Zinc Carbonate Market By Product Type (Zinc Carbonate Monohydrate, Zinc Carbonate Hemihydrate, Zinc Carbonate Anhydrous), By Application (Agriculture, Pharmaceuticals, Rubber Industry, Paints and Coatings, Chemicals and Metallurgy), By End-User Industry (Agriculture and Fertilizers, Pharmaceuticals, Cosmetics and Personal Care, Chemical Manufacturing, Rubber and Plastics, Paint and Coatings), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Zinc Carbonate Market was valued at USD 0.2 billion in 2023 and will surpass USD 0.3 billion by 2030; growing at a CAGR of 5.7% during 2024 - 2030.

The zinc carbonate market is an essential segment of the broader chemicals industry, driven by its extensive use across various applications. Zinc carbonate is a versatile chemical compound used primarily in agriculture, pharmaceuticals, rubber, paints, and coatings. The market's growth is influenced by the increasing demand for agricultural fertilizers, rising health awareness leading to pharmaceutical applications, and expanding industrial applications. As industries increasingly focus on sustainability and efficiency, zinc carbonate plays a critical role in meeting the requirements of various sectors. The demand for zinc carbonate is expected to continue growing as the global economy shifts towards more eco-friendly practices and higher health standards.

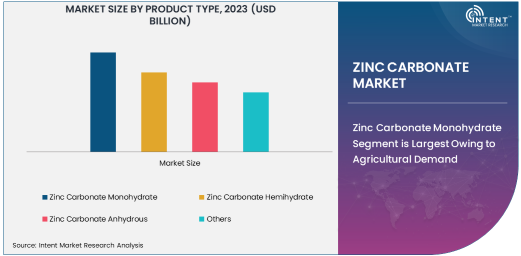

Zinc Carbonate Monohydrate Segment is Largest Owing to Agricultural Demand

The largest product segment in the zinc carbonate market is Zinc Carbonate Monohydrate. This form of zinc carbonate is widely utilized in the agricultural sector due to its high bioavailability and efficiency as a micronutrient in fertilizers. Zinc deficiency in soil is a common problem, particularly in regions with high crop demand, making zinc carbonate monohydrate an essential ingredient for improving crop yield and soil health. It is used to fortify fertilizers, ensuring that crops receive the necessary micronutrients to thrive, which in turn boosts agricultural productivity.

Zinc carbonate monohydrate is also used in animal feed and other agricultural products. As the demand for high-quality food products continues to rise globally, particularly in emerging economies, the need for effective agricultural supplements such as zinc carbonate monohydrate is growing. This increasing use in the agricultural industry, especially in countries with large agricultural sectors such as India and China, positions zinc carbonate monohydrate as the dominant product segment in the market.

Agriculture Segment is Largest Owing to Fertilizer Demand

The Agriculture application segment is the largest within the zinc carbonate market, primarily driven by the increasing use of zinc-based fertilizers. Zinc plays a crucial role in the growth of crops by aiding in the synthesis of chlorophyll and other vital functions. As a result, the demand for high-quality zinc-based fertilizers, such as those containing zinc carbonate, has surged. Zinc is a critical micronutrient that boosts soil fertility and improves crop resistance to environmental stresses, making it a vital component of modern agricultural practices.

The agriculture sector's continued focus on increasing food production to meet the needs of a growing global population further amplifies the demand for zinc-based fertilizers. Additionally, government policies encouraging sustainable farming practices and the promotion of micronutrient-enriched fertilizers in developing countries are supporting the growth of the agriculture segment. The rise of organic farming also supports the demand for zinc carbonate, as it is considered an environmentally friendly and safe alternative to synthetic fertilizers.

Agriculture and Fertilizers Segment is Largest Owing to Zinc Fertilizer Demand

The Agriculture and Fertilizers end-user industry is the largest in the zinc carbonate market, owing to the critical role zinc plays in improving agricultural productivity. Zinc deficiency in soils is common in many parts of the world, leading to reduced crop yields and poorer quality produce. Zinc carbonate is widely used in fertilizers to correct these deficiencies, thus enhancing crop growth. The growing demand for higher agricultural output and better-quality food is driving the growth of this segment, particularly in emerging economies.

The increasing awareness of soil health and the importance of micronutrients in crop production has led to a rise in the adoption of zinc-based fertilizers. The agricultural sector's focus on sustainable farming and nutrient management practices further propels this demand. As countries like India, China, and Brazil prioritize agricultural sustainability and food security, the use of zinc carbonate in fertilizers is expected to continue to grow, reinforcing the prominence of the agriculture and fertilizers end-user segment.

Asia-Pacific Region is Largest Owing to Agricultural Dominance

The Asia-Pacific region is the largest market for zinc carbonate, driven by the region's strong agricultural base and growing industrial demand. Countries like China and India have extensive agricultural sectors, where the need for micronutrient-rich fertilizers is particularly high. Zinc carbonate, due to its efficiency and bioavailability, is in high demand as a key ingredient in fertilizers. Additionally, the pharmaceutical and chemical industries in Asia-Pacific are growing, which supports further market expansion.

The region's growing population and increasing food consumption also play a pivotal role in driving agricultural growth and, consequently, the demand for zinc carbonate. Asia-Pacific's rapid industrialization and expanding manufacturing sectors further bolster the demand for zinc carbonate in paints, coatings, and rubber. As the region continues to prioritize sustainable farming and agricultural productivity, Asia-Pacific will remain the largest market for zinc carbonate in the coming years.

Competitive Landscape and Leading Companies

The zinc carbonate market is highly competitive, with numerous players operating across various geographies. Leading companies in this market include Zinc Nacional S.A. de C.V., Sumitomo Chemical Co., Ltd., Shaanxi Yinxin Nonferrous Metal Co., Ltd., American Elements, and Reinhold Group. These companies dominate the market through strategic partnerships, technological advancements, and a diverse range of high-quality zinc carbonate products. Their strong presence in key markets such as agriculture, pharmaceuticals, and chemical manufacturing positions them as market leaders.

As demand continues to grow, these companies are increasingly focused on expanding their product offerings, enhancing production capacities, and exploring new applications for zinc carbonate. This includes innovations in zinc-based fertilizers, pharmaceutical applications, and sustainable industrial processes. Mergers, acquisitions, and collaborations are common strategies employed by these players to strengthen their market position and improve global reach. With the ongoing industrial and agricultural advancements, the competitive landscape will continue to evolve, with companies focusing on sustainable growth and expanding their market share

Recent Developments:

- Zinc Nacional S.A. de C.V. announced the expansion of its production facilities to meet the growing demand for zinc carbonate in the agricultural and industrial sectors.

- Sumitomo Chemical Co., Ltd. introduced a new zinc carbonate formulation designed for better efficacy in fertilizers and as a precursor in zinc oxide production.

- Shaanxi Yinxin Nonferrous Metal Co., Ltd. has formed strategic partnerships with agricultural firms to supply high-quality zinc carbonate for micronutrient fertilizers.

- American Elements has acquired a zinc processing facility to enhance its supply of zinc carbonate and improve product availability for pharmaceutical and industrial customers.

- Henan Tianfu Chemical Co., Ltd. announced an expansion into European and North American markets with its range of zinc carbonate products for rubber and coatings applications.

List of Leading Companies:

- Zinc Nacional S.A. de C.V.

- Sumitomo Chemical Co., Ltd.

- Shaanxi Yinxin Nonferrous Metal Co., Ltd.

- American Elements

- Zinc Oxide LLC

- Reinhold Group

- Yunnan Tin Company Limited

- Acmol Chemicals

- Hongda Group

- Henan Tianfu Chemical Co., Ltd.

- ViiV Healthcare

- Nantong Jinhao Chemicals Co., Ltd.

- Jiangsu Zhenyu Chemical Co., Ltd.

- Wuhan Xinrong New Materials Co., Ltd.

- Shenzhen Zhenyu Technology

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 0.2 Billion |

|

Forecasted Value (2030) |

USD 0.3 Billion |

|

CAGR (2024 – 2030) |

5.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Zinc Carbonate Market By Product Type (Zinc Carbonate Monohydrate, Zinc Carbonate Hemihydrate, Zinc Carbonate Anhydrous), By Application (Agriculture, Pharmaceuticals, Rubber Industry, Paints and Coatings, Chemicals and Metallurgy), By End-User Industry (Agriculture and Fertilizers, Pharmaceuticals, Cosmetics and Personal Care, Chemical Manufacturing, Rubber and Plastics, Paint and Coatings) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zinc Nacional S.A. de C.V., Sumitomo Chemical Co., Ltd., Shaanxi Yinxin Nonferrous Metal Co., Ltd., American Elements, Zinc Oxide LLC, Reinhold Group, Yunnan Tin Company Limited, Acmol Chemicals, Hongda Group, Henan Tianfu Chemical Co., Ltd., ViiV Healthcare, Nantong Jinhao Chemicals Co., Ltd., Jiangsu Zhenyu Chemical Co., Ltd., Wuhan Xinrong New Materials Co., Ltd., Shenzhen Zhenyu Technology |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Zinc Carbonate Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Zinc Carbonate Monohydrate |

|

4.2. Zinc Carbonate Hemihydrate |

|

4.3. Zinc Carbonate Anhydrous |

|

4.4. Others |

|

5. Zinc Carbonate Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Agriculture |

|

5.2. Pharmaceuticals |

|

5.3. Rubber Industry |

|

5.4. Paints and Coatings |

|

5.5. Chemicals and Metallurgy |

|

5.6. Others |

|

6. Zinc Carbonate Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Agriculture and Fertilizers |

|

6.2. Pharmaceuticals |

|

6.3. Cosmetics and Personal Care |

|

6.4. Chemical Manufacturing |

|

6.5. Rubber and Plastics |

|

6.6. Paint and Coatings |

|

6.7. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Zinc Carbonate Market, by Product Type |

|

7.2.7. North America Zinc Carbonate Market, by Application |

|

7.2.8. North America Zinc Carbonate Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Zinc Carbonate Market, by Product Type |

|

7.2.9.1.2. US Zinc Carbonate Market, by Application |

|

7.2.9.1.3. US Zinc Carbonate Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Zinc Nacional S.A. de C.V. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Sumitomo Chemical Co., Ltd. |

|

9.3. Shaanxi Yinxin Nonferrous Metal Co., Ltd. |

|

9.4. American Elements |

|

9.5. Zinc Oxide LLC |

|

9.6. Reinhold Group |

|

9.7. Yunnan Tin Company Limited |

|

9.8. Acmol Chemicals |

|

9.9. Hongda Group |

|

9.10. Henan Tianfu Chemical Co., Ltd. |

|

9.11. ViiV Healthcare |

|

9.12. Nantong Jinhao Chemicals Co., Ltd. |

|

9.13. Jiangsu Zhenyu Chemical Co., Ltd. |

|

9.14. Wuhan Xinrong New Materials Co., Ltd. |

|

9.15. Shenzhen Zhenyu Technology |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Zinc Carbonate Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Zinc Carbonate Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Zinc Carbonate Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats