sales@intentmarketresearch.com

+1 463-583-2713

Microfluidics Market to reach USD 51.0 billion in 2030, at a CAGR of 14.0%

The Microfluidics Market was estimated at USD 23.1 billion in 2023-e, and is projected to grow at a CAGR of 14.0% through 2030 to reach USD 51.0 billion. The COVID-19 pandemic played a pivotal role in shaping the market dynamics, particularly in the healthcare sector. Companies initially focused on developing sensor devices and equipment for wearables and mobile devices to remotely monitor chronically ill patients. The surge in COVID-19 cases led to a growing demand for point-of-care diagnostics, driving the development of various microfluidic technologies. For instance, microfluidic techniques such as the DA-D4 and sandwich/competitive immune-sensors were employed to detect SARS-CoV-2 antibodies efficiently, exemplify the market's response to the global health crisis.

Continuous innovation in Lab-On-A-Chip (LOC) devices drives microfluidics market growth. These miniaturized platforms streamline diagnostics and research, emphasizing integration, automation, and expanding applications. The evolving LOC landscape offers versatile tools for high-throughput analysis, point-of-care diagnostics, and efficient workflows. Notably, In June 2021, Health Logic Interactive's MATLOC technology exemplifies transformative potential in managing chronic kidney disease, showcasing the market's ongoing expansion.

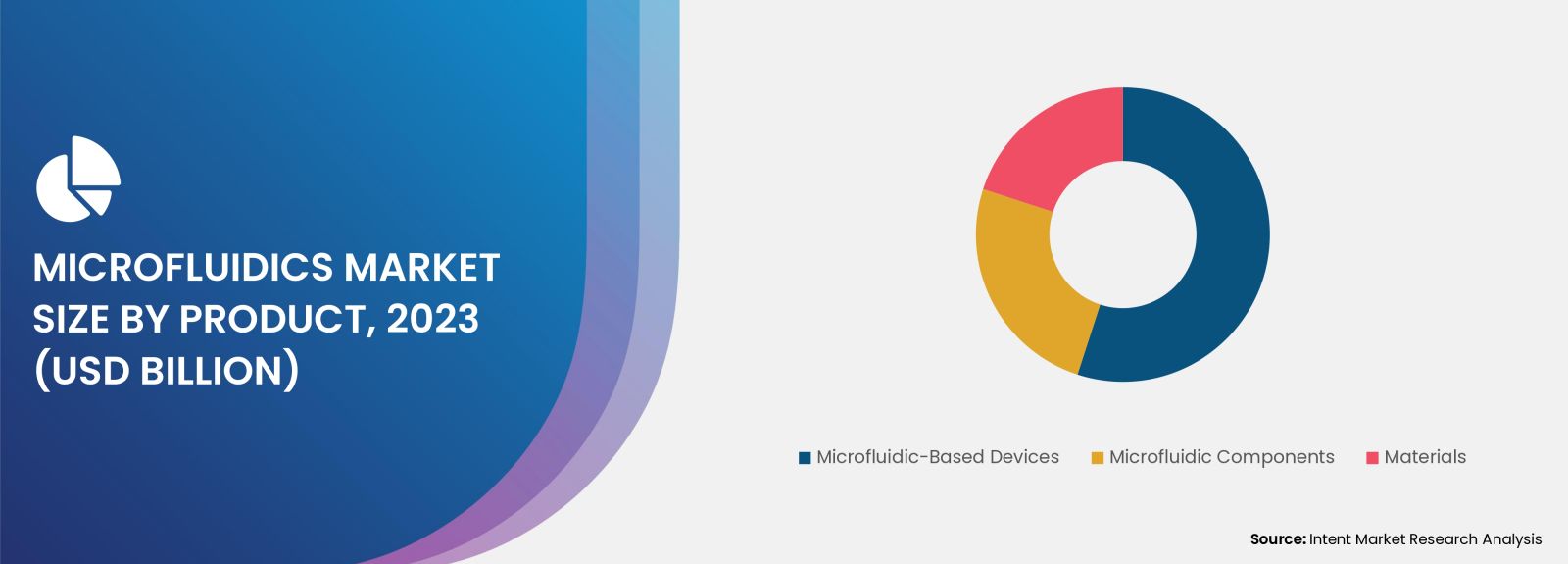

The microfluidic devices segment has secured the predominant share in the microfluidics market. The integration of microfluidics into point-of-care testing devices represents a key application. This technology excels at detecting and regulating fluids within a single component, enhancing sensitivity and specificity for the detection of target analyses in small volumes. Examples include Revogene, a microfluidics cartridge-based real-time PCR device providing rapid results for C. difficile, Strep B., and Streptococcus A in approximately 2 minutes.

Europe microfluidics market is anticipated to witness significant growth during the forecast period. The region's focus on research & development, exemplified by substantial investments by pharmaceutical companies, further contributes to market dominance. In January 2024, Roche enhances its diagnostic portfolio through a USD 295 million agreement to acquire LumiraDx's point-of-care diagnostics platform. The acquired microfluidics-based diagnostics platform facilitates multiple tests on a single-use device, aligning with Roche's strategic expansion in the diagnostics sector.

Furthermore, in May 2020, A Belgian startup, miDiagnostics, pioneers the use of Lab-on-a-Chip technology for swift, precise disease diagnosis at point-of-care. They employ silicon chips and nanoscale-precision microfluidics for advanced diagnostic capabilities. Strategic initiatives, including funding activities and mergers and acquisitions within the region are anticipated to fuel regional market growth.

The microfluidics market is characterized by the presence of various small and big players. The major market players include Agilent Technologies, Becton Dickinson and Company, Biomérieux, Bio-Rad, Danaher Corporation, Fluidigm Corporation, Hologic, Illumina, PerkinElmer, Roche, and Thermo Fisher Scientific, amongst others. In a competitive market landscape, players are swiftly embracing advanced technologies to enhance microfluidics market operations and bolster their competitive stance through strategic initiatives, including mergers, acquisitions, and the introduction of new products.

Available Formats