As per Intent Market Research, the Wine Production Machinery Market was valued at USD 2.1 billion in 2023 and will surpass USD 3.7 billion by 2030; growing at a CAGR of 8.2% during 2024 - 2030.

The wine production machinery market is witnessing significant growth driven by increased demand for wine and the ongoing shift toward automation within the industry. As wineries seek to improve efficiency, maintain consistent quality, and reduce labor costs, machinery and technology innovations have become critical in meeting these needs. The market spans a wide range of equipment types such as fermentation tanks, bottling machines, and filtration equipment, all designed to optimize various stages of the winemaking process. Additionally, the growing trend of large-scale production, alongside a rise in small-scale artisanal winemakers, is further contributing to the diversification of machinery types and applications.

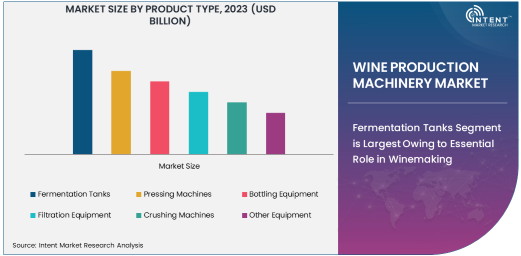

Fermentation Tanks Segment is Largest Owing to Essential Role in Winemaking

Fermentation tanks are the backbone of any winemaking operation, serving as the primary vessel where yeast converts sugars into alcohol during fermentation. These tanks are available in various sizes and materials, including stainless steel, which is favored for its durability, ease of cleaning, and resistance to corrosion. The demand for fermentation tanks remains the largest in the wine production machinery market due to the essential role they play in ensuring the consistency and quality of wine. As wineries grow in scale, the need for larger, more efficient fermentation tanks that can handle higher volumes of grape must has driven market demand.

The growth of premium and large-scale wineries, particularly in regions such as Europe and North America, has further fueled this segment. Fermentation tanks also benefit from technological advancements, including temperature control features and automation, which help improve fermentation consistency and reduce human error. The importance of fermentation tanks in achieving desired wine characteristics, such as flavor and aroma, ensures they remain the dominant product type in the wine production machinery market.

Wine Manufacturers Segment is Largest End-User Industry Due to Strong Demand for Wine Production

Wine manufacturers represent the largest end-user industry within the wine production machinery market. This is driven by the continuous growth of the global wine industry, which is supported by both established wineries and new entrants looking to meet the rising demand for wine across various regions. Wine manufacturers invest significantly in high-quality machinery, particularly fermentation tanks, bottling lines, and filtration systems, to enhance production capabilities and ensure the highest standards of quality.

The wine manufacturing industry has seen a shift toward larger production facilities equipped with state-of-the-art machinery to handle the rising demand for bottled wine. In regions like Europe and the Americas, where wine consumption is high, the demand for machinery in large-scale production facilities is expected to continue growing. Additionally, wineries are increasingly focusing on sustainability and energy efficiency, which has led to the adoption of automated and semi-automated systems in wine production.

Automated Wine Production Machinery Segment is Fastest Growing Due to Efficiency Demands

The automated wine production machinery segment is the fastest growing within the industry, driven by the increasing need for efficiency, consistency, and reduced labor costs. Automated systems provide wineries with the ability to streamline operations, minimize human error, and ensure precise control over various winemaking processes, including fermentation, bottling, and packaging. Automation has been particularly advantageous in large-scale wine production, where volume and speed are critical.

This segment's growth is particularly noticeable in regions like North America and Asia-Pacific, where wineries are scaling up production capabilities while focusing on operational efficiency. Automated machinery is also being integrated with advanced technologies such as artificial intelligence and IoT, which enables wineries to monitor production in real time, further enhancing the growth of this segment. The move toward automation is also being driven by labor shortages and the increasing cost of skilled workers in the wine industry.

Small-Scale Wine Production Segment is Fastest Growing Application Due to Emerging Wine Producers

The small-scale wine production segment is experiencing rapid growth, driven by the rising number of artisanal and boutique wineries globally. These producers often prioritize quality over quantity, creating unique wines in small batches, which requires specialized machinery tailored to their production needs. Equipment like small-scale fermentation tanks, crushing machines, and bottling lines are in high demand as these producers seek to scale up while maintaining their craft production standards.

Small-scale winemakers are increasingly focusing on sustainable and eco-friendly practices, which has also driven demand for machinery designed for energy efficiency and waste reduction. As consumer preferences shift toward artisanal and locally produced wines, the small-scale wine production sector is expected to continue to expand, particularly in regions like North America and parts of Europe, where boutique wineries are flourishing.

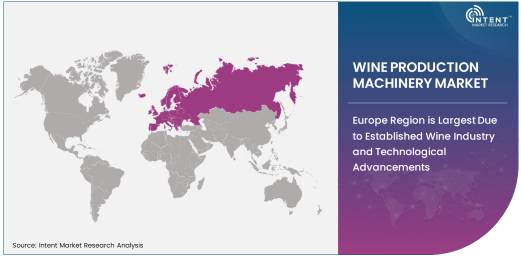

Europe Region is Largest Due to Established Wine Industry and Technological Advancements

Europe remains the largest region in the wine production machinery market, owing to the region's long history and strong presence in the global wine industry. Countries such as France, Italy, Spain, and Germany are among the world’s largest producers and exporters of wine, driving substantial demand for wine production machinery. European wineries are known for their advanced production techniques and high-quality standards, leading to increased investments in state-of-the-art machinery to maintain competitiveness.

The European market is also witnessing an ongoing trend of modernization, with wineries adopting new technologies like automated bottling lines and temperature-controlled fermentation tanks. The focus on sustainability and eco-friendly practices in Europe further fuels the demand for energy-efficient and environmentally conscious wine production machinery. Additionally, Europe serves as a hub for leading machinery manufacturers, contributing to the growth and innovation of the market in this region.

Competitive Landscape and Leading Companies in the Wine Production Machinery Market

The wine production machinery market is highly competitive, with several well-established global companies leading the industry. Key players include GAI S.p.A., Bucher Vaslin, Tetra Pak, and IMA Group, all of which offer a wide range of products designed to cater to various stages of the winemaking process, from fermentation to bottling. These companies are focused on innovation, offering automated solutions that help wineries increase production efficiency and product consistency.

Competition is also driven by advancements in technology, such as the integration of IoT and AI for real-time monitoring and control, as well as sustainability initiatives aimed at reducing energy consumption and waste. Strategic partnerships and acquisitions are also common in this space, as companies seek to expand their portfolios and enhance their technological capabilities. As the market evolves, these leading companies will continue to play a pivotal role in shaping the future of wine production machinery, driving growth through both innovation and regional expansion

List of Leading Companies:

- GAI S.p.A.

- Bucher Vaslin

- VST Technologies

- Della Toffola

- Sidem S.r.l.

- Eraldo S.r.l.

- IMA Group

- Tetra Pak

- JBT Corporation

- Krones AG

- Criveller Group

- Fenzi

- SPX Flow

- Sourcetech

- Omet

Recent Developments:

- GAI S.p.A. launched a new automatic bottling system designed to reduce labor costs and improve efficiency for medium-sized wineries.

- Bucher Vaslin acquired a competitor, expanding its product line and market presence in the global wine machinery market.

- IMA Group announced a partnership with leading wine producers to develop a new range of automated fermentation systems tailored for high-quality wine production.

- Tetra Pak introduced a new range of energy-efficient filtration machines, aimed at reducing water consumption in the wine production process.

- Krones AG expanded its offerings with the release of an innovative bottling line that incorporates advanced robotic technology for higher throughput and flexibility in small-scale wine production.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.1 Billion |

|

Forecasted Value (2030) |

USD 3.7 Billion |

|

CAGR (2024 – 2030) |

8.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wine Production Machinery Market By Product Type (Fermentation Tanks, Pressing Machines, Bottling Equipment, Filtration Equipment, Crushing Machines), By End-User Industry (Wine Manufacturers, Distilleries, Breweries, Food & Beverage Industry, Agricultural Equipment Industry), By Technology (Automated Wine Production Machinery, Semi-Automated Wine Production Machinery, Manual Wine Production Machinery), By Application (Small-Scale Wine Production, Medium-Scale Wine Production, Large-Scale Wine Production) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

GAI S.p.A., Bucher Vaslin, VST Technologies, Della Toffola, Sidem S.r.l., Eraldo S.r.l., IMA Group, Tetra Pak, JBT Corporation, Krones AG, Criveller Group, Fenzi, SPX Flow, Sourcetech, Omet |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wine Production Machinery Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Fermentation Tanks |

|

4.2. Pressing Machines |

|

4.3. Bottling Equipment |

|

4.4. Filtration Equipment |

|

4.5. Crushing Machines |

|

4.6. Others |

|

5. Wine Production Machinery Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Wine Manufacturers |

|

5.2. Distilleries |

|

5.3. Breweries |

|

5.4. Food & Beverage Industry |

|

5.5. Agricultural Equipment Industry |

|

5.6. Others |

|

6. Wine Production Machinery Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Automated Wine Production Machinery |

|

6.2. Semi-Automated Wine Production Machinery |

|

6.3. Manual Wine Production Machinery |

|

7. Wine Production Machinery Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Small-Scale Wine Production |

|

7.2. Medium-Scale Wine Production |

|

7.3. Large-Scale Wine Production |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Wine Production Machinery Market, by Product Type |

|

8.2.7. North America Wine Production Machinery Market, by End-User Industry |

|

8.2.8. North America Wine Production Machinery Market, by Application |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Wine Production Machinery Market, by Product Type |

|

8.2.9.1.2. US Wine Production Machinery Market, by End-User Industry |

|

8.2.9.1.3. US Wine Production Machinery Market, by Application |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. GAI S.p.A. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Bucher Vaslin |

|

10.3. VST Technologies |

|

10.4. Della Toffola |

|

10.5. Sidem S.r.l. |

|

10.6. Eraldo S.r.l. |

|

10.7. IMA Group |

|

10.8. Tetra Pak |

|

10.9. JBT Corporation |

|

10.10. Krones AG |

|

10.11. Criveller Group |

|

10.12. Fenzi |

|

10.13. SPX Flow |

|

10.14. Sourcetech |

|

10.15. Omet |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wine Production Machinery Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wine Production Machinery Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wine Production Machinery Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA