As per Intent Market Research, the Wound Type Current Transformer Market was valued at USD 12.5 billion in 2023 and will surpass USD 89.7 billion by 2030; growing at a CAGR of 32.5% during 2024 - 2030.

The Wound Type Current Transformer (CT) market is crucial for various electrical applications, providing reliable current measurement and protection in power systems. These transformers are integral to power generation, transmission, and industrial settings, offering accurate data to safeguard against faults and maintain efficiency in electrical grids. The market is seeing growth driven by advancements in technology, increasing power demand, and the shift towards smart grid solutions. Moreover, with expanding industrial infrastructure and the increasing focus on renewable energy, the need for dependable and efficient current transformers is becoming more pronounced.

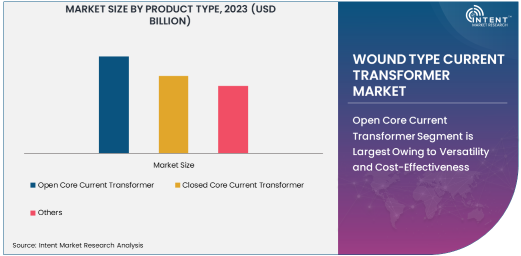

Open Core Current Transformer Segment is Largest Owing to Versatility and Cost-Effectiveness

Among the different types of Wound Type Current Transformers, the Open Core Current Transformer segment is the largest due to its versatility and cost-effectiveness. Open core transformers are widely used across various applications due to their ability to measure high currents efficiently and their simpler construction, which reduces manufacturing costs. This makes them a popular choice for industrial and commercial applications. These transformers are generally more affordable compared to their closed-core counterparts, contributing to their widespread adoption in industries where cost efficiency is critical.

Additionally, open core current transformers are easier to install and maintain, which makes them particularly appealing for power transmission and distribution networks. They are well-suited for measuring electrical currents in large-scale infrastructure projects, making them indispensable for power companies. As the need for electrical safety and accurate measurement continues to grow, open core current transformers remain the dominant choice in the market.

Power Generation End-Use Industry is Largest Due to Increased Demand for Reliable Power Supply

The Power Generation segment is the largest end-user of Wound Type Current Transformers, driven by the continuous demand for reliable power supply. With the growing global focus on sustainable and renewable energy sources, there is a heightened need for dependable transformers to ensure the proper functioning of power plants. These transformers play a critical role in monitoring current flow and providing protection, which is vital in preventing costly downtime and ensuring the smooth operation of power generation plants.

In particular, power plants require highly accurate current transformers to monitor the electrical output and ensure that everything is operating within safe limits. The integration of renewable energy sources, such as wind and solar power, is further fueling the demand for advanced current transformers in power generation. As the industry continues to innovate and expand, the need for these transformers in power generation applications is expected to grow steadily.

Measurement and Protection Application is Fastest Growing Owing to Technological Advancements

Among the various applications of Wound Type Current Transformers, the Measurement and Protection segment is the fastest growing. This is primarily due to the increasing adoption of smart grid technology and the ongoing digital transformation of power systems. Accurate current measurement and protection are essential to prevent overloads, short circuits, and equipment failure in both industrial and commercial sectors. The rising demand for enhanced electrical grid stability and automation has further spurred the growth of this segment.

Technological advancements in sensors and real-time monitoring are driving the need for more efficient measurement and protection transformers. As industries move towards a more interconnected and automated environment, the role of current transformers in ensuring the safety and reliability of electrical systems becomes more critical. Consequently, this segment is poised for rapid growth, with an increasing shift towards integrated protection and monitoring systems in both the industrial and utility sectors.

Asia Pacific Region is Fastest Growing Due to Expanding Infrastructure and Energy Demand

The Asia Pacific region is the fastest growing market for Wound Type Current Transformers. The rapid industrialization, increasing demand for electricity, and expansion of power grids in countries like China, India, and Southeast Asia are major factors driving the demand for these transformers. The region is heavily investing in upgrading its power infrastructure to meet the growing energy needs, and Wound Type Current Transformers play a crucial role in this process by offering reliable current measurement and protection solutions.

Additionally, with the growing emphasis on renewable energy sources in the region, the demand for efficient power generation and transmission systems is further elevating the need for advanced current transformers. As countries in Asia Pacific push for energy reforms and infrastructure modernization, the Wound Type Current Transformer market is expected to continue expanding at a rapid pace in this region, offering significant growth opportunities for manufacturers.

Leading Companies and Competitive Landscape

The Wound Type Current Transformer market is highly competitive, with several leading companies contributing to its growth. Key players include Siemens AG, ABB Ltd., Schneider Electric SE, General Electric Company, and Mitsubishi Electric Corporation. These companies are at the forefront of technological advancements in transformer design and are constantly innovating to meet the demands of the rapidly evolving power industry.

The competitive landscape is shaped by the increasing focus on energy efficiency, renewable energy integration, and smart grid solutions. Leading companies are investing in research and development to introduce new transformer models that are more accurate, efficient, and compatible with digital monitoring systems. Additionally, mergers and acquisitions are common in this sector, as companies seek to expand their product portfolios and strengthen their market presence. As the demand for reliable current measurement and protection solutions continues to rise, these companies are well-positioned to capitalize on the growing market opportunities.

Recent Developments:

- Siemens AG announced the launch of its latest series of high-efficiency Wound Type Current Transformers designed for smart grid applications, offering improved measurement accuracy and reduced energy losses.

- ABB Ltd. completed an acquisition of a leading provider of protection and control solutions, strengthening its portfolio in the Wound Type Current Transformer market for power transmission and distribution networks.

- General Electric (GE) introduced new Wound Type Current Transformers with integrated IoT capabilities, allowing for real-time monitoring and predictive maintenance in industrial applications.

- Mitsubishi Electric Corporation unveiled its advanced closed-core Wound Type Current Transformers that offer better fault detection and enhanced safety features for industrial applications, targeting growing demand in the renewable energy sector.

- Toshiba Corporation received regulatory approval for its new Wound Type Current Transformer models, which comply with the latest international safety and environmental standards, expanding their use in power plants globally

List of Leading Companies:

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- General Electric Company (GE)

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- Eaton Corporation Plc

- Toshiba Corporation

- CG Power and Industrial Solutions Limited

- RITTAL GmbH & Co. KG

- Powell Industries, Inc.

- Fuji Electric Co. Ltd.

- Crompton Greaves Consumer Electricals Limited

- BHEL (Bharat Heavy Electricals Limited)

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 12.5 Billion |

|

Forecasted Value (2030) |

USD 89.7 Billion |

|

CAGR (2024 – 2030) |

32.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wound Type Current Transformer Market By Product Type (Open Core Current Transformer, Closed Core Current Transformer), By End-Use Industry (Power Generation, Power Transmission and Distribution, Industrial Applications, Commercial Applications), By Application (Measurement and Protection, Power and Energy Metering, Substation Protection) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Siemens AG, ABB Ltd., Schneider Electric SE, General Electric Company (GE), Mitsubishi Electric Corporation, Honeywell International Inc., Emerson Electric Co., Eaton Corporation Plc, Toshiba Corporation, CG Power and Industrial Solutions Limited, RITTAL GmbH & Co. KG, Powell Industries, Inc., Fuji Electric Co. Ltd., Crompton Greaves Consumer Electricals Limited, BHEL (Bharat Heavy Electricals Limited) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wound Type Current Transformer Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Open Core Current Transformer |

|

4.2. Closed Core Current Transformer |

|

4.3. Others |

|

5. Wound Type Current Transformer Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Power Generation |

|

5.2. Power Transmission and Distribution |

|

5.3. Industrial Applications |

|

5.4. Commercial Applications |

|

5.5. Others |

|

6. Wound Type Current Transformer Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Measurement and Protection |

|

6.2. Power and Energy Metering |

|

6.3. Substation Protection |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wound Type Current Transformer Market, by Product Type |

|

7.2.7. North America Wound Type Current Transformer Market, by End-Use Industry |

|

7.2.8. North America Wound Type Current Transformer Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wound Type Current Transformer Market, by Product Type |

|

7.2.9.1.2. US Wound Type Current Transformer Market, by End-Use Industry |

|

7.2.9.1.3. US Wound Type Current Transformer Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Siemens AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. ABB Ltd. |

|

9.3. Schneider Electric SE |

|

9.4. General Electric Company (GE) |

|

9.5. Mitsubishi Electric Corporation |

|

9.6. Honeywell International Inc. |

|

9.7. Emerson Electric Co. |

|

9.8. Eaton Corporation Plc |

|

9.9. Toshiba Corporation |

|

9.10. CG Power and Industrial Solutions Limited |

|

9.11. RITTAL GmbH & Co. KG |

|

9.12. Powell Industries, Inc. |

|

9.13. Fuji Electric Co. Ltd. |

|

9.14. Crompton Greaves Consumer Electricals Limited |

|

9.15. BHEL (Bharat Heavy Electricals Limited) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wound Type Current Transformer Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wound Type Current Transformer Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wound Type Current Transformer Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA