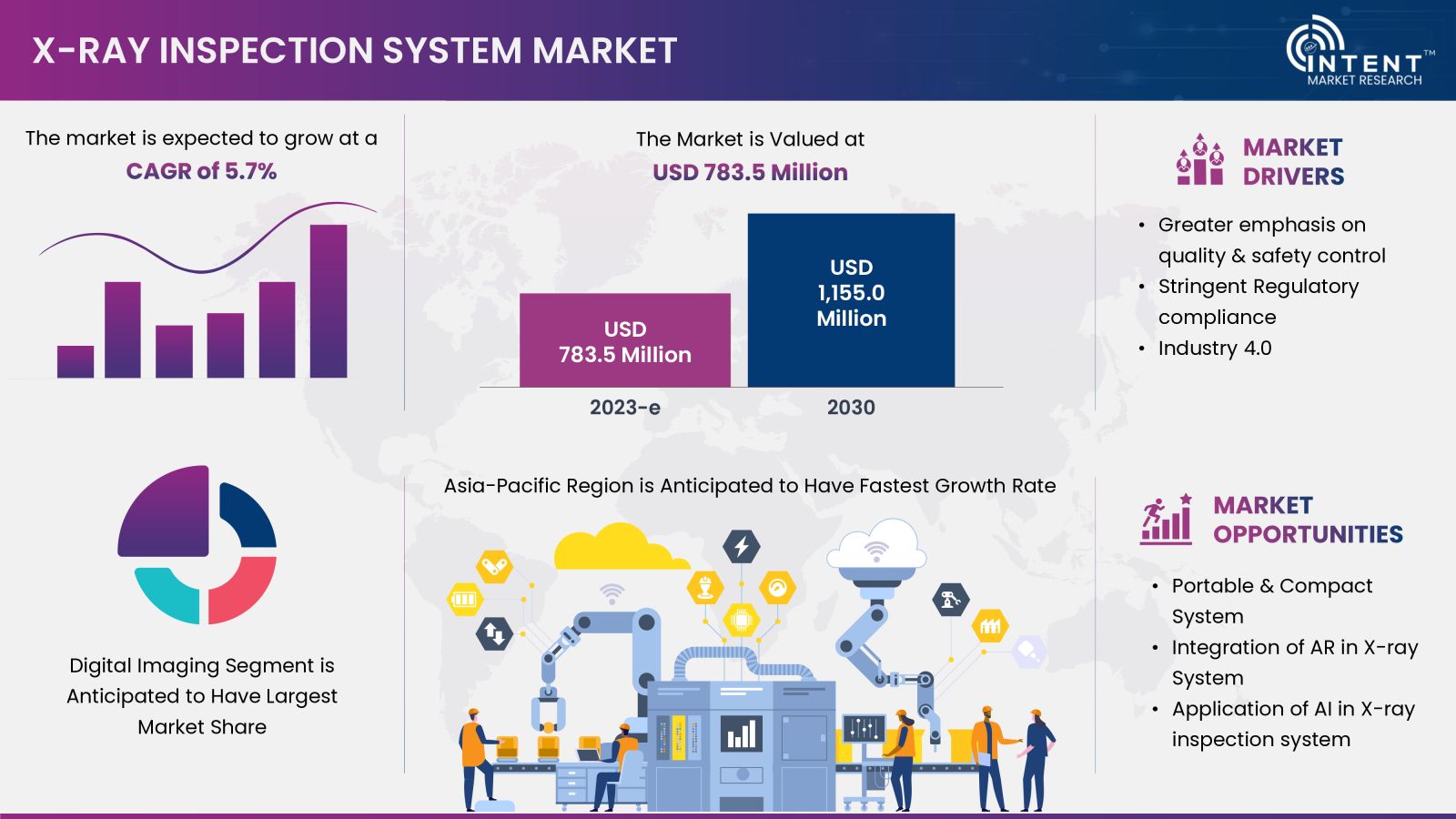

According to Intent Market Research, the X-ray Inspection System Market is expected to grow from USD 783.5 million billion in 2023-e at a CAGR of 5.7% to touch USD 1,155.0 million by 2030. The X-ray inspection system market is competitive, the prominent players in the global market include Anritsu, Comet, Ishida, Mettler Toledo, Nikon, Nordson DAGE, Omron, Shimadzu, Smiths Detection, Thermo Fisher Scientific, Toshiba, among others. An X-ray inspection system uses a non-destructive inspection method such as radiography to find hidden features within a target object. It is mainly used to identify contaminants, cracks, and related manufacturing errors. It is widely used in various industries to improve quality of product.

Click here to: Get FREE Sample Pages of this Report

Stringent regulatory compliance driving the X-ray inspection demand from industries

Stringent regulatory compliance requirements are a major driving force behind the increased demand for X-ray inspection systems across various industries. Regulatory standards are put in place to ensure the safety, quality, and reliability of products and processes. X-ray inspection systems play a crucial role in helping industries meet and exceed these standards. Such regulations helps to build the trust between producer and consumer.

Several countries have charted mandatory quality standards for different industries to improve the product quality and for the benefits of consumers. This, in turn, drives the demand for such products considering the trustworthy quality standards from the government body. Such government bodies also reinforce the industry players to stick to best quality standards that are critical for consumer’s consumption or use. In December 2023, U.S. FDA has inspected the Dr. Reddy's R&D center in India.

X-ray inspection system market segment insights

Faster inspection from digital imaging, drives the segmental growth

The X-ray inspection system market is dominated by digital imaging segment in 2023. Digital imaging offers increased efficiency, reduced film and chemical expenses, and improved productivity. Also, digital X-ray systems offer faster image acquisition and reduced processing time. The immediate availability of digital images contributes to improved workflow efficiency. Such images can be transferred electronically, allowing for seamless and rapid sharing of data.

3D systems poised to grow in the forecasted period

The growth of 3D system is due to the stringent government regulations for high quality standards and greater focus of safety control, and rising demand for high quality products from consumers. It is estimated that the 3D X-ray inspection system will grow with the significant CAGR during the forecasted period as it can provide 3D imaging, allowing for a more detailed inspection of complex 3D structures.

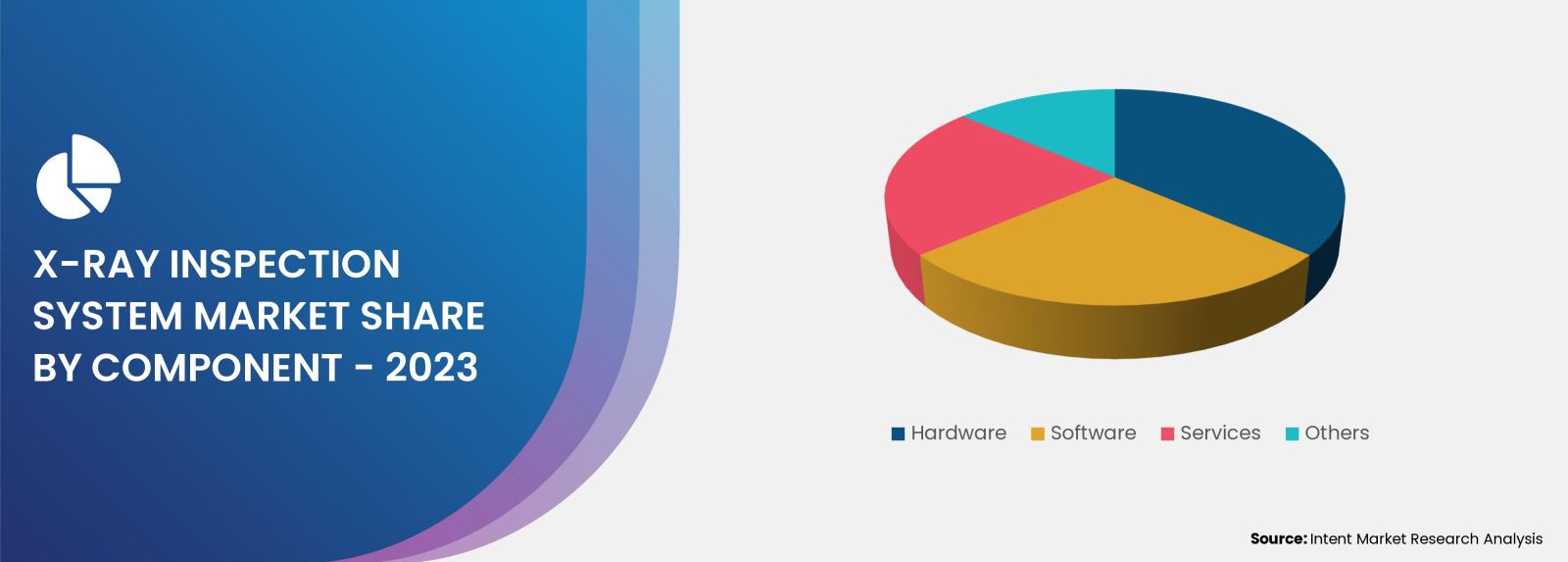

Software segment poised for high growth in coming years

Rapid advancement in digital imaging of X-ray inspection systems is poised to grow the share of the software segment in the forecast period. Software integrated in X-ray inspection systems is a critical aspect that enhances functionality, data management, and overall efficiency. X-ray inspection system are integrated with software such as image acquisition & processing, real-time imaging, workflow optimization, data sharing, etc. The critical role of software to function inspection systems is poised to show a significant growth rate during the forecasted period.

Solid/Metal inspection captures the major share of the market

In several industries, solid/metal inspection is critical for matching quality standards. In automotive, and electronics & semiconductor, X-ray inspection is widely used for inspecting solid materials such as metal, plastic, ceramic, and composite components. In aerospace & defense, it is employed for quality control, defect detection, and ensuring the structural integrity of manufactured items.

X-ray inspection is crucial for inspecting welds, castings, and complex structures in the aerospace and automotive industries to ensure compliance with safety and quality standards. The high utilization of X-ray system for solid/metal inspection across various industries has promoted its share at the global level.

Fully automatic system expected to grow during the forecast period

A fully automatic X-ray inspection system offers several benefits across various industries, providing efficient and reliable solutions for quality control, defect detection, and non-destructive testing. Fully automatic X-ray inspection systems operate without the need for manual intervention. This automation speeds up the inspection process, leading to higher throughput and increased overall efficiency.

Automation eliminates variability introduced by human factors, ensuring consistent and repeatable inspection results. This is crucial for applications that require high precision and accuracy in defect detection and measurement. Fully automatic X-ray inspection systems, with their combination of speed, precision, and adaptability, expected to record significant growth rate during the forecast period.

Contaminant detection to drive the segmental growth

X-ray inspection system sees wide application of contaminant detection, weight inspection, packaging inspection etc. In food processing, pharmaceuticals, manufacturing, contaminant detection is crucial for the highest standard of production. X-ray inspection can detect various foreign objects, including metal, glass, plastic, stone, bone, and other dense materials. It can also identify organic contaminants, such as wood, rubber, or insects, depending on their density.

X-ray inspection system has high demand from oil & gas industry

X-ray inspection systems play a crucial role in the oil and gas industry for non-destructive testing (NDT) and quality control of various components and materials. These systems help ensure the integrity of critical assets, comply with industry standards, and identify potential defects in pipelines, welds, and other components. X-ray inspection is used to assess the quality of welds in pipelines. It helps identify weld defects such as porosity, cracks, and lack of fusion, ensuring the structural integrity of the welded joints.

The harsh and challenging environments, as well as the critical nature of oil and gas facilities, demand thorough and regular inspection processes. A regular inspection in oil & gas plant prevents heavy loss of capital, thereby improving overall productivity of the plant.

Asia-Pacific to see Higher Growth during the Forecast Period

Asia-Pacific has been a hub for manufacturing activities across various industries, including automotive, electronics, food & beverages, and pharmaceuticals. The demand for X-ray inspection systems in manufacturing is driven by the need for quality control and defect detection. The pharmaceutical sector in the Asia-Pacific has seen significant growth in the recent past. X-ray inspection is crucial in pharmaceutical manufacturing for quality control, ensuring the integrity of tablets, capsules, and other medical products.

Additionally, stringent regulatory standards mandated by the regional governments for various industries, such as food safety and manufacturing, drive the adoption of X-ray inspection systems to meet compliance standards.

Major industry players are enhancing their market positions by adopting several growth strategies

Major players operating in the global X-ray inspection system market are Anritsu, Comet, Ishida, Mettler Toledo, Nikon, Nordson DAGE, Omron, Shimadzu, Smiths Detection, Thermo Fisher Scientific, Toshiba, among others. Presence of several players have significantly fragmented the market. To tap the potential share of the market, major players have started adopting strategies such as new product launch, merger & acquisition, partnership & collaboration, etc. Some of the significant developments are mentioned below

- In April 2023, Nikon announced the launch of the large-volume high-performance X-ray and CT Systems "VOXLS 40 C 450". This product realizes non-destructive inspection of various components, from small to large by using the X-ray and CT (computed tomography scan) function to implement high-accuracy measurement, confirmation of internal shapes, and defect analysis.

- In October 2023, Nordson unveil its new Quadra Pro 7 Manual X-Ray Inspection (MXI) system. Its Onyx detector technology ensures exceptional image clarity and reduced noise levels, ultimately translating to elevated levels of precision and efficiency.

Click here to: Get your custom research report today

X-ray Inspection System Market Coverage

The report provides key insights into the X-ray inspection system market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting the market growth. It analyses key players as well as the competitive landscape within the global X-ray inspection system market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 783.5 Million |

|

Forecast Revenue (2030) |

USD 1,155.0 Million |

|

CAGR (2024-2030) |

5.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

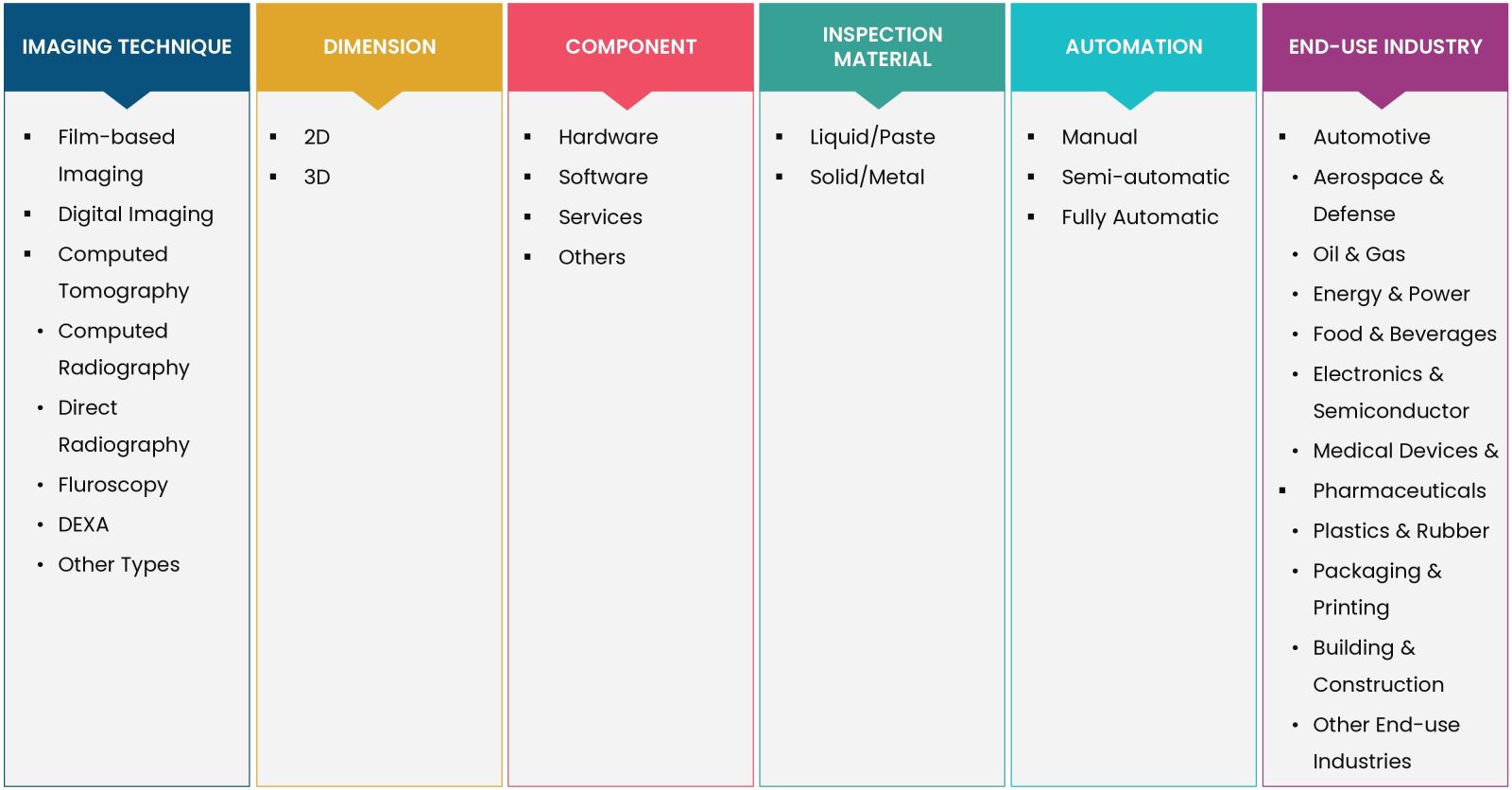

Segments Covered |

X-ray Inspection System Market By Imaging Technique (Film-Based Imaging, Digital Imaging (Computed Tomography, Computed Radiography, Direct Radiography, Fluroscopy, Dual-Energy X-ray Absorptiometry, Other Types)); By Dimension (2D, 3D); By Component (Hardware, Software, Services, Others); By Inspection Material (Liquid/Paste Inspection, Solid/Metal Inspection); By Automation (Manual, Semi-automatic, Fully Automatic) By Application (Contaminant Detection, Weight Inspection, Others); By End-use Industry (Automotive, Aerospace & Defense, Oil & Gas, Energy & Power, Food & Beverages, Electronics & Semiconductor, Medical Devices & Pharmaceuticals, Plastics & Rubber, Packaging & Printing, Building & Construction, Other End-use Industries). |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America and Middle East & Africa |

|

Competitive Landscape |

Anritsu, Comet, Ishida, Mettler Toledo, Nikon, Nordson DAGE, Omron, Shimadzu, Smiths Detection, Thermo Fisher Scientific, Toshiba, among others. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions & Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.Greater Emphasis on Quality & Safety Control |

|

4.1.2.Stringent Regulatory Compliance |

|

4.1.3.Growing Focus on Industrial Automation & Robotics, and Industry 4.0 |

|

4.2.Restraints |

|

4.2.1.High Cost of System |

|

4.2.2.Availability of Substitute Technologies |

|

4.3.Opportunities |

|

4.3.1.Demand for Portable & Compact System |

|

4.3.2.Integration of AR in X-ray System |

|

4.4.Challenges |

|

4.4.1.Complexity in Integration of Advanced Technologies Within Older Production Line |

|

4.5.Trends |

|

4.5.1.Application of AI in X-ray Inspection System |

|

5.Market Outlook |

|

5.1.Pricing Analysis |

|

5.2.Supply Chain Analysis |

|

5.3.PORTER's Five Forces Analysis |

|

5.4.PESTLE Analysis |

|

6.Market Size By Imaging Technique (Market Size & Forecast: USD Million, 2024 – 2030) |

|

6.1.Film-Based Imaging |

|

6.2.Digital Imaging |

|

6.2.1.Computed Radiography |

|

6.2.2.Computed Tomography |

|

6.2.3.Direct Radiography |

|

6.2.4.Fluroscopy |

|

6.2.5.Dual-Energy X-ray Absorptiometry (DEXA) |

|

6.2.6.Other Types |

|

7.Market Size By Dimension (Market Size & Forecast: USD Million, 2024 – 2030) |

|

7.1.2D |

|

7.2.3D |

|

8.Market Size By Component (Market Size & Forecast: USD Million, 2024 – 2030) |

|

8.1.Hardware |

|

8.2.Software |

|

8.3.Services |

|

8.4.Others (Consumables, Accessories, etc.) |

|

9.Market Size By Inspection Material Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

9.1.Liquid/Paste Inspection |

|

9.2.Solid/Metal Inspection |

|

10.Market Size By Automation (Market Size & Forecast: USD Million, 2024 – 2030) |

|

10.1. Manual |

|

10.2. Semi-automatic |

|

10.3. Fully Automatic |

|

11.Market Size By Application (Market Size & Forecast: USD Million, 2024 – 2030) |

|

11.1. Contaminant Detection (Quality Inspection) |

|

11.2. Weight Inspection |

|

11.3. Others |

|

12.Market Size By End-use Industry (Market Size & Forecast: USD Million, 2024 – 2030) |

|

12.1. Automotive |

|

12.2. Aerospace & Defense |

|

12.3. Oil & Gas |

|

12.4. Energy & Power |

|

12.5. Food & Beverages |

|

12.6. Electronics & Semiconductor |

|

12.7. Medical Devices & Pharmaceuticals |

|

12.8. Plastics & Rubber |

|

12.9. Packaging & Printing |

|

12.10. Building & Construction |

|

12.11. Other End-use Industries |

|

13.Regional Outlook (Market Size & Forecast: USD Million, 2024 – 2030) |

|

13.1. North America |

|

13.1.1. US |

|

13.1.1.1. US Market Outlook by Imaging Technique |

|

13.1.1.2. US Market Outlook by Dimension |

|

13.1.1.3. US Market Outlook by Component |

|

13.1.1.4. US Market Outlook by Inspection Material Type |

|

13.1.1.5. US Market Outlook by Automation |

|

13.1.1.6. US Market Outlook by Application |

|

13.1.1.7. US Market Outlook by End-use Industry |

|

Note: Similar Cross-segmentation for each country will be covered as shown above |

|

13.1.2. Canada |

|

13.2. Asia-Pacific |

|

13.2.1. China |

|

13.2.2. Japan |

|

13.2.3. South Korea |

|

13.2.4. India |

|

13.3. Europe |

|

13.3.1. UK |

|

13.3.2. Germany |

|

13.3.3. France |

|

13.3.4. Italy |

|

13.4. Latin America |

|

13.5. Middle East & Africa |

|

14.Competitive Landscape |

|

14.1. Market Share Analysis |

|

14.2. Key Market Growth Strategies |

|

14.3. Company Strategy Analysis |

|

14.4. Competitive Benchmarking |

|

15.Company Profile |

|

15.1. Anritsu |

|

15.2. Comet |

|

15.3. Ishida |

|

15.4. Mettler Toledo |

|

15.5. Nikon |

|

15.6. Nordson DAGE |

|

15.7. Omron |

|

15.8. Shimadzu |

|

15.9. Smiths Detection |

|

15.10. Thermo Fisher Scientific |

|

15.11. Toshiba |

|

16.Appendix |

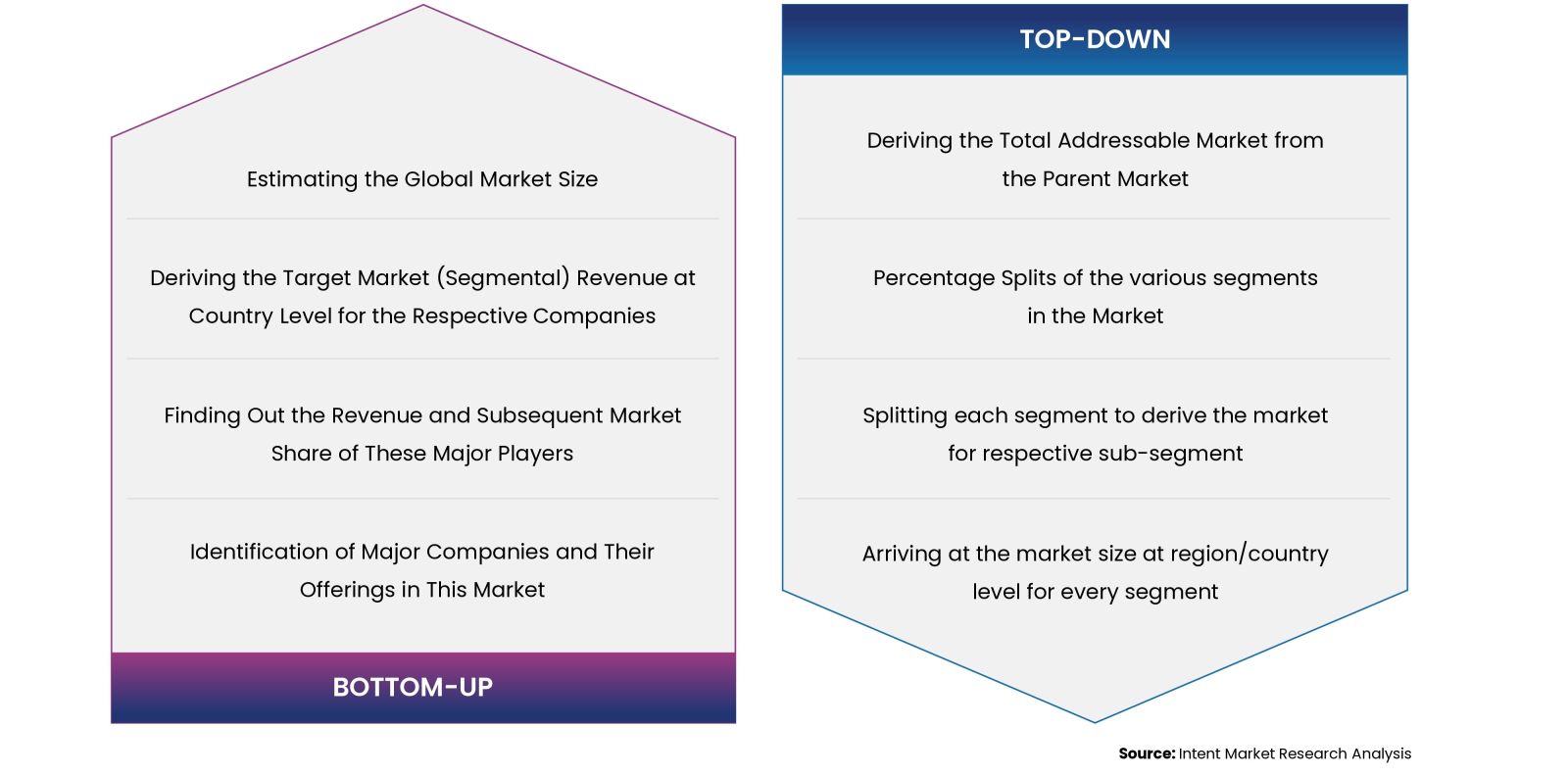

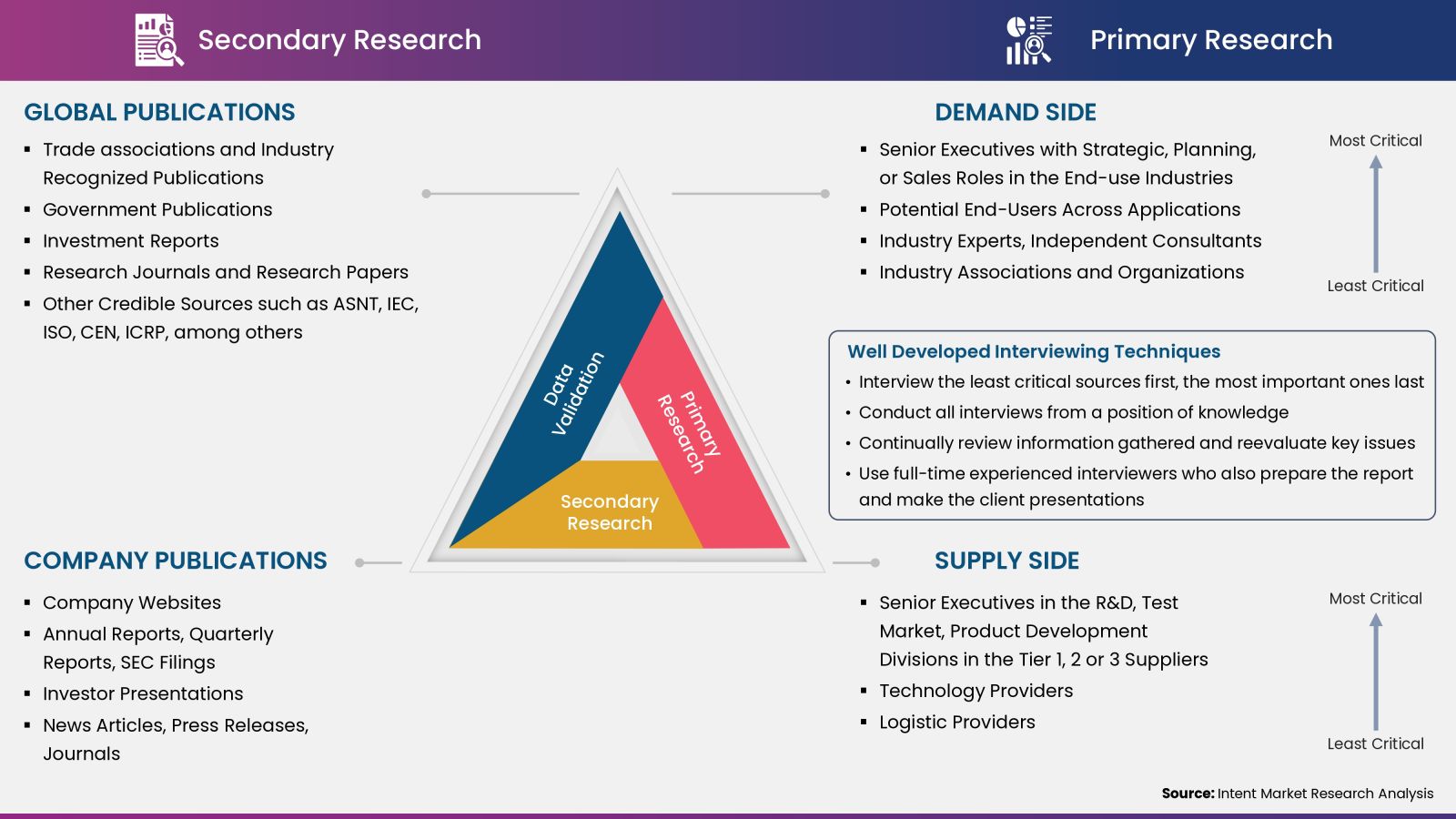

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.