As per Intent Market Research, the Wood Plastic Composite Market was valued at USD 6.8 billion in 2023 and will surpass USD 17.9 billion by 2030; growing at a CAGR of 14.7% during 2024 - 2030.

The global Wood Plastic Composite (WPC) market has been experiencing significant growth due to the rising demand for eco-friendly and sustainable materials across various industries. WPC is a combination of wood fibers or sawdust and plastic, offering the durability and look of wood with the strength and weather resistance of plastic. These composite materials are increasingly being used in building and construction, automotive, and furniture industries due to their unique properties such as low maintenance, high strength, and environmental sustainability. The WPC market is projected to continue its growth trajectory, driven by increased consumer awareness and the adoption of green building practices.

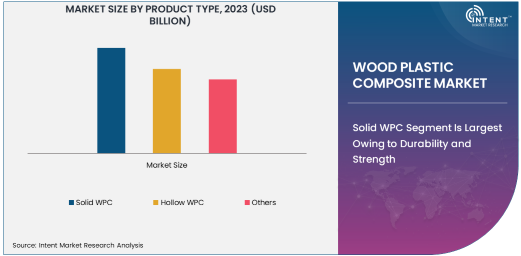

Solid WPC Segment Is Largest Owing to Durability and Strength

Among the various product types in the WPC market, the solid WPC segment holds the largest share. This subsegment is highly valued for its durability, resistance to rot, and aesthetic appeal, making it a preferred choice for applications in decking, cladding, and other outdoor furniture in the construction sector. Solid WPC products are robust, require low maintenance, and offer long-term performance, making them highly attractive in both residential and commercial applications. As the demand for sustainable building materials continues to rise, solid WPCs have found a strong foothold due to their ability to withstand environmental challenges while offering the appearance of traditional wood.

The growing interest in solid WPC is particularly notable in developed regions where consumers and industries are seeking more sustainable alternatives to traditional wood products. Additionally, advancements in manufacturing processes and material innovations are making solid WPC more affordable and accessible. As a result, the market for solid WPC is expected to remain dominant, with significant adoption in outdoor applications and green building projects.

Building and Construction Segment Is Fastest Growing Owing to Sustainable Practices

The building and construction segment is the fastest-growing application for Wood Plastic Composites. The shift toward sustainable construction materials, driven by environmental concerns and regulations, has fueled the adoption of WPC products. These materials are increasingly being used for decking, cladding, flooring, and other outdoor building applications, as they offer improved durability, low maintenance, and resistance to weathering compared to traditional wood. The construction industry’s focus on reducing its environmental footprint and enhancing energy efficiency is contributing to the surge in demand for eco-friendly materials like WPC.

Building and construction projects, particularly in residential housing and commercial spaces, are turning to WPC as a versatile solution to replace conventional materials. As urbanization and infrastructure development accelerate, especially in emerging economies, the building and construction segment is poised for continued expansion. This trend is amplified by the growing consumer preference for products that contribute to LEED (Leadership in Energy and Environmental Design) certifications and other green building standards.

Building & Construction End-Use Industry Is Largest Owing to Growing Demand for Green Materials

The building and construction end-user industry remains the largest segment in the WPC market, driven by the increasing demand for sustainable and low-maintenance materials. The construction of both residential and commercial buildings continues to expand globally, especially in regions that emphasize sustainable and environmentally friendly practices. WPC offers an excellent solution for outdoor applications like decking, fencing, and cladding, due to its ability to mimic the appearance of natural wood while offering superior durability and resistance to the elements.

The growth of the building and construction industry in developing regions such as Asia-Pacific and Latin America, coupled with rising awareness about eco-friendly building solutions, is expected to further boost the demand for WPC materials. Moreover, the trend toward green and energy-efficient buildings, alongside stricter regulations on construction waste and material sourcing, has created a strong market for WPC in the construction sector.

North America Region Is Largest Due to Strong Demand for Sustainable Products

The North American region holds the largest share of the global WPC market, primarily due to the strong demand for sustainable building materials in both residential and commercial construction projects. The United States and Canada have been early adopters of eco-friendly construction materials, and WPC products are widely used in decking, siding, and other applications. The region's robust construction industry, combined with growing environmental awareness, continues to drive the demand for WPC products. Moreover, North America’s stringent environmental regulations and green building certifications have played a significant role in encouraging the use of sustainable materials like WPC.

North America’s leadership in the WPC market is further bolstered by key players in the region, who are continually innovating and expanding their product offerings. With increasing investments in green infrastructure and sustainable construction, North America is expected to maintain its position as the largest market for WPC.

Competitive Landscape and Leading Companies

The global WPC market is highly competitive, with several players striving to expand their market share through innovation, strategic partnerships, and regional expansions. Leading companies such as Trex Company, Inc., UPM-Kymmene Corporation, and Advanced Environmental Recycling Technologies (AERT) dominate the market with their broad product portfolios and strong distribution networks. These companies are focused on enhancing the performance of WPC products, such as improving UV resistance, enhancing durability, and reducing maintenance needs.

In addition to product development, mergers and acquisitions have become a key strategy to gain a competitive edge in the WPC market. For example, companies are acquiring smaller players in emerging markets to diversify their portfolios and strengthen their presence in growing regions. The competitive landscape remains dynamic, with increasing investments in research and development to create high-quality, cost-effective, and environmentally friendly WPC products.

As the demand for sustainable materials grows, the competition among key players will intensify. Companies that focus on innovation, cost-efficiency, and meeting the growing consumer demand for green building materials will be best positioned for long-term success in the WPC market

Recent Developments:

- Trex Company, Inc. announced the expansion of its manufacturing facilities in the U.S. to meet the increasing demand for sustainable outdoor decking solutions made from Wood Plastic Composites.

- UPM-Kymmene Corporation unveiled a new range of WPC products designed for the construction industry, focusing on improving durability while reducing the carbon footprint.

- Advanced Environmental Recycling Technologies (AERT) launched a new line of WPC decking products that feature enhanced scratch resistance and UV stability, aimed at providing more durable solutions for outdoor applications.

- TimberTech introduced a new range of environmentally friendly composite decking, offering superior protection against the elements and a long lifespan, contributing to the growing trend toward sustainable construction materials.

- Kingspan Group completed the acquisition of a leading WPC manufacturer, enhancing its portfolio of eco-friendly building materials and expanding its presence in the global market for sustainable construction solutions

List of Leading Companies:

- UPM-Kymmene Corporation

- Trex Company, Inc.

- Advanced Environmental Recycling Technologies, Inc. (AERT)

- Fiberon LLC

- Green Dot Bioplastics

- UFP Industries, Inc.

- MexyTech

- Kingspan Group

- TimberTech

- NaturInnovations GmbH

- Polyplank

- Flexitec

- Yunnan Tin Company Limited

- Lankhorst Mouldings

- Beijing Tenbro Bamboo Textile Co.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 6.8 Billion |

|

Forecasted Value (2030) |

USD 17.9 Billion |

|

CAGR (2024 – 2030) |

14.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wood Plastic Composite Market By Product Type (Solid WPC, Hollow WPC), By Application (Building and Construction, Automotive, Industrial, Consumer Goods), By End-User Industry (Building & Construction, Automotive, Furniture & Interior Design, Consumer Goods, Industrial) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

UPM-Kymmene Corporation, Trex Company, Inc., Advanced Environmental Recycling Technologies, Inc. (AERT), Fiberon LLC, Green Dot Bioplastics, UFP Industries, Inc., MexyTech, Kingspan Group, TimberTech, NaturInnovations GmbH, Polyplank, Flexitec, Yunnan Tin Company Limited, Lankhorst Mouldings, Beijing Tenbro Bamboo Textile Co. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wood Plastic Composite Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Solid WPC |

|

4.2. Hollow WPC |

|

4.3. Others |

|

5. Wood Plastic Composite Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Building and Construction |

|

5.2. Automotive |

|

5.3. Industrial |

|

5.4. Consumer Goods |

|

5.5. Others |

|

6. Wood Plastic Composite Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Building & Construction |

|

6.2. Automotive |

|

6.3. Furniture & Interior Design |

|

6.4. Consumer Goods |

|

6.5. Industrial |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wood Plastic Composite Market, by Product Type |

|

7.2.7. North America Wood Plastic Composite Market, by Application |

|

7.2.8. North America Wood Plastic Composite Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wood Plastic Composite Market, by Product Type |

|

7.2.9.1.2. US Wood Plastic Composite Market, by Application |

|

7.2.9.1.3. US Wood Plastic Composite Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. UPM-Kymmene Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Trex Company, Inc. |

|

9.3. Advanced Environmental Recycling Technologies, Inc. (AERT) |

|

9.4. Fiberon LLC |

|

9.5. Green Dot Bioplastics |

|

9.6. UFP Industries, Inc. |

|

9.7. MexyTech |

|

9.8. Kingspan Group |

|

9.9. TimberTech |

|

9.10. NaturInnovations GmbH |

|

9.11. Polyplank |

|

9.12. Flexitec |

|

9.13. Yunnan Tin Company Limited |

|

9.14. Lankhorst Mouldings |

|

9.15. Beijing Tenbro Bamboo Textile Co. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wood Plastic Composite Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wood Plastic Composite Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wood Plastic Composite Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA