As per Intent Market Research, the White Noise Sleep Aid Market was valued at USD 516.3 million in 2024-e and will surpass USD 987.8 million by 2030; growing at a CAGR of 11.4% during 2025 - 2030.

The global white noise sleep aid market is experiencing significant growth, driven by increasing awareness about sleep health and the rising prevalence of sleep disorders. As individuals prioritize mental well-being and physical health, sleep aid solutions have gained traction. White noise products, known for their ability to mask disruptive sounds and create a calm sleep environment, are now widely adopted across various demographics. Technological advancements and the proliferation of innovative apps and devices are further propelling the market.

The demand is particularly high in urban areas where environmental noise pollution disrupts sleep patterns. Additionally, the market benefits from growing adoption in healthcare settings, where white noise aids are used to improve patient comfort. As the market evolves, competition intensifies, with players focusing on product innovation and strategic distribution to cater to diverse consumer preferences.

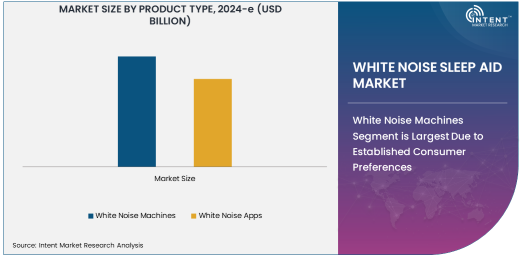

White Noise Machines Segment is Largest Owing to Widespread Adoption

The white noise machines segment dominates the product type category, holding the largest market share. These devices are particularly popular for their efficiency in producing consistent sound frequencies that block background noise. They cater to diverse consumer needs, from individuals seeking better sleep quality to parents using them for infants and young children. The convenience, portability, and customizable sound settings of modern machines further drive their popularity.

Healthcare facilities have also contributed to the growth of this segment. White noise machines are increasingly used in hospitals and clinics to create a more soothing environment for patients, especially in neonatal care and psychiatric wards. This dual appeal to individual and institutional buyers cements their leadership in the market.

Home Use Application is Fastest Growing Owing to Increased Consumer Awareness

Home use is the fastest-growing application segment, fueled by rising consumer awareness about the benefits of white noise in creating optimal sleep conditions. As remote working trends persist and consumers spend more time at home, the demand for sleep aids tailored for personal use has surged. White noise sleep aids for home use address diverse needs, such as improving sleep quality for adults, aiding infants' sleep routines, and enhancing relaxation for elderly users.

Innovative product designs, including compact devices and app-based solutions, have made these tools more accessible and affordable. With the growing focus on wellness and self-care, consumers are increasingly investing in products that improve sleep quality, boosting the growth of the home use application segment.

Individuals End-User Segment is Largest Owing to Personalized Demand

The individuals segment represents the largest end-user category, driven by the need for tailored solutions to address unique sleep challenges. A significant portion of the population struggles with issues such as insomnia, stress-induced sleep disruptions, and irregular sleep cycles. White noise sleep aids cater to these challenges by providing customizable soundscapes that promote better sleep.

Additionally, the increasing availability of user-friendly devices and apps has made white noise solutions more accessible to individuals. The growing adoption of wearables and integrated technologies that sync with white noise products further highlights the segment's robust demand.

Online Sales Distribution Channel is Fastest Growing Owing to E-Commerce Expansion

Online sales are the fastest-growing distribution channel, driven by the global expansion of e-commerce platforms and changing consumer buying behaviors. Digital marketplaces provide a wide variety of products, enabling consumers to compare features, read reviews, and make informed decisions. The convenience of home delivery, combined with frequent online promotions and discounts, has further accelerated this trend.

Additionally, the COVID-19 pandemic significantly boosted online shopping, creating long-term changes in consumer behavior. Manufacturers and retailers have embraced digital channels to tap into this growing market, offering enhanced customer experiences through virtual consultations and product demonstrations.

North America is the Largest Region Owing to High Consumer Awareness

North America leads the white noise sleep aid market, driven by high consumer awareness about sleep health and a significant prevalence of sleep disorders. The region's urban population frequently deals with noise pollution, prompting widespread adoption of white noise solutions. Moreover, the presence of advanced healthcare systems that integrate white noise devices into patient care further supports market growth. The U.S. dominates the North American market due to its large consumer base and early adoption of innovative sleep aid technologies. Companies in the region focus on product development and strategic collaborations, ensuring sustained growth.

Leading Companies and Competitive Landscape

The white noise sleep aid market is competitive, with a range of companies offering innovative products across both the white noise machine and app segments. Key players in the market include companies such as LectroFan, Sound+Sleep (Adaptive Sound Technologies), and Marpac, which are renowned for their high-quality white noise machines designed to cater to both individual and commercial needs. In the app segment, companies like Calm, Relax Melodies, and White Noise Free are prominent players offering customizable soundscapes and sleep-related features.

The competitive landscape is marked by constant innovation, with companies focusing on enhancing the functionality of their devices and apps. Features such as customizable sound frequencies, integration with smart home systems, and the ability to sync with other health and wellness apps are becoming increasingly common. As the market continues to grow, leading companies are expected to invest heavily in research and development to cater to the diverse preferences of consumers while expanding their product offerings to include additional sound therapy solutions for improved sleep and relaxation.

Recent Developments:

- In December 2024, LectroFan introduced a new white noise machine with customizable sound settings, catering to various sleep environments and preferences.

- In November 2024, Marpac launched a new range of portable white noise machines designed for travelers, emphasizing convenience and relaxation on the go.

- In October 2024, Homedics expanded its sleep aid portfolio with a hybrid white noise machine that includes additional features like ambient light therapy.

- In September 2024, Snooze partnered with wellness influencers to raise awareness of the health benefits of white noise for better sleep quality.

- In August 2024, iHome introduced a smart white noise machine with voice control, offering ease of use for sleep-conscious consumers.

List of Leading Companies:

- LectroFan

- Marpac

- Homedics

- Adaptive Sound Technologies, Inc.

- Snooze

- Sound Oasis

- iHome

- Grain Audio

- Sleep Easy

- Hatch

- Cloud B

- Shhh...Noise

- Big Red Rooster

- White Noise Solutions

- Pure Enrichment

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 516.3 million |

|

Forecasted Value (2030) |

USD 987.8 million |

|

CAGR (2025 – 2030) |

11.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

White Noise Sleep Aid Market By Product Type (White Noise Machines, White Noise Apps), By Application (Home Use, Commercial Use), By End-User (Individuals, Healthcare Facilities, Hospitals and Clinics), By Distribution Channel (Online Sales, Retail Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

LectroFan, Marpac, Homedics, Adaptive Sound Technologies, Inc., Snooze, Sound Oasis, iHome, Grain Audio, Sleep Easy, Hatch, Cloud B, Shhh...Noise, Big Red Rooster, White Noise Solutions, Pure Enrichment |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. White Noise Sleep Aid Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. White Noise Machines |

|

4.2. White Noise Apps |

|

5. White Noise Sleep Aid Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Home Use |

|

5.2. Commercial Use |

|

6. White Noise Sleep Aid Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Individuals |

|

6.2. Healthcare Facilities |

|

6.3. Hospitals and Clinics |

|

7. White Noise Sleep Aid Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Sales |

|

7.2. Retail Sales |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America White Noise Sleep Aid Market, by Product Type |

|

8.2.7. North America White Noise Sleep Aid Market, by Application |

|

8.2.8. North America White Noise Sleep Aid Market, by End-User |

|

8.2.9. North America White Noise Sleep Aid Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US White Noise Sleep Aid Market, by Product Type |

|

8.2.10.1.2. US White Noise Sleep Aid Market, by Application |

|

8.2.10.1.3. US White Noise Sleep Aid Market, by End-User |

|

8.2.10.1.4. US White Noise Sleep Aid Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. LectroFan |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Marpac |

|

10.3. Homedics |

|

10.4. Adaptive Sound Technologies, Inc. |

|

10.5. Snooze |

|

10.6. Sound Oasis |

|

10.7. iHome |

|

10.8. Grain Audio |

|

10.9. Sleep Easy |

|

10.10. Hatch |

|

10.11. Cloud B |

|

10.12. Shhh...Noise |

|

10.13. Big Red Rooster |

|

10.14. White Noise Solutions |

|

10.15. Pure Enrichment |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the White Noise Sleep Aid Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the White Noise Sleep Aid Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the White Noise Sleep Aid Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA