As per Intent Market Research, the Workplace Stress Management Market was valued at USD 8.5 billion in 2023 and will surpass USD 14.5 billion by 2030; growing at a CAGR of 7.9% during 2024 - 2030.

The workplace stress management market has emerged as a critical segment of the corporate wellness industry, driven by the increasing awareness of the impact of stress on employee productivity and overall health. Organizations across the globe are adopting various stress management programs to enhance workplace morale, reduce absenteeism, and boost efficiency. With advancements in delivery modes and tailored programs, the market is witnessing significant growth in both developed and developing regions.

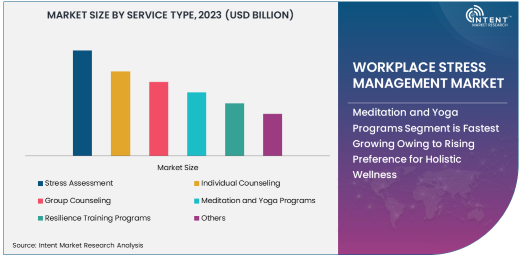

Meditation and Yoga Programs Segment is Fastest Growing Owing to Rising Preference for Holistic Wellness

The meditation and yoga programs segment is experiencing rapid growth in the workplace stress management market. These programs have gained immense popularity due to their proven effectiveness in reducing stress and promoting mental well-being. With organizations increasingly focusing on holistic wellness, meditation and yoga are being integrated into employee wellness initiatives.

The flexibility and adaptability of these programs make them suitable for a wide range of workplaces, from corporate enterprises to SMEs. Additionally, the inclusion of digital platforms and virtual classes has expanded accessibility, enabling employees to participate from anywhere. This trend aligns with the growing emphasis on mental health and the adoption of preventive wellness strategies in corporate environments.

Online/Virtual Programs Segment Leads Owing to Scalability and Convenience

The online/virtual programs segment dominates the market due to its scalability, flexibility, and cost-effectiveness. These programs have become particularly relevant in the post-pandemic era, where remote work and hybrid models are prevalent. Organizations are leveraging virtual platforms to deliver stress management solutions, ensuring employee access regardless of location.

The convenience of on-demand sessions, combined with interactive features such as live webinars and personalized assessments, has significantly contributed to the popularity of virtual programs. This delivery mode not only reduces logistical challenges but also allows for real-time monitoring and feedback, making it a preferred choice for many enterprises.

Corporate Enterprises Segment is Largest Owing to Investment in Employee Wellness

The corporate enterprises segment holds the largest share in the workplace stress management market, driven by their substantial investment in employee wellness programs. Large organizations recognize the critical link between employee well-being and business performance, leading to the widespread adoption of structured stress management initiatives.

Corporate enterprises often have dedicated budgets and resources to implement comprehensive wellness programs, including stress assessment, counseling, and resilience training. The focus on creating a positive work environment and enhancing employee retention further drives the demand for stress management solutions in this segment.

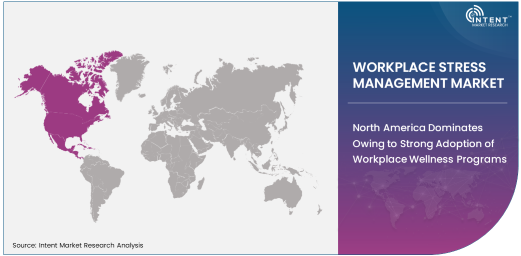

North America Dominates Owing to Strong Adoption of Workplace Wellness Programs

North America leads the workplace stress management market, owing to the strong adoption of wellness programs across industries. The region's corporate culture emphasizes employee well-being as a strategic priority, with companies actively investing in innovative stress management solutions.

The presence of advanced healthcare infrastructure and high awareness of mental health issues contribute to the region’s dominance. Additionally, government regulations and initiatives promoting workplace wellness further support market growth. The United States, in particular, is a major contributor, with organizations of all sizes recognizing the importance of addressing workplace stress.

Competitive Landscape and Key Players

The workplace stress management market is highly competitive, with key players focusing on innovation, technology integration, and strategic collaborations. Leading companies such as ComPsych, Optum, Wellness Corporate Solutions, and Virgin Pulse offer a range of services tailored to diverse organizational needs.

Startups and niche players are also making significant inroads by offering specialized programs and leveraging digital platforms for enhanced reach. The market is characterized by continuous advancements, with a growing emphasis on data-driven insights and customized solutions. As the demand for effective stress management programs increases, competition among providers is expected to intensify, driving further innovation in the industry.

Recent Developments:

- ComPsych Corporation introduced AI-powered tools for stress assessment and intervention.

- Lyra Health partnered with a global tech firm to offer mental health support for employees worldwide.

- Headspace Inc. launched a corporate-focused mindfulness program tailored for hybrid workforces.

- SilverCloud Health expanded its offerings with interactive resilience training modules.

- Magellan Health acquired a wellness startup to enhance its digital stress management services.

List of Leading Companies:

- ComPsych Corporation

- LifeWorks Inc.

- Optum, Inc.

- Headspace Inc.

- Lyra Health

- SilverCloud Health

- Magellan Health, Inc.

- BHS (Behavioral Health Systems)

- Cascade Centers, Inc.

- CVS Health (Aetna Resources for Living)

- CuraLinc Healthcare

- Workplace Options

- Talkspace Inc.

- BetterHelp

- Modern Health

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 8.5 Billion |

|

Forecasted Value (2030) |

USD 14.5 Billion |

|

CAGR (2024 – 2030) |

7.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Workplace Stress Management Market by Service Type (Stress Assessment, Individual Counseling, Group Counseling, Meditation and Yoga Programs, Resilience Training Programs), by Delivery Mode (On-Site Programs, Online/Virtual Programs), and by End-Use Industry (Corporate Enterprises, Small and Medium Enterprises (SMEs), Government Organizations) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

ComPsych Corporation, LifeWorks Inc., Optum, Inc., Headspace Inc., Lyra Health, SilverCloud Health, BHS (Behavioral Health Systems), Cascade Centers, Inc., CVS Health (Aetna Resources for Living), CuraLinc Healthcare, Workplace Options, Talkspace Inc., Modern Health |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Workplace Stress Management Market, by Service Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Stress Assessment |

|

4.2. Individual Counseling |

|

4.3. Group Counseling |

|

4.4. Meditation and Yoga Programs |

|

4.5. Resilience Training Programs |

|

4.6. Others |

|

5. Workplace Stress Management Market, by Delivery Mode (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. On-Site Programs |

|

5.2. Online/Virtual Programs |

|

6. Workplace Stress Management Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Corporate Enterprises |

|

6.2. Small and Medium Enterprises (SMEs) |

|

6.3. Government Organizations |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Workplace Stress Management Market, by Service Type |

|

7.2.7. North America Workplace Stress Management Market, by Delivery Mode |

|

7.2.8. North America Workplace Stress Management Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Workplace Stress Management Market, by Service Type |

|

7.2.9.1.2. US Workplace Stress Management Market, by Delivery Mode |

|

7.2.9.1.3. US Workplace Stress Management Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. ComPsych Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. LifeWorks Inc. |

|

9.3. Optum, Inc. |

|

9.4. Headspace Inc. |

|

9.5. Lyra Health |

|

9.6. SilverCloud Health |

|

9.7. Magellan Health, Inc. |

|

9.8. BHS (Behavioral Health Systems) |

|

9.9. Cascade Centers, Inc. |

|

9.10. CVS Health (Aetna Resources for Living) |

|

9.11. CuraLinc Healthcare |

|

9.12. Workplace Options |

|

9.13. Talkspace Inc. |

|

9.14. BetterHelp |

|

9.15. Modern Health |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Workplace Stress Management Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Workplace Stress Management Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Workplace Stress Management Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA