As per Intent Market Research, the Wellness Genomics Market was valued at USD 20.9 billion in 2023 and will surpass USD 54.3 billion by 2030; growing at a CAGR of 14.6% during 2024 - 2030.

The wellness genomics market is rapidly growing as consumers increasingly seek personalized health solutions based on their genetic makeup. This market leverages advanced genetic testing technologies to tailor health, fitness, and nutritional recommendations, helping individuals optimize their wellness. With rising health awareness and the increasing role of genetics in disease prevention, wellness genomics is poised to revolutionize how people approach their health, combining genetics with lifestyle, diet, and fitness for more effective results.

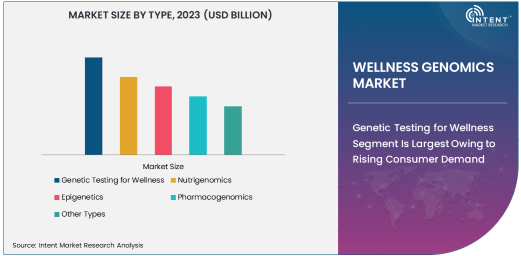

Genetic Testing for Wellness Segment Is Largest Owing to Rising Consumer Demand

Genetic testing for wellness remains the largest segment in the wellness genomics market. This growth is driven by the increasing consumer interest in understanding their genetic predispositions and how these impact their health and lifestyle choices. Genetic testing offers insights into individual risks for specific diseases, nutritional needs, fitness potential, and other health-related factors. As more consumers seek personalized health plans, genetic testing provides a foundation for informed decision-making.

The adoption of genetic testing is also accelerated by the increasing availability and affordability of at-home testing kits. Companies like 23andMe and Ancestry.com have made genetic testing more accessible to the general public, leading to a surge in consumer interest. As a result, this segment continues to dominate the market, with advancements in technology driving further growth in genetic testing services.

Fitness and Wellness Application Is Fastest Growing Due to Health and Lifestyle Trends

The fitness and wellness application segment is the fastest growing in the wellness genomics market. This growth is attributed to the growing trend of using genomics to enhance fitness and overall well-being. Consumers are increasingly leveraging genetic insights to optimize their exercise routines, improve athletic performance, and customize their fitness goals. Personalizing fitness plans based on genetic data allows for more effective and targeted outcomes, which is a significant driver of the demand in this segment.

Fitness genomics companies are capitalizing on this trend by offering specialized services to help individuals understand how their genes influence factors like muscle composition, endurance, and recovery. These insights enable consumers to adopt more personalized and effective fitness strategies. As the fitness industry continues to emphasize personalized wellness, the fitness and wellness application segment is expected to expand rapidly, especially with the integration of wearable devices and fitness apps that track genetic data.

Healthcare Providers End-User Segment Is Largest Owing to Broad Adoption

Healthcare providers represent the largest end-user segment in the wellness genomics market. The growing importance of personalized medicine and preventative healthcare has spurred the adoption of genomics-based services in clinical settings. Healthcare professionals use genetic testing to offer tailored treatment plans, identify genetic predispositions to diseases, and provide preventive measures to improve patient health outcomes. This has become an integral part of modern healthcare, driving the segment's dominance.

In addition to personalized treatment, healthcare providers are increasingly relying on genetic insights for disease prevention and early diagnosis. As healthcare systems evolve to focus more on preventative care, the demand for genetic testing and related wellness services in clinical settings is expected to continue growing, reinforcing healthcare providers as a key segment for wellness genomics companies.

North America Region Leads the Wellness Genomics Market

North America is the largest region in the wellness genomics market, primarily driven by the United States and Canada. The region's advanced healthcare infrastructure, high consumer awareness, and strong demand for personalized wellness solutions contribute to its leading position. Moreover, North America is home to some of the largest wellness genomics companies, such as 23andMe and Helix, which have further expanded the adoption of genetic testing services in the region.

The regulatory environment in North America has also been conducive to the growth of wellness genomics. With increasing investments in healthcare innovation and a robust consumer base interested in personalized health solutions, North America is expected to maintain its position as the dominant market for wellness genomics throughout the forecast period.

Leading Companies and Competitive Landscape

The wellness genomics market is highly competitive, with several key players leading the charge in genetic testing and personalized wellness solutions. Companies like 23andMe, Ancestry.com, and Helix are at the forefront, offering a wide range of wellness genomics services that cater to both consumers and healthcare providers. These companies are focused on expanding their customer base through innovations in genetic testing technology and personalized health solutions.

Additionally, companies such as Nutrigenomix and DNAfit are specializing in nutrigenomic testing, offering personalized dietary recommendations based on genetic data. The market is also seeing growth from fitness-focused genomics companies like DNAlysis and LifeCodexx, which provide tailored fitness plans. As the wellness genomics market continues to evolve, companies are expected to differentiate themselves through technological advancements, partnerships, and expanding their service offerings to meet the growing demand for personalized wellness solutions.

Recent Developments:

- In 2023, 23andMe expanded its wellness reports offering to include a deeper analysis of genetic predispositions for various health conditions, providing more customized health insights to consumers.

- Nutrigenomix entered into a partnership with major fitness centers across North America in early 2024 to provide personalized nutrigenomic testing services for gym members, enhancing fitness regimes and dietary plans

- Everlywell received FDA clearance for its new wellness-focused genetic testing kits in 2023, enabling consumers to access genetic health insights from the comfort of their homes.

- In 2024, Helix announced the acquisition of DNAfit, a leading provider of genetic fitness testing, to broaden its wellness genomics portfolio and enhance its offerings in personalized health and fitness solutions.

List of Leading Companies:

- 23andMe

- Ancestry.com

- DNAfit

- Helix

- Everlywell

- PureHealth

- GenePlanet

- Nutrigenomix

- DNAlysis

- Pathway Genomics

- LifeCodexx

- Allari

- SelfDecode

- Nutrigenomix

- Genomind

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 20.9 Billion |

|

Forecasted Value (2030) |

USD 54.3 Billion |

|

CAGR (2024 – 2030) |

14.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wellness Genomics Market By Product Type (Genetic Testing for Wellness, Nutrigenomics, Epigenetics, Pharmacogenomics), By Application (Personalized Health Plans, Fitness and Wellness, Disease Prevention, Nutrition and Diet, Mental Health Wellness), By End-User (Healthcare Providers, Fitness Centers, Research Institutes, Consumers, Pharmaceutical & Biotechnology Companies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

23andMe, Ancestry.com, DNAfit, Helix, Everlywell, PureHealth, GenePlanet, Nutrigenomix, DNAlysis, Pathway Genomics, LifeCodexx, Allari, SelfDecode, Nutrigenomix, Genomind |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wellness Genomics Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Genetic Testing for Wellness |

|

4.2. Nutrigenomics |

|

4.3. Epigenetics |

|

4.4. Pharmacogenomics |

|

4.5. Other Types |

|

5. Wellness Genomics Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Personalized Health Plans |

|

5.2. Fitness and Wellness |

|

5.3. Disease Prevention |

|

5.4. Nutrition and Diet |

|

5.5. Mental Health Wellness |

|

6. Wellness Genomics Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Healthcare Providers |

|

6.2. Fitness Centers |

|

6.3. Research Institutes |

|

6.4. Consumers |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wellness Genomics Market, by Type |

|

7.2.7. North America Wellness Genomics Market, by Application |

|

7.2.8. North America Wellness Genomics Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wellness Genomics Market, by Type |

|

7.2.9.1.2. US Wellness Genomics Market, by Application |

|

7.2.9.1.3. US Wellness Genomics Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. 23andMe |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Ancestry.com |

|

9.3. DNAfit |

|

9.4. Helix |

|

9.5. Everlywell |

|

9.6. PureHealth |

|

9.7. GenePlanet |

|

9.8. Nutrigenomix |

|

9.9. DNAlysis |

|

9.10. Pathway Genomics |

|

9.11. LifeCodexx |

|

9.12. Allari |

|

9.13. SelfDecode |

|

9.14. Nutrigenomix |

|

9.15. Genomind |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wellness Genomics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wellness Genomics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wellness Genomics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA