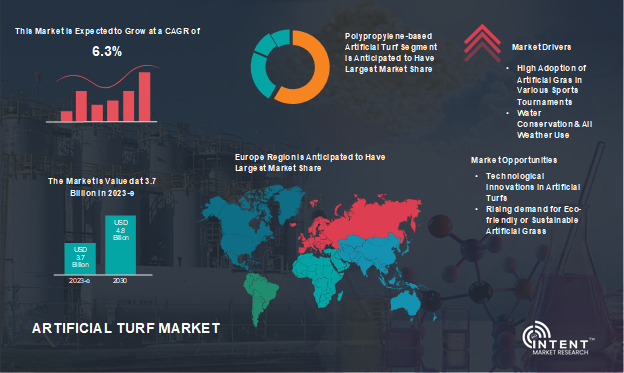

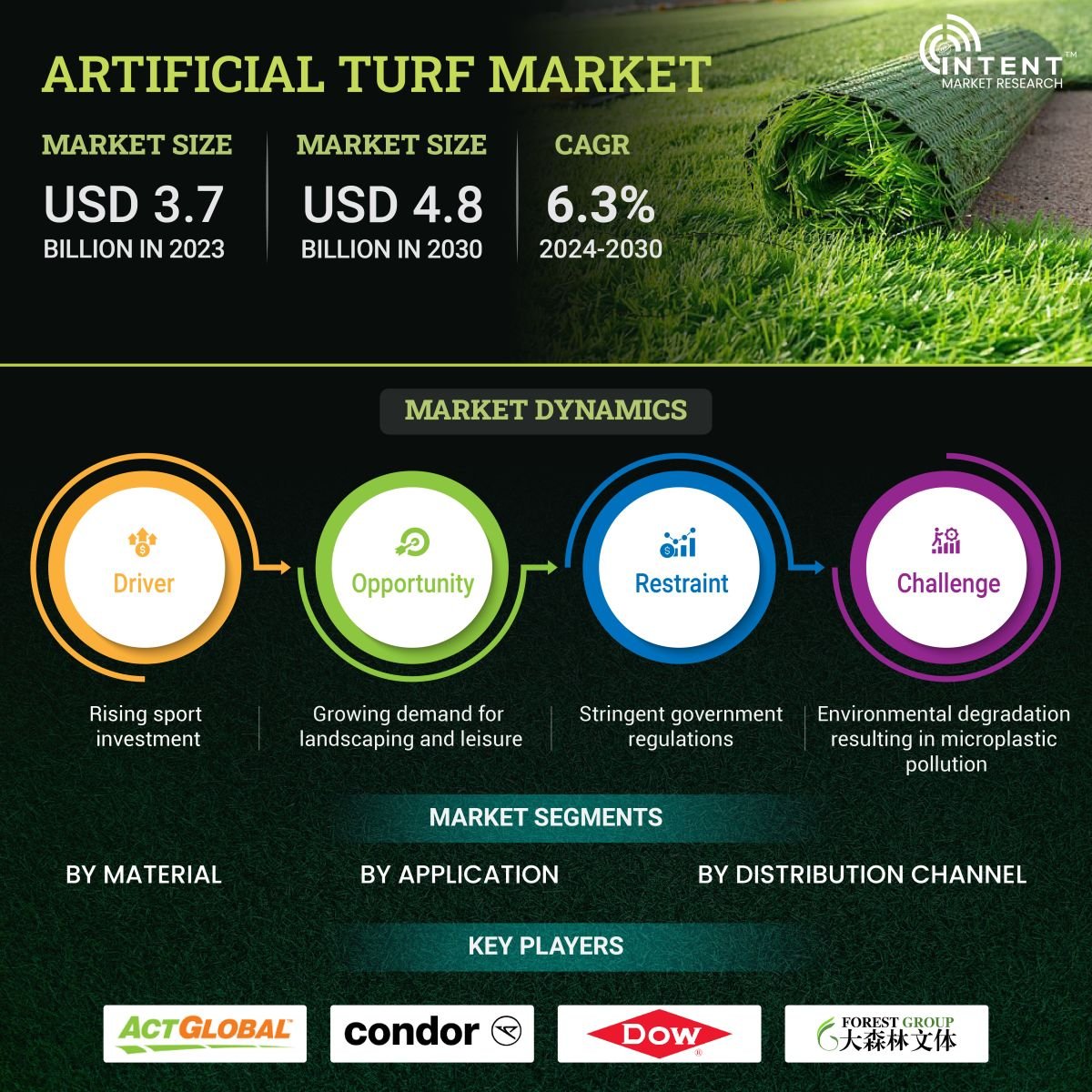

As per Intent Market Research, the global artificial turf market is projected to grow from USD 3.7 billion in 2023-e to USD 4.8 billion by 2030, at a CAGR of 6.3% during the forecast period. Some of the prominent players in the global artificial turf market are Act Global, Co-Creation Grass, Condor, Dow, ForestGrass, Global Syn-Turf, Polytan, Shaw Industries, SIS Group, SpectraTurf, Sports Group, Tarkett and TenCate.

As per Intent Market Research, the global artificial turf market is projected to grow from USD 3.7 billion in 2023-e to USD 4.8 billion by 2030, at a CAGR of 6.3% during the forecast period. (2024-2030). Increasing demand for easy to maintain, durable, and cost-effective flooring products for their use in outdoor applications are the major factors driving the demand for artificial turf.

Artificial turf, also known as synthetic turf or fake grass, is a surface made from synthetic fibers designed to resemble natural grass. It is commonly used in sports arenas for sports that were traditionally played on grass. The main idea behind artificial turf is to create a surface that requires minimal maintenance, doesn't need water, and can withstand heavy use. The advantages of artificial turf include reduced water usage, lower maintenance costs, and the ability to sustain heavy foot traffic without becoming muddy.

Artificial Turf Market Dynamics

Rising Demand for Eco-Friendly Turf is Driving the Growth of the Artificial Turf Market

The increasing environmental consciousness among population is resulting in a rising demand for eco-friendly, sustainable artificial turf. Moreover, the growing emission of greenhouse gases is a rising demand for plant-based artificial turf. Synlawn is one such global market player that uses sugarcane blades in making plant-based artificial turf. For instance, in June 2020, Synlawn artificial grass introduced a product line of the safest and uncontaminated turf to prevent infection from the grass to the user. Such product innovations and technological insights in artificial turf manufacturing are also significantly contributing to the market revenue growth.

Stringent Government Regulations & Environmental Degradation is Impeding the Artificial Turf Market

The European Commission has imposed stricter laws and regulations after eight compounds were identified in rubber pellets and ground cover used as infill in artificial sports fields and playgrounds. Over 145,000 tons of microplastics are used knowingly every year in the European Economic Area (EEA). One-third of these microplastics that have been purposefully added escape into the environment. The granular infill material used on artificial turf pitches, which emits up to 16,000 tons, is the main source.

It is estimated that every year in Europe, 176,000 tons of accidentally created microplastics are released into surface waters. To avoid or lessen environmental pollution, the European Chemicals Agency (ECHA) has proposed limiting the use of microplastics that are purposefully added to products such as artificial grass fields. The two solutions under consideration are to either keep infill inside a pitch's bounds, ensuring that the yearly emission of microplastics stays below 7g per pitch/per year, or outright forbid its use over a six-year transitional period.

Artificial Turf Market Segment Insights

Properties Such as Durability, Softness, and Resilience of Polyethylene are Boosting the Growth of the Artificial Turf Market

Factors such as the realistic-looking grass, with high water absorbent properties, a perfect combination of toughness and ductile strength, along with low maintenance cost are resulting in rising demand for polyethylene artificial turf, especially for commercial purposes. The new product line, which was created for companies around the country looking for solutions to heightened concerns about cleanliness and improved safety measures in fitness, sports, and athletic facilities, delivers the first athletic artificial turf product with built-in antimicrobial protection. A patented, high-performance polyethylene is used to create Smart Turf Athletic Turf, which delivers excellent resiliency while staying soft to the touch.

Source: Intent Market Research Analysis

Increasing Participation in Outdoor Sports by Youth Is Driving the Need for Artificial Turf

The main factors driving the growth of sports & leisure are improved performance, safety, weather resistance, and cost-effectiveness of artificial turf. Additionally, increasing awareness of the benefits of artificial turf is accelerating the product's adoption in sports fields, stadiums, and recreational areas around the world. Also, natural grass surfaces are difficult to withstand such heavy use, leading to rapid deterioration and requiring frequent maintenance.

Therefore, the increasing demand for artificial turf that provides a durable and long-lasting solution that withstands foot traffic and intense activity without compromising performance is also a key factor driving growth. Additionally, artificial turf offers consistent playing characteristics, ensuring consistent ball bounce and predictable stance for athletes across different sports, driving artificial turf market growth.

B2B Sales Helps in Large-Scale Projects Such as Sports Field Installations, Landscaping For Commercial Properties

B2B sales are common in the artificial turf industry, especially for large-scale projects such as sports field installations, landscaping for commercial properties, and recreational facilities. Sports facilities, stadiums, and arenas often source artificial turf through B2B transactions. These projects may involve B2B sales in the artificial turf industry to cater to the specific requirements of businesses and organizations involved in the planning, design, and implementation of outdoor projects. These transactions often involve a combination of product supply, project management, and installation services. collaborations between artificial turf manufacturers, suppliers, and construction companies.

Regional Insights

Rising Usage of Artificial Turfs in The Residential and Commercial Sectors is Driving the Artificial Turf Market Growth in The Region

Europe accounted for a major share of the market in 2023-e and is anticipated to grow at a significant rate over the forthcoming years. The presence of various sports fields, switching trends from natural grass to synthetic grass, and rising demand for outdoor sports are witnessed to upkeep the market growth for artificial turf in the region. Also, the increasing deployment of artificial turfs in residential and commercial constructions in the region is further anticipated to support the artificial turfs.

Competitive Landscape

The Players Are Engaged in Product Development and Strategic Alliances to Gain a Major Market Share

The global artificial turf market is moderately competitive owing to the presence of multinational manufacturers and a large number of domestic players supplying application-specific products. Marketing strategies adopted by industry players include the production of artificial turfs that have good quality and are approved by FIFA, FIH, ITF, etc. For instance, In June 2023, the MHC Weesp manufactured a unique, dry, and artificial turf surface. This club is the first to have a full-size hockey field located in TenCate's zero-water artificial turf technology.

Some prominent players in the global artificial turf market are Act Global, Co-Creation Grass, Condor, Dow, ForestGrass, Global Syn-Turf, Polytan, Shaw Industries, SIS Group., SpectraTurf, Sports Group, Tarkett and TenCate

Artificial Turf Market Coverage

The report provides key insights into the artificial turf market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The analysis focuses on market drivers, restraints, and opportunities, and examines key players and the competitive landscape within the artificial turf market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 3.7 billion |

|

Forecast Revenue (2030) |

USD 4.8 billion |

|

CAGR (2024-2030) |

6.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

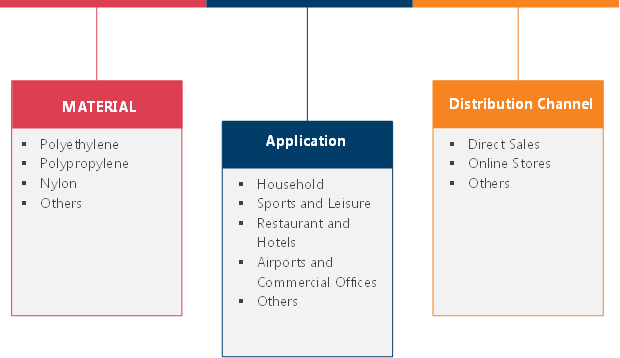

Segments Covered |

By Material (Polyethylene, Polypropylene Nylon & Others), By Application (Household, Sports and Leisure, Restaurant and Hotels, Airports and Commercial Offices & Others) By Distribution Channel (Direct Sales, Online Stores & Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

Act Global, Co-Creation Grass, Condor, Dow, ForestGrass, Global Syn-Turf, Polytan, Shaw Industries, SIS Group, SpectraTurf, Sports Group, Tarkett and TenCate |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Artificial Turf Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Artificial Turf Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. Artificial Turf Market Outlook |

|

5.1. Technological Advancements |

|

5.2 Regulatory Framework |

|

5.3. Pricing Analysis |

|

5.4. Customer Mapping |

|

5.5. COVID-19 Impact Analysis |

|

5.5. Industry Value Chain Analysis |

|

5.7. PESTEL Analysis |

|

5.8. Porters Five forces |

|

5.9. Case Study |

|

6. Global Artificial Turf Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.1 Material |

|

6.1.1 Polyethylene |

|

6.1.2 Polypropylene |

|

6.1.3 Nylon |

|

6.1.4 Others |

|

6.2 Application |

|

6.2.1 Household |

|

6.2.2 Sports and Leisure |

|

6.2.3 Restaurant and Hotels |

|

6.2.4 Airports and Commercial Offices |

|

6.2.5 Others |

|

6.3 Distribution Channel |

|

6.3.1 Direct Sales |

|

6.3.2 Online Stores |

|

6.3.3 Others |

|

6.4 Geography |

|

6.4.1 North America |

|

6.4.2 Europe |

|

6.4.3 Asia-Pacific |

|

6.4.4 Latin America |

|

6.4.5 Middle East and Africa |

|

7. North America Artificial Turf Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.1 Material |

|

7.1.1 Polyethylene |

|

7.1.2 Polypropylene |

|

7.1.3 Nylon |

|

7.1.4 Others |

|

7.2 Application |

|

7.2.1 Household |

|

7.2.2 Sports and Leisure |

|

7.2.3 Restaurant and Hotels |

|

7.2.4 Airports and Commercial Offices |

|

7.2.5 Others |

|

7.3 Distribution Channel |

|

7.3.1 Direct Sales |

|

7.3.2 Online Stores |

|

7.3.3 Others |

|

7.4 Country |

|

7.4.1 United States |

|

7.4.1.1 Material |

|

7.4.1.1.1 Polyethylene |

|

7.4.1.1.2 Polypropylene |

|

7.4.1.1.3 Nylon |

|

7.4.1.1.4 Others |

|

7.4.1.2 Application |

|

7.4.1.2.1 Medical |

|

7.4.1.2.2 Consumer Electronics |

|

7.4.1.2.3 Airports and Commercial Offices |

|

7.4.1.2.4 Sports and Leisure |

|

7.4.1.2.5 Others |

|

7.4.1.3 Distribution Channel |

|

7.4.1.3.1 Direct Sales |

|

7.4.1.3.2 Online Stores |

|

7.4.1.3.3 Others |

|

7.4.2 Canada |

|

7.4.2.1 Material |

|

7.4.2.1.1 Polyethylene |

|

7.4.2.1.2 Polypropylene |

|

7.4.2.1.3 Nylon |

|

7.4.2.1.4 Others |

|

7.4.2.2 Application |

|

7.4.2.2.1 Medical |

|

7.4.2.2.2 Consumer Electronics |

|

7.4.2.2.3 Airports and Commercial Offices |

|

7.4.2.2.4 Sports and Leisure |

|

7.4.2.2.5 Others |

|

7.4.2.3 Distribution Channel |

|

7.4.2.3.1 Direct Sales |

|

7.4.2.3.2 Online Stores |

|

7.4.2.3.3 Others |

|

8. Europe Market Artificial Turf Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.1 Material |

|

8.1.1 Polyethylene |

|

8.1.2 Polypropylene |

|

8.1.3 Nylon |

|

8.1.4 Others |

|

8.2 Application |

|

8.2.1 Household |

|

8.2.2 Sports and Leisure |

|

8.2.3 Restaurant and Hotels |

|

8.2.4 Airports and Commercial Offices |

|

8.2.5 Others |

|

8.3 Distribution Channel |

|

8.3.1 Direct Sales |

|

8.3.2 Online Stores |

|

8.3.3 Others |

|

8.4 Country |

|

8.4.1 United Kingdom |

|

8.4.1.1 Material |

|

8.4.1.1.1 Polyethylene |

|

8.4.1.1.2 Polypropylene |

|

8.4.1.1.3 Nylon |

|

8.4.1.1.4 Others |

|

8.4.1.2 Application |

|

8.4.1.2.1 Medical |

|

8.4.1.2.2 Consumer Electronics |

|

8.4.1.2.3 Airports and Commercial Offices |

|

8.4.1.2.4 Sports and Leisure |

|

8.4.1.2.5 Others |

|

8.4.1.3 Distribution Channel |

|

8.4.1.3.1 Direct Sales |

|

8.4.1.3.2 Online Stores |

|

8.4.1.3.3 Others |

|

8.4.2 France |

|

8.4.2.1 Material |

|

8.4.2.1.1 Polyethylene |

|

8.4.2.1.2 Polypropylene |

|

8.4.2.1.3 Nylon |

|

8.4.2.1.4 Others |

|

8.4.2.2 Application |

|

8.4.2.2.1 Medical |

|

8.4.2.2.2 Consumer Electronics |

|

8.4.2.2.3 Airports and Commercial Offices |

|

8.4.2.2.4 Sports and Leisure |

|

8.4.2.2.5 Others |

|

8.4.2.3 Distribution Channel |

|

8.4.2.3.1 Direct Sales |

|

8.4.2.3.2 Online Stores |

|

8.4.2.3.3 Others |

|

8.4.3 Germany |

|

8.4.3.1 Material |

|

8.4.3.1.1 Polyethylene |

|

8.4.3.1.2 Polypropylene |

|

8.4.3.1.3 Nylon |

|

8.4.3.1.4 Others |

|

8.4.3.2 Application |

|

8.4.3.2.1 Medical |

|

8.4.3.2.2 Consumer Electronics |

|

8.4.3.2.3 Airports and Commercial Offices |

|

8.4.3.2.4 Sports and Leisure |

|

8.4.3.2.5 Others |

|

8.4.3.3 Distribution Channel |

|

8.4.3.3.1 Direct Sales |

|

8.4.3.3.2 Online Stores |

|

8.4.3.3.3 Others |

|

8.4.4 Italy |

|

8.4.4.1 Material |

|

8.4.4.1.1 Polyethylene |

|

8.4.4.1.2 Polypropylene |

|

8.4.4.1.3 Nylon |

|

8.4.4.1.4 Others |

|

8.4.4.2 Application |

|

8.4.4.2.1 Medical |

|

8.4.4.2.2 Consumer Electronics |

|

8.4.4.2.3 Airports and Commercial Offices |

|

8.4.4.2.4 Sports and Leisure |

|

8.4.4.2.5 Others |

|

8.4.4.3 Distribution Channel |

|

8.4.4.3.1 Direct Sales |

|

8.4.4.3.2 Online Stores |

|

8.4.4.3.3 Others |

|

9. Asia Pacific Artificial Turf Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.1 Material |

|

9.1.1 Polyethylene |

|

9.1.2 Polypropylene |

|

9.1.3 Nylon |

|

9.1.4 Others |

|

9.2 Application |

|

9.2.1 Household |

|

9.2.2 Sports and Leisure |

|

9.2.3 Restaurant and Hotels |

|

9.2.4 Airports and Commercial Offices |

|

9.2.5 Others |

|

9.3 Distribution Channel |

|

9.3.1 Direct Sales |

|

9.3.2 Online Stores |

|

9.3.3 Others |

|

9.4 Country |

|

9.4.1 China |

|

9.4.1.1 Material |

|

9.4.1.1.1 Polyethylene |

|

9.4.1.1.2 Polypropylene |

|

9.4.1.1.3 Nylon |

|

9.4.1.1.4 Others |

|

9.4.1.2 Application |

|

9.4.1.2.1 Medical |

|

9.4.1.2.2 Consumer Electronics |

|

9.4.1.2.3 Airports and Commercial Offices |

|

9.4.1.2.4 Sports and Leisure |

|

9.4.1.2.5 Others |

|

9.4.1.3 Distribution Channel |

|

9.4.1.3.1 Direct Sales |

|

9.4.1.3.2 Online Stores |

|

9.4.1.3.3 Others |

|

9.4.2 Japan |

|

9.4.2.1 Material |

|

9.4.2.1.1 Polyethylene |

|

9.4.2.1.2 Polypropylene |

|

9.4.2.1.3 Nylon |

|

9.4.2.1.4 Others |

|

9.4.2.2 Application |

|

9.4.2.2.1 Medical |

|

9.4.2.2.2 Consumer Electronics |

|

9.4.2.2.3 Airports and Commercial Offices |

|

9.4.2.2.4 Sports and Leisure |

|

9.4.2.2.5 Others |

|

9.4.2.3 Distribution Channel |

|

9.4.2.3.1 Direct Sales |

|

9.4.2.3.2 Online Stores |

|

9.4.2.3.3 Others |

|

9.4.3 India |

|

9.4.3.1 Material |

|

9.4.3.1.1 Polyethylene |

|

9.4.3.1.2 Polypropylene |

|

9.4.3.1.3 Nylon |

|

9.4.3.1.4 Others |

|

9.4.3.2 Application |

|

9.4.3.2.1 Medical |

|

9.4.3.2.2 Consumer Electronics |

|

9.4.3.2.3 Airports and Commercial Offices |

|

9.4.3.2.4 Sports and Leisure |

|

9.4.3.2.5 Others |

|

9.4.3.3 Distribution Channel |

|

9.4.3.3.1 Direct Sales |

|

9.4.3.3.2 Online Stores |

|

9.4.3.3.3 Others |

|

9.4.4 South Korea |

|

9.4.4.1 Material |

|

9.4.4.1.1 Polyethylene |

|

9.4.4.1.2 Polypropylene |

|

9.4.4.1.3 Nylon |

|

9.4.4.1.4 Others |

|

9.4.4.2 Application |

|

9.4.4.2.1 Medical |

|

9.4.4.2.2 Consumer Electronics |

|

9.4.4.2.3 Airports and Commercial Offices |

|

9.4.4.2.4 Sports and Leisure |

|

9.4.4.2.5 Others |

|

9.4.4.3 Distribution Channel |

|

9.4.4.3.1 Direct Sales |

|

9.4.4.3.2 Online Stores |

|

9.4.4.3.3 Others |

|

10. Latin America Artificial Turf Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

10.1 Material |

|

10.1.1 Polyethylene |

|

10.1.2 Polypropylene |

|

10.1.3 Nylon |

|

10.1.4 Others |

|

10.2 Application |

|

10.2.1 Household |

|

10.2.2 Sports and Leisure |

|

10.2.3 Restaurant and Hotels |

|

10.2.4 Airports and Commercial Offices |

|

10.2.5 Others |

|

10.3 Distribution Channel |

|

10.3.1 Direct Sales |

|

10.3.2 Online Stores |

|

10.3.3 Others |

|

10.4 Country |

|

10.4.1 Brazil |

|

10.4.1.1 Material |

|

10.4.1.1.1 Polyethylene |

|

10.4.1.1.2 Polypropylene |

|

10.4.1.1.3 Nylon |

|

10.4.1.1.4 Others |

|

10.4.1.2 Application |

|

10.4.1.2.1 Medical |

|

10.4.1.2.2 Consumer Electronics |

|

10.4.1.2.3 Airports and Commercial Offices |

|

10.4.1.2.4 Sports and Leisure |

|

10.4.1.2.5 Others |

|

10.4.1.3 Distribution Channel |

|

10.4.1.3.1 Direct Sales |

|

10.4.1.3.2 Online Stores |

|

10.4.1.3.3 Others |

|

10.4.2 Mexico |

|

10.4.2.1 Material |

|

10.4.2.1.1 Polyethylene |

|

10.4.2.1.2 Polypropylene |

|

10.4.2.1.3 Nylon |

|

10.4.2.1.4 Others |

|

10.4.2.2 Application |

|

10.4.2.2.1 Medical |

|

10.4.2.2.2 Consumer Electronics |

|

10.4.2.2.3 Airports and Commercial Offices |

|

10.4.2.2.4 Sports and Leisure |

|

10.4.2.2.5 Others |

|

10.4.2.3 Distribution Channel |

|

10.4.2.3.1 Direct Sales |

|

10.4.2.3.2 Online Stores |

|

10.4.2.3.3 Others |

|

10.4.3 Argentina |

|

10.4.3.1 Material |

|

10.4.3.1.1 Polyethylene |

|

10.4.3.1.2 Polypropylene |

|

10.4.3.1.3 Nylon |

|

10.4.3.1.4 Others |

|

10.4.3.2 Application |

|

10.4.3.2.1 Medical |

|

10.4.3.2.2 Consumer Electronics |

|

10.4.3.2.3 Airports and Commercial Offices |

|

10.4.3.2.4 Sports and Leisure |

|

10.4.3.2.5 Others |

|

10.4.3.3 Distribution Channel |

|

10.4.3.3.1 Direct Sales |

|

10.4.3.3.2 Online Stores |

|

10.4.3.3.3 Others |

|

11. Middle East & Africa Artificial Turf Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

11.1 Material |

|

11.1.1 Polyethylene |

|

11.1.2 Polypropylene |

|

11.1.3 Nylon |

|

11.1.4 Others |

|

11.2 Application |

|

11.2.1 Household |

|

11.2.2 Sports and Leisure |

|

11.2.3 Restaurant and Hotels |

|

11.2.4 Airports and Commercial Offices |

|

11.2.5 Others |

|

11.3 Distribution Channel |

|

11.3.1 Direct Sales |

|

11.3.2 Online Stores |

|

11.3.3 Others |

|

11.4 Country |

|

11.4.1 Saudi Arabia |

|

11.4.1.1 Material |

|

11.4.1.1.1 Polyethylene |

|

11.4.1.1.2 Polypropylene |

|

11.4.1.1.3 Nylon |

|

11.4.1.1.4 Others |

|

11.4.1.2 Application |

|

11.4.1.2.1 Medical |

|

11.4.1.2.2 Consumer Electronics |

|

11.4.1.2.3 Airports and Commercial Offices |

|

11.4.1.2.4 Sports and Leisure |

|

11.4.1.2.5 Others |

|

11.4.1.3 Distribution Channel |

|

11.4.1.3.1 Direct Sales |

|

11.4.1.3.2 Online Stores |

|

11.4.1.3.3 Others |

|

11.4.2 South Africa |

|

11.4.2.1 Material |

|

11.4.2.1.1 Polyethylene |

|

11.4.2.1.2 Polypropylene |

|

11.4.2.1.3 Nylon |

|

11.4.2.1.4 Others |

|

11.4.2.2 Application |

|

11.4.2.2.1 Medical |

|

11.4.2.2.2 Consumer Electronics |

|

11.4.2.2.3 Airports and Commercial Offices |

|

11.4.2.2.4 Sports and Leisure |

|

11.4.2.2.5 Others |

|

11.4.2.3 Distribution Channel |

|

11.4.2.3.1 Direct Sales |

|

11.4.2.3.2 Online Stores |

|

11.4.2.3.3 Others |

|

11.4.3 United Arab Emirates |

|

11.4.3.1 Material |

|

11.4.3.1.1 Polyethylene |

|

11.4.3.1.2 Polypropylene |

|

11.4.3.1.3 Nylon |

|

11.4.3.1.4 Others |

|

11.4.3.2 Application |

|

11.4.3.2.1 Medical |

|

11.4.3.2.2 Consumer Electronics |

|

11.4.3.2.3 Airports and Commercial Offices |

|

11.4.3.2.4 Sports and Leisure |

|

11.4.3.2.5 Others |

|

11.4.3.3 Distribution Channel |

|

11.4.3.3.1 Direct Sales |

|

11.4.3.3.2 Online Stores |

|

11.4.3.3.3 Others |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.3 Emerging Players Operating in the Market |

|

12.4 Product Benchmarking |

|

13. Company Profiles |

|

13.1 Act Global |

|

13.1.1 Company Synopsis |

|

13.1.2 Company Financials |

|

13.1.3 Product/ Service Portfolio |

|

13.1.4 Recent Developments |

|

13.2 Co-Creation Grass |

|

13.3 Condor Group |

|

13.4 Dow |

|

13.5 ForestGrass |

|

13.6 Global Syn-Turf |

|

13.7 Polytan |

|

13.8 Shaw Industries Group (Berkshire Hathaway Company) |

|

13.9 SIS Group |

|

13.10 SpectraTurf (Ecore International Inc.) |

|

13.11 Sport Group |

|

13.12 Tarkett |

|

13.13 Koninklijke TenCate |

|

14. Appendix |

Let us connect with you TOC

Artificial Turfs Methodology

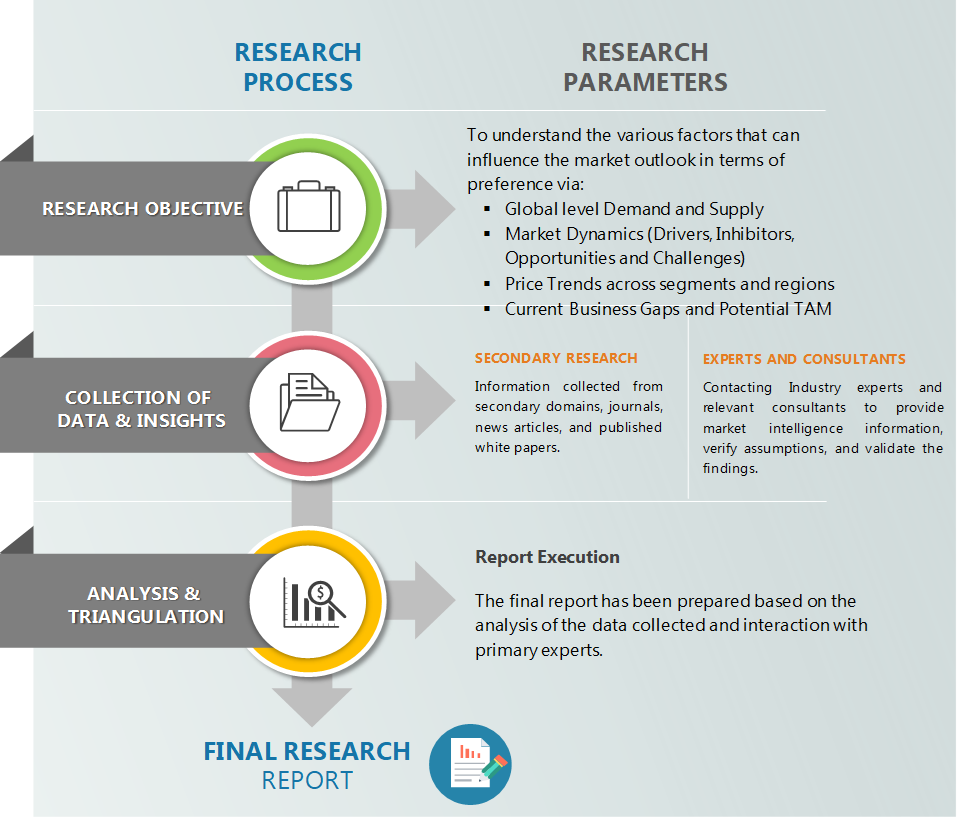

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats