As per Intent Market Research, the White Coal Market was valued at USD 4.3 Billion in 2024-e and will surpass USD 6.8 Billion by 2030; growing at a CAGR of 8.0% during 2025 - 2030.

The white coal market has emerged as a crucial part of the renewable energy landscape, driven by the growing demand for sustainable alternatives to traditional fossil fuels. White coal, which refers to biofuels such as briquettes, pellets, and pucks made from biomass materials like agricultural waste, wood, and other organic substances, is gaining traction in various industries. These biofuels are seen as an environmentally friendly alternative for power generation, residential heating, and industrial use. With increasing concerns over carbon emissions and the depletion of non-renewable energy sources, white coal is becoming a preferred choice due to its renewable nature, ease of storage, and transportation.

The market for white coal is segmented into product types, applications, and end-use industries. Each of these segments has been evolving rapidly as governments, industries, and consumers turn towards cleaner energy solutions. The growing shift towards sustainable practices in energy consumption, coupled with government incentives for green energy technologies, is expected to drive significant growth in the white coal market in the coming years. Increased production and technological advancements in the manufacturing of biofuels are also contributing to the market's expansion.

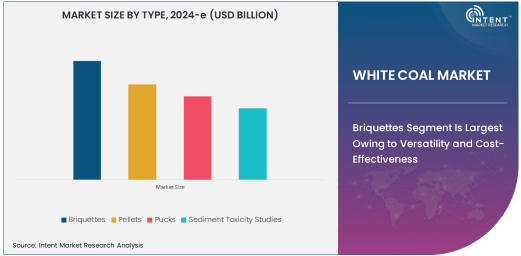

Briquettes Segment Is Largest Owing to Versatility and Cost-Effectiveness

The briquettes segment holds the largest share of the white coal market due to their versatility and cost-effectiveness. Briquettes, made by compressing biomass into dense blocks, are widely used in power generation and industrial applications. Their relatively lower cost compared to traditional fossil fuels, combined with the ease of handling and storage, makes them an attractive option for both large-scale power plants and smaller industries. Briquettes also have a higher energy density than raw biomass, leading to better combustion efficiency and a reduction in waste generation, which further boosts their adoption.

Briquettes are particularly popular in countries with a strong focus on renewable energy and sustainability, where they provide an efficient alternative to coal for power generation and heating. The growing demand for biofuels in the industrial sector, where briquettes can be used for heating and energy generation in processes such as cement and steel manufacturing, is a major factor driving the dominance of this segment. As industries continue to seek alternatives to fossil fuels to comply with environmental regulations, the briquettes segment is expected to remain the largest in the white coal market.

Power Generation Segment Is Fastest Growing Owing to Increasing Demand for Clean Energy

The power generation segment is the fastest growing in the white coal market, driven by the rising demand for clean and sustainable energy sources. With the global shift towards reducing carbon emissions and mitigating the impacts of climate change, biofuels such as white coal are gaining favor in power generation over traditional fossil fuels. White coal provides a renewable source of energy that can be used in power plants, reducing dependency on coal and other non-renewable energy sources.

The growing concern about air pollution and the environmental impact of traditional power generation methods is pushing governments and energy companies to invest in renewable alternatives. White coal, particularly in the form of briquettes and pellets, is well-suited for combustion in power plants as a cleaner energy source. Additionally, the availability of incentives and government policies promoting the use of biofuels further contributes to the rapid growth of the power generation segment. As countries work towards achieving their sustainability goals, this segment is expected to witness substantial growth in the coming years.

Energy Sector Segment Is Largest Owing to Widespread Adoption of Biofuels

The energy sector is the largest end-use industry in the white coal market, driven by the increasing adoption of biofuels for power generation and industrial heating. White coal is seen as an ideal alternative to traditional fossil fuels in the energy sector because it is renewable, produces lower emissions, and helps reduce dependence on coal and petroleum-based fuels. The demand for cleaner energy solutions in the energy sector, driven by government policies and growing environmental awareness, has significantly boosted the adoption of white coal in power plants and industrial applications.

In many regions, the energy sector is undergoing a transition towards more sustainable practices, and biofuels such as white coal play a critical role in this shift. With advancements in biomass technology and an increasing number of power plants equipped to use biofuels, the energy sector remains the largest end-user of white coal. As the global demand for renewable energy sources continues to rise, the energy sector is expected to maintain its dominant position in the market, further driving the growth of white coal usage.

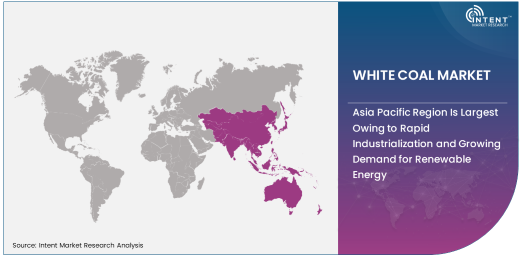

Asia Pacific Region Is Largest Owing to Rapid Industrialization and Growing Demand for Renewable Energy

The Asia Pacific region is the largest market for white coal, primarily due to rapid industrialization and the increasing demand for renewable energy solutions in countries such as China, India, and Japan. These nations are heavily investing in alternative energy sources, including biomass-based fuels like white coal, to reduce air pollution and dependence on traditional fossil fuels. The region’s growing industrial base, especially in manufacturing, power generation, and residential heating, further drives the demand for biofuels.

Asia Pacific’s large agricultural sector also plays a role in the growth of the white coal market, as biomass waste from agriculture is readily available for use in biofuel production. The government policies and initiatives in these countries, such as subsidies for renewable energy projects and stricter emissions regulations, continue to support the adoption of white coal as a sustainable energy source. Given the region's immense population and industrial base, Asia Pacific is expected to maintain its leadership as the largest market for white coal, with substantial growth projected over the coming years.

Competitive Landscape and Leading Companies

The white coal market is highly competitive, with several companies leading the charge in the production and distribution of biofuels. Key players in this market include companies such as VBC Ferro Alloys, BioEnergy, and Enviva, which are actively involved in the production of briquettes, pellets, and pucks from various biomass sources. These companies focus on innovation in production techniques, quality control, and expanding their product offerings to meet the growing demand for white coal in power generation, industrial use, and residential heating.

The market is also seeing increasing collaborations and partnerships between biofuel producers and energy companies to ensure a steady supply of white coal for power plants and industrial applications. With the global shift towards renewable energy and stricter environmental regulations, companies in the white coal market are investing heavily in R&D to improve the efficiency of biofuels and expand their market presence. As the demand for sustainable energy solutions continues to rise, the competitive landscape in the white coal market will remain dynamic, with new entrants seeking to capitalize on the growing opportunities in this sector.

Recent Developments:

- Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) has expanded its white coal production facility to cater to the increasing demand for cleaner fuel in India.

- Biomass Secure Power launched a new range of white coal pellets with enhanced energy efficiency for industrial applications.

- Energos Technologies entered a partnership with a European company to develop new biomass power plants that use white coal as the primary fuel.

- Drax Group announced an investment in new white coal production technologies to reduce the carbon footprint of its existing power plants.

- TATA Power has launched an initiative to replace a portion of its fossil fuel usage with white coal in its thermal power generation plants.

List of Leading Companies:

- Gujarat Narmada Valley Fertilizers & Chemicals (GNFC)

- Eco Green Energy

- Vancouver Pellet Inc.

- Biomass Secure Power

- Energos Technologies

- Zilkha Biomass Energy

- Hurst Boiler & Welding Co., Inc.

- GDF Suez

- Fireside Energy

- Cedar Creek Renewable Energy

- Drax Group

- AET (Andritz)

- TATA Power

- Abellon Clean Energy

- Boralex Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.3 Billion |

|

Forecasted Value (2030) |

USD 6.8 Billion |

|

CAGR (2025 – 2030) |

8.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

White Coal Market by Type (Briquettes, Pellets, Pucks), by Application (Power Generation, Industrial Use, Residential Heating), by End-Use Industry (Energy, Chemical Industry, Residential Sector, Manufacturing), and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Eco Green Energy, Vancouver Pellet Inc., Biomass Secure Power, Energos Technologies, Zilkha Biomass Energy, GDF Suez, Fireside Energy, Cedar Creek Renewable Energy, Drax Group, AET (Andritz), TATA Power, Boralex Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. White Coal Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. IgG |

|

4.2. IgA |

|

4.3. IgM |

|

4.4. IgE |

|

4.5. IgD |

|

5. White Coal Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Primary Immunodeficiency |

|

5.2. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) |

|

5.3. Myasthenia Gravis |

|

5.4. Others |

|

6. White Coal Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Clinics |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America White Coal Market, by Type |

|

7.2.7. North America White Coal Market, by Application |

|

7.2.8. North America White Coal Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US White Coal Market, by Type |

|

7.2.9.1.2. US White Coal Market, by Application |

|

7.2.9.1.3. US White Coal Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. CSL Behring |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Grifols, S.A. |

|

9.3. Takeda Pharmaceutical Company Limited |

|

9.4. Kedrion Biopharma |

|

9.5. Octapharma AG |

|

9.6. Bio Products Laboratory (BPL) |

|

9.7. LFB Group |

|

9.8. Shanghai RAAS Blood Products Co., Ltd. |

|

9.9. Baxalta (A Takeda Company) |

|

9.10. China Biologic Products Holdings, Inc. |

|

9.11. Sanquin Blood Supply Foundation |

|

9.12. Emergent BioSolutions Inc. |

|

9.13. Biotest AG |

|

9.14. Hualan Biological Engineering Inc. |

|

9.15. ADMA Biologics, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the White Coal Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the White Coal Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the White Coal Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA