As per Intent Market Research, the Xanthan Gum Market was valued at USD 0.6 billion in 2023 and will surpass USD 0.9 billion by 2030; growing at a CAGR of 6.3% during 2024 - 2030.

The xanthan gum market has seen significant growth driven by its versatile applications across various industries. Xanthan gum, a natural polysaccharide, is widely used as a stabilizer, thickening agent, and emulsifier in food & beverages, oil & gas, pharmaceuticals, cosmetics, and industrial products. As the demand for natural and gluten-free products increases, the xanthan gum market is experiencing expansion, with key players continuously innovating to meet the needs of diverse industries. The global market is expected to grow at a steady pace, driven by the increasing preference for plant-based ingredients and the growing need for high-quality, functional products in multiple sectors.

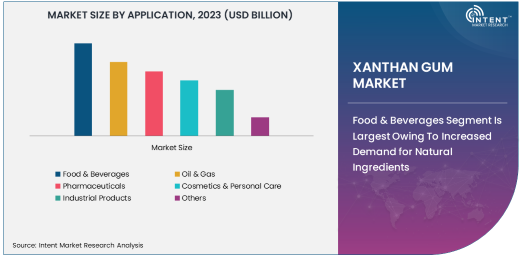

Food & Beverages Segment Is Largest Owing To Increased Demand for Natural Ingredients

The food and beverages segment remains the largest consumer of xanthan gum due to its widespread use in food processing. Xanthan gum is primarily used as a thickening agent, stabilizer, and emulsifier in various food products, including sauces, dressings, baked goods, dairy products, and beverages. Its ability to improve the texture and stability of food products makes it highly desirable, especially in gluten-free formulations and plant-based food alternatives. As the consumer demand for clean-label and natural ingredients continues to rise, xanthan gum's role in food manufacturing becomes even more critical. Companies are increasingly looking for alternatives to synthetic additives, making xanthan gum a preferred choice in the food industry.

The growing trend toward healthier, gluten-free, and organic food products further strengthens the demand for xanthan gum in the food and beverages sector. With an increasing number of consumers opting for plant-based, dairy-free, and gluten-free alternatives, the demand for xanthan gum in products like gluten-free baked goods, vegan beverages, and dairy substitutes is expected to continue its upward trajectory. This rise in consumer preference for healthier food options is expected to fuel the long-term growth of the xanthan gum market in the food and beverage industry.

Oil & Gas Segment Is Fastest Growing Owing To Enhanced Drilling Fluids Demand

The oil and gas sector is one of the fastest-growing applications of xanthan gum, primarily due to its critical role in drilling operations. Xanthan gum is used as a viscosifier in drilling fluids to improve the flow properties and stability of the fluid, ensuring efficient drilling activities. It also helps in suspending solids and promoting better circulation of mud during oil extraction processes. The increasing demand for oil and gas, coupled with the push for deeper and more complex drilling operations, has resulted in heightened demand for high-performance xanthan gum in the industry.

The oil and gas market is witnessing significant growth due to the continuous exploration of untapped reserves and the need for more advanced drilling technologies. As the market for unconventional oil and gas resources, such as shale oil, grows, the use of xanthan gum in drilling fluids becomes even more important. This growth is expected to continue as energy companies prioritize efficiency, sustainability, and cost-effectiveness in their operations, making xanthan gum an essential component in modern drilling fluids.

Powder Form Is Largest Owing To Versatility and Ease of Use

Xanthan gum is available in both powder and liquid forms, with powder being the largest subsegment due to its versatility and ease of use. The powder form of xanthan gum is highly preferred in applications where it needs to be mixed or dissolved in dry ingredients, such as in food and beverage products, cosmetics, and pharmaceuticals. Its ease of transport, storage, and handling has made it the preferred choice for manufacturers across various industries. Additionally, the powder form allows for precise control over the concentration of xanthan gum in formulations, offering manufacturers flexibility in product development.

The demand for powdered xanthan gum is also driven by the increasing need for customized formulations in different sectors. With the ability to blend easily into dry mixes, powder xanthan gum is favored in the production of bakery products, sauces, dressings, and cosmetics. Its application in powdered beverage formulations, such as instant smoothies and powdered protein drinks, is also gaining popularity. As the demand for high-quality, specialized products continues to rise, powdered xanthan gum will remain the dominant form in the market.

North America Is Largest Region Owing To Strong Demand Across Multiple Sectors

North America holds the largest market share for xanthan gum, driven by high demand from the food and beverage, oil and gas, and pharmaceutical industries. The region's well-established food processing sector, coupled with increasing consumer preference for natural and gluten-free products, contributes to the significant demand for xanthan gum. The presence of key xanthan gum manufacturers, such as CP Kelco, ADM, and DuPont, further strengthens North America's position as the largest market. Additionally, the growth of the oil and gas industry in North America, particularly in the United States, boosts the demand for xanthan gum in drilling operations.

North America is expected to continue its dominance due to the ongoing trends of clean-label and organic food products, as well as advancements in drilling technologies. The increasing demand for high-performance xanthan gum in pharmaceuticals, cosmetics, and personal care products also supports growth in the region. Furthermore, North America's strong regulatory environment ensures the quality and safety of xanthan gum products, making it a favorable market for manufacturers.

Competitive Landscape and Leading Companies

The xanthan gum market is highly competitive, with several large players dominating the global landscape. Companies like CP Kelco, DuPont, Cargill, and Fufeng Group are leading the market, focusing on product innovation and expansion to meet the growing demand for xanthan gum in various industries. These companies are leveraging their strong distribution networks and technological advancements to strengthen their position in the market. Strategic mergers and acquisitions, as well as investments in R&D, are key strategies employed by these players to enhance their product offerings and sustain their market leadership.

The competitive environment in the xanthan gum market is also shaped by increasing efforts to improve product sustainability and reduce environmental impact. As consumers become more environmentally conscious, manufacturers are adopting greener production methods and sustainable sourcing practices. The market is also witnessing increased collaboration among companies to develop customized xanthan gum solutions for specific industries, such as pharmaceuticals and cosmetics. These strategic moves are expected to drive market growth and shape the future of the xanthan gum industry.

Recent Developments:

- CP Kelco has announced the expansion of its xanthan gum production capabilities in North America to meet growing demand in the food and beverage industry.

- DuPont launched a new xanthan gum formulation designed specifically for enhanced performance in oil drilling operations, focusing on improving drilling fluid stability.

- Fufeng Group acquired a major xanthan gum manufacturer in Europe, strengthening its position in the global market and expanding its product offerings in the food sector.

- ADM introduced a new xanthan gum product aimed at improving the texture and consistency of gluten-free baked goods, catering to the rising consumer demand for gluten-free products.

- Solvay has implemented new sustainability initiatives in its xanthan gum production processes, reducing environmental impact and improving energy efficiency across its global operations.

List of Leading Companies:

- CP Kelco

- DuPont

- Fufeng Group

- Jiangsu Dehe Biological Technology

- ADM (Archer Daniels Midland)

- Cargill

- Hangzhou Fuyang Biotech

- Zhejiang Xinan Chemical

- Miwon Commercial Co.

- Shandong Zhongtian Biotechnology

- Solvay

- Kerry Group

- Lamberti Group

- Meihua Group

- Tianjin Chenguang Biotech Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 0.6 Billion |

|

Forecasted Value (2030) |

USD 0.9 Billion |

|

CAGR (2024 – 2030) |

6.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Xanthan Gum Market By Application (Food & Beverages, Oil & Gas, Pharmaceuticals, Cosmetics & Personal Care, Industrial Products), By End-User Industry (Food and Beverage Industry, Oil and Gas Industry, Pharmaceutical Industry, Cosmetics Industry), By Form (Powder, Liquid) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

CP Kelco, DuPont, Fufeng Group, Jiangsu Dehe Biological Technology, ADM (Archer Daniels Midland), Cargill, Hangzhou Fuyang Biotech, Zhejiang Xinan Chemical, Miwon Commercial Co., Shandong Zhongtian Biotechnology, Solvay, Kerry Group, Lamberti Group, Meihua Group, Tianjin Chenguang Biotech Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Xanthan Gum Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Food & Beverages |

|

4.2. Oil & Gas |

|

4.3. Pharmaceuticals |

|

4.4. Cosmetics & Personal Care |

|

4.5. Industrial Products |

|

4.6. Others |

|

5. Xanthan Gum Market, by Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Powder |

|

5.2. Liquid |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Xanthan Gum Market, by Application |

|

6.2.7. North America Xanthan Gum Market, by Form |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Xanthan Gum Market, by Application |

|

6.2.8.1.2. US Xanthan Gum Market, by Form |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. CP Kelco |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. DuPont |

|

8.3. Fufeng Group |

|

8.4. Jiangsu Dehe Biological Technology |

|

8.5. ADM (Archer Daniels Midland) |

|

8.6. Cargill |

|

8.7. Hangzhou Fuyang Biotech |

|

8.8. Zhejiang Xinan Chemical |

|

8.9. Miwon Commercial Co. |

|

8.10. Shandong Zhongtian Biotechnology |

|

8.11. Solvay |

|

8.12. Kerry Group |

|

8.13. Lamberti Group |

|

8.14. Meihua Group |

|

8.15. Tianjin Chenguang Biotech Group |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Xanthan Gum Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Xanthan Gum Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Xanthan Gum Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA