As per Intent Market Research, the Whey Protein Isolates Market was valued at USD 10.8 billion in 2023 and will surpass USD 18.8 billion by 2030; growing at a CAGR of 8.2% during 2024 - 2030.

The whey protein isolates market has seen significant growth in recent years, driven by an increasing demand for high-quality proteins in various sectors, including sports nutrition, food and beverages, and dietary supplements. Whey protein isolates are highly valued for their purity, as they contain a high percentage of protein, minimal fat, and lactose, making them ideal for muscle repair, recovery, and growth. This market is influenced by evolving health and fitness trends, rising awareness of the benefits of protein-rich diets, and the growing popularity of protein supplements among athletes, bodybuilders, and the general population. As these dietary habits become more ingrained, the market for whey protein isolates is expected to continue its expansion globally.

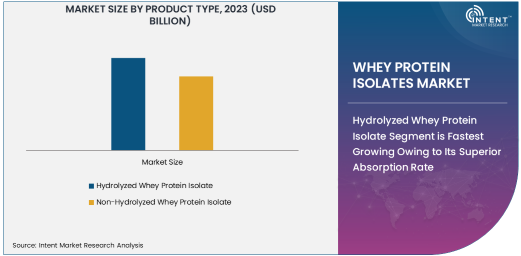

Hydrolyzed Whey Protein Isolate Segment is Fastest Growing Owing to Its Superior Absorption Rate

Hydrolyzed whey protein isolate is gaining significant traction due to its rapid absorption and faster digestibility, making it particularly popular in the sports nutrition market. This type of protein is processed through hydrolysis, breaking it down into smaller peptides that the body can quickly absorb. As a result, hydrolyzed whey protein isolates provide quicker muscle recovery, which is a key factor driving their demand among athletes and fitness enthusiasts. Additionally, they are often preferred by individuals with lactose intolerance, as the hydrolysis process reduces lactose content, making it easier on the digestive system.

The demand for hydrolyzed whey protein is expected to rise sharply in the coming years, driven by the increasing number of athletes, gym-goers, and fitness-conscious individuals seeking quick recovery and muscle-building benefits. As consumers become more aware of the advantages of faster-digesting proteins, this subsegment will continue to lead the growth in the whey protein isolates market. Moreover, advancements in processing technologies have led to improved product quality, further boosting the attractiveness of hydrolyzed whey protein isolate in the global market.

Sports Nutrition Application is Largest Owing to Rising Fitness and Health Trends

The sports nutrition segment holds the largest share of the whey protein isolates market, driven by the increasing number of individuals engaging in fitness routines and the rising demand for products that support muscle recovery and performance. Whey protein isolates are a key component in many sports nutrition supplements, including protein powders, shakes, and bars. These products are designed to enhance muscle recovery, improve endurance, and support overall athletic performance, making them a staple for athletes, bodybuilders, and fitness enthusiasts.

The growing global trend towards health and fitness, coupled with increasing awareness of the importance of protein for muscle repair, is expected to further fuel the demand for whey protein isolates in sports nutrition. This segment is not only large but also continues to witness innovation, with brands offering new formulations and products tailored to specific athlete needs, such as post-workout recovery or muscle-building formulas. As more people adopt active lifestyles, the sports nutrition segment will maintain its position as the dominant application for whey protein isolates.

Online Retail Distribution Channel is Fastest Growing Owing to E-Commerce Growth

Online retail has emerged as the fastest-growing distribution channel for whey protein isolates, driven by the rapid expansion of e-commerce platforms and the increasing preference for shopping online. Consumers are increasingly turning to online platforms for convenience, a wide variety of options, and the ability to compare prices and reviews before making a purchase. This shift is particularly evident in the health and wellness sector, where a large portion of whey protein isolate sales now occur via online channels such as Amazon, specialized health stores, and direct-to-consumer websites.

Online retail offers the advantage of providing easy access to a wide range of products, including premium and niche whey protein isolate brands that may not be available in physical stores. As the e-commerce landscape continues to grow, the online distribution channel for whey protein isolates is expected to expand rapidly, creating new opportunities for both established and emerging brands to reach a global customer base. This trend is supported by improving internet penetration and the growing trust in online shopping, further solidifying online retail as the most dynamic distribution channel in the market.

Sports & Fitness End-User Industry is Largest Owing to Surge in Fitness Awareness

The sports and fitness industry is the largest end-user segment for whey protein isolates, driven by the increasing awareness of the benefits of protein supplementation for muscle recovery, weight management, and overall fitness goals. Athletes and fitness enthusiasts are the primary consumers of whey protein isolates, using them to support their exercise regimens and improve performance. This segment benefits from the growing global trend of health-conscious consumers seeking to enhance their physical performance and recover faster from intense workouts.

As more individuals adopt healthier lifestyles and prioritize fitness, the demand for whey protein isolates in the sports and fitness sector is expected to continue its upward trajectory. Brands are increasingly targeting this segment with specialized products designed for specific fitness goals, such as muscle growth, fat loss, or post-workout recovery. With the rise of fitness culture worldwide, the sports and fitness industry will remain the key driver for growth in the whey protein isolates market.

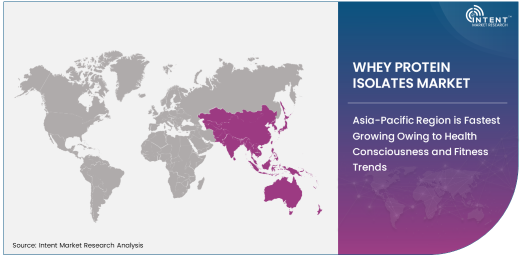

Asia-Pacific Region is Fastest Growing Owing to Health Consciousness and Fitness Trends

Asia-Pacific is the fastest-growing region in the whey protein isolates market, driven by increasing health consciousness, rising disposable incomes, and a growing interest in fitness among consumers. Countries such as China, India, Japan, and South Korea are experiencing a surge in demand for protein supplements, with whey protein isolates being a preferred choice due to their high protein content and easy digestibility. The growing middle class in these countries is becoming more aware of the importance of protein in their diet, further fueling the market for whey protein isolates.

The fitness industry in Asia-Pacific is also expanding rapidly, with more gyms, fitness centers, and online health platforms emerging to cater to the growing demand for sports nutrition products. As a result, the region is expected to continue its rapid growth in the whey protein isolates market, driven by a shift towards healthier lifestyles and increased participation in fitness activities. The expanding e-commerce sector and the availability of international whey protein brands are contributing to the accessibility of these products, further boosting market growth in the region.

Competitive Landscape and Leading Companies

The whey protein isolates market is highly competitive, with several global companies leading the charge in product innovation, distribution, and brand recognition. Key players such as Nestlé, Glanbia Nutritionals, Arla Foods, Danone, and FrieslandCampina dominate the market, offering a wide range of whey protein isolate products across various applications. These companies have established themselves as leaders by focusing on quality, innovation, and meeting the growing consumer demand for high-protein, health-focused products.

The competitive landscape also includes smaller, emerging companies that are carving out niches by offering specialized whey protein isolates tailored to specific consumer needs, such as lactose-free or organic options. As demand for whey protein isolates continues to rise, companies are focusing on improving processing technologies, expanding their product offerings, and increasing their presence in emerging markets like Asia-Pacific. With the increasing popularity of online retail and e-commerce platforms, these companies are leveraging digital marketing strategies to reach a wider customer base, further intensifying competition in the market.

List of Leading Companies:

- Nestlé Nutrition

- Arla Foods

- Whey Protein Isolates (WPI) - Glanbia Nutritionals

- The Kraft Heinz Company

- Danone S.A.

- Agropur Ingredients

- The Fonterra Co-operative Group

- Davisco Foods International, Inc.

- FrieslandCampina

- Hiland Dairy

- Leprino Foods

- Whey Protein Solutions

- BASF SE

- Herbalife Nutrition Ltd.

- PepsiCo, Inc.

Recent Developments:

- Nestlé Nutrition launched a new product line incorporating high-quality whey protein isolates aimed at enhancing endurance and recovery for athletes.

- Glanbia announced a significant investment in expanding its whey protein isolate production facility to meet growing demand in the global sports nutrition sector.

- Danone acquired a leading dietary supplement company to enhance its position in the whey protein isolates market, particularly in the sports nutrition and health supplement segments.

- FrieslandCampina unveiled a new range of whey protein isolate products tailored for the European market, focusing on athletes and fitness enthusiasts.

- Arla Foods collaborated with a global fitness brand to develop innovative whey protein isolate formulations aimed at improving post-workout recovery and muscle growth.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 10.8 billion |

|

Forecasted Value (2030) |

USD 18.8 billion |

|

CAGR (2024 – 2030) |

8.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Whey Protein Isolates Market By Product Type (Hydrolyzed Whey Protein Isolate, Non-Hydrolyzed Whey Protein Isolate), By Application (Sports Nutrition, Food & Beverages, Dietary Supplements, Infant Nutrition), By End-User Industry (Sports & Fitness, Food & Beverage, Pharmaceutical, Personal Care & Cosmetics), By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Direct Sales, Pharmacies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Nestlé Nutrition, Arla Foods, Whey Protein Isolates (WPI) - Glanbia Nutritionals, The Kraft Heinz Company, Danone S.A., Agropur Ingredients, The Fonterra Co-operative Group, Davisco Foods International, Inc., FrieslandCampina, Hiland Dairy, Leprino Foods, Whey Protein Solutions, BASF SE, Herbalife Nutrition Ltd., PepsiCo, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Whey Protein Isolates Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hydrolyzed Whey Protein Isolate |

|

4.2. Non-Hydrolyzed Whey Protein Isolate |

|

5. Whey Protein Isolates Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Sports Nutrition |

|

5.2. Food & Beverages |

|

5.3. Dietary Supplements |

|

5.4. Infant Nutrition |

|

5.5. Others |

|

6. Whey Protein Isolates Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Sports & Fitness |

|

6.2. Food & Beverage |

|

6.3. Pharmaceutical |

|

6.4. Personal Care & Cosmetics |

|

6.5. Others |

|

7. Whey Protein Isolates Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Online Retail |

|

7.2. Supermarkets/Hypermarkets |

|

7.3. Specialty Stores |

|

7.4. Direct Sales |

|

7.5. Pharmacies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Whey Protein Isolates Market, by Product Type |

|

8.2.7. North America Whey Protein Isolates Market, by Application |

|

8.2.8. North America Whey Protein Isolates Market, by End-User Industry |

|

8.2.9. North America Whey Protein Isolates Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Whey Protein Isolates Market, by Product Type |

|

8.2.10.1.2. US Whey Protein Isolates Market, by Application |

|

8.2.10.1.3. US Whey Protein Isolates Market, by End-User Industry |

|

8.2.10.1.4. US Whey Protein Isolates Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Nestlé Nutrition |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Arla Foods |

|

10.3. Whey Protein Isolates (WPI) - Glanbia Nutritionals |

|

10.4. The Kraft Heinz Company |

|

10.5. Danone S.A. |

|

10.6. Agropur Ingredients |

|

10.7. The Fonterra Co-operative Group |

|

10.8. Davisco Foods International, Inc. |

|

10.9. FrieslandCampina |

|

10.10. Hiland Dairy |

|

10.11. Leprino Foods |

|

10.12. Whey Protein Solutions |

|

10.13. BASF SE |

|

10.14. Herbalife Nutrition Ltd. |

|

10.15. PepsiCo, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Whey Protein Isolates Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Whey Protein Isolates Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Whey Protein Isolates Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA