As per Intent Market Research, the Wound Care Biologics Market was valued at USD 2.3 billion in 2023 and will surpass USD 4.3 billion by 2030; growing at a CAGR of 9.1% during 2024 - 2030.

The Wound Care Biologics Market has seen substantial growth in recent years, driven by advancements in biotechnology and an increasing demand for effective treatments for chronic and acute wounds. Biologics offer promising solutions for wound healing, especially for difficult-to-treat wounds such as diabetic ulcers, burns, and surgical wounds. These products, which include growth factors, skin substitutes, and cellular therapies, are revolutionizing wound care by enhancing the body’s natural healing processes and promoting tissue regeneration. As the global population ages and the incidence of chronic conditions such as diabetes increases, the need for advanced wound care products is expected to rise, further fueling the market's growth.

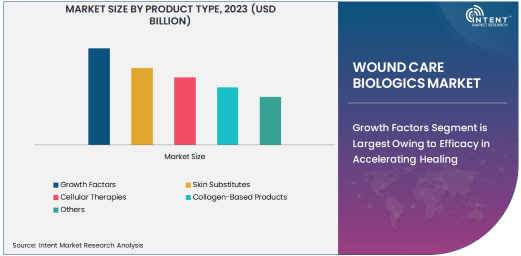

Growth Factors Segment is Largest Owing to Efficacy in Accelerating Healing

Among the various product types, growth factors hold the largest share in the wound care biologics market. These biologics are derived from proteins or peptides that stimulate cell growth, tissue regeneration, and wound healing. Growth factors are particularly useful in treating chronic wounds, such as diabetic foot ulcers and venous ulcers, where the body’s natural healing process is impaired. The effectiveness of growth factors in accelerating wound healing and promoting tissue repair has made them a primary choice for healthcare professionals.

As a result, the growth factors segment continues to dominate the market. Their ability to target specific stages of the wound healing process, such as inflammation and tissue regeneration, makes them indispensable in modern wound care. Additionally, the increasing approval and availability of growth factor-based treatments have bolstered their presence in both clinical and home care settings.

Chronic Wounds Segment is Largest Owing to Rising Prevalence of Diabetes

In terms of application, chronic wounds account for the largest share of the wound care biologics market. Chronic wounds, such as diabetic ulcers, venous ulcers, and pressure ulcers, represent a significant healthcare challenge due to their prolonged healing time and complexity. The increasing prevalence of chronic conditions like diabetes, which impairs wound healing, has led to a higher incidence of chronic wounds, thus driving the demand for advanced biologic treatments.

Biologics, such as growth factors and skin substitutes, have proven to be effective in managing chronic wounds by stimulating healing, reducing infection risk, and promoting tissue regeneration. This segment's dominance is further bolstered by the growing awareness and focus on wound care management, particularly in the elderly population, who are more susceptible to chronic wounds.

Hospitals Segment is Largest Owing to High Treatment Demand

The hospitals segment is the largest end-use industry in the wound care biologics market. Hospitals serve as primary centers for treating complex and chronic wounds, particularly in patients with co-morbidities such as diabetes, cardiovascular diseases, or obesity. The demand for advanced wound care treatments, including biologics, is higher in hospital settings due to the need for specialized care and medical supervision.

Moreover, hospitals often have the necessary infrastructure and expertise to administer biologic treatments, such as growth factors and cellular therapies, which require skilled healthcare professionals and advanced technology. This, combined with the increasing burden of chronic wounds, ensures that hospitals continue to be the largest consumers of wound care biologics.

North America Leads the Market Owing to Advanced Healthcare Infrastructure

North America is the leading region for the wound care biologics market, driven by the presence of advanced healthcare systems, high healthcare expenditure, and a growing aging population. The United States, in particular, accounts for a large portion of the market, with an increasing number of patients suffering from chronic conditions like diabetes, which significantly contribute to the prevalence of chronic wounds.

North America's strong focus on research and development, as well as the widespread availability of advanced wound care treatments, further strengthens its position in the global market. Hospitals and healthcare centers in the region are early adopters of innovative wound care biologics, making North America the largest and most lucrative market.

Competitive Landscape and Key Players

The wound care biologics market is highly competitive, with several key players leading the market. Companies such as Smith & Nephew, Mölnlycke Health Care, and Integra LifeSciences are at the forefront of offering advanced biologic products, including skin substitutes, growth factors, and cellular therapies. These companies invest significantly in research and development to innovate new biologic treatments that can improve wound healing outcomes.

In addition to large multinational companies, smaller biotech firms are also contributing to the market by developing specialized biologics and targeted therapies. Strategic partnerships, mergers, and acquisitions are common in this space as companies seek to expand their product offerings and enhance their competitive edge. With the growing demand for advanced wound care solutions, the market is expected to remain dynamic and competitive in the coming years.

Recent Developments:

- Smith & Nephew launched a new collagen-based product for chronic wound healing that accelerates recovery time.

- Integra LifeSciences Corporation announced the acquisition of a leading company in the skin substitute sector to enhance its wound care portfolio.

- ConvaTec Group introduced an innovative growth factor therapy for diabetic foot ulcers, showing promising results in clinical trials.

- Organogenesis Inc. expanded its product line with a novel cellular therapy for acute wound treatment, improving patient outcomes.

- MiMedx Group, Inc. received FDA approval for its advanced wound care biologic, aimed at treating burns and surgical wounds.

List of Leading Companies:

- Smith & Nephew

- Mölnlycke Health Care

- Integra LifeSciences Corporation

- Acelity Inc.

- ConvaTec Group

- Organogenesis Inc.

- MiMedx Group, Inc.

- AlloSource

- B. Braun Melsungen AG

- Medtronic PLC

- Derma Sciences, Inc.

- Celltex Therapeutics Corporation

- Advanced BioHealing, Inc.

- Tissue Regenix

- Human Biosciences, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.3 Billion |

|

Forecasted Value (2030) |

USD 4.3 Billion |

|

CAGR (2024 – 2030) |

9.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wound Care Biologics Market by Product Type (Growth Factors, Skin Substitutes, Cellular Therapies, Collagen-Based Products), by Application (Chronic Wounds, Acute Wounds), and by End-Use Industry (Hospitals, Ambulatory Surgical Centers, Others) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Smith & Nephew, Mölnlycke Health Care, Integra LifeSciences Corporation, Acelity Inc., ConvaTec Group, Organogenesis Inc., AlloSource, B. Braun Melsungen AG, Medtronic PLC, Derma Sciences, Inc., Celltex Therapeutics Corporation, Advanced BioHealing, Inc., Human Biosciences, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wound Care Biologics Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Growth Factors |

|

4.2. Skin Substitutes |

|

4.3. Cellular Therapies |

|

4.4. Collagen-Based Products |

|

4.5. Others |

|

5. Wound Care Biologics Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Chronic Wounds |

|

5.2. Acute Wounds |

|

6. Wound Care Biologics Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wound Care Biologics Market, by Product Type |

|

7.2.7. North America Wound Care Biologics Market, by Application |

|

7.2.8. North America Wound Care Biologics Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wound Care Biologics Market, by Product Type |

|

7.2.9.1.2. US Wound Care Biologics Market, by Application |

|

7.2.9.1.3. US Wound Care Biologics Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Fuji Film Holdings Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Agfa-Gevaert Group |

|

9.3. Carestream Health |

|

9.4. Varex Imaging Corporation |

|

9.5. Eastman Kodak Company |

|

9.6. Konica Minolta, Inc. |

|

9.7. PerkinElmer, Inc. |

|

9.8. Dentsply Sirona |

|

9.9. Foma Bohemia a.s. |

|

9.10. Imageworks LLC |

|

9.11. Ortho-Clinical Diagnostics, Inc. |

|

9.12. Shenzhen Anke High-Tech Co., Ltd. |

|

9.13. Xograph Healthcare Ltd. |

|

9.14. UDL Laboratories Ltd. |

|

9.15. Shandong Xinhua Pharmaceutical Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wound Care Biologics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wound Care Biologics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wound Care Biologics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA