As per Intent Market Research, the Wind Turbine Inspection Services Market was valued at USD 4.6 billion in 2023 and will surpass USD 12.9 billion by 2030; growing at a CAGR of 15.8% during 2024 - 2030.

The wind turbine inspection services market is an integral part of the renewable energy sector, particularly as the global shift toward cleaner energy increases. Inspection services ensure the ongoing operational efficiency, safety, and maintenance of wind turbines. With the growing deployment of onshore and offshore wind farms, these services have become essential for identifying potential issues early, reducing downtime, and extending the lifespan of turbines. Inspection methods such as UAV drone services, thermal imaging, and visual inspections have become the standard, offering cost-effective solutions to assess turbine conditions in a timely manner.

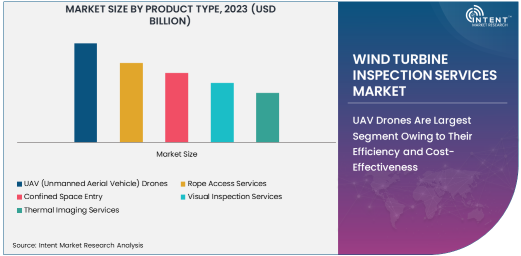

UAV Drones Are Largest Segment Owing to Their Efficiency and Cost-Effectiveness

Among the various product types, UAV drones represent the largest segment in the wind turbine inspection services market. Drones are preferred for their ability to conduct inspections quickly, safely, and at lower costs than traditional methods. Equipped with high-resolution cameras, LiDAR technology, and thermal sensors, drones can access hard-to-reach areas, such as turbine blades at great heights, without the need for scaffolding or manual climbing. The efficiency and flexibility of UAVs make them a popular choice for both onshore and offshore wind turbine inspections. As the wind industry continues to grow, the demand for drone-based inspections is expected to rise significantly, further cementing their dominance in the market.

LiDAR Technology is Fastest-Growing Segment Due to Precision and Accuracy

Among the different inspection technologies, LiDAR (Light Detection and Ranging) is the fastest-growing segment in the wind turbine inspection services market. LiDAR technology offers high precision and accuracy by using laser light to measure distances and create detailed 3D models of turbine components. This technology is particularly useful for detecting minute defects or structural issues that might otherwise go unnoticed. The growing adoption of LiDAR for wind turbine inspection is driven by its ability to enhance data quality, speed up inspections, and reduce the need for extensive human labor. With the increasing demand for comprehensive data to optimize turbine performance and maintenance, LiDAR is expected to continue its rapid growth in the coming years.

Offshore Wind Farms Are Fastest-Growing End-Use Industry Owing to Expanding Investment

The fastest-growing end-use industry in the wind turbine inspection services market is offshore wind farms. As global investments in offshore wind projects soar, the need for efficient and reliable inspection services has become critical. Offshore wind farms present unique challenges, including harsh environmental conditions and difficult accessibility, making the use of drones and advanced technologies like thermal imaging and LiDAR particularly advantageous. The growth in offshore wind projects, particularly in Europe, North America, and Asia, is fueling the demand for specialized inspection services that can reduce downtime, enhance operational safety, and improve asset management. The rapid growth in offshore wind installations is expected to continue driving this segment forward.

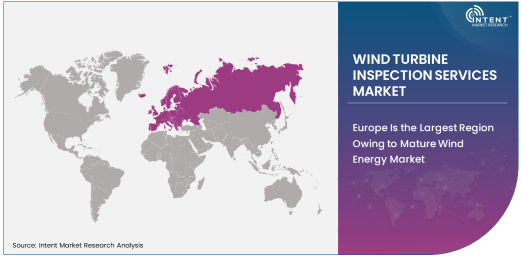

Europe Is the Largest Region Owing to Mature Wind Energy Market

Europe remains the largest region in the wind turbine inspection services market, primarily due to its mature and well-established wind energy infrastructure. The region is home to some of the largest offshore and onshore wind farms globally, with countries such as Germany, the UK, and Denmark leading the way in wind energy production. The European market is highly focused on sustainability, which has spurred investments in wind turbine inspection services to ensure the longevity and optimal performance of turbines. Additionally, Europe has robust regulatory frameworks that emphasize regular maintenance and inspection of renewable energy assets, further promoting the growth of this market. With ongoing expansion in offshore wind farms, Europe is expected to maintain its leading position in the market.

Competitive Landscape and Leading Companies in the Market

The wind turbine inspection services market is highly competitive, with several global players providing a range of specialized inspection solutions. Leading companies such as GE Renewable Energy, Siemens Gamesa, Nordex SE, and Vestas are heavily investing in advanced technologies, including drones and AI-driven data analysis tools, to enhance the efficiency and accuracy of their inspection services. Other prominent companies like Cyberhawk Innovations, Skyspecs, and MISTRAS Group are gaining market share by offering innovative solutions for both onshore and offshore wind turbines. These companies are leveraging cutting-edge technologies such as LiDAR, thermal imaging, and drones to offer a comprehensive suite of inspection services. As the market grows, competition will intensify, with companies focusing on technological advancements and strategic partnerships to secure a competitive edge. The increasing focus on operational safety, cost optimization, and data analytics will drive innovation and growth in the market

List of Leading Companies:

- GE Renewable Energy

- Siemens Gamesa

- Nordex SE

- Vestas Wind Systems A/S

- MISTRAS Group, Inc.

- Cyberhawk Innovations

- Skyspecs

- DJI Innovations

- Aerodyne Group

- Kespry

- Falcon UAV

- DroneScan

- TÜV Rheinland

- Red Rock Renewable Energy

- Bluebird International

Recent Developments:

- GE Renewable Energy has unveiled its new inspection services for offshore wind farms, utilizing drones and advanced AI for more efficient and accurate inspections, improving safety and reducing operational downtime.

- Siemens Gamesa has expanded its wind turbine health monitoring services to include advanced condition monitoring technologies, ensuring better performance prediction and preventive maintenance.

- Cyberhawk Innovations announced a strategic partnership with Vestas to provide advanced drone-based inspection services, enhancing turbine inspections with real-time data analysis and reducing costs for Vestas’ clients.

- Skyspecs, a leading provider of drone inspection services, acquired Kespry to strengthen its portfolio of drone inspection capabilities, aiming to deliver more comprehensive, AI-driven inspection data for wind turbines.

- Nordex has partnered with TÜV Rheinland to develop next-generation wind turbine inspection services, utilizing a combination of AI, drone technology, and thermal imaging to provide more accurate diagnostics of turbine components

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.6 Billion |

|

Forecasted Value (2030) |

USD 12.9 Billion |

|

CAGR (2024 – 2030) |

15.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wind Turbine Inspection Services Market By Product Type (UAV (Unmanned Aerial Vehicle) Drones, Rope Access Services, Confined Space Entry, Visual Inspection Services, Thermal Imaging Services), By Technology (LiDAR (Light Detection and Ranging) Technology, Thermal Imaging, Visual Inspection, GPS-Based Technologies, Drones with High-Resolution Cameras), By End-Use Industry (Power Generation, Utilities, Offshore Wind Farms, Onshore Wind Farms, Industrial Manufacturing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

GE Renewable Energy, Siemens Gamesa, Nordex SE, Vestas Wind Systems A/S, MISTRAS Group, Inc., Cyberhawk Innovations, Skyspecs, DJI Innovations, Aerodyne Group, Kespry, Falcon UAV, DroneScan, TÜV Rheinland, Red Rock Renewable Energy, Bluebird International |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wind Turbine Inspection Services Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. UAV (Unmanned Aerial Vehicle) Drones |

|

4.2. Rope Access Services |

|

4.3. Confined Space Entry |

|

4.4. Visual Inspection Services |

|

4.5. Thermal Imaging Services |

|

5. Wind Turbine Inspection Services Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. LiDAR (Light Detection and Ranging) Technology |

|

5.2. Thermal Imaging |

|

5.3. Visual Inspection |

|

5.4. GPS-based Technologies |

|

5.5. Drones with High-Resolution Cameras |

|

6. Wind Turbine Inspection Services Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Power Generation |

|

6.2. Utilities |

|

6.3. Offshore Wind Farms |

|

6.4. Onshore Wind Farms |

|

6.5. Industrial Manufacturing |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wind Turbine Inspection Services Market, by Product Type |

|

7.2.7. North America Wind Turbine Inspection Services Market, by Technology |

|

7.2.8. North America Wind Turbine Inspection Services Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wind Turbine Inspection Services Market, by Product Type |

|

7.2.9.1.2. US Wind Turbine Inspection Services Market, by Technology |

|

7.2.9.1.3. US Wind Turbine Inspection Services Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. GE Renewable Energy |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Siemens Gamesa |

|

9.3. Nordex SE |

|

9.4. Vestas Wind Systems A/S |

|

9.5. MISTRAS Group, Inc. |

|

9.6. Cyberhawk Innovations |

|

9.7. Skyspecs |

|

9.8. DJI Innovations |

|

9.9. Aerodyne Group |

|

9.10. Kespry |

|

9.11. Falcon UAV |

|

9.12. DroneScan |

|

9.13. TÜV Rheinland |

|

9.14. Red Rock Renewable Energy |

|

9.15. Bluebird International |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wind Turbine Inspection Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wind Turbine Inspection Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wind Turbine Inspection Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA