As per Intent Market Research, the Wet Marine Scrubber Systems Market was valued at USD 6.3 Billion in 2024-e and will surpass USD 17.1 Billion by 2030; growing at a CAGR of 18.1% during 2025-2030.

The Wet Marine Scrubber Systems market is witnessing significant growth due to increasing environmental regulations governing sulfur emissions in the maritime industry. These scrubber systems are designed to remove sulfur oxides (SOx) from exhaust gases produced by ships, ensuring compliance with global regulations, such as the International Maritime Organization’s (IMO) 2020 sulfur cap, which limits sulfur content in marine fuel. Wet scrubbers use water to neutralize sulfur oxides, and their use is becoming critical for shipping companies and marine transportation industries seeking to meet stringent emission standards while maintaining operational efficiency.

The market includes several types of scrubber systems, primarily divided by their operational mechanisms, which use either seawater or freshwater as scrubbing material. The rapid adoption of these systems across various sectors of the marine industry is driven by regulatory pressures, environmental considerations, and the long-term cost savings from using scrubbers in comparison to switching to low-sulfur fuels. The demand for Wet Marine Scrubber Systems is expected to rise as the global push for cleaner marine transportation intensifies.

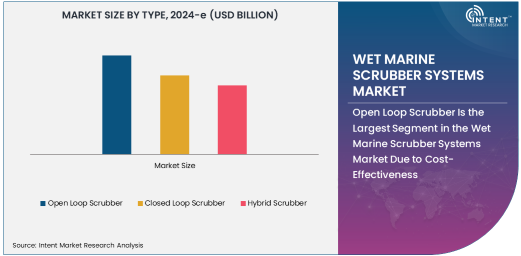

Open Loop Scrubber Is the Largest Segment in the Wet Marine Scrubber Systems Market Due to Cost-Effectiveness

Open loop scrubbers are the most commonly used type in the Wet Marine Scrubber Systems market due to their relatively lower operational costs. These systems utilize seawater as a scrubbing material, which is naturally alkaline and helps neutralize sulfur oxides in exhaust gases. Open loop scrubbers are particularly popular in regions with abundant seawater availability and where discharging treated seawater back into the ocean is legally permissible.

Their widespread adoption is driven by their simplicity, cost-effectiveness, and relatively low maintenance requirements. However, their use is restricted in some regions due to environmental regulations regarding the discharge of scrubber water into the ocean, which has led to increased interest in closed loop and hybrid scrubber systems.

Closed Loop Scrubber Is the Fastest Growing Segment in the Wet Marine Scrubber Systems Market Due to Environmental Concerns

Closed loop scrubbers are gaining traction in the market due to stricter environmental regulations and concerns over the discharge of contaminated water into the sea. These systems use freshwater or a recirculating solution to neutralize sulfur oxides from exhaust gases. The scrubbed water is filtered and re-used in the system, making it more environmentally friendly compared to open loop scrubbers, which discharge the used seawater directly into the ocean.

Closed loop systems are preferred in areas where the discharge of water from open loop scrubbers is prohibited, such as in ecologically sensitive regions or those with stringent environmental policies. While closed loop scrubbers come with higher installation and operational costs, they are seen as a more sustainable option, especially for ships that operate in areas with strict emission standards.

Hybrid Scrubber Provides Flexibility in the Wet Marine Scrubber Systems Market

Hybrid scrubbers offer a combination of both open loop and closed loop scrubber technologies. These systems can switch between using seawater (open loop) or freshwater (closed loop) based on the environmental regulations in the region where the ship is operating. Hybrid scrubbers provide greater flexibility for shipping companies, allowing them to meet a wider range of regulatory standards without having to install different systems for different regions.

The hybrid scrubber market is growing, driven by its adaptability in meeting both environmental and operational needs. It is particularly useful for shipping companies operating in international waters, where regulations can vary significantly from one region to another.

Marine Transportation Is the Largest End-User Industry in the Wet Marine Scrubber Systems Market

The marine transportation industry is the largest end-user of Wet Marine Scrubber Systems due to the sheer volume of ships and the critical need to meet sulfur emissions regulations. Shipping companies and marine operators must comply with international sulfur emission standards set by the IMO, making the adoption of scrubber systems a necessity. These systems are crucial for large vessels, such as container ships, tankers, and bulk carriers, that rely on heavy fuel oil, which has a high sulfur content.

The demand for Wet Marine Scrubber Systems is expected to remain strong in the marine transportation industry, driven by the global shipping fleet's need to comply with emission control regulations while maintaining fuel efficiency. Additionally, the growing emphasis on environmental sustainability is pushing the industry to adopt cleaner technologies like scrubbers.

Offshore Platforms Are a Key Market for Wet Marine Scrubber Systems Due to Emission Control Requirements

Offshore platforms, particularly those in oil and gas extraction, are significant adopters of Wet Marine Scrubber Systems. These platforms generate large amounts of exhaust gases, which must be treated to comply with stringent air quality standards in offshore operations. Wet scrubbers are installed to reduce sulfur oxide emissions from power generation engines and other operations on offshore platforms.

As regulations around offshore environmental impact become stricter, offshore platforms are increasingly turning to Wet Marine Scrubber Systems to ensure compliance and reduce the environmental impact of their operations.

Exhaust Gas Cleaning Systems (EGCS) Are the Leading Technology in the Wet Marine Scrubber Systems Market

Exhaust Gas Cleaning Systems (EGCS) technology is the leading technology in the Wet Marine Scrubber Systems market, encompassing both open loop and closed loop scrubber systems. EGCS are designed to clean sulfur emissions from ship exhaust gases, using advanced filtration and scrubbing processes. These systems are crucial in meeting the IMO’s sulfur emission limits, which have become more stringent over the years.

As technology continues to evolve, EGCS are becoming more efficient, enabling ships to achieve higher emission reduction rates and meet the varying regulatory standards in different regions. The technology is expected to continue dominating the Wet Marine Scrubber Systems market, with increasing investments in improving scrubber performance and efficiency.

Sulfur Oxide (SOx) Emission Control Is the Largest Application in the Wet Marine Scrubber Systems Market

SOx emission control remains the largest application segment in the Wet Marine Scrubber Systems market due to the need for ships to comply with sulfur regulations. The implementation of Wet Marine Scrubber Systems is essential for reducing SOx emissions from vessels, helping them meet the stringent sulfur content limits set by the IMO. These systems play a key role in limiting air pollution from ships, which is a major environmental concern, particularly in coastal areas.

As sulfur content regulations continue to tighten, the demand for scrubber systems that effectively reduce SOx emissions will remain high, solidifying SOx emission control as the largest application in the market.

Asia-Pacific Is the Fastest-Growing Region in the Wet Marine Scrubber Systems Market

Asia-Pacific is the fastest-growing region in the Wet Marine Scrubber Systems market due to rapid industrialization and the region’s significant role in global shipping. Countries like China, Japan, and South Korea are major maritime nations with large fleets of commercial vessels. These countries are increasingly adopting scrubber systems to comply with international environmental regulations, particularly in the wake of the IMO 2020 sulfur cap.

The demand for Wet Marine Scrubber Systems is also rising in Southeast Asia as the region becomes an important shipping hub and adopts more stringent emissions standards. As the shipping industry in the Asia-Pacific region continues to grow, so will the demand for scrubber systems that meet both operational and environmental requirements.

Competitive Landscape

The Wet Marine Scrubber Systems market is highly competitive, with numerous players offering various solutions in the market. Leading companies such as Alfa Laval, Wärtsilä, and DuPont are prominent suppliers of scrubber systems, offering a range of technologies, including open loop, closed loop, and hybrid systems. These companies compete based on technological advancements, system efficiency, and the ability to meet evolving regulatory requirements.

In addition to large players, several smaller, specialized companies are entering the market with innovative solutions to meet the unique needs of different sectors, including marine transportation and offshore platforms. Strategic partnerships, technological collaborations, and mergers and acquisitions are expected to intensify competition as companies seek to enhance their offerings and expand their market share in the growing Wet Marine Scrubber Systems market.

Recent Developments:

- In December 2024, Wärtsilä Corporation secured a contract to supply exhaust gas cleaning systems to several newbuild vessels in Asia, helping companies comply with SOx emission standards.

- In November 2024, Mitsubishi Heavy Industries announced a new hybrid scrubber design offering greater energy efficiency and reduced maintenance requirements.

- In October 2024, Alfa Laval AB launched an upgraded closed-loop scrubber system designed to improve fuel efficiency and reduce emissions for marine vessels.

- In September 2024, Hyundai Heavy Industries introduced a new line of environmentally friendly scrubbers tailored to comply with stricter regulations in European waters.

- In August 2024, MAN Energy Solutions unveiled a new hybrid scrubber system that optimizes sulfur oxide removal while minimizing the use of freshwater.

List of Leading Companies:

- Wärtsilä Corporation

- Mitsubishi Heavy Industries Ltd.

- MAN Energy Solutions

- Yara International

- Alfa Laval AB

- Caterpillar Inc.

- Lloyd’s Register

- Hyundai Heavy Industries Co., Ltd.

- FLSmidth

- Doosan Heavy Industries & Construction

- Clyde Bergemann Power Group

- Aalborg CSP

- Valmet Corporation

- TGE Marine Gas Engineering

- Kwangsung Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 6.3 Billion |

|

Forecasted Value (2030) |

USD 17.1 Billion |

|

CAGR (2025 – 2030) |

18.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wet Marine Scrubber Systems Market by Type (Open Loop Scrubber, Closed Loop Scrubber, Hybrid Scrubber), Scrubbing Material (Seawater, Freshwater), End-User Industry (Marine Transportation, Shipping Companies, Ports & Harbors, Offshore Platforms), Technology (Exhaust Gas Cleaning Systems (EGCS), Scrubber Tower Design), Application (Sulfur Oxide (SOx) Emission Control, Air Quality Control in Maritime) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Wärtsilä Corporation, Mitsubishi Heavy Industries Ltd., MAN Energy Solutions, Yara International, Alfa Laval AB, Caterpillar Inc., Lloyd’s Register, Hyundai Heavy Industries Co., Ltd., FLSmidth, Doosan Heavy Industries & Construction, Clyde Bergemann Power Group, Aalborg CSP, Valmet Corporation, TGE Marine Gas Engineering, Kwangsung Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wet Marine Scrubber Systems Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Open Loop Scrubber |

|

4.2. Closed Loop Scrubber |

|

4.3. Hybrid Scrubber |

|

5. Wet Marine Scrubber Systems Market, by Scrubbing Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Seawater |

|

5.2. Freshwater |

|

6. Wet Marine Scrubber Systems Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Marine Transportation |

|

6.2. Shipping Companies |

|

6.3. Ports & Harbors |

|

6.4. Offshore Platforms |

|

7. Wet Marine Scrubber Systems Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Exhaust Gas Cleaning Systems (EGCS) |

|

7.2. Scrubber Tower Design |

|

8. Wet Marine Scrubber Systems Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Sulfur Oxide (SOx) Emission Control |

|

8.2. Air Quality Control in Maritime |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Wet Marine Scrubber Systems Market, by Type |

|

9.2.7. North America Wet Marine Scrubber Systems Market, by Scrubbing Material |

|

9.2.8. North America Wet Marine Scrubber Systems Market, by End-User Industry |

|

9.2.9. North America Wet Marine Scrubber Systems Market, by Technology |

|

9.2.10. North America Wet Marine Scrubber Systems Market, by Application |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Wet Marine Scrubber Systems Market, by Type |

|

9.2.11.1.2. US Wet Marine Scrubber Systems Market, by Scrubbing Material |

|

9.2.11.1.3. US Wet Marine Scrubber Systems Market, by End-User Industry |

|

9.2.11.1.4. US Wet Marine Scrubber Systems Market, by Technology |

|

9.2.11.1.5. US Wet Marine Scrubber Systems Market, by Application |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Wärtsilä Corporation |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Mitsubishi Heavy Industries Ltd. |

|

11.3. MAN Energy Solutions |

|

11.4. Yara International |

|

11.5. Alfa Laval AB |

|

11.6. Caterpillar Inc. |

|

11.7. Lloyd’s Register |

|

11.8. Hyundai Heavy Industries Co., Ltd. |

|

11.9. FLSmidth |

|

11.10. Doosan Heavy Industries & Construction |

|

11.11. Clyde Bergemann Power Group |

|

11.12. Aalborg CSP |

|

11.13. Valmet Corporation |

|

11.14. TGE Marine Gas Engineering |

|

11.15. Kwangsung Co., Ltd. |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wet Marine Scrubber Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wet Marine Scrubber Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wet Marine Scrubber Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA