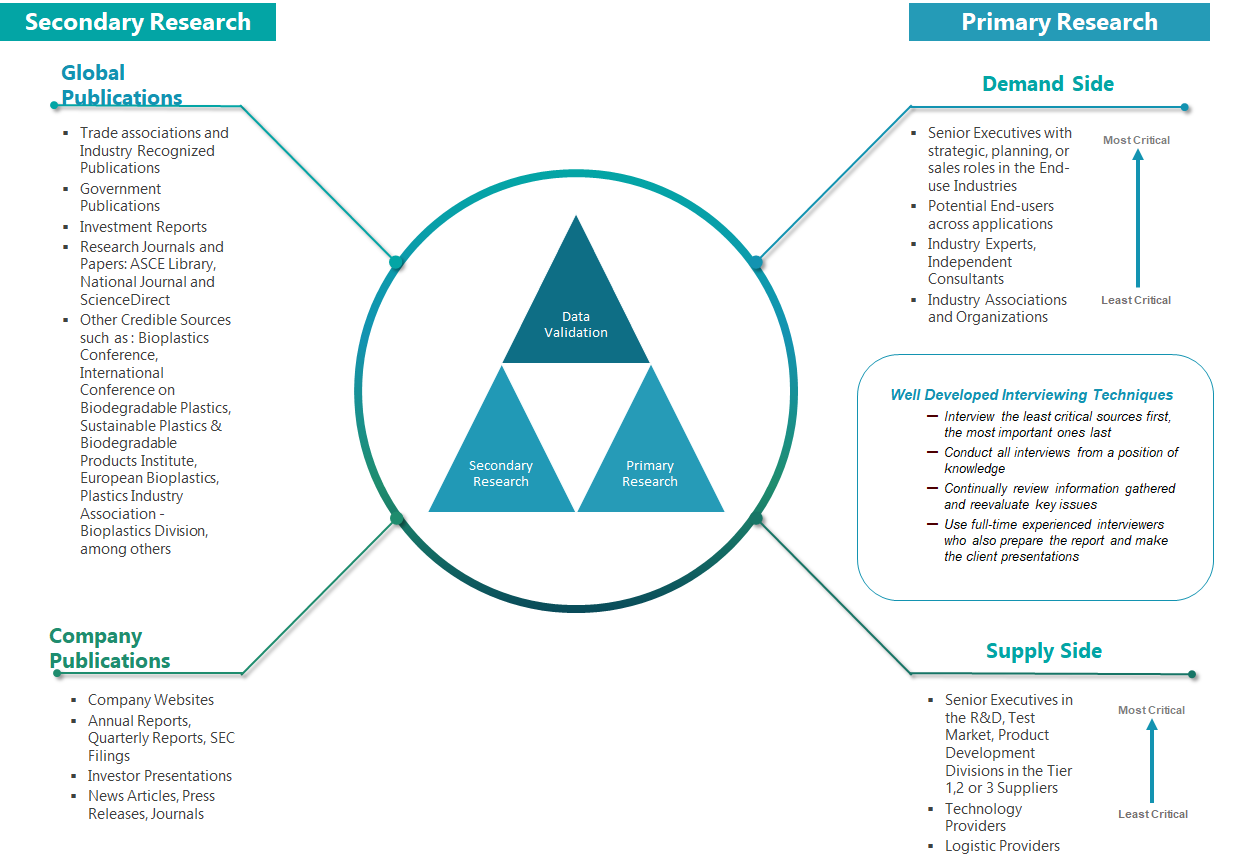

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats