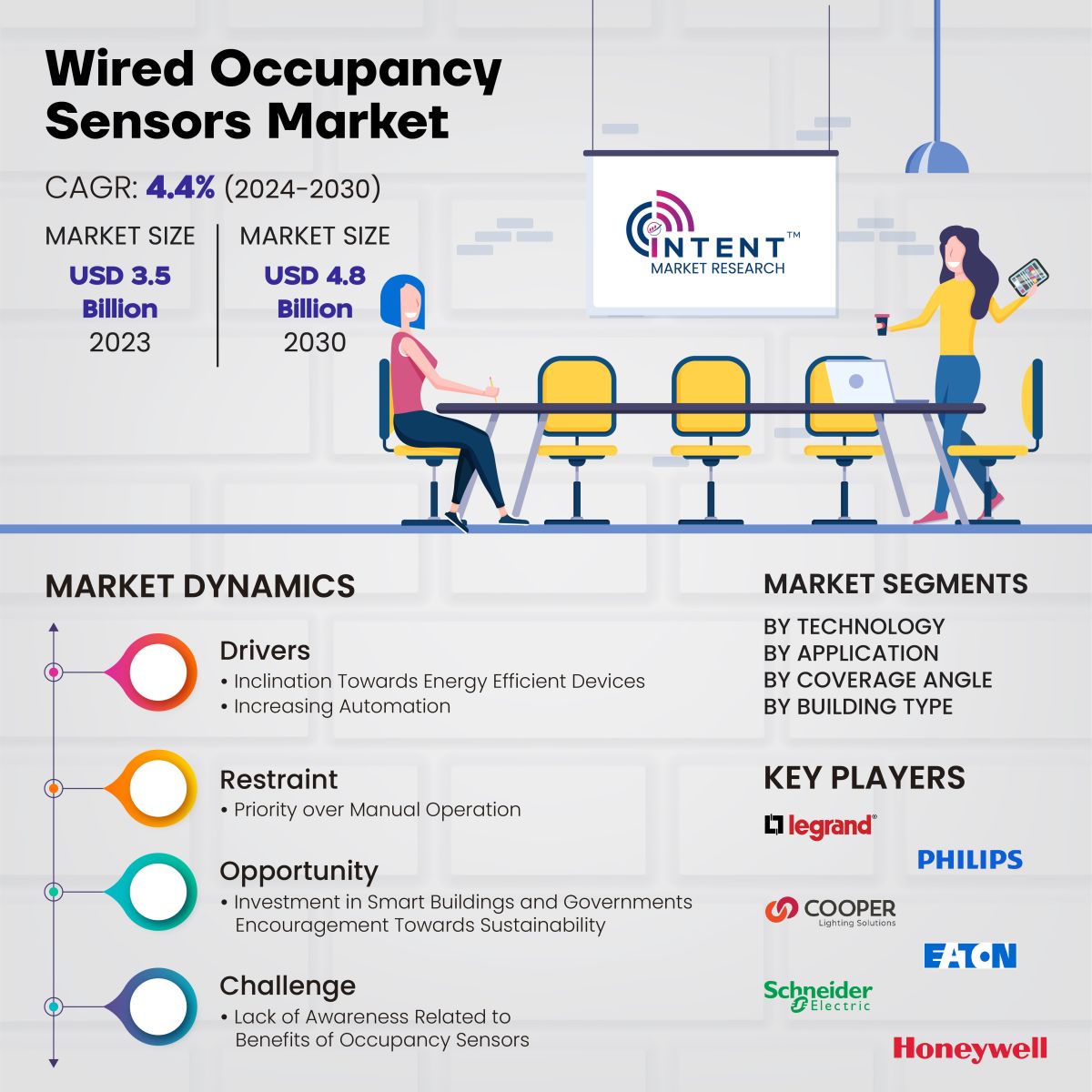

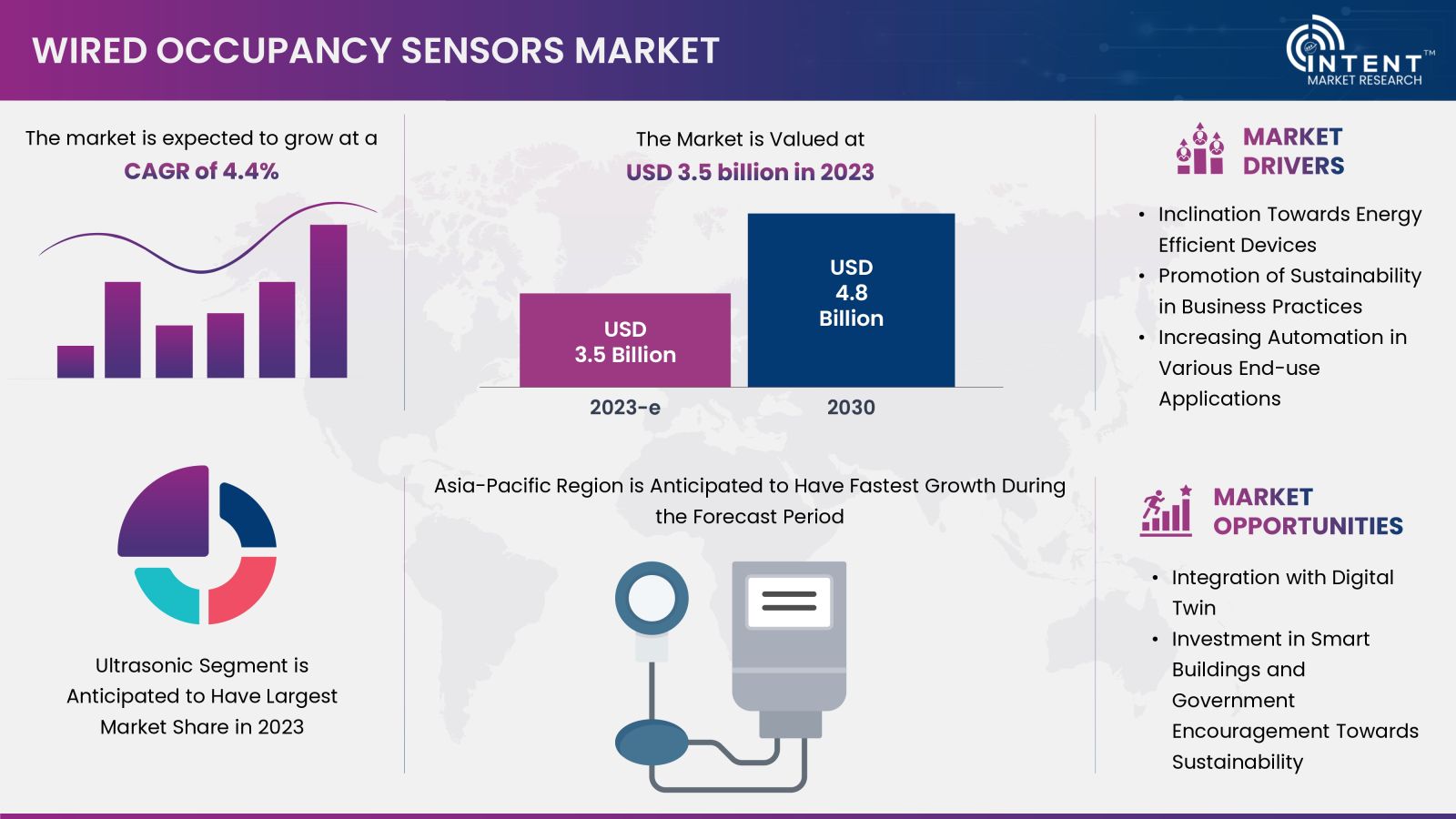

According to Intent Market Research, the Wired Occupancy Sensors Market is expected to grow from USD 3.5 billion in 2023-e at a CAGR of 4.4% to touch USD 4.8 billion by 2030. The wired occupancy sensors market is a competitive market, the prominent players in the global market include Eaton, Honeywell, Schneider Electric, General Electric, Philips, Legrand, Cooper Lighting, Acuity Brands, Johnson Controls, Texas Instruments, Leviton Manufacturing, among others. The growth of this market is attributed to factors such as the inclination towards energy-efficient devices, the promotion of sustainability in business practices, and increasing automation in various end-use applications.

Click here to: Get FREE Sample Pages of this Report

The increasing investment in smart buildings and government support for sustainability are anticipated to provide significant growth opportunities for market stakeholders. Smart buildings leverage technology to enhance efficiency, sustainability, and user experience. Occupancy sensors play a crucial role in achieving these goals by providing real-time data on the utilization of spaces within a building. These sensors are used to detect the presence or absence of people in a particular area. They are commonly employed in HVAC systems to optimize energy usage based on actual occupancy. It can also control lighting systems and lights can be automatically turned off in unoccupied rooms or areas, reducing energy consumption.

Sustainability promotion in business practices driving market growth

The demand for occupancy sensors is driven by the increasing promotion of sustainability in business practices. According to the World Wildlife Fund, Google searches for sustainable products surged by 71% from 2016 to 2021, indicating a heightened interest in sustainability. Additionally, the World Economic Forum noted that 67% of Millennials and Generation X prefer buying from sustainable brands whenever possible.

Several nations have formulated policies to endorse sustainability. For instance, India's Mission LiFE aims to engage one billion Indians and global citizens in adopting sustainable and environmentally conscious lifestyles from 2022 to 2028. Within India, the government is targeting at least 80% of all villages and urban local bodies to become environment-friendly by 2028. Such a growing focus on sustainability has promoted the adoption of occupancy sensors, thereby driving the wired occupancy sensors market.

Key findings of the wired occupancy sensors market

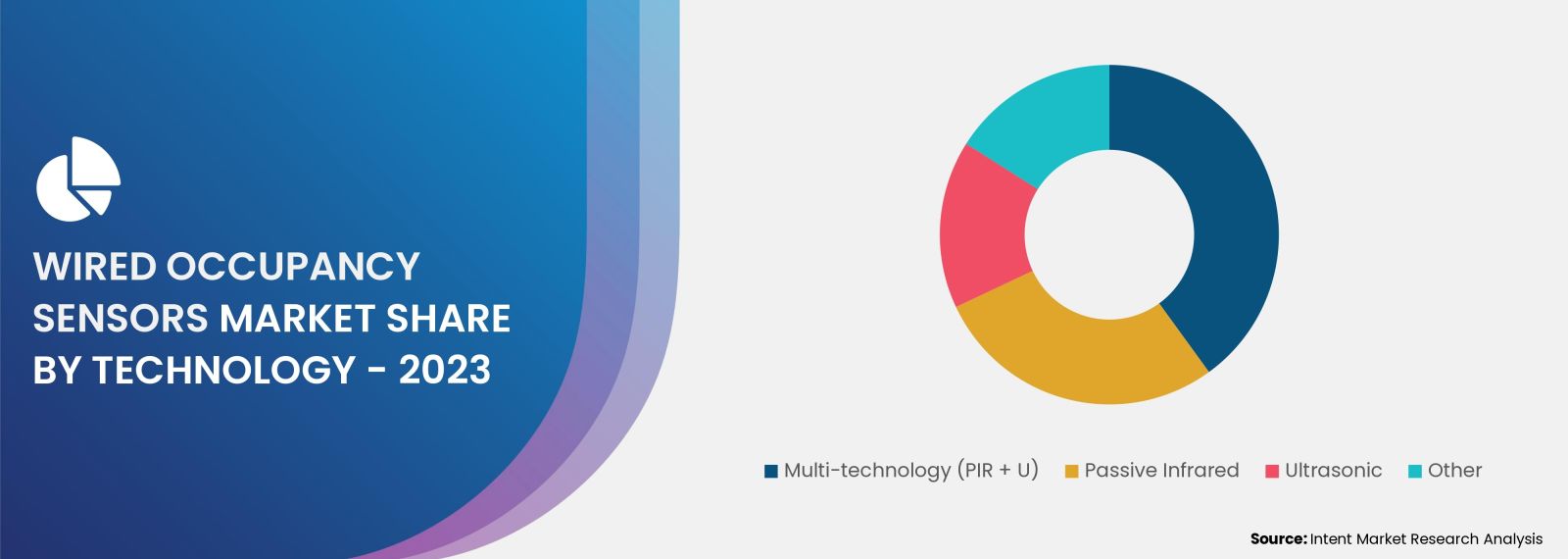

The multi-technology segment expected to witness significant growth from 2024 to 2030

Multi-tech segment is anticipated to experience remarkable growth throughout the forecast period, offering more precise occupancy detection. Multi-tech sensors are the combination of PIR and ultrasonic sensors that allows for dual verification of occupancy. Both sensors have to detect motion to confirm occupancy, thereby adds a layer of reliability to the system. Multi-tech sensor are long-range wireless sensors that utilize the LoRaWAN wireless standard and are engineered for long-range, low cost, and extended battery life applications. Additionally, these sensors are available at an affordable cost which will further boost their adoption in developing economies.

Lighting control is the major application of the market

Lighting control segment accounted for a significant market share of the global wired occupancy sensors market in 2023. Occupancy sensors are predominantly used for controlling lights in buildings. In commercial buildings, such as offices, educational institute, and medical & healthcare facilities, the adoption of occupancy sensors is high and increasing. It helps in energy saving as well. As per Better Buildings, an initiative of the U.S. Department of Energy (DOE), lighting controls that reduce or turn off the lighting when a space is not in use can reduce lighting energy use by 10% to 90%.

Higher coverage angle for better efficiency

Based on coverage angle, the wired occupancy sensors market is segmented into lower than 90°, 90°−179°, and 180°−360°. In 2023, the 180°−360° coverage angle segment holds a noteworthy market share and is projected to achieve a significant CAGR in the forecast period. The 180°−360° coverage angle provides largest coverage area that can be monitored in a building by a single sensor only. The large coverage area nullify the need to install more cameras or sensors in different places for monitoring. This helps in reducing cost of the purchasing and operation.

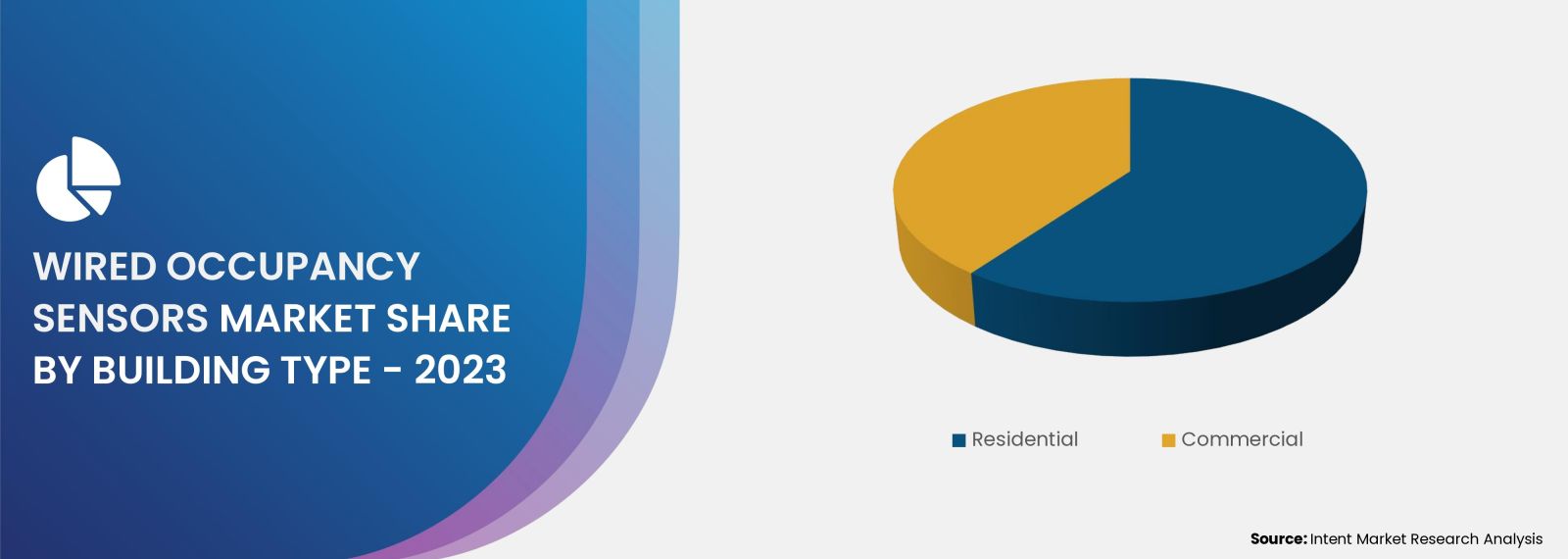

Commercial buildings captured the major share

Wired occupancy sensors applications in commercial buildings captured a significant market share in 2023. The segmental growth of the market is propelled by high adoption rates in commercial buildings, including healthcare facilities, educational institutes, office buildings, industrial plants & factories, shopping complexes & supermarkets, and parking lots.

Commercial buildings consumes lot more energy than residential building. In 2022, the US Department of Energy estimates that commercial buildings in the US account for 18% of total U.S. energy consumption, leading to an energy expenditures of USD 190 billion each year. Also, buildings sector is responsible for energy related CO2 emissions accounting for approximately 826 million metric tons annually indicates need for occupancy sensors.

North America holds largest share in the global wired occupancy sensors market

North America wired occupancy sensors market has recorded a significant share of the market in 2023. The increasing number of smart buildings, and penetration of automation in industries and commercial places are driving the regional growth. The US and Canada both have drafted policies to reduce the carbon emission from the building infrastructure. In Canada’s national capital region, the smart buildings technology has resulted in energy savings of up to 17%, which translates into savings of approximately USD 736,361.0 (CAD 1,000,000)* annually.

Presence of SMEs has fragmented the market up to certain level

Key players operating in the global wired occupancy sensors market are Acuity Brands, Cooper Lighting, Eaton, General Electric, Honeywell, Philips, Legrand, Leviton Manufacturing, Johnson Controls, Schneider Electric, Texas Instruments, among others. Additionally, there are several small & mid-size market players that provides wired occupancy sensors. Presence of large number of SMEs has fragmented the market. The same scenario is expected continue during the forecast period.

Click here to: Get your custom research report today

Wired Occupancy Sensors Market Coverage

The report provides key insights into the wired occupancy sensors market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting the market growth. It analyses key players as well as the competitive landscape within the global market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 3.5 billion |

|

Forecast Revenue (2030) |

USD 4.8 billion |

|

CAGR (2024-2030) |

4.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Market By Technology (Passive Infrared, Ultrasonic, Multi-Technology); By Application (Lighting Control, Security & Surveillance, HVAC Control); By Coverage Angle (Below 90°, 90°−179°, 180°−360°); By Building Type (Smart Homes, Smart Societies, Healthcare Facilities, Educational Institutes, Office Building, Industrial Plant & Factories, Commercial, Shopping Complex & Supermarkets) |

|

Regional Analysis |

North America (USA, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America and Middle East & Africa |

|

Competitive Landscape |

Eaton, Honeywell, Schneider Electric, General Electric, Philips, Legrand, Cooper Lighting, Acuity Brands, Johnson Controls, Texas Instruments, and Leviton Manufacturing |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions and Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.Inclination Towards Energy-Efficient Devices |

|

4.1.2.Promotion of Sustainability in Business Practices |

|

4.1.3.Increasing Automation in Various End-use Applications |

|

4.2.Restraints |

|

4.2.1.Priority Over Manual Operation |

|

4.3.Opportunities |

|

4.3.1.Investment in Smart Buildings and Government Encouragement Towards Sustainability |

|

4.4.Threats or Challenges |

|

4.4.1.Lack of Awareness Related to the Benefits |

|

4.4.2.Alternate Cost-effective Ways |

|

4.5.Trends |

|

4.5.1.Integration with Digital Twin |

|

5.Market Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.PORTER’S Five Forces Analysis |

|

5.2.PESTLE Analysis |

|

6.Market Size by Technology |

|

6.1.Passive Infrared (PIR) |

|

6.2.Ultrasonic |

|

6.3.Multi-tech |

|

6.4.Other Technologies (Microwave and Acoustic) |

|

7.Market Size by Coverage Angle |

|

7.1.Lower Than 90° |

|

7.2.90°−179° |

|

7.3.180°−360° |

|

8.Market Size by Application |

|

8.1.Lighting Control |

|

8.2.Security & Surveillance |

|

8.3.HVAC Control |

|

8.4.Other Applications |

|

9.Market Size by Building Type |

|

9.1.Residential |

|

9.1.1.Smart Homes |

|

9.1.2.Smart Societies |

|

9.2.Commercial |

|

9.2.1.Medical & Healthcare Facilities |

|

9.2.2.Educational Institutes |

|

9.2.3.Office Buildings |

|

9.2.4.Industrial Plant & Factories |

|

9.2.5.Shopping Complex & Supermarkets |

|

9.2.6.Others (Street Light, Parking Lot, Parks and Promenades) |

|

10.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1.North America |

|

10.1.1.U.S. |

|

10.1.2.Canada |

|

10.2.Asia-Pacific |

|

10.2.1.China |

|

10.2.2.Japan |

|

10.2.3.South Korea |

|

10.2.4.India |

|

10.3.Europe |

|

10.3.1.U.K. |

|

10.3.2.Germany |

|

10.3.3.France |

|

10.3.4.Italy |

|

10.4.Latin America |

|

10.5.Middle East & Africa |

|

11.Competitive Landscape |

|

11.1.Market Share Analysis |

|

11.2.Key Market Growth Strategies |

|

11.3.Company Strategy Analysis |

|

11.4.Competitive Benchmarking |

|

12.Company Profile |

|

12.1.Eaton |

|

12.2.Honeywell |

|

12.3.Schneider Electric |

|

12.4.General Electric |

|

12.5.Philips |

|

12.6.Legrand |

|

12.7.Cooper Lighting |

|

12.8.Acuity Brands |

|

12.9.Johnson Controls |

|

12.10.Texas Instruments |

|

12.11.Leviton Manufacturing |

|

13.Appendix |

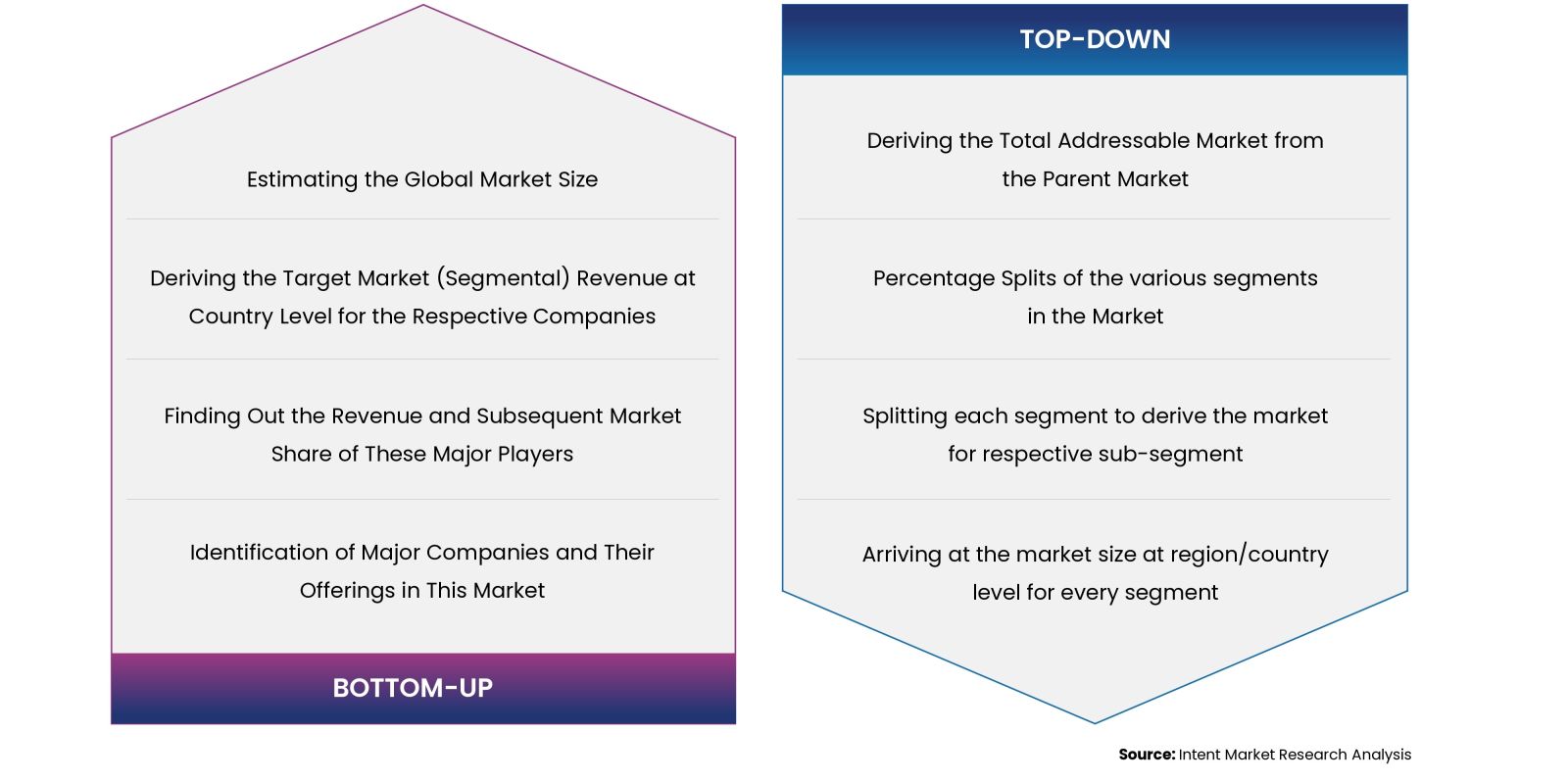

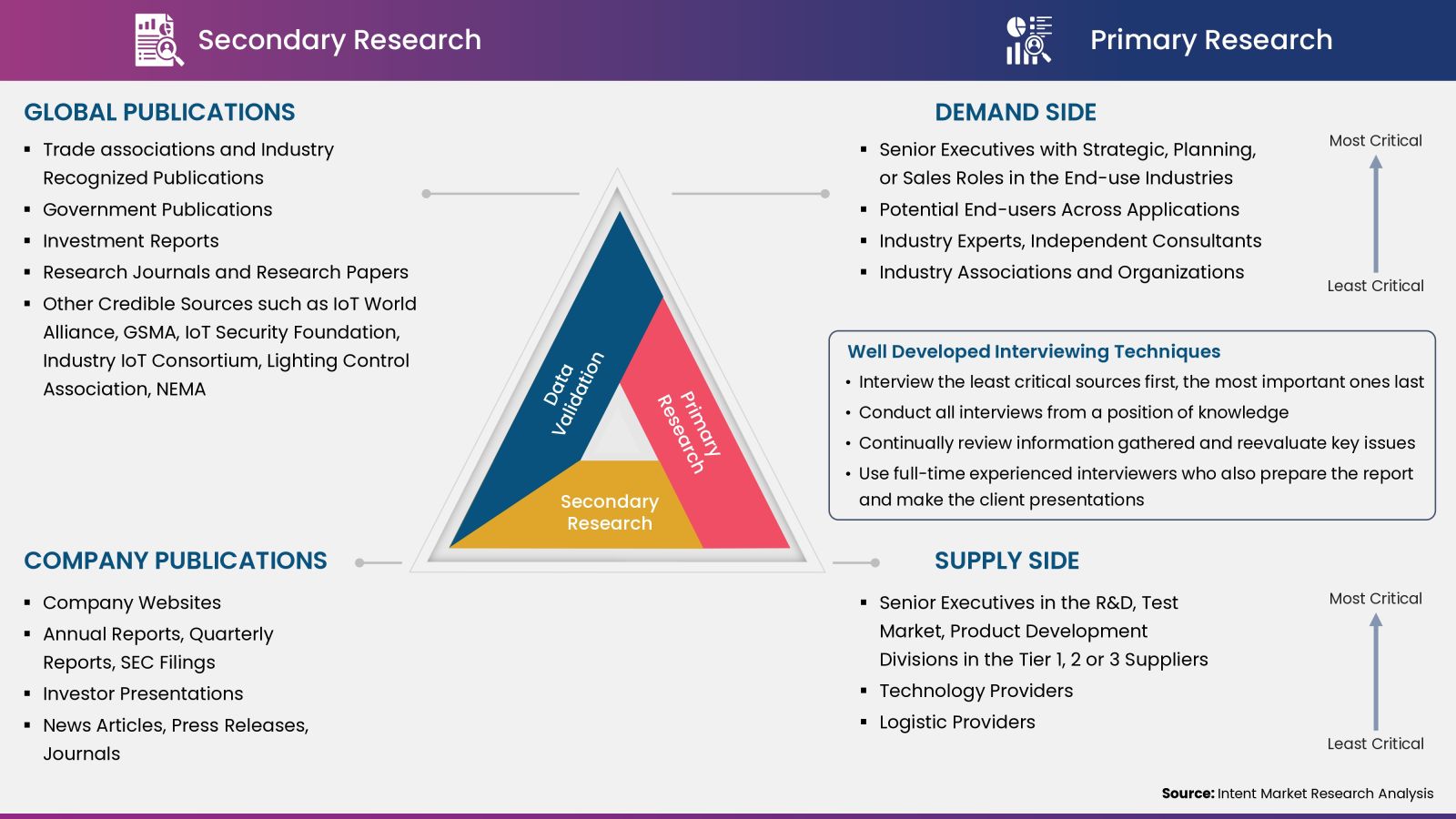

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as macro-indicator analysis, factor analysis, value chain-based sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.