As per Intent Market Research, the Women Health Diagnostics Market was valued at USD 9.4 billion in 2023 and will surpass USD 21.3 billion by 2030; growing at a CAGR of 12.4% during 2024 - 2030.

The women health diagnostics market is experiencing significant growth, driven by increased awareness of women's health issues, advancements in diagnostic technologies, and the rising demand for early detection of various health conditions. These diagnostics cover a wide range of applications, including reproductive health, cancer screening, and infectious disease diagnostics, addressing the unique healthcare needs of women. The increasing prevalence of conditions such as breast cancer, cervical cancer, and reproductive disorders, along with the growing trend of preventive care, is fueling the demand for these diagnostic solutions. Additionally, technological innovations in testing methods, including molecular diagnostics, point-of-care (POC) diagnostics, and imaging technologies, are transforming the landscape of women's health diagnostics, making them more accessible, accurate, and efficient.

In addition to improving the accuracy and speed of diagnosis, these advancements are also contributing to the growing trend of at-home testing, empowering women to monitor their health independently. As the healthcare system shifts towards more personalized and patient-centric care, the demand for diagnostic tests tailored to women’s health needs is expected to continue rising. Furthermore, government initiatives and health programs aimed at addressing women's health issues, particularly in developing regions, are likely to further expand the market in the coming years.

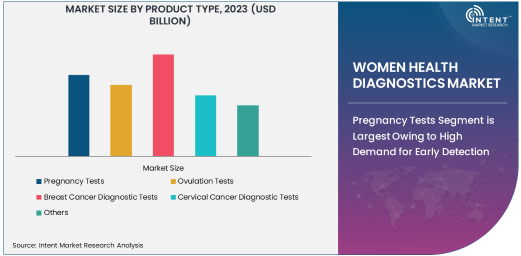

Pregnancy Tests Segment is Largest Owing to High Demand for Early Detection

The pregnancy tests segment is the largest in the women health diagnostics market, driven by the widespread demand for early detection and the increasing popularity of at-home pregnancy testing kits. Pregnancy tests are a key tool for women, enabling them to confirm pregnancies at an early stage, making them essential for family planning and reproductive health management. The convenience of home-based pregnancy tests, which provide quick and accurate results, has significantly contributed to the dominance of this segment.

Advancements in pregnancy test technology have further improved the accuracy of results, offering higher sensitivity and quicker outcomes. With more women delaying childbirth and the growing focus on family planning, the demand for pregnancy tests continues to rise. In addition, the increasing availability of pregnancy test kits in pharmacies, online stores, and healthcare facilities makes these products widely accessible, further driving growth in the pregnancy test segment.

Point-of-Care Diagnostics Segment is Fastest Growing Due to Convenience and Immediate Results

The point-of-care (POC) diagnostics segment is the fastest growing within the women health diagnostics market. POC diagnostics provide the advantage of offering immediate results without the need for a laboratory visit, which is particularly beneficial for women in remote areas or those with limited access to healthcare services. POC tests, such as pregnancy tests, ovulation kits, and STI screenings, are increasingly popular due to their ease of use and the convenience of obtaining results on-site.

The growth of POC diagnostics is driven by the rising demand for self-testing and the need for rapid results. With more women seeking to manage their health independently and conveniently, POC tests are becoming a preferred option for monitoring conditions like fertility, reproductive health, and infections. The availability of POC tests in pharmacies and online platforms further supports their adoption, and the ongoing development of new POC testing technologies is expected to fuel continued market growth.

Reproductive Health Application is Largest Owing to Increased Awareness and Demand for Fertility Monitoring

The reproductive health application is the largest in the women health diagnostics market. Reproductive health diagnostics, including pregnancy tests, ovulation tests, and STI screenings, are crucial for monitoring fertility and reproductive well-being. The increasing number of women seeking to delay childbirth, along with the growing awareness of conditions such as polycystic ovary syndrome (PCOS) and endometriosis, is driving the demand for reproductive health diagnostics. These tests help women track their fertility cycles, detect early signs of reproductive disorders, and make informed decisions about family planning.

As more women are seeking fertility treatments or using assisted reproductive technologies (ART), the demand for reproductive health diagnostics has surged. In addition, home-based tests such as ovulation kits and pregnancy tests are widely available, making it easier for women to manage their reproductive health on their own. The focus on early diagnosis, preventive care, and personalized reproductive health monitoring will continue to drive the growth of this application segment.

North America is Largest Region Owing to Advanced Healthcare Infrastructure and High Awareness

North America is the largest region in the women health diagnostics market, with the U.S. contributing significantly to the market’s growth. The region boasts advanced healthcare infrastructure, widespread access to diagnostic technologies, and high awareness of women’s health issues. The increasing prevalence of conditions such as breast cancer, cervical cancer, and reproductive disorders is fueling demand for women’s health diagnostics in North America. Additionally, the growing emphasis on preventive care and early detection has led to the widespread adoption of diagnostic tests like mammograms, Pap smears, and pregnancy tests.

The high penetration of healthcare services and the increasing use of home-based diagnostic kits, such as pregnancy tests and ovulation tests, have also contributed to the region’s dominance. North America’s strong regulatory framework, healthcare policies, and government-funded programs supporting women’s health further ensure the continued growth of this market in the region.

Competitive Landscape

The women health diagnostics market is highly competitive, with several key players operating in the space, including Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Hologic, and Quest Diagnostics. These companies are focusing on innovation, expanding their product portfolios, and leveraging advanced technologies to enhance the accuracy, speed, and convenience of women’s health diagnostics. Partnerships, acquisitions, and collaborations with healthcare providers and technology companies are common strategies for strengthening market presence and expanding offerings.

The market is also witnessing the rise of startups that focus on women’s health, offering innovative solutions like at-home diagnostic kits for fertility monitoring, pregnancy testing, and STI screenings. As the demand for personalized and self-administered diagnostics grows, these companies are well-positioned to capture a significant share of the market. The competitive landscape will continue to evolve, with ongoing technological advancements and a shift towards more accessible and user-friendly testing solutions.

List of Leading Companies:

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Hologic, Inc.

- Thermo Fisher Scientific

- Danaher Corporation

- GE Healthcare

- Quest Diagnostics

- Becton Dickinson and Company

- Labcorp Diagnostics

- Bio-Rad Laboratories

- PerkinElmer, Inc.

- Cepheid (Danaher Corporation)

- BioMerieux

- Ortho Clinical Diagnostics

Recent Developments:

- Abbott Laboratories launched an advanced molecular diagnostic test for breast cancer detection, improving early detection rates.

- Thermo Fisher Scientific acquired a leading molecular diagnostics company to expand its women’s health diagnostic portfolio.

- GE Healthcare unveiled a new imaging system aimed at improving the accuracy of gynecological cancer detection.

- Quest Diagnostics partnered with a biotechnology firm to introduce at-home cervical cancer screening kits for women.

- Hologic, Inc. received FDA approval for a next-generation pregnancy test that uses saliva to detect early pregnancy biomarkers.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 9.4 Billion |

|

Forecasted Value (2030) |

USD 21.3 Billion |

|

CAGR (2024 – 2030) |

12.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Women Health Diagnostics Market by Product Type (Pregnancy Tests, Ovulation Tests, Breast Cancer Diagnostic Tests, Cervical Cancer Diagnostic Tests, STI and Vaginal Health Diagnostic Tests, Hormonal Health Tests), by Technology Type (Immunoassay, Molecular Diagnostics, Point-of-Care (POC) Diagnostics, Imaging Diagnostics), by Application (Reproductive Health, Gynecology and Obstetrics, Cancer Screening, Infectious Disease Diagnostics), and by End-Use Industry (Hospitals, Diagnostic Laboratories, Homecare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Hologic, Inc., Thermo Fisher Scientific, Danaher Corporation, Quest Diagnostics, Becton Dickinson and Company, Labcorp Diagnostics, Bio-Rad Laboratories, PerkinElmer, Inc., Cepheid (Danaher Corporation), Ortho Clinical Diagnostics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Women's Healthcare Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Contraceptive Devices |

|

4.2. Menstrual Health Products |

|

4.3. Pregnancy and Fertility Products |

|

4.4. Breast Cancer Treatment and Screening |

|

4.5. Others |

|

5. Women's Healthcare Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Hospitals |

|

5.2. Clinics |

|

5.3. Others |

|

6. Women's Healthcare Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Reproductive Health |

|

6.2. Gynecological Health |

|

6.3. Menopause Management |

|

6.4. Cancer Care |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Women's Healthcare Market, by Product Type |

|

7.2.7. North America Women's Healthcare Market, by End-Use Industry |

|

7.2.8. North America Women's Healthcare Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Women's Healthcare Market, by Product Type |

|

7.2.9.1.2. US Women's Healthcare Market, by End-Use Industry |

|

7.2.9.1.3. US Women's Healthcare Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Johnson & Johnson |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bayer AG |

|

9.3. Merck & Co., Inc. |

|

9.4. Procter & Gamble |

|

9.5. Pfizer Inc. |

|

9.6. Abbott Laboratories |

|

9.7. Teva Pharmaceuticals |

|

9.8. Hologic, Inc. |

|

9.9. AbbVie Inc. |

|

9.10. Mylan N.V. |

|

9.11. Medtronic |

|

9.12. GlaxoSmithKline plc |

|

9.13. Sanofi S.A. |

|

9.14. Eli Lilly and Company |

|

9.15. Organon & Co. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Women Health Diagnostics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Women Health Diagnostics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Women Health Diagnostics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA