As per Intent Market Research, the Wireless Electric Vehicle Charging Market was valued at USD 1.2 billion in 2023 and will surpass USD 13.7 billion by 2030; growing at a CAGR of 41.6% during 2024 - 2030.

The wireless electric vehicle (EV) charging market has gained significant traction as the demand for electric vehicles continues to rise globally. This technology offers the convenience of charging without the need for physical connectors, providing a seamless and efficient solution for EV users. As governments and consumers alike focus on reducing carbon emissions and embracing sustainable mobility, wireless EV charging is being hailed as a critical step in advancing the EV ecosystem. Several technologies, including inductive charging and resonant inductive charging, are being developed to enhance the performance of this charging method. The market is expected to grow exponentially due to its advantages in terms of user convenience, safety, and the potential for widespread infrastructure development.

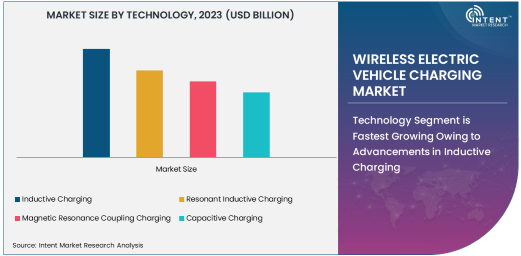

Technology Segment is Fastest Growing Owing to Advancements in Inductive Charging

The fastest-growing technology segment in the wireless EV charging market is inductive charging. This method uses electromagnetic fields to transfer energy between a transmitter coil and a receiver coil, enabling vehicles to charge without the need for physical connections. The increasing popularity of electric vehicles, along with the growing need for efficient, convenient charging solutions, has driven the demand for inductive charging systems. Inductive charging offers several advantages, such as increased convenience and the potential for more compact, less intrusive charging stations. These systems also reduce wear and tear on vehicle connectors, making them an attractive option for both residential and commercial applications.

As the technology continues to evolve, inductive charging systems are becoming more efficient and capable of higher power output, allowing faster charging times. Innovations in inductive charging are expected to significantly reduce the installation costs, making the technology more accessible. With the increasing adoption of EVs worldwide and the shift toward cleaner, smarter cities, inductive charging technology is positioned for rapid growth, especially in urban areas with high demand for accessible and non-intrusive charging solutions.

Power Output Segment is Largest Owing to Demand for High-Power Charging

The largest power output segment in the wireless EV charging market is high power (above 22 kW). As electric vehicles become more powerful and consumers seek faster charging solutions, high-power wireless charging systems are in high demand. These systems allow for quick charging, reducing the downtime for EVs and enhancing the overall convenience of electric mobility. High-power charging is particularly essential for commercial fleet operators, public transport systems, and other large-scale EV applications, where fast turnaround times are critical.

In addition, high-power charging solutions are essential for maintaining the efficiency and reliability of electric vehicle fleets, which are expected to grow significantly in the coming years. The development of high-power wireless charging technology also aligns with the advancements in electric vehicle battery technology, enabling faster and more efficient charging processes. As more industries transition to electric fleets, high-power wireless charging solutions are expected to lead the market, offering scalable and rapid charging infrastructure to meet the growing demand.

Application Segment is Largest Owing to Automotive Demand

The automotive application segment is the largest in the wireless EV charging market, driven by the increasing adoption of electric vehicles across the globe. As electric vehicle sales continue to rise, the demand for efficient and convenient charging solutions has also surged. The automotive industry is embracing wireless charging technology as a means to reduce the need for plugging in vehicles, thereby enhancing the user experience. Wireless charging systems in the automotive sector are designed to be integrated seamlessly into vehicles, ensuring quick, easy, and efficient charging.

Automotive manufacturers are investing heavily in wireless charging technologies to differentiate themselves in the competitive EV market. Additionally, wireless charging systems are being incorporated into smart cities and urban mobility solutions, enabling EVs to charge while parked in various locations, such as public spaces or residential parking lots. As the automotive market shifts toward fully electric fleets, wireless charging will continue to play a vital role in supporting the growth of electric mobility and helping to overcome the limitations of conventional charging methods.

Charging Infrastructure Segment is Largest Owing to Growth in Commercial Charging

The commercial charging infrastructure segment is the largest in the wireless EV charging market, as businesses and municipalities seek to support the increasing number of electric vehicles. Commercial charging stations are being equipped with wireless charging technology to cater to both private and fleet electric vehicles. As more businesses transition to electric fleets, they are adopting wireless charging infrastructure to streamline their operations and reduce costs related to traditional charging methods. These charging stations are often located in high-traffic areas, such as shopping centers, parking garages, and office complexes, providing EV users with convenient and accessible charging options.

Furthermore, public charging networks are expanding to meet the growing demand for electric vehicle charging infrastructure. The installation of wireless charging stations in commercial areas is seen as a critical step in making EV adoption more convenient for users, further enhancing the overall growth of the wireless EV charging market. With continuous innovation in charging technology and the global shift toward electric mobility, commercial charging infrastructure is expected to remain a significant focus for the industry in the coming years.

End-User Segment is Largest Owing to Demand from Private Users

Private users represent the largest end-user segment in the wireless EV charging market. With the growing popularity of electric vehicles among individual consumers, the demand for convenient, efficient charging solutions has surged. Private users are increasingly turning to wireless charging as it offers a seamless, plug-free solution for daily charging needs. Residential applications for wireless charging are expected to grow as more individuals adopt electric vehicles, particularly in urban areas where the convenience of wireless charging is a significant draw.

Moreover, private users are often early adopters of new technologies, and as wireless charging infrastructure becomes more accessible and cost-effective, the number of private users opting for wireless charging systems is expected to increase. The adoption of wireless charging solutions in residential settings will also drive the expansion of the market, as homeowners seek more flexible and efficient ways to power their electric vehicles at home. As EV ownership continues to rise, private users will remain a key driver of demand for wireless charging technologies.

Geographical Insights: Asia-Pacific is Fastest Growing Region

The Asia-Pacific region is the fastest-growing market for wireless electric vehicle charging, driven by the rapid adoption of electric vehicles, especially in countries like China, Japan, and South Korea. Governments in the region are actively promoting electric vehicle adoption through incentives, subsidies, and investments in EV infrastructure. As a result, the demand for wireless EV charging solutions is increasing, particularly in urban centers where space is limited, and efficient, non-intrusive charging solutions are required. China, being the largest EV market in the world, is seeing a rapid deployment of wireless charging infrastructure to support its growing electric vehicle fleet.

Furthermore, with Asia-Pacific countries leading the way in technological innovation, the region is expected to play a crucial role in the development of advanced wireless charging technologies. The adoption of these technologies is further facilitated by strong government support and the push for sustainable transportation solutions, positioning Asia-Pacific as a key driver of market growth in the coming years.

Competitive Landscape and Leading Companies

The wireless electric vehicle charging market is highly competitive, with a mix of established players and emerging innovators striving for market share. Leading companies such as Qualcomm, WiTricity, and HEVO Power are at the forefront of developing and deploying wireless EV charging technologies. These companies are investing heavily in research and development to improve the efficiency and affordability of wireless charging solutions. In addition to established players, new entrants are focusing on niche areas, such as high-power wireless charging and integrating wireless charging systems into public transport infrastructure.

The competitive landscape is marked by strategic partnerships, mergers, and acquisitions, as companies aim to expand their reach and enhance their technology offerings. As the market grows, collaborations between automakers, technology providers, and infrastructure developers are expected to increase, driving innovation and accelerating the adoption of wireless EV charging technologies.

List of Leading Companies:

- Qualcomm Incorporated

- WiTricity Corporation

- HEVO Power

- Toyota Industries Corporation

- Bosch Group

- Evatran Group, Inc.

- ElectReon

- ZTE Corporation

- Plugless Power

- Momentum Dynamics

- ABB Ltd.

- Siemens AG

- Delphi Technologies

- Schneider Electric

- LG Electronics

Recent Developments:

- Qualcomm unveiled a new wireless EV charging platform designed to improve the efficiency and scalability of charging infrastructure for electric vehicles, aiming to support the growing global demand for EVs.

- WiTricity formed partnerships with several major automakers to integrate its wireless charging technology into upcoming electric vehicle models, marking a significant step toward mass adoption.

- HEVO Power secured a new round of funding to expand its wireless EV charging network, focusing on deploying high-power charging stations across major cities and public spaces.

- ElectReon signed a major agreement with several municipalities to install wireless charging systems in urban areas, aiming to improve EV infrastructure and provide efficient charging options for electric buses.

- Bosch initiated a pilot project for wireless EV charging in public spaces, showcasing its innovative solution for urban areas where traditional charging stations may not be as viable

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.2 Billion |

|

Forecasted Value (2030) |

USD 13.7 Billion |

|

CAGR (2024 – 2030) |

41.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wireless Electric Vehicle Charging Market By Technology (Inductive Charging, Resonant Inductive Charging, Magnetic Resonance Coupling Charging, Capacitive Charging), By Power Output (Low Power, Medium Power, High Power), By Application (Automotive, Commercial Fleets, Two-Wheelers, Public Transport), By Charging Infrastructure (Residential Charging, Commercial Charging, Public Charging), By End-User (Private Users, Fleet Operators, Government & Municipalities, Businesses) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Qualcomm Incorporated, WiTricity Corporation, HEVO Power, Toyota Industries Corporation, Bosch Group, Evatran Group, Inc., ElectReon, ZTE Corporation, Plugless Power, Momentum Dynamics, ABB Ltd., Siemens AG, Delphi Technologies, Schneider Electric, LG Electronics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wireless Electric Vehicle Charging Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Inductive Charging |

|

4.2. Resonant Inductive Charging |

|

4.3. Magnetic Resonance Coupling Charging |

|

4.4. Capacitive Charging |

|

5. Wireless Electric Vehicle Charging Market, by Power Output (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Low Power (Up to 3.7 kW) |

|

5.2. Medium Power (3.7 kW to 22 kW) |

|

5.3. High Power (Above 22 kW) |

|

6. Wireless Electric Vehicle Charging Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Automotive |

|

6.2. Commercial Fleets |

|

6.3. Two-Wheelers |

|

6.4. Public Transport |

|

7. Wireless Electric Vehicle Charging Market, by Charging Infrastructure (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Residential Charging |

|

7.2. Commercial Charging |

|

7.3. Public Charging |

|

8. Wireless Electric Vehicle Charging Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Private Users |

|

8.2. Fleet Operators |

|

8.3. Government & Municipalities |

|

8.4. Businesses |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Wireless Electric Vehicle Charging Market, by Technology |

|

9.2.7. North America Wireless Electric Vehicle Charging Market, by Power Output |

|

9.2.8. North America Wireless Electric Vehicle Charging Market, by Application |

|

9.2.9. North America Wireless Electric Vehicle Charging Market, by Charging Infrastructure |

|

9.2.10. North America Wireless Electric Vehicle Charging Market, by |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Wireless Electric Vehicle Charging Market, by Technology |

|

9.2.11.1.2. US Wireless Electric Vehicle Charging Market, by Power Output |

|

9.2.11.1.3. US Wireless Electric Vehicle Charging Market, by Application |

|

9.2.11.1.4. US Wireless Electric Vehicle Charging Market, by Charging Infrastructure |

|

9.2.11.1.5. US Wireless Electric Vehicle Charging Market, by |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Qualcomm Incorporated |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. WiTricity Corporation |

|

11.3. HEVO Power |

|

11.4. Toyota Industries Corporation |

|

11.5. Bosch Group |

|

11.6. Evatran Group, Inc. |

|

11.7. ElectReon |

|

11.8. ZTE Corporation |

|

11.9. Plugless Power |

|

11.10. Momentum Dynamics |

|

11.11. ABB Ltd. |

|

11.12. Siemens AG |

|

11.13. Delphi Technologies |

|

11.14. Schneider Electric |

|

11.15. LG Electronics |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wireless Electric Vehicle Charging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wireless Electric Vehicle Charging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wireless Electric Vehicle Charging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA