As per Intent Market Research, the Wet Chemicals for Electronics and Semiconductor Applications Market was valued at USD 8.8 Billion in 2024-e and will surpass USD 14.4 Billion by 2030; growing at a CAGR of 8.5% during 2025-2030.

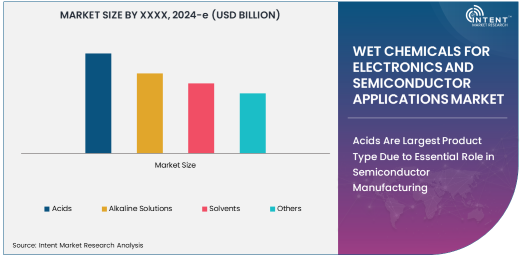

The wet chemicals market for electronics and semiconductor applications is expanding rapidly, driven by the increasing demand for semiconductors and electronic devices across various industries. Among the various product types, acids dominate the market due to their critical role in semiconductor manufacturing processes. Acids, such as sulfuric acid, hydrochloric acid, and hydrofluoric acid, are essential in etching, cleaning, and preparing semiconductor wafers. They are used to remove oxides, contaminants, and other impurities from the wafer surfaces during the production of integrated circuits (ICs) and microchips.

The semiconductor industry’s reliance on high-purity acids for the production of highly intricate and sensitive electronic components continues to fuel the growth of this segment. The increasing complexity of semiconductor devices, along with advancements in miniaturization and precision, ensures that acids will remain a key product in wet chemical formulations. As the demand for semiconductors continues to rise, especially in the fields of AI, 5G, and IoT, the acids segment is expected to maintain its leadership in the wet chemicals market.

Semiconductor Manufacturing Is Fastest Growing Application Due to Increased Demand for Advanced Chips

Semiconductor manufacturing is the fastest-growing application segment in the wet chemicals market, largely driven by the rapid expansion of the semiconductor industry. The global demand for semiconductors is at an all-time high, fueled by advancements in technology such as 5G, AI, IoT, and electric vehicles, all of which require sophisticated chips and microprocessors. Wet chemicals, particularly acids and alkaline solutions, play a crucial role in various stages of semiconductor production, from wafer cleaning and etching to photolithography and deposition.

The complexity of modern semiconductor manufacturing, including the need for higher precision and cleanliness, has resulted in increased demand for high-quality wet chemicals. As semiconductor companies invest in more advanced production facilities to meet the needs of next-generation technologies, the semiconductor manufacturing segment will continue to be the key driver of market growth. The rapid pace of innovation and the shift towards smaller, more powerful chips will keep the demand for wet chemicals in semiconductor manufacturing high, ensuring its position as the fastest growing application segment.

Printed Circuit Board (PCB) Manufacturing Is Largest Application Due to Widespread Use of PCBs in Electronics

Printed circuit board (PCB) manufacturing is the largest application segment for wet chemicals in the electronics and semiconductor market. PCBs are essential components of virtually all electronic devices, from consumer electronics and industrial machinery to automotive systems and medical devices. Wet chemicals, particularly solvents and acidic solutions, are used extensively in the PCB manufacturing process to clean, etch, and prepare the board surfaces for component placement. The precision and efficiency of these chemicals are vital for ensuring the quality and reliability of PCBs, which are integral to the functionality of modern electronic products.

The growing demand for electronics, including smartphones, computers, and automotive electronics, directly supports the continued need for high-quality PCBs. As electronics become more advanced, the complexity and size of PCBs also increase, driving further demand for wet chemicals in the PCB manufacturing process. This segment’s dominance in the market reflects the essential role that PCBs play in the broader electronics and semiconductor industries.

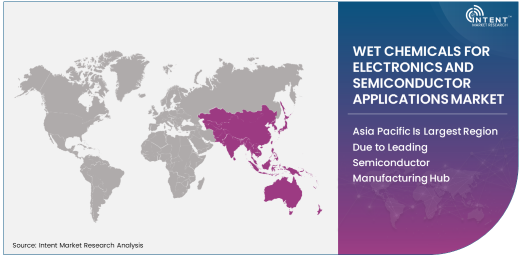

Asia Pacific Is Largest Region Due to Leading Semiconductor Manufacturing Hub

Asia Pacific is the largest region in the wet chemicals for electronics and semiconductor applications market, primarily driven by its dominance in semiconductor manufacturing. Countries like China, Taiwan, South Korea, Japan, and Singapore are global leaders in semiconductor production, housing some of the world’s largest chip manufacturers such as TSMC, Samsung, and Intel. As a result, the region accounts for a significant portion of global demand for wet chemicals used in semiconductor fabrication.

The continuous growth of the electronics and semiconductor industries in Asia Pacific, driven by both domestic consumption and global export demands, supports the strong demand for wet chemicals. Furthermore, the increasing focus on advanced technologies, such as 5G and AI, is expected to propel the region’s semiconductor sector even further, ensuring Asia Pacific remains the dominant market for wet chemicals in electronics and semiconductor applications.

Leading Companies and Competitive Landscape

The wet chemicals market for electronics and semiconductor applications is highly competitive, with leading companies such as BASF, Merck Group, Honeywell, Mitsubishi Chemical Corporation, and Kanto Chemical Co. operating as key players in the global market. These companies are focused on developing high-purity, specialty chemicals tailored to meet the growing demands of the semiconductor and electronics industries.

The competitive landscape is shaped by ongoing innovations in chemical formulations and production technologies, aimed at improving the efficiency and environmental sustainability of manufacturing processes. As the semiconductor industry continues to evolve, these companies are also investing in research and development to provide cutting-edge solutions that meet the increasingly complex requirements of modern electronics manufacturing. Strategic partnerships, mergers, and acquisitions are likely to play a pivotal role in shaping the future dynamics of the wet chemicals market, ensuring that leading companies remain at the forefront of this rapidly growing industry.

Recent Developments:

- Dow Inc. launched a new line of wet chemicals designed for high-performance semiconductor cleaning.

- BASF SE expanded its portfolio of etching solutions for advanced semiconductor manufacturing processes.

- Merck Group introduced new solvents for PCB manufacturing, enhancing production efficiency and reducing waste.

- JSR Corporation unveiled a new line of wet chemicals for solar panel manufacturing, designed for better performance under extreme conditions.

- Albemarle Corporation developed a new acid solution for semiconductor wafer processing, improving yield and surface integrity.

List of Leading Companies:

- Dow Inc.

- BASF SE

- Merck Group

- Air Products and Chemicals, Inc.

- JSR Corporation

- TOKYO OHKA KOGYO CO., LTD.

- Albemarle Corporation

- Lanxess AG

- SUMITOMO CHEMICAL CO., LTD.

- Kanto Chemical Co., Inc.

- Wacker Chemie AG

- Versum Materials, Inc.

- Solvay S.A.

- Momentive Performance Materials Inc.

- Jiangsu Pacific Quartz Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 8.8 Billion |

|

Forecasted Value (2030) |

USD 14.4 Billion |

|

CAGR (2025 – 2030) |

8.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wet Chemicals for Electronics and Semiconductor Applications Market By Product Type (Acids, Alkaline Solutions, Solvents, Others) and By Application (Semiconductor Manufacturing, Printed Circuit Board Manufacturing, Solar Panel Manufacturing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dow Inc., BASF SE, Merck Group, Air Products and Chemicals, Inc., JSR Corporation, TOKYO OHKA KOGYO CO., LTD., Albemarle Corporation, Lanxess AG, SUMITOMO CHEMICAL CO., LTD., Kanto Chemical Co., Inc., Wacker Chemie AG, Versum Materials, Inc., Solvay S.A., Momentive Performance Materials Inc., Jiangsu Pacific Quartz Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wet Chemicals for Electronics and Semiconductor Applications Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Acids |

|

4.2. Alkaline Solutions |

|

4.3. Solvents |

|

4.4. Others |

|

5. Wet Chemicals for Electronics and Semiconductor Applications Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Semiconductor Manufacturing |

|

5.2. Printed Circuit Board (PCB) Manufacturing |

|

5.3. Solar Panel Manufacturing |

|

5.4. Other Electronics Applications |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Wet Chemicals for Electronics and Semiconductor Applications Market, by Product Type |

|

6.2.7. North America Wet Chemicals for Electronics and Semiconductor Applications Market, by Application |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Wet Chemicals for Electronics and Semiconductor Applications Market, by Product Type |

|

6.2.8.1.2. US Wet Chemicals for Electronics and Semiconductor Applications Market, by Application |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Dow Inc. |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. BASF SE |

|

8.3. Merck Group |

|

8.4. Air Products and Chemicals, Inc. |

|

8.5. JSR Corporation |

|

8.6. TOKYO OHKA KOGYO CO., LTD. |

|

8.7. Albemarle Corporation |

|

8.8. Lanxess AG |

|

8.9. SUMITOMO CHEMICAL CO., LTD. |

|

8.10. Kanto Chemical Co., Inc. |

|

8.11. Wacker Chemie AG |

|

8.12. Versum Materials, Inc. |

|

8.13. Solvay S.A. |

|

8.14. Momentive Performance Materials Inc. |

|

8.15. Jiangsu Pacific Quartz Co., Ltd. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wet Chemicals for Electronics and Semiconductor Applications Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wet Chemicals for Electronics and Semiconductor Applications Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wet Chemicals for Electronics and Semiconductor Applications Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA