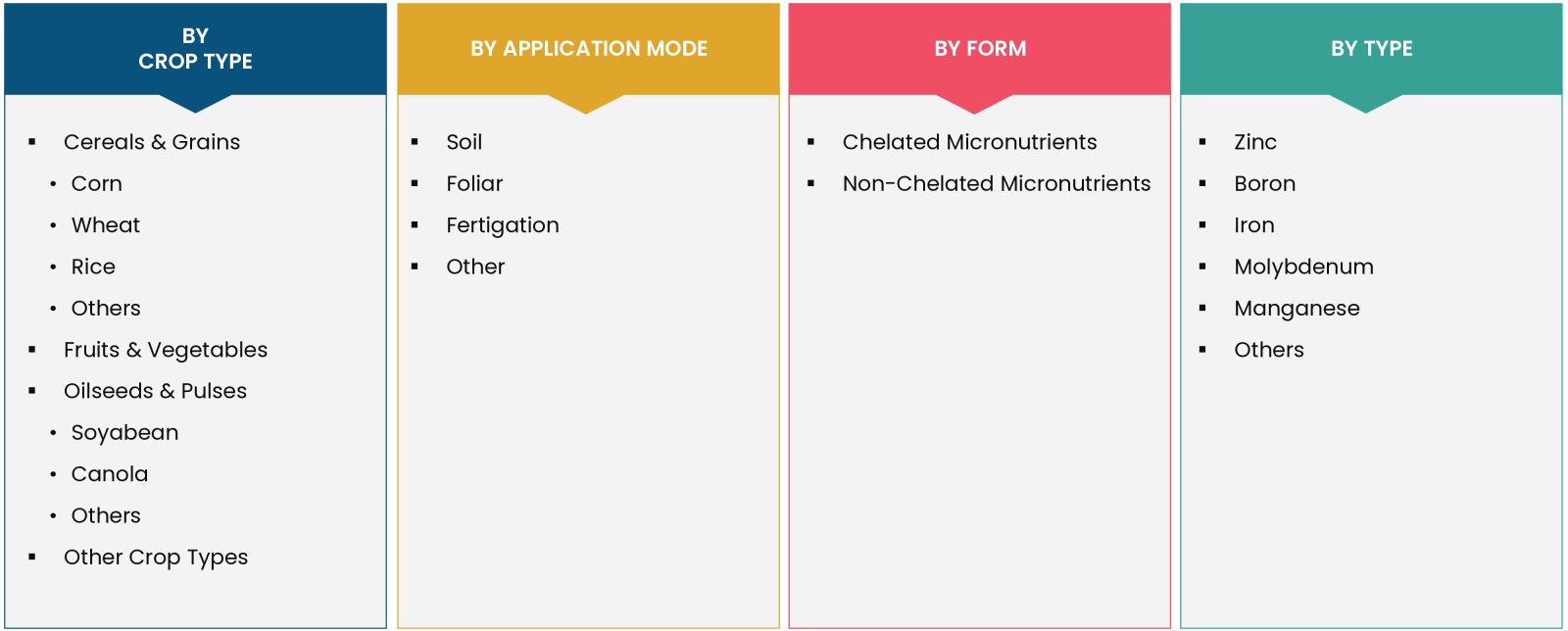

Agricultural Micronutrients Market Size Analysis, By Type (Zinc, Boron, Iron, Molybdenum, Manganese), By Form (Chelated, Non-chelated), By Crop Type (Cereals & Grains {Corn, Wheat, Rice}, Fruits & Vegetables, Oilseeds & Pulses {Soyabean, Canola}), By Application Mode (Soil, Foliar, Fertigation), and By Region; Global Insights & Forecast to 2030

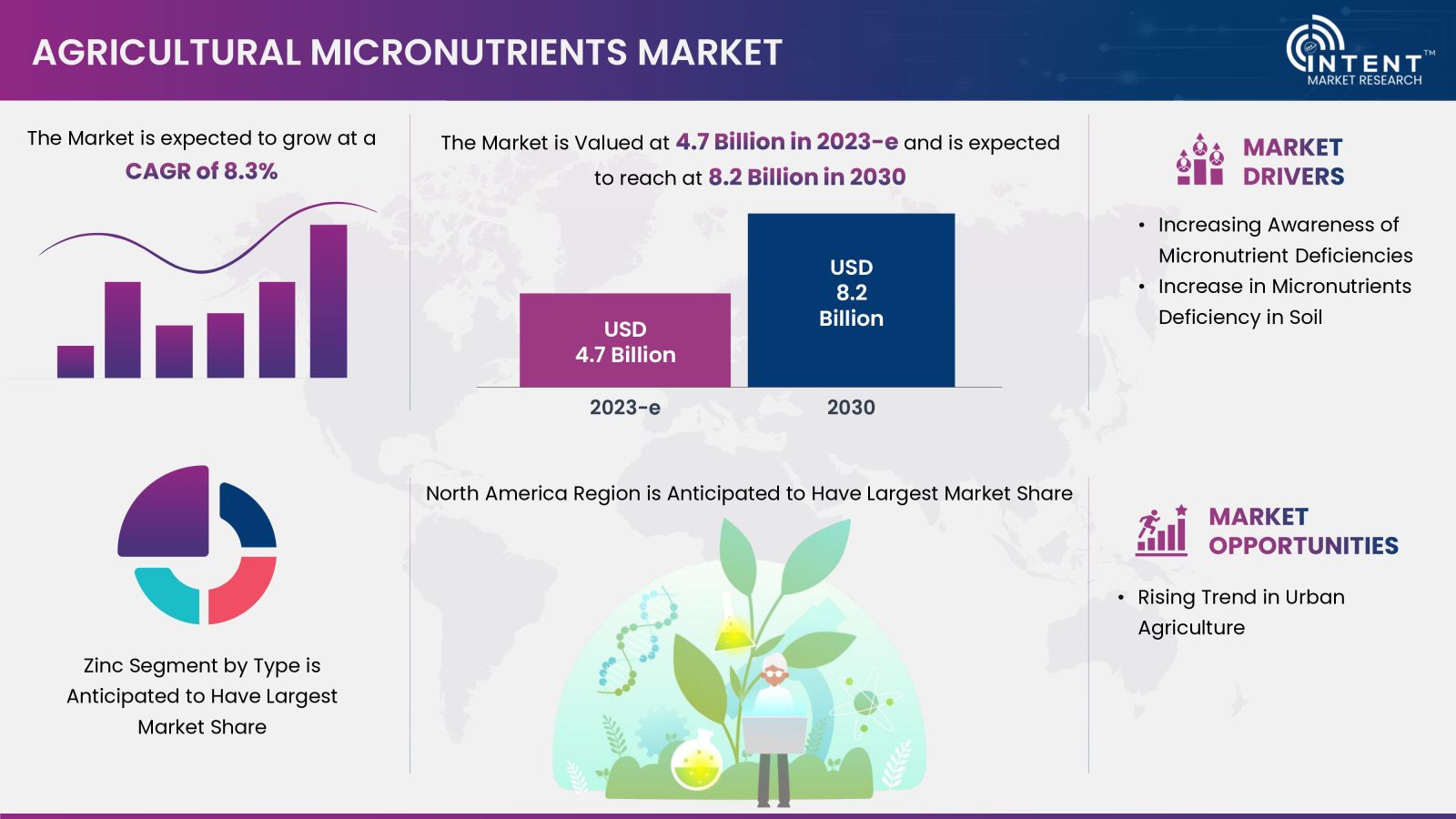

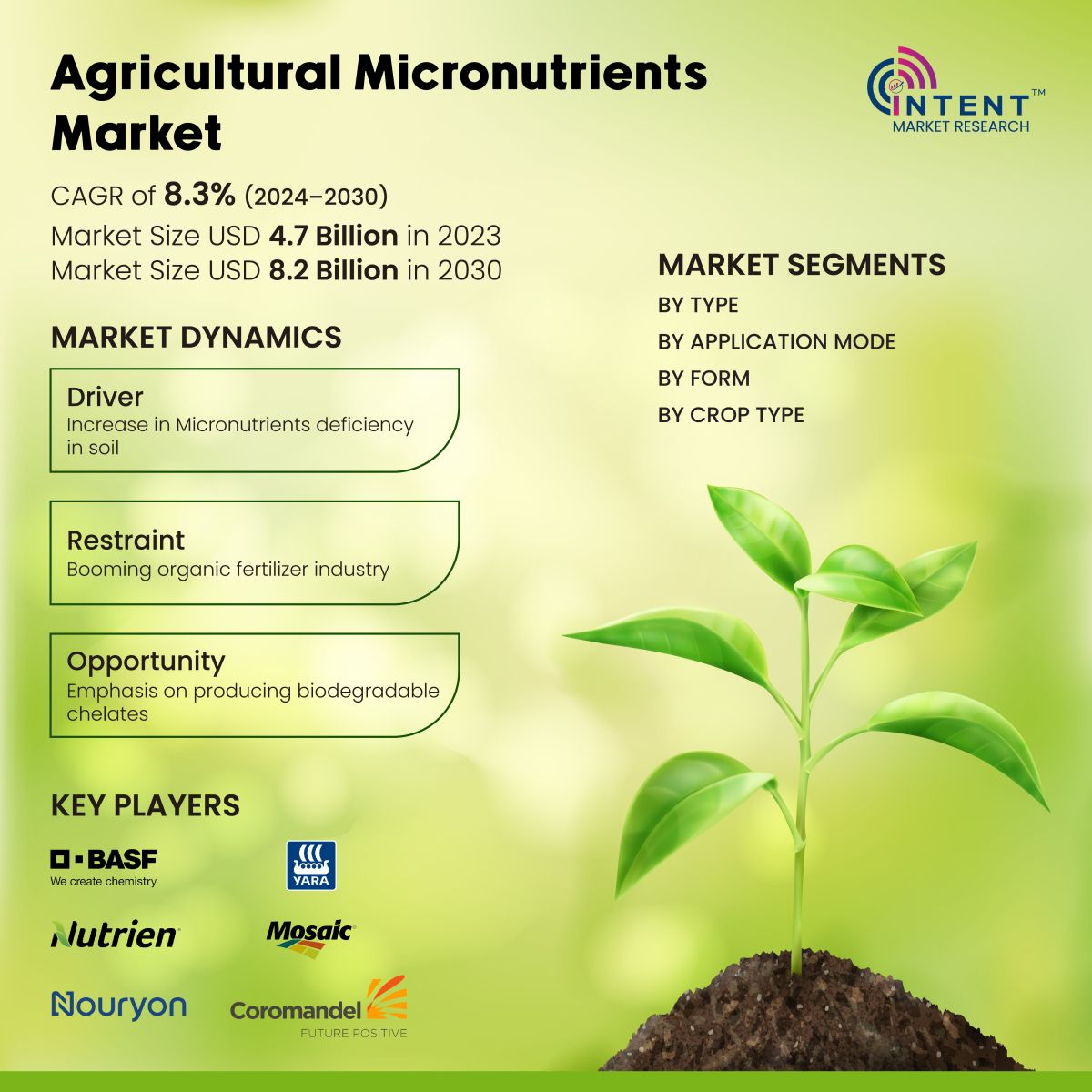

Agricultural micronutrients market is expected to grow from USD 4.7 billion in 2023-e to USD 8.2 billion by 2030, growing at a CAGR of 8.3% during the forecast period. The agricultural micronutrients market is a competitive market, the prominent players in the global market include BASF, Coromandel International, Helena Agri-Enterprises, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Land O'Lakes, Nouryon, Nufarm, The Mosaic Company, Yara International, and Zuari Agro Chemicals.

Agricultural micronutrient is a pivotal minerals required in small quantities for plant growth, play a vital role in modern agricultural practices. Zinc, boron, iron, molybdenum, chloride, nickel, copper, and manganese serve as essential micronutrients in agriculture, applied to crops to mitigate micronutrient deficiencies in soil. These micronutrients, available in chelated or non-chelated forms, hence they find application in various crops, including cereals, pulses and oilseeds, fruits and vegetables.

Increasing Micronutrient Deficiencies in Soil & Rising Awareness Among Farmers Related to Same To Drive the Market Growth

The rising awareness of micronutrient deficiencies in agriculture stems from a growing understanding of their pivotal role in plant health. Micronutrients, including zinc, iron, and copper, are essential for various physiological processes, and deficiencies can lead to reduced crop yields and inferior quality. Farmers and agricultural practitioners are becoming more cognizant of the nuanced nutritional needs of plants, prompting them to adopt micronutrient management strategies.

Education programs and advancements in soil testing technologies contribute to this awareness, empowering farmers to address micronutrient deficiencies proactively. As a result, the agriculture industry is witnessing a shift towards precision farming, where micronutrients are applied in targeted and customized ways to optimize plant nutrition.

Increase in Micronutrient Deficiency in Soil to Propel the Growth of the Market

Changes in agricultural practices, soil management, and environmental factors contribute to an observable increase in micronutrient deficiencies within soils. Factors such as intensive farming, imbalanced fertilizer use, and soil degradation can lead to reduced micronutrient levels. Soil testing has become a crucial tool for identifying deficiencies and guiding corrective measures. This trend underscores the need for a holistic approach to soil health, emphasizing sustainable practices that maintain a balance of essential nutrients. Agricultural stakeholders are increasingly acknowledging the significance of soil testing and nutrient management plans. This recognition aims to address micronutrient deficiencies, ultimately fostering improved crop performance and enhancing overall agricultural sustainability. Addressing these deficiencies is vital for ensuring long-term soil fertility and food security.

Cereals Segment Accounted for Significant Agricultural Micronutrient Market Share in 2023

The cereals segment commands for significant market share, primarily due to its high yield and the extensive agricultural land dedicated to cultivating cereals such as wheat, maize, and rice. Cereal grains, including essential staples such as wheat, maize, and rice, play a significant role in contributing to the global production in agricultural micronutrient market.

Zinc Segment is Anticipated to Witness Significant Market Growth During the Forecast Period

There is a widespread use of zinc owing towards the zinc deficiencies in the soil. Zinc significance lies in its dual nature, acting as both essential and potentially toxic depending on concentration levels. Zn contributes to numerous cellular and physiological activities in plants, fostering growth, development, and yield. As an integral component of proteins and enzymes, Zn holds structural, enzymatic, and regulatory importance. Widespread Zn deficiency in crops globally leads to substantial production losses and compromises nutritional quality.

The Dominant Market Share is held by the Soil Segment in the Agricultural Micronutrient Market

The soil segment commands for a prominent market share, and its application mode is widely favored globally due to its simplicity and cost-effectiveness. Fertilizers are efficiently spread over entire fields at the surface using high-capacity spreaders in the soil application method. The market is set to witness growth with increased investments and initiatives aimed at developing new and advanced higher-capacity fertilizer spreaders.

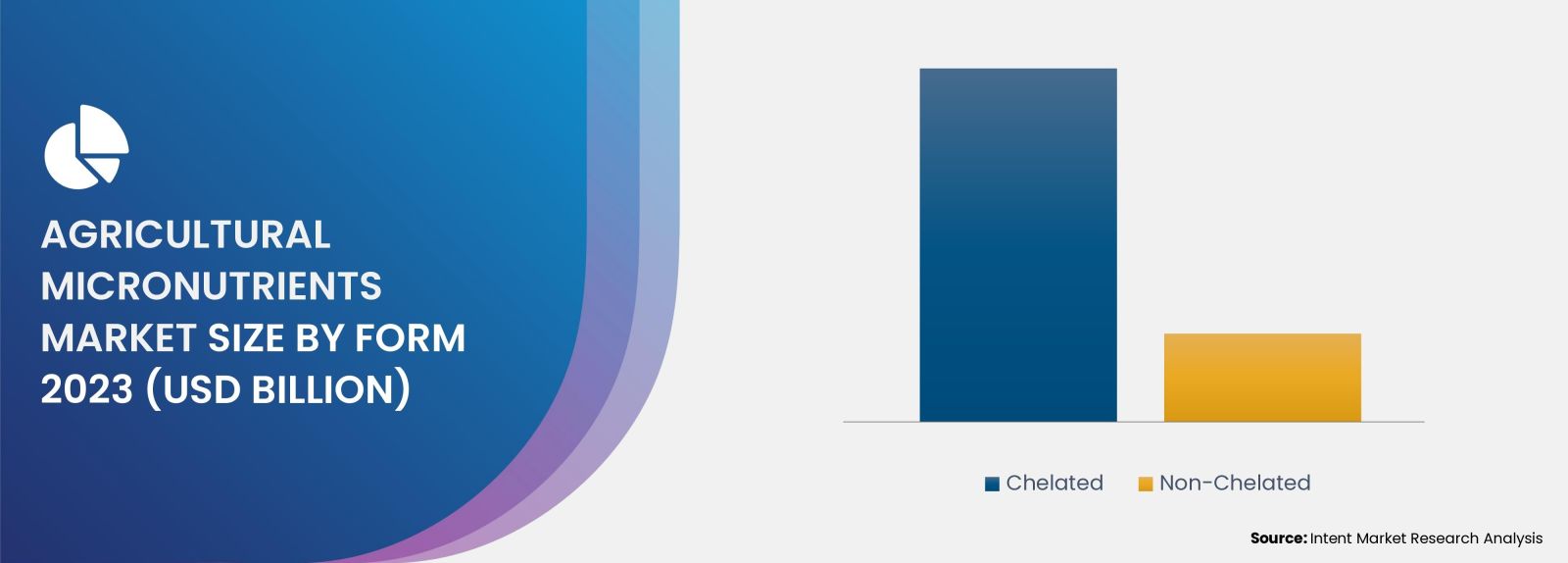

The Chelated Micronutrient Segment is Booming due to its Robust Growth and Development in Agricultural Micronutrient Market

Chelated micronutrients are witnessing significant growth in the agricultural micronutrients market, driven by their numerous advantages. These micronutrients are easily absorbed by plants, promoting robust growth and development. Their efficient utilization contributes to increased crop yields, making them a preferred choice for farmers aiming for higher productivity. Chelation enhances micronutrient stability and availability, reducing the risk of nutrient deficiencies in crops and ensuring overall plant health. Ongoing research and development efforts continue to improve formulations, ensuring consistent and enhanced performance. Thus chelated micronutrients holds a significant importance in addressing nutrient deficiencies, promoting sustainable farming practices, and ultimately boosting crop yields.

Consequently, companies are expanding their distribution channels to meet the rising demand. For instance, in April 2019, BASF SE Canada partnered with Quadra Chemicals as the new distributor of its chelated micronutrient products in Canada to address the increasing demand for these micronutrients.

Europe is poised for Significant Market Growth over the Forecast Period

The advancements in crop production technology and increasing awareness of micronutrient deficiencies is poised to dominate the Europe market growth. Illustratively, a survey published in the National Library of Medicine covering multiple European nations, including Portugal, Spain, and Italy, unveiled that 60% of soil samples had reduced levels of Fe, while 28% showed diminished levels of Zn. Additionally, technological innovations, such as Verde AgriTech's introduction of K Forte, a multi-nutrient fertilizer tailored to regional needs, play a role in expanding the market.

The acquisition of smaller players and product innovations by major players are driving the market growth.

Agricultural Micronutrients market is characterized by intense competition due to the presence of numerous international and domestic players. Agricultural micronutrients market, in particular, is dominated by key players such as BASF, Coromandel International, Helena Agri-Enterprises, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Land O'Lakes, Nouryon, Nufarm, The Mosaic Company, Yara International, Zuari Agro Chemicals. The primary focus of these industry leaders is on acquiring smaller players and innovating their product lines to meet the demands of the agricultural micronutrients market.

Agricultural Micronutrients Market Coverage

The report provides key insights into the agricultural micronutrients market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players as well as the competitive landscape within the market. The report offers the market size and forecasts for agricultural micronutrients in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.7 billion |

|

Forecast Revenue (2030) |

USD 8.2 billion |

|

CAGR (2024-2030) |

8.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Type (Zinc, Boron, Iron, Molybdenum, Manganese, Others), By Form (Chelated, Non-chelated), By Crop Type (Cereals & Grains {Corn, Wheat, Rice, Others}, Fruits & Vegetables, Oilseeds & Pulses {Soyabean, Canola, Others} Other Crop Types), By Application Mode (Soil, Foliar, Fertigation, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

BASF, Nouryon, Nufarm, Nutrien, Yara International, The Mosaic Company, and Coromandel International, Indian Farmers Fertilizer Cooperative Limited (IFFCO) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Increasing Awareness of Micronutrient Deficiencies |

|

4.1.2.Increase in Micronutrients Deficiency in Soil |

|

4.1.3.Global Population Growth and Food Security Concerns |

|

4.1.4.Shift Toward Sustainable Agriculture |

|

4.2.Market Growth Challenges |

|

4.2.1.Booming organic fertilizer industry |

|

4.2.2.Bio-Accumulation of Non-Biodegradable Chelates |

|

4.2.3.Fluctuating Costs of Raw Materials |

|

4.3.Market Growth Opportunities |

|

4.3.1.Rising Trend in Urban Agriculture |

|

4.4.Pestle Analysis |

|

4.5.Porter’s Five Forces Analysis |

|

5.Market Outlook |

|

5.1. Overview (Industry Snapshot) |

|

5.2. Technology Analysis |

|

5.3. Supply Chain Analysis |

|

5.4. Value Chain Analysis |

|

5.5. Patent Analysis |

|

5.6. Ecosystem Analysis |

|

5.7. Trade Analysis |

|

5.8. Key Conference and Events |

|

5.9. Average Selling Price |

|

5.10. Key Developments |

|

6.Market Segment Outlook |

|

6.1.Segment Synopsis |

|

6.2.By Crop Type (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.2.1.Cereals & Grains |

|

6.2.1.1.Corn |

|

6.2.1.2.Wheat |

|

6.2.1.3.Rice |

|

6.2.1.4.Others |

|

6.2.2.Fruits & Vegetables |

|

6.2.3.Oilseeds & Pulses |

|

6.2.3.1.Soyabean |

|

6.2.3.2.Canola |

|

6.2.3.3.Others |

|

6.2.4.Other Crop Types |

|

6.3.By Application Mode (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.3.1.Soil |

|

6.3.2.Foliar |

|

6.3.3.Fertigation |

|

6.3.4.Others |

|

6.4.By Form (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.4.1.Chelated Micronutrients |

|

6.4.2.Non-Chelated Micronutrients |

|

6.5.By Type (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.5.1.Zinc |

|

6.5.2.Boron |

|

6.5.3.Iron |

|

6.5.4.Molybdenum |

|

6.5.5.Manganese |

|

6.5.6.Others |

|

7.Regional Outlook |

|

7.1.Global Market Synopsis |

|

7.2.North America (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.2.1.North America Agricultural Micronutrients Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Agricultural Micronutrients Market, By Type |

|

7.2.2.2.US Agricultural Micronutrients Market, By Application Mode |

|

7.2.2.3.US Agricultural Micronutrients Market, By Form |

|

7.2.2.4.US Agricultural Micronutrients Market, By Crop Type |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.3.Europe (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.3.1.Europe Agricultural Micronutrients Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.4.1.Asia-Pacific Agricultural Micronutrients Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.5.1.Latin America Agricultural Micronutrients Market Outlook |

|

7.5.2.Mexico |

|

7.5.3.Brazil |

|

7.6.Middle East & Africa (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.6.1.Middle East & Africa Agricultural Micronutrients Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Volume Output Analysis |

|

8.3.Company Strategy Analysis |

|

8.4.Competitive Matrix |

|

9.Company Profiles |

|

9.1. BASF |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.Analyst Perception |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.2.Coromandel International |

|

9.3.Helena Agri-Enterprises |

|

9.4.Indian Farmers Fertiliser Cooperative Limited (IFFCO) |

|

9.5.Land O'Lakes |

|

9.6.Nouryon |

|

9.7.Nufarm |

|

9.8.The Mosaic Company |

|

9.9.Yara International |

|

9.10. Zuari Agro Chemicals |

Let us connect with you TOC

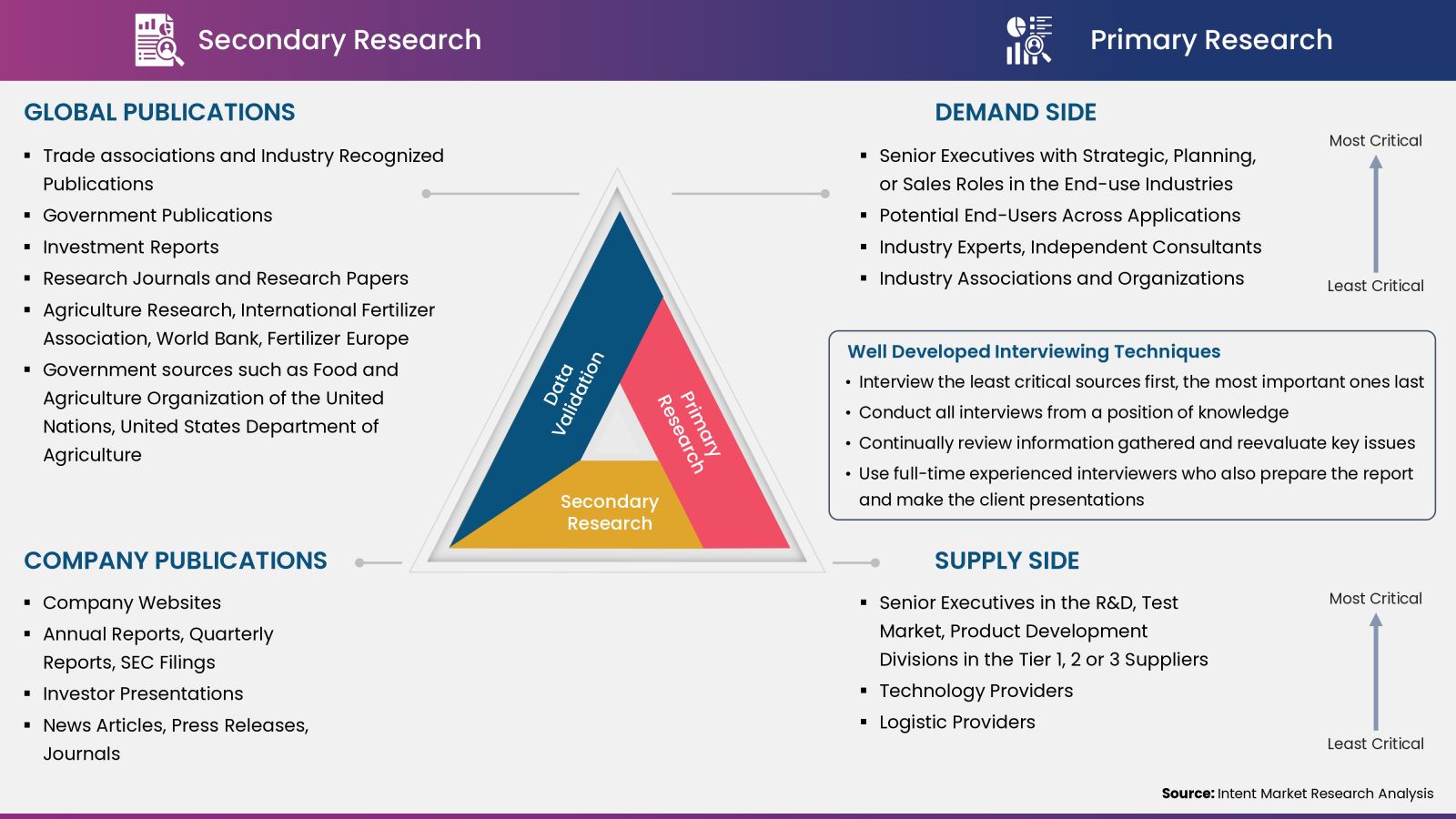

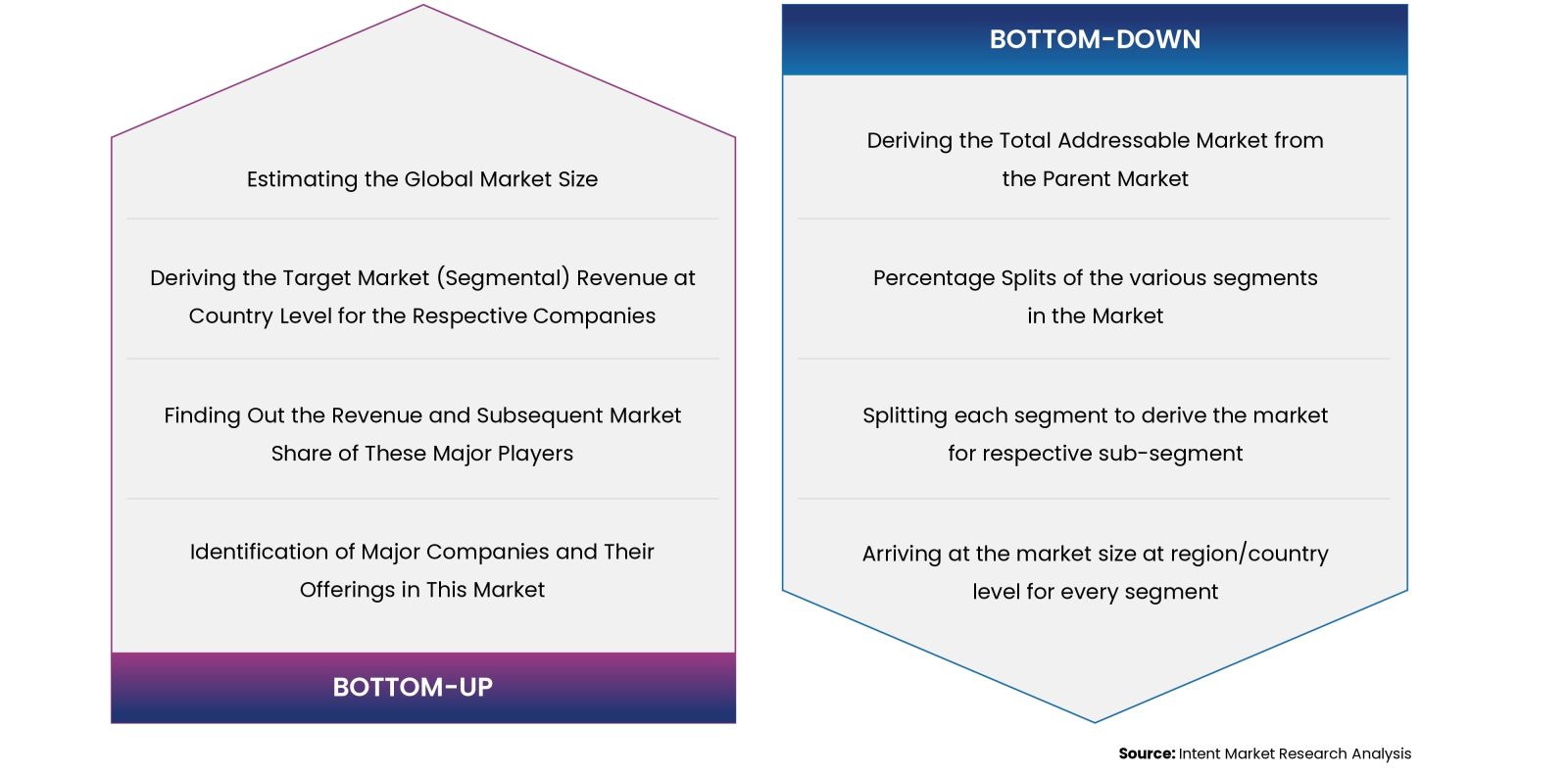

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats