As per Intent Market Research, the Whole Slide Imaging Market was valued at USD 4.9 billion in 2024-e and will surpass USD 9.5 billion by 2030; growing at a CAGR of 11.8% during 2025 - 2030.

The whole slide imaging (WSI) market is witnessing substantial growth due to the increasing adoption of digital pathology solutions in medical diagnostics, research, and education. Whole slide imaging allows the scanning of entire glass slides and the digitization of pathological tissue samples, offering high-resolution images that can be analyzed, shared, and stored digitally. This technology enables pathologists and medical professionals to make more accurate diagnoses, collaborate remotely, and reduce the risks associated with traditional glass slide handling. As the healthcare sector embraces digital transformation, the demand for whole slide imaging systems has grown, particularly in pathology departments, research institutes, and educational settings.

Technological advancements, such as improved slide scanners, specialized software, and high-definition imaging, have further fueled the market growth. The use of WSI in education and training also contributes significantly to its expanding market share, as it offers an efficient way for medical students and pathologists in training to study complex specimens remotely. With the rise of personalized medicine and the increasing prevalence of chronic diseases such as cancer, whole slide imaging is expected to play a crucial role in advancing diagnostic accuracy and accelerating drug development. The market is poised for continued growth as healthcare facilities increasingly invest in advanced digital pathology systems to improve patient care and streamline workflow efficiency.

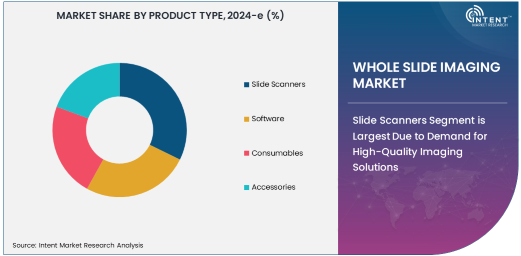

Slide Scanners Segment is Largest Due to Demand for High-Quality Imaging Solutions

The slide scanners segment holds the largest share of the whole slide imaging market, primarily due to the increasing need for high-quality, high-resolution imaging solutions in the medical and research sectors. Slide scanners, which are designed to digitize entire glass slides, allow pathologists to examine specimens in great detail, enhancing the accuracy of diagnoses, especially in oncology and other disease-specific applications. These scanners offer advanced features such as multi-layer scanning, automated focusing, and high-speed image capture, enabling pathologists to work more efficiently and access images remotely for collaboration with other specialists.

The increasing use of digital pathology in hospitals, diagnostic laboratories, and research institutes has driven the demand for slide scanners. The ability to scan slides in a fraction of the time it would take to manually review them, along with the ease of sharing digital images for second opinions or telepathology, has made these scanners an essential tool in modern healthcare. As healthcare providers continue to invest in digital pathology, slide scanners will maintain their leading role in the market, offering cutting-edge solutions for improving diagnostic workflows and advancing research.

Digital Pathology Application is Fastest Growing Due to Improved Diagnostic Efficiency

The digital pathology application is the fastest-growing segment in the whole slide imaging market, driven by the rising demand for more efficient, accurate, and accessible diagnostic methods. Digital pathology leverages whole slide imaging technology to create high-resolution digital slides, which can be viewed, analyzed, and shared electronically. This shift from traditional microscopy to digital platforms allows for better visualization of specimens, enhanced accuracy in diagnosing diseases such as cancer, and the ability to store and retrieve images easily.

The adoption of digital pathology is particularly accelerated by its ability to support telepathology, which enables pathologists to collaborate remotely and consult with specialists across geographical boundaries. This technology is also integral in personalized medicine, as it helps pathologists identify specific biomarkers and make data-driven decisions for patient treatment plans. As the healthcare industry continues to focus on improving diagnostic accuracy and efficiency, the digital pathology application segment is expected to see rapid growth in the coming years.

North America Dominates the Whole Slide Imaging Market Due to Advanced Healthcare Infrastructure

North America leads the whole slide imaging market, supported by its well-established healthcare infrastructure, the presence of leading healthcare providers, and the increasing adoption of advanced digital pathology solutions. The United States, in particular, is a major contributor to the market’s growth due to the widespread use of whole slide imaging technology in hospitals, diagnostic laboratories, and academic research institutes. The region has seen substantial investments in healthcare digitization, which has driven the demand for high-quality slide scanners and other digital pathology tools.

In addition, regulatory support and the approval of digital pathology systems by bodies such as the FDA have provided a boost to the market in North America. The increasing prevalence of chronic diseases, coupled with the growing emphasis on personalized medicine and telemedicine, further contributes to the adoption of whole slide imaging systems in the region. North America is expected to continue holding the largest market share as healthcare providers and research institutions continue to embrace digital pathology solutions to improve patient outcomes and drive medical innovation.

Leading Companies and Competitive Landscape

The whole slide imaging market is highly competitive, with a number of prominent players offering a wide range of products, including slide scanners, software, and consumables. Key companies such as Leica Microsystems, Hamamatsu Photonics, Roche Diagnostics, and 3DHistech lead the market by providing cutting-edge imaging solutions for digital pathology. These companies are focused on developing advanced systems that offer enhanced image quality, faster processing speeds, and better integration with laboratory information systems.

The competitive landscape also includes a focus on innovation and product differentiation, with companies exploring artificial intelligence (AI) and machine learning (ML) integration to enhance diagnostic accuracy and automate image analysis. Strategic partnerships, mergers, and acquisitions are common in this space as companies seek to expand their product portfolios and enter new markets. As the demand for digital pathology continues to rise, leading companies are expected to invest heavily in R&D to stay competitive and address the evolving needs of healthcare providers, researchers, and educational institutions.

Recent Developments:

- In December 2024, Leica Microsystems launched a new high-speed whole slide scanner that significantly reduces scanning time while maintaining image clarity.

- In November 2024, 3DHISTECH introduced an AI-powered image analysis platform for enhancing diagnostic accuracy in oncology and neurology.

- In October 2024, Philips Healthcare announced a partnership with leading medical institutions to expand the use of whole slide imaging in pathology research.

- In September 2024, Hamamatsu Photonics unveiled a compact whole slide scanner designed for use in smaller labs and hospitals with limited space.

- In August 2024, Roche Diagnostics integrated AI-based image processing into its slide scanning systems, improving pathology workflow and diagnostic precision.

List of Leading Companies:

- Hamamatsu Photonics K.K.

- Leica Microsystems

- Philips Healthcare

- 3DHISTECH

- Fujifilm Medical Systems

- Olympus Corporation

- Zeiss Group

- Ventana Medical Systems

- Glencoe Software

- Roche Diagnostics

- Apogee Imaging Systems

- Indica Labs

- PerkinElmer Inc.

- Thermo Fisher Scientific

- BioImagene Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.9 billion |

|

Forecasted Value (2030) |

USD 9.5 billion |

|

CAGR (2025 – 2030) |

11.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Whole Slide Imaging Market By Product Type (Slide Scanners, Software, Consumables, Accessories), By Application (Digital Pathology, Education and Training, Drug Development and Research), By End-User (Hospitals, Diagnostic Laboratories, Research Institutes) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Hamamatsu Photonics K.K., Leica Microsystems, Philips Healthcare, 3DHISTECH, Fujifilm Medical Systems, Olympus Corporation, Zeiss Group, Ventana Medical Systems, Glencoe Software, Roche Diagnostics, Apogee Imaging Systems, Indica Labs, PerkinElmer Inc., Thermo Fisher Scientific, BioImagene Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Whole Slide Imaging Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Slide Scanners |

|

4.1.1. Brightfield Scanners |

|

4.1.2. Fluorescence Scanners: |

|

4.1.3. Confocal Scanners |

|

4.2. Software |

|

4.3. Consumables |

|

4.4. Accessories |

|

5. Whole Slide Imaging Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Digital Pathology |

|

5.2. Education and Training |

|

5.3. Drug Development and Research |

|

5.4. Others |

|

6. Whole Slide Imaging Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Diagnostic Laboratories |

|

6.3. Research Institutes |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Whole Slide Imaging Market, by Product Type |

|

7.2.7. North America Whole Slide Imaging Market, by Application |

|

7.2.8. North America Whole Slide Imaging Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Whole Slide Imaging Market, by Product Type |

|

7.2.9.1.2. US Whole Slide Imaging Market, by Application |

|

7.2.9.1.3. US Whole Slide Imaging Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Hamamatsu Photonics K.K. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Leica Microsystems |

|

9.3. Philips Healthcare |

|

9.4. 3DHISTECH |

|

9.5. Fujifilm Medical Systems |

|

9.6. Olympus Corporation |

|

9.7. Zeiss Group |

|

9.8. Ventana Medical Systems |

|

9.9. Glencoe Software |

|

9.10. Roche Diagnostics |

|

9.11. Apogee Imaging Systems |

|

9.12. Indica Labs |

|

9.13. PerkinElmer Inc. |

|

9.14. Thermo Fisher Scientific |

|

9.15. BioImagene Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Whole Slide Imaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Whole Slide Imaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Whole Slide Imaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA