As per Intent Market Research, the Wound Care Centers Market was valued at USD 11.3 billion in 2023 and will surpass USD 19.8 billion by 2030; growing at a CAGR of 8.4% during 2024 - 2030.

The Wound Care Centers market has experienced significant growth due to the rising incidence of chronic and acute wounds, driven by factors such as the increasing global aging population and the rising prevalence of chronic conditions like diabetes, cardiovascular diseases, and obesity. These conditions often lead to chronic wounds that require specialized care. Wound care centers play a crucial role in providing advanced treatment options for a wide range of wound types, including diabetic ulcers, pressure ulcers, and surgical wounds. With a focus on delivering tailored, patient-centered care, these centers employ a variety of wound care services, from advanced dressings and therapies to surgical interventions, to accelerate healing and improve patient outcomes.

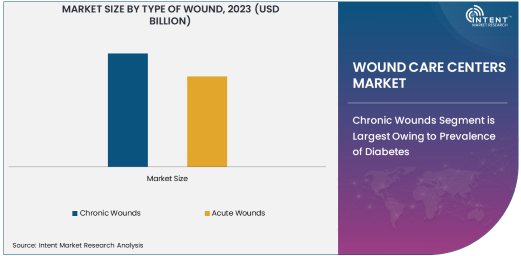

Chronic Wounds Segment is Largest Owing to Prevalence of Diabetes

Among the different types of wounds treated at wound care centers, chronic wounds represent the largest segment. Chronic wounds, particularly diabetic foot ulcers, venous ulcers, and pressure ulcers, are becoming increasingly prevalent due to the rise in chronic diseases such as diabetes and obesity. Chronic wounds are notoriously difficult to heal, often leading to prolonged treatment durations and more complex care needs. As these conditions become more common, there is a growing demand for specialized wound care services, making chronic wounds the largest focus within the wound care centers market.

Wound care centers provide specialized treatments for chronic wounds, including advanced dressings, debridement, negative pressure wound therapy (NPWT), and biological therapies, which significantly enhance the healing process. The demand for these services continues to grow as the global population ages and the incidence of chronic diseases rises, making chronic wounds the dominant driver of the market's growth.

Outpatient Services Segment is Largest Owing to Convenience and Cost-Effectiveness

In terms of services offered, outpatient services are the largest segment in the wound care centers market. Outpatient services are preferred by patients due to their convenience, lower costs, and the ability to continue with regular daily activities. These services are particularly beneficial for patients with chronic wounds who require ongoing management but do not need the intensive care provided by inpatient services. Many wound care centers offer outpatient treatments such as wound dressing changes, debridement, and advanced therapies like hyperbaric oxygen therapy (HBOT) for chronic wound healing.

The outpatient model is widely adopted as it allows patients to receive treatment on a flexible schedule, without the need for extended hospital stays. Moreover, the cost-effectiveness of outpatient care makes it an attractive option for both patients and healthcare providers, contributing to its dominance in the market.

Specialized Wound Care Centers Segment is Fastest Growing Owing to Increased Focus on Expertise

The specialized wound care centers segment is the fastest growing in the market. These centers focus exclusively on providing specialized treatments for a variety of wounds, including chronic and acute wounds, and offer tailored care that often involves advanced technologies, medical expertise, and a multi-disciplinary approach. The growing recognition of the importance of specialized care for complex wounds is driving the demand for these centers, particularly in urban areas where access to advanced treatments is more readily available.

Specialized wound care centers typically offer a range of services, including non-surgical and surgical treatments, advanced wound dressings, and personalized care plans, to ensure the best possible outcomes. Their ability to provide focused and expert care for chronic and complex wounds has led to a steady increase in the number of such centers, making them the fastest-growing segment in the wound care centers market.

Hospitals Segment is Largest End-Use Industry Due to Broad Patient Base

The hospitals segment is the largest end-use industry in the wound care centers market. Hospitals cater to a wide range of patients, including those with acute and chronic wounds, and often have dedicated departments or specialized wound care units. Hospitals play a pivotal role in managing severe or complex cases of wound care, especially for patients with underlying health conditions such as diabetes, which can complicate wound healing. The comprehensive care provided by hospitals, including surgical intervention, advanced wound therapies, and inpatient care, positions them as the dominant provider of wound care services.

Moreover, hospitals benefit from the infrastructure and resources needed to provide high-quality care, such as trained medical personnel and access to advanced medical technologies. As a result, they continue to be the largest providers of wound care services, especially for patients requiring intensive, multi-disciplinary treatment.

North America Leads the Market Owing to Advanced Healthcare Infrastructure

North America remains the largest region in the wound care centers market, driven by well-established healthcare infrastructure, high levels of healthcare spending, and a growing geriatric population. The United States, in particular, accounts for a significant share of the market due to the prevalence of chronic diseases such as diabetes and obesity, which contribute to the high incidence of chronic wounds. The demand for advanced wound care services in the region is further supported by the presence of a large number of hospitals and specialized wound care centers offering comprehensive care.

The region also benefits from advanced healthcare technologies, including the widespread use of negative pressure wound therapy, bioengineered skin substitutes, and hyperbaric oxygen therapy, which are commonly used in wound care centers. As the healthcare system continues to evolve to meet the growing demand for specialized wound care, North America is expected to remain the largest and most lucrative market for wound care centers.

Competitive Landscape

The wound care centers market is highly competitive, with several leading players providing comprehensive wound care services. Some of the key players include Amedisys Inc., Healogics Inc., and LHC Group, which operate extensive networks of wound care centers across North America. These companies offer a wide range of services, including outpatient and inpatient care, advanced therapies, and surgical wound care, catering to both chronic and acute wound management.

In addition to large healthcare providers, many independent wound care centers are expanding their reach to meet the growing demand for specialized treatments. The market is characterized by a mix of well-established hospitals, specialized centers, and ambulatory surgical centers, which are increasingly adopting advanced technologies and treatment methods to improve patient outcomes. Strategic partnerships, acquisitions, and the adoption of innovative technologies are key trends shaping the competitive landscape in the wound care centers market.

Recent Developments:

- Healogics Inc. expanded its network of wound care centers across the U.S., introducing advanced biologic treatments for chronic wounds.

- Smith & Nephew partnered with a leading wound care center to introduce a new line of innovative wound management products.

- Acelity Inc. launched a new advanced tissue therapy device in collaboration with multiple wound care centers, aimed at improving healing times.

- Medtronic PLC opened a new regional wound care center, focusing on providing specialized services for diabetic foot ulcers.

- ConvaTec Group acquired a key competitor in the wound care center sector, strengthening its global reach in providing wound healing solutions.

List of Leading Companies:

- Acelity Inc.

- Wound Care Centers, LLC

- Healogics Inc.

- BioMedica Inc.

- Advanced Tissue

- KCI Medical

- Medtronic PLC

- Mölnlycke Health Care

- ConvaTec Group

- Smith & Nephew

- Integra LifeSciences

- Organogenesis

- Woundtech, Inc.

- Patient Care Systems

- Swiss Medical Solutions

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 11.3 Billion |

|

Forecasted Value (2030) |

USD 19.8 Billion |

|

CAGR (2024 – 2030) |

8.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wound Care Centers Market by Type of Wound (Chronic Wounds, Acute Wounds), by Services Offered (Outpatient Services, Inpatient Services, Surgical Wound Care, Non-Surgical Wound Care), and by End-Use Industry (Hospitals, Specialized Wound Care Centers, Ambulatory Surgical Centers, Home Healthcare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Acelity Inc., Wound Care Centers, LLC, Healogics Inc., BioMedica Inc., Advanced Tissue, KCI Medical, Mölnlycke Health Care, ConvaTec Group, Smith & Nephew, Integra LifeSciences, Organogenesis, Woundtech, Inc., Swiss Medical Solutions |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wound Care Centers Market, by Type of Wound (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Chronic Wounds |

|

4.2. Acute Wounds |

|

5. Wound Care Centers Market, by Services Offered (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Outpatient Services |

|

5.2. Inpatient Services |

|

5.3. Surgical Wound Care |

|

5.4. Non-Surgical Wound Care |

|

6. Wound Care Centers Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hospitals |

|

6.2. Specialized Wound Care Centers |

|

6.3. Ambulatory Surgical Centers |

|

6.4. Home Healthcare |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wound Care Centers Market, by Type of Wound |

|

7.2.7. North America Wound Care Centers Market, by Services Offered |

|

7.2.8. North America Wound Care Centers Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wound Care Centers Market, by Type of Wound |

|

7.2.9.1.2. US Wound Care Centers Market, by Services Offered |

|

7.2.9.1.3. US Wound Care Centers Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Fuji Film Holdings Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Agfa-Gevaert Group |

|

9.3. Carestream Health |

|

9.4. Varex Imaging Corporation |

|

9.5. Eastman Kodak Company |

|

9.6. Konica Minolta, Inc. |

|

9.7. PerkinElmer, Inc. |

|

9.8. Dentsply Sirona |

|

9.9. Foma Bohemia a.s. |

|

9.10. Imageworks LLC |

|

9.11. Ortho-Clinical Diagnostics, Inc. |

|

9.12. Shenzhen Anke High-Tech Co., Ltd. |

|

9.13. Xograph Healthcare Ltd. |

|

9.14. UDL Laboratories Ltd. |

|

9.15. Shandong Xinhua Pharmaceutical Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wound Care Centers Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wound Care Centers Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wound Care Centers Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA