As per Intent Market Research, the Zonal Isolation Market was valued at USD 5.6 billion in 2023 and will surpass USD 8.5 billion by 2030; growing at a CAGR of 6.3% during 2024 - 2030.

The zonal isolation market is critical to enhancing the integrity and performance of wells, particularly in the oil and gas industry. It is primarily used to prevent fluid migration between different geological formations within a well, ensuring optimal reservoir management and well performance. Zonal isolation technologies are also important in industries like water treatment and mining, where controlling fluid flow and preventing cross-contamination are essential. With rising global energy demand and more complex drilling operations, the need for efficient zonal isolation solutions is increasing. These technologies support both traditional and unconventional oil and gas extraction, including offshore and deepwater drilling.

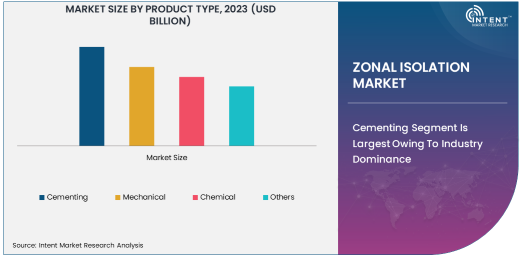

Cementing Segment Is Largest Owing To Industry Dominance

Cementing is the largest subsegment within the zonal isolation market, playing a pivotal role in ensuring well integrity and isolating geological zones. In oil and gas operations, cementing is the primary method used to create a permanent seal within the wellbore. This process is especially critical for controlling unwanted fluid migration between various formations, which could lead to operational hazards or contamination. Cementing offers a cost-effective and efficient means of isolating zones, contributing to its widespread adoption across both onshore and offshore fields. The cementing process also supports enhanced oil recovery (EOR) techniques, which increase overall production by preserving reservoir pressure.

The global cementing market is set to grow due to increasing investments in oil and gas exploration, especially in offshore oil fields, and the ongoing demand for new well construction and maintenance. Additionally, cementing technologies are evolving to meet the challenges of deeper and more complex wells, contributing to sustained growth in the segment. Furthermore, advancements in materials and technologies that improve the bonding strength and resistance to harsh environments continue to support the dominance of cementing solutions.

Sleeve Technology Is Fastest Growing Due To Innovation

Among various zonal isolation technologies, sleeve technology is the fastest-growing subsegment. Sleeve systems provide a mechanical barrier that can be activated to isolate specific zones in a well. This technology is particularly valuable in applications that require multistage isolation or stimulation. Sleeve-based systems allow for selective zone isolation without the need for additional fluid intervention, making them a more efficient solution for wells with complex conditions, such as multi-zone or extended-reach wells. The ability to achieve precise, repeatable zonal isolation with minimal impact on other zones is driving the growing adoption of sleeve technology.

The expansion of sleeve technology is also being fueled by advancements in materials, which enable the production of more durable and high-performance sleeves for deeper and harsher drilling environments. Furthermore, the increasing demand for multistage fracturing in unconventional resource plays, especially in shale oil and gas exploration, is spurring the rapid adoption of sleeve technology. This trend is expected to continue as operators seek more efficient and cost-effective ways to manage multiple isolated zones within wells.

Offshore Segment Is Largest Owing To Growing Exploration

The offshore segment is the largest application subsegment in the zonal isolation market. Offshore oil and gas exploration requires advanced zonal isolation solutions due to the unique challenges posed by deepwater environments. Zonal isolation is critical in these regions to prevent fluid migration between different geological layers, which could compromise the well integrity and hinder production. Offshore drilling operations are also subject to stricter environmental regulations, which demand the use of more effective isolation technologies to ensure safety and compliance with industry standards.

As offshore oil and gas reserves continue to be explored, particularly in regions like the North Sea, Gulf of Mexico, and offshore Brazil, the demand for reliable zonal isolation solutions will remain robust. The growing investment in deepwater and ultra-deepwater drilling technologies has further driven the need for advanced isolation technologies that can withstand extreme pressures, temperatures, and corrosive conditions. This trend is expected to continue as energy companies seek to tap into harder-to-reach reserves.

Oil & Gas Industry Is Largest End-User Due To Extensive Applications

The oil and gas industry remains the largest end-user in the zonal isolation market. Zonal isolation plays a crucial role in ensuring well integrity, improving production efficiency, and enabling enhanced oil recovery (EOR) in the oil and gas sector. With the ever-increasing demand for energy and the need to maximize output from existing reserves, oil companies are adopting more advanced isolation technologies to maintain optimal well conditions and prevent cross-contamination between zones. Zonal isolation methods such as cementing, mechanical seals, and packers are extensively used in both conventional and unconventional resource plays.

As exploration moves into more challenging environments, particularly offshore and deepwater, the demand for advanced zonal isolation solutions continues to grow. Additionally, the rise of hydraulic fracturing and multistage stimulation techniques, which require multiple isolated zones for efficient production, further drives the adoption of zonal isolation technologies in the oil and gas industry. These factors combined ensure that the oil and gas sector remains the dominant end-user of zonal isolation solutions.

North America Is Largest Region Due To Robust Oil & Gas Industry

North America is the largest region in the zonal isolation market, driven primarily by the dominance of the oil and gas industry in the United States and Canada. The U.S. is one of the largest oil producers globally, with a strong focus on unconventional drilling methods such as hydraulic fracturing and horizontal drilling. This has led to a significant increase in the demand for zonal isolation solutions, as operators require reliable methods to manage multiple isolated zones within a single well. The region's technological leadership in deepwater drilling and exploration also contributes to the growth of the zonal isolation market.

North America's position as the largest region is further bolstered by its substantial offshore oil and gas operations, especially in the Gulf of Mexico. With continued investment in shale gas production, offshore fields, and advanced drilling technologies, North America is expected to maintain its dominance in the zonal isolation market. Additionally, the region's strong regulatory frameworks ensure high standards for well integrity and environmental protection, driving the need for advanced zonal isolation technologies.

Competitive Landscape: Leading Companies and Market Outlook

The zonal isolation market is highly competitive, with several key players dominating the landscape. Major companies such as Schlumberger, Halliburton, Baker Hughes, and Weatherford International are leading the charge in providing innovative zonal isolation solutions across various sectors, including oil and gas, water treatment, and mining. These companies are focusing on product innovations, partnerships, and acquisitions to enhance their market position.

In addition to large multinational corporations, smaller companies specializing in niche technologies, such as sleeve and packer systems, are also making strides in the market. As exploration activities expand in unconventional and offshore fields, the demand for efficient and cost-effective zonal isolation technologies is expected to increase, presenting significant growth opportunities for both established players and new entrants. The market is anticipated to experience continued growth, driven by innovations in technology and the ongoing need for enhanced well integrity in increasingly challenging environments.

Recent Developments:

- In 2024, Schlumberger launched an innovative zonal isolation solution aimed at reducing operational costs while improving well integrity in deepwater offshore projects.

- Halliburton announced the expansion of its mechanical zonal isolation portfolio with a new packer technology to enhance well integrity for both onshore and offshore applications.

- In 2023, Baker Hughes acquired a regional service provider specializing in advanced zonal isolation technologies, enhancing its offshore operations.

- Weatherford International introduced a new suite of chemical-based zonal isolation services designed for ultra-deepwater drilling projects.

- NOV entered into a strategic partnership with a leading global oil operator to provide innovative zonal isolation solutions for both onshore and offshore exploration projects

List of Leading Companies:

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International PLC

- National Oilwell Varco

- NOV Inc.

- ArcelorMittal

- ChampionX

- Aker Solutions

- Welltec

- Oil States International

- Superior Energy Services

- Tenaris

- St. Mary Land & Exploration Co.

- CNPC (China National Petroleum Corporation)

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.6 Billion |

|

Forecasted Value (2030) |

USD 8.5 Billion |

|

CAGR (2024 – 2030) |

6.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Zonal Isolation Market, By Product Type (Cementing, Mechanical, Chemical), By Technology (Sleeve Technology, Packer Technology, Multistage Fracturing), By Application (Onshore, Offshore), By End-User Industry (Oil & Gas, Water Treatment, Mining) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International PLC, National Oilwell Varco, NOV Inc., ArcelorMittal, ChampionX, Aker Solutions, Welltec, Oil States International, Superior Energy Services, Tenaris, St. Mary Land & Exploration Co., CNPC (China National Petroleum Corporation) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Zonal Isolation Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Cementing |

|

4.2. Mechanical |

|

4.3. Chemical |

|

4.4. Others |

|

5. Zonal Isolation Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Sleeve Technology |

|

5.2. Packer Technology |

|

5.3. Multistage Fracturing |

|

5.4. Others |

|

6. Zonal Isolation Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Onshore |

|

6.2. Offshore |

|

7. Zonal Isolation Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Oil & Gas |

|

7.2. Water Treatment |

|

7.3. Mining |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Zonal Isolation Market, by Product Type |

|

8.2.7. North America Zonal Isolation Market, by Technology |

|

8.2.8. North America Zonal Isolation Market, by Application |

|

8.2.9. North America Zonal Isolation Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Zonal Isolation Market, by Product Type |

|

8.2.10.1.2. US Zonal Isolation Market, by Technology |

|

8.2.10.1.3. US Zonal Isolation Market, by Application |

|

8.2.10.1.4. US Zonal Isolation Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Schlumberger Limited |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Halliburton Company |

|

10.3. Baker Hughes Company |

|

10.4. Weatherford International PLC |

|

10.5. National Oilwell Varco |

|

10.6. NOV Inc. |

|

10.7. ArcelorMittal |

|

10.8. ChampionX |

|

10.9. Aker Solutions |

|

10.10. Welltec |

|

10.11. Oil States International |

|

10.12. Superior Energy Services |

|

10.13. Tenaris |

|

10.14. St. Mary Land & Exploration Co. |

|

10.15. CNPC (China National Petroleum Corporation) |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Zonal Isolation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Zonal Isolation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Zonal Isolation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA