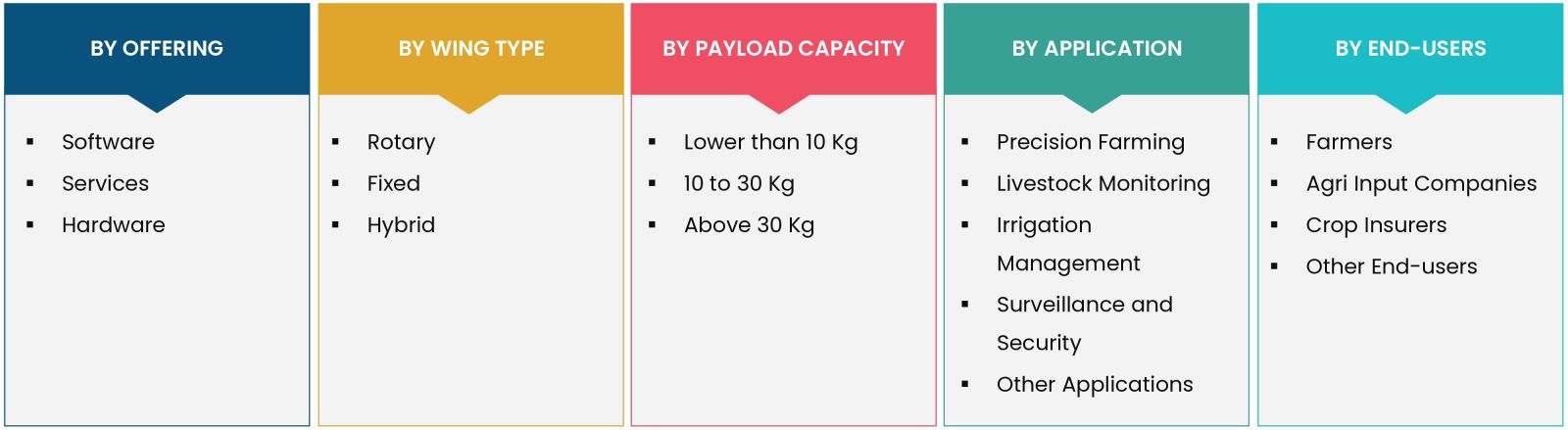

Agriculture Drones Market By Offering (Hardware, Software, Services), By Wing Type (Rotary, Fixed, Hybrid), By Payload Capacity (Lower than 10 Kg, 10 to 30 Kg, Above 30 Kg), By Application (Precision Farming, Livestock Monitoring, Irrigation Management, Surveillance and Security), By End-users (Farmers, Agri Input Companies, Crop Insurers), and By Region; Global Insights & Forecast (2024 – 2030)

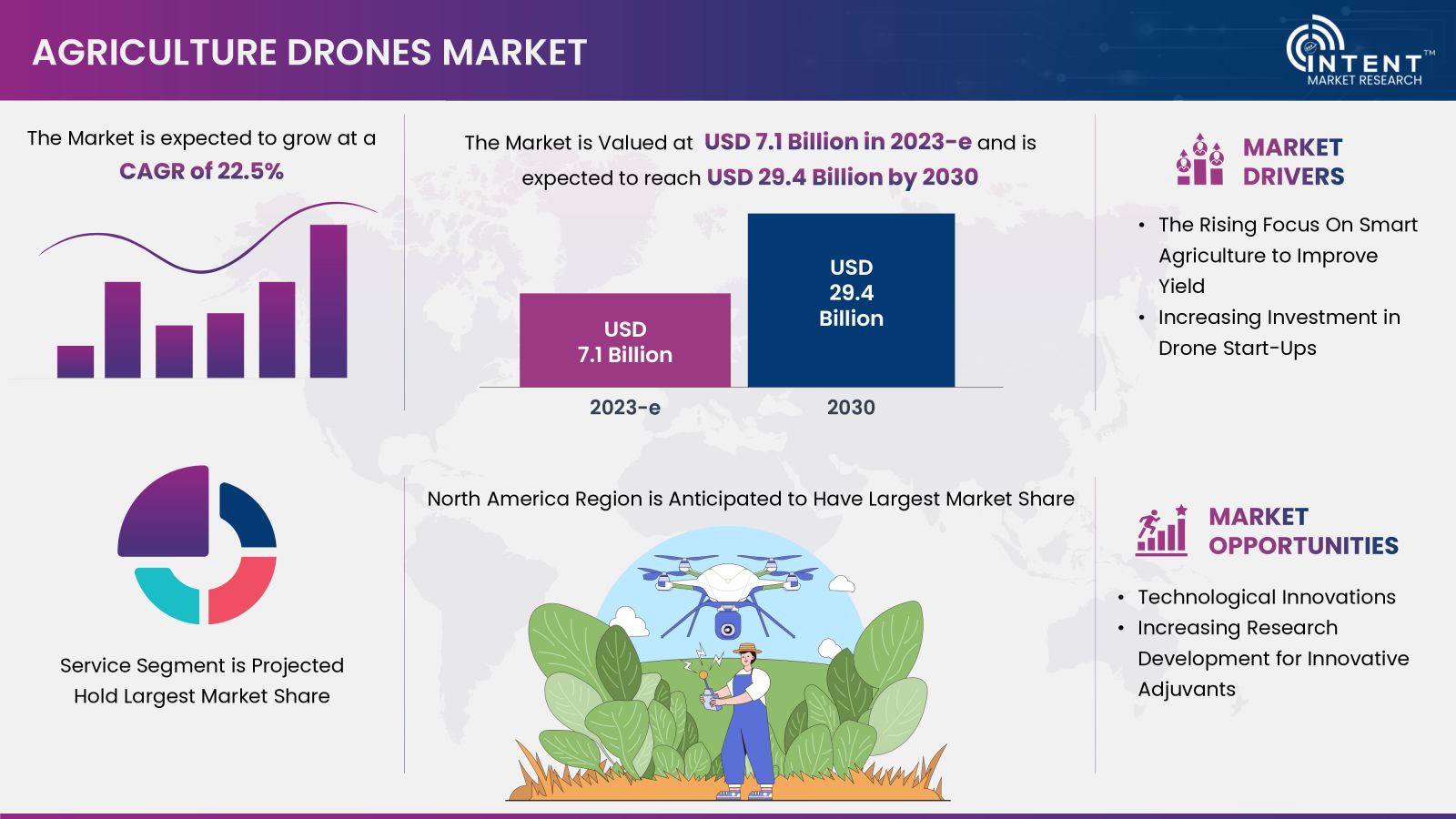

According to Intent Market Research, the Agriculture Drones Market is expected to grow from USD 7.1 billion in 2023-e at a CAGR of 22.5% to touch USD 29.4 billion by 2030. The agriculture drones market is dominated by key players such as AeroVironment, AgEagle, DJI, Draganfly, Elbit Systems, Parrot Drone, PrecisionHawk, XAG, among others. The rising focus on smart agriculture to improve yield is expected to propel the market growth

Click here to: Get FREE Sample Pages of this Report

The agriculture drone market is anticipated to grow significantly due to its utilization in a range of agricultural tasks, including precision farming, livestock monitoring, smart greenhouse management, precision fish farming, horticulture, and forestry. These drones are affordable, straightforward aerial camera platforms, equipped with autopilot technology using GPS and sensors to gather essential data. The integration of advanced technologies such as AI, autonomous drones, drone swarms, cloud computing, and drone data analytics is shaping the global market landscape.

The increasing demand for agriculture drones is driven by the recognition among farmers of precision agriculture's potential to enhance crop yield. This trend is fueling continuous research and innovation in the industry.

Agriculture Drones Market Dynamics

Growing Demand for Drones from APAC is Expected to Propel the Market Growth

The use of drones in agriculture has significantly increased in Asian countries specially in India and China. The increased demand is attributed to factors such as improved cost efficiency and yield revenues through the use of drones.

Drones present an opportunity for farm operators to enhance operational efficiency by reducing expenditures on labor, herbicides, pesticides, and fertilizers which are critical components of overall overhead costs. Drones are mainly used for spraying agrochemicals to reduce time and increase efficiency.

For instance, in June 2023, according to research published in Precision Agriculture, a Germany-based research journal, in 2021, China utilized 70,344 unmanned aerial vehicles (UAVs) for crop protection, effectively treating 14.48 million hectares of farmland. UAVs, primarily employed for pesticide application, have become a prevalent and valuable technology in Chinese agriculture.

Increasing Government Investment in Start-Ups Involved in Drone Manufacturing is Driving the Market Growth

The increased incorporation of drones in agriculture is primarily due to strong governmental backing. This underscores a favorable outlook, highlighting efforts to improve agricultural quality and reduce the cost of drone services for farmers.

By employing a combination of incentives and strategic policies, the government proactively encourages farmers to integrate drones into their practices for tasks such as crop monitoring, pesticide management, and even pollination. This initiative aims to boost agricultural productivity significantly. In September 2022, according to India Briefing, an India-based business news journal, the government anticipates that the industry focused on manufacturing drones and their components will draw investments exceeding USD 600 million (INR 50 billion) within the upcoming three years.

Farmer’s Resistance to Change May Hinder the Agriculture Drones Market Growth

The current scenario surrounding farmers' resistance to adopting drones is multifaceted. Traditional farming practices deeply rooted in daily routines contribute to some farmers' reluctance to embrace change. For instance, in July 2023, according to a research article published in The Pharma Innovation Journal, an India-based international peer reviewed open source journal, mentioned that; according to the research findings, 70.83% of farmers have knowledge about agricultural drones, with 22.5% actively adopting the technology. The primary barriers to adoption include a lack of technical expertise, limited access to drones, and challenges related to unsynchronized farming practices.

Agriculture Drones Market Segment Insights

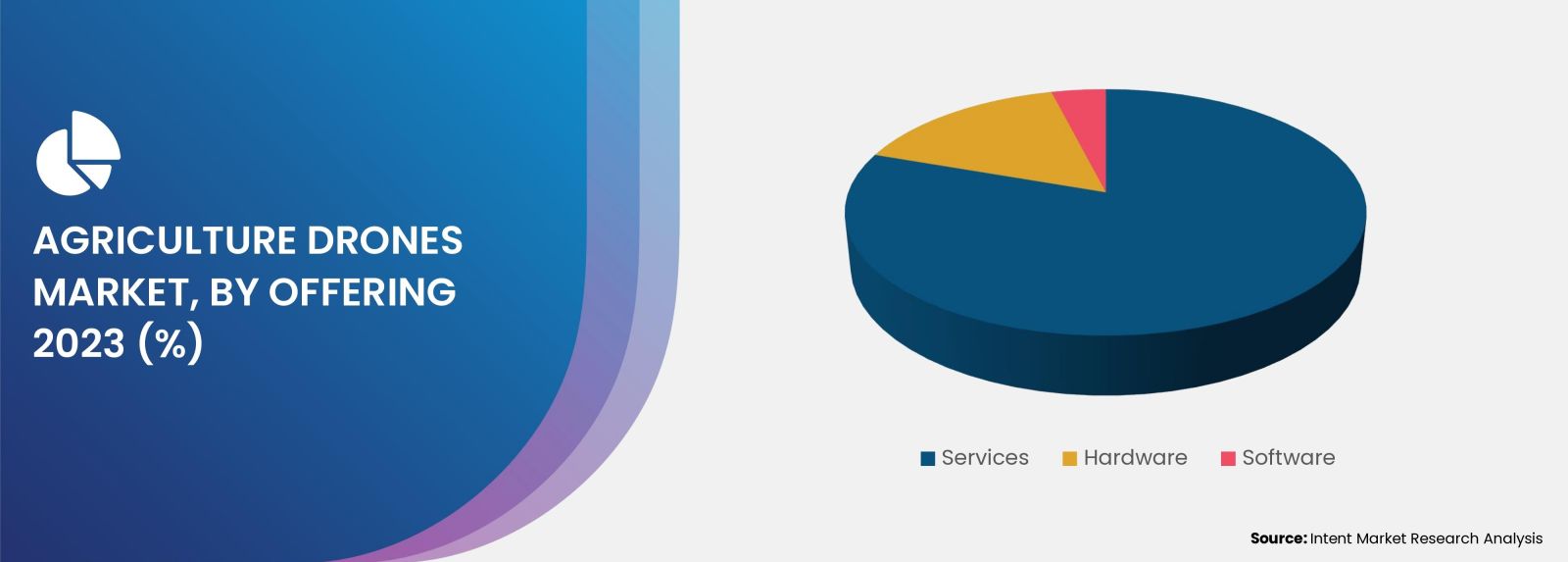

The Services Segment Held the Largest Market Share

Agriculture drones offer a wide range of services aimed at enhancing farm management and improving crop yields. Equipped with advanced cameras, these drones capture high-resolution aerial images for detailed crop monitoring and analysis.

Key players in this market are leveraging drone technology to provide innovative spraying solutions for farmers. These solutions help in maintaining optimal soil moisture levels and crop distribution, thereby aiding in irrigation planning and soil management. Additionally, drones are used to survey large agricultural areas, providing detailed maps and 3D models for crop inventory and yield prediction.

In February 2022, FMC Corporation, a leading US-based chemical manufacturing company, launched drone spray services for farmers in India. This spraying service is designed to offer farmers access to innovative solutions for sustainable yield growth. It includes provisions for drone technology access, training programs, and financing options, aimed at fostering rural entrepreneurship and advancing agricultural practices.

Rotary Wing Drone Segment Is Anticipated to be the Fastest Growing Market Share

Rotary wing drones are popular in agriculture for their agility in tasks like crop monitoring. Equipped with sensors, they offer detailed imagery for assessing crop health and irrigation. However, their shorter flight times and limited range can be limiting. Leading companies are developing drones tailored for agriculture, with features like automatic flight and advanced information security.

In October 2022, Yamaha Motor Co., a Japan-based industrial machinery and automotive manufacturing company, announced the launch of YMR-II equipped with an automatic flight function. This drone is designed to advanced information security functions to safeguard agricultural know-how and prevent unauthorized access. Additionally, it boasts user-friendly automatic navigation, takeoff, and landing through the agFMS-IIm application, catering even to beginners, while ensuring enhanced flight stability with its 6-rotor layout and box frame structure.

Lower than 10 kg Segment Held the Largest Share in Agriculture Drones Market

These drones, also known as, lightweight drones are effective for aerial imaging, providing visual insights into field conditions and crop distribution. They help farmers make informed decisions about irrigation, nutrient management, and farm strategies, improving productivity and yields. These drones offer a cost-effective solution for gathering aerial data, monitoring crops, and implementing precision agriculture.

Key companies are developing lightweight drones with advanced imaging and spraying capabilities, making them valuable tools for optimizing farm management and enhancing productivity. For instance, Multiplex Drone has developed the MD-5Q agriculture drone, featuring a 5 kg payload capacity. Tailor-made for precision spraying in smaller plots, it prioritizes safety with terrain and obstacle RADAR systems, adapting seamlessly to varied landscapes and navigating enclosed areas with obstacles. Crafted with aerospace-grade materials like carbon fiber and aluminum, the MD-5Q series ensures durability and efficiency in agricultural operations.

Precision Farming Segment to Drive the Agriculture Drones Market

Drones are revolutionizing precision farming by providing detailed aerial data to optimize agricultural practices. High-resolution imagery enables precise monitoring of crop health, aiding decisions on irrigation, fertilization, and pest control. Targeted interventions based on real-time data help minimize resource usage and maximize yields, enhancing productivity and sustainability.

Leading companies are collaborating to advance precision agriculture solutions. They are enhancing their capability to capture RGB and multispectral data simultaneously, offering comprehensive crop health assessments. For example, in August 2023, Advexure partnered with Aerobotics to introduce the DJI Mavic 3 Multispectral & Aerobotics Aeroview Package. This product offers an affordable precision agriculture solution, empowering producers to monitor each tree on their farms and utilize field data effectively.

North America Held the Largest Market Share Owing to Availability of Advanced Technologies

North America held the largest market share due to advanced drone technologies, supportive government regulations, and rising adoption of precision agriculture solutions. Farmers are increasingly integrating drones into their agricultural practices for tasks such as crop monitoring, field mapping, irrigation management, and pest detection. This trend is fueled by various factors such as the availability of advanced drone technologies and supportive government regulations.

Major Industry Players Are Enhancing Their Positions by Focusing On Technological Innovation

The market is characterized by intense competition due to the presence of numerous international and domestic players. The agriculture drones market is dominated by key players such as AeroVironment, AgEagle, DJI, Draganfly, Elbit Systems, Parrot Drone, PrecisionHawk, and XAG, among others. These industry leaders are extensively investing in R&D to offer advanced drone solutions.

- In September 2023, Trimble, a US-based software, hardware, and services technology company announced their partnership with AGCO, a US-based agricultural machinery manufacturing company. This partnership establishes a globally leading mixed-fleet precision agriculture platform, positioned as the exclusive provider of Trimble Ag's extensive technology offerings. This platform supports the ongoing advancement and distribution of next-generation agricultural technologies.

- In November 2022, DJI, a China-based camera and drone technology company launched Mavic 3 Multispectral. This drone features an advanced multispectral imaging system, enabling swift acquisition of crop growth data for enhanced agricultural productivity. Positioned as an indispensable solution, the Mavic 3 Multispectral proves valuable across various applications in precision agriculture and environmental monitoring.

Note: *Exchange rate (2023) USD 1.0 = INR 82.8

Get your custom research report today

Agriculture Drones Market Coverage

The report provides key insights into the agriculture drone market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market. The report offers the market size and forecasts for the agriculture drones market in value (USD million) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 7.1 billion |

|

Forecast Revenue (2030) |

USD 29.4 billion |

|

CAGR (2024-2030) |

22.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Offering (Software {Data Analytics, Imaging Software, Mapping Software, and Others}, Services {Data Analytics Service, Mapping & Imaging Services, and Training & Support}, Hardware {Cameras, Batteries, Navigation System and Others}), By Wing Type (Rotary, Fixed, and Hybrid), By Payload Capacity (Lower than 10 Kg, 10 to 30 Kg, and Above 30 Kg), By Applications (Precision Farming {Field Mapping & Monitoring, Crop Spraying, Seed Planting}, Livestock Monitoring, Irrigation Management, Surveillance and Security, Other Applications), By End-users (Farmers, Agri Input Companies, Crop Insurers, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

AeroVironment, AgEagle, DJI, Draganfly, Elbit Systems, JOUAV, Parrot, PrecisionHawk, Topcon, Trimble, XAG, Yamaha Motor, and Yuneec |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Key Research Objectives |

|

1.2.Market Definition |

|

1.3.Report Scope |

|

1.4.Currency & Conversion |

|

2.Research Methodology |

|

2.1.Research Design |

|

2.2.Market Size Estimation & Data Triangulation |

|

2.3.Key Sources |

|

2.4.Research Assumptions & Limitations |

|

3.Executive Summary |

|

4.Agriculture Drones Market Insights |

|

4.1.Market Growth Drivers |

|

4.1.1.Growing Demand for Drones from APAC |

|

4.1.2.Increasing Investment In Start-Ups |

|

4.1.3.The Rising Focus On Smart Agriculture to Improve Yield |

|

4.2.Market Growth Restraints |

|

4.2.1.Resistance to Change of Farmers and Lack of Need and Capital |

|

4.2.2.Small Farm Size in Many Parts of the World |

|

4.2.3.Regulations & Policy and Impact of Geopolitics |

|

4.3.Market Growth Opportunities |

|

4.3.1.Lower Operational Cost and Farm Waste |

|

4.3.2.Better Water Management Using Drones |

|

4.4.Market Growth Challenges |

|

4.4.1.High Initial Cost of Drones |

|

4.4.2.Lack of Financial Capacity & Technical Know-How |

|

4.5.Market Growth Trends |

|

4.5.1.Emergence of Autonomous Drones |

|

4.5.2.Integration of Edge Computing with Drones |

|

4.5.3.Emergence of Drone Swarm |

|

4.5.4.Synergizing Cloud Computing and Data Analytics with Drones |

|

5.Agriculture Drones Market Outlook |

|

5.1.Technology Roadmap |

|

5.2.Regulatory Analysis |

|

5.3.Use Case Analysis |

|

5.4.Emerging Trends |

|

6.Agriculture Drones Market, By Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Hardware |

|

6.1.1.Motor |

|

6.1.2.Cameras |

|

6.1.3.Batteries |

|

6.1.4.Navigation System |

|

6.1.5.Others |

|

6.2.Software |

|

6.2.1.Data Analytics |

|

6.2.2.Imaging Software |

|

6.2.3.Mapping Software |

|

6.2.4.Others |

|

6.3.Services |

|

6.3.1.Data Analytics Service |

|

6.3.2.Mapping & Imaging Services |

|

6.3.3.Training & Support |

|

7.Agriculture Drones Market, By Wing Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Multi-rotor |

|

7.2.Fixed |

|

8.Agriculture Drones Market, By Payload Capacity (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Lower than 10 kg |

|

8.2.10 to 30 kg |

|

8.3.Above 30 kg |

|

9.Agriculture Drones Market, By Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.Precision Farming |

|

9.1.1.Field Mapping & Monitoring |

|

9.1.2.Crop Spraying |

|

9.1.3.Seed Planting |

|

9.1.4.Others |

|

9.2.Livestock Monitoring |

|

9.3.Irrigation Management |

|

9.4.Surveillance and Security |

|

9.5.Others |

|

10.Agriculture Drones Market By End-users (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1.Farmers |

|

10.2.Agri Input Companies |

|

10.3.Crop Insurers |

|

10.4.Other End-users |

|

11.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

11.1.Global Market Synopsis |

|

11.2.North America |

|

11.2.1.North America Agriculture Drones Market Outlook |

|

11.2.1.1.North America Agriculture Drones Market, By Offering |

|

11.2.1.2.North America Agriculture Drones Market, By Wing Type |

|

11.2.1.3.North America Agriculture Drones Market, By Payload Capacity |

|

11.2.1.4.North America Agriculture Drones Market, By Application |

|

11.2.1.5.North America Agriculture Drones Market, By End-users |

|

*Note: Cross-segmentation by segments for each region will be covered as shown above. |

|

11.2.2.US |

|

11.2.2.1.US Agriculture Drones Market, By Offering |

|

11.2.2.2.US Agriculture Drones Market, By Wing Type |

|

11.2.2.3.US Agriculture Drones Market, By Payload Capacity |

|

11.2.2.4.US Agriculture Drones Market, By Application |

|

11.2.2.5.US Agriculture Drones Market, By End-users |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

11.2.3.Canada |

|

11.3.Europe |

|

11.3.1.Europe Agriculture Drones Market Outlook |

|

11.3.2.UK |

|

11.3.3.Germany |

|

11.3.4.France |

|

11.3.5.Italy |

|

11.3.6.Rest of Europe |

|

11.4.Asia-Pacific |

|

11.4.1.Asia-Pacific Agriculture Drones Market Outlook |

|

11.4.2.China |

|

11.4.3.India |

|

11.4.4.Japan |

|

11.4.5.South Korea |

|

11.4.6.Rest of APAC |

|

11.5.Latin America |

|

11.5.1.Latin America Agriculture Drones Market Outlook |

|

11.6.Middle East & Africa |

|

11.6.1.Middle East & Africa Agriculture Drones Market Outlook |

|

12.Competitive Landscape |

|

12.1.Market Share Analysis |

|

12.2.Company Strategy Analysis |

|

12.3.Competitive Matrix |

|

13.Company Profiles |

|

13.1.Agriculture Drones Leading Companies |

|

13.1.1.AeroVironment |

|

13.1.1.1. Company Synopsis |

|

13.1.1.2. Company Financials |

|

13.1.1.3. Product/Service Portfolio |

|

13.1.1.4. Recent Developments |

|

*Note: All the companies in the section 13.1 will cover same sub-chapters as above. |

|

13.1.2.AgEagle |

|

13.1.3.DJI |

|

13.1.4.Draganfly |

|

13.1.5.Elbit Systems |

|

13.1.6.JOUAV |

|

13.1.7.Parrot Drone |

|

13.1.8.PrecisionHawk |

|

13.1.9.Topcon |

|

13.1.10.Trimble |

|

13.1.11.XAG Co. |

|

13.1.12.Yamaha Motor Co. |

|

13.1.13.Yuneec |

|

13.2.Agriculture Drones Start-ups |

|

13.2.1.Aquiline Drones |

|

13.2.2.Atmos UAV |

|

13.2.3.Autel Robotics |

|

13.2.4.Delair |

|

13.2.5.DroneDeploy |

|

13.2.6.Garuda Aerospace |

|

13.2.7.General Aeronautics |

|

13.2.8.Marut Drones |

|

13.2.9.Sentera |

|

13.2.10.Wingtra |

|

14.Appendix |

|

14.1.Discussion Guidelines |

Let us connect with you TOC

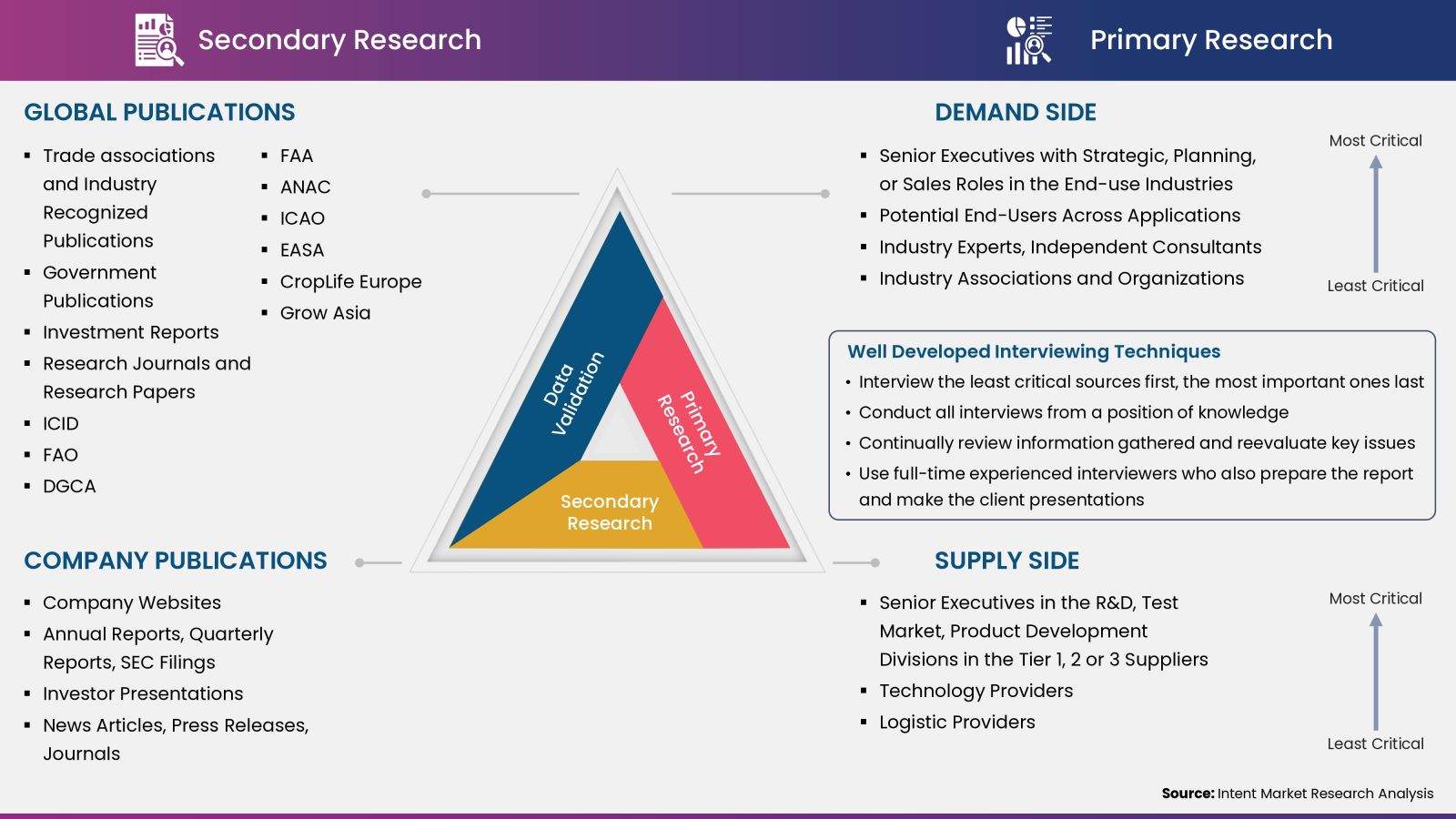

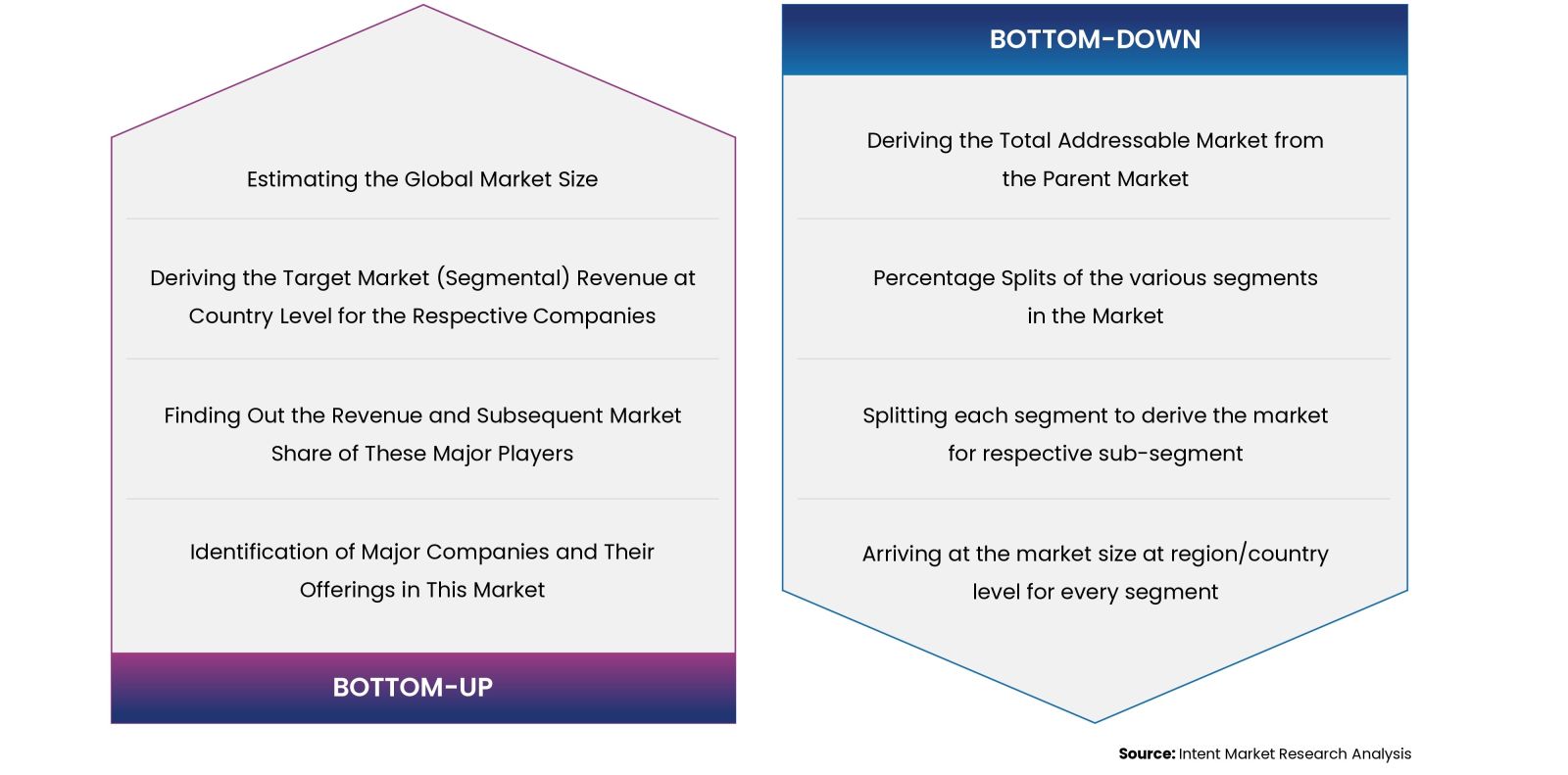

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats