As per Intent Market Research, the Well Stimulation Materials Market was valued at USD 20.5 billion in 2023 and will surpass USD 35.9 billion by 2030; growing at a CAGR of 8.3% during 2024 - 2030.

The well stimulation materials market plays a crucial role in enhancing oil and gas production by improving the flow of hydrocarbons from wellbore to surface. These materials are widely used in hydraulic fracturing, acidizing, and other stimulation techniques to increase well productivity, especially in challenging geologies such as shale formations. The market has experienced steady growth due to the rising demand for energy, the ongoing exploration of unconventional oil reserves, and the increasing adoption of advanced stimulation techniques. As oil and gas companies strive to optimize production from mature fields and unconventional resources, the demand for well stimulation materials is expected to remain robust.

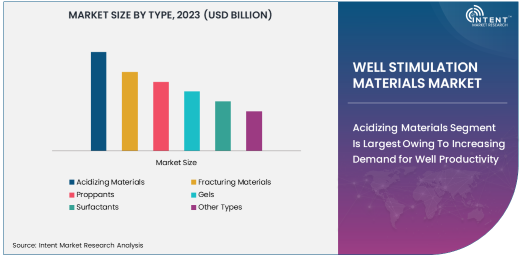

Acidizing Materials Segment Is Largest Owing To Increasing Demand for Well Productivity

Acidizing materials dominate the well stimulation materials market due to their critical role in enhancing well productivity. Acidizing is a well stimulation process in which acid is injected into the wellbore to dissolve minerals, remove scale, and enhance the permeability of rock formations. This process is particularly effective in carbonate reservoirs, where the rock formations often contain minerals that restrict the flow of hydrocarbons. The demand for acidizing materials has increased significantly, driven by the growing need for improving production from mature oil and gas fields. Furthermore, the continuous advancements in acidizing technologies have contributed to their widespread adoption, solidifying their position as the largest subsegment in the market.

In addition to improving well productivity, acidizing materials also help in reducing formation damage during drilling operations. The ongoing exploration and production from mature oilfields, combined with the growing complexity of shale gas extraction, are driving the high demand for acidizing materials. As more operators focus on enhancing recovery from existing wells, acidizing continues to be a key method for revitalizing underperforming wells and maintaining optimal flow rates, which further drives its dominance in the well stimulation materials market.

Offshore Application Segment Is Fastest Growing Owing To Expanding Deepwater Exploration

The offshore application segment is growing at the fastest pace within the well stimulation materials market, driven by the increasing demand for energy and the exploration of deepwater oil and gas reserves. Offshore fields often present more complex geological conditions compared to onshore wells, necessitating the use of specialized stimulation materials. As global oil and gas companies move towards untapped offshore reserves, the need for efficient and reliable well stimulation techniques, including hydraulic fracturing and acidizing, has grown significantly. This trend is particularly evident in regions like the North Sea, Gulf of Mexico, and offshore Brazil, where deepwater exploration is becoming increasingly vital to meet global energy demands.

The offshore market's rapid growth is also fueled by the rising technological advancements in subsea well stimulation, which allow for more efficient and cost-effective production. As exploration ventures move further offshore into deepwater and ultra-deepwater regions, operators require well stimulation materials that are specifically formulated to withstand harsh environmental conditions. This has led to the continuous development of specialized products, thus accelerating the growth of the offshore application segment.

Oil & Gas End-User Industry Is Largest Owing To Dominant Role in Energy Production

The oil and gas industry remains the largest end-user of well stimulation materials, owing to its dominant role in global energy production. Oil and gas operators rely heavily on well stimulation techniques to optimize production, especially in unconventional reservoirs such as shale gas and tight oil formations. The ongoing demand for energy, coupled with the depletion of easy-to-access oil reserves, has led to a surge in the need for enhanced recovery techniques like hydraulic fracturing and acidizing. As a result, oil and gas companies are driving the demand for well stimulation materials to maximize output from both new and existing wells.

The oil and gas industry’s reliance on stimulation materials is further amplified by the growing trend of enhanced oil recovery (EOR) techniques, which aim to extract more hydrocarbons from mature reservoirs. This segment will continue to lead the market due to its immense contribution to global energy production and the continuous need for optimization in oil and gas extraction processes.

North America Region Is Largest Owing To Shale Oil & Gas Boom

North America stands as the largest regional market for well stimulation materials, primarily driven by the shale oil and gas boom in the United States and Canada. The discovery and development of vast shale reserves in regions such as the Permian Basin and Marcellus Shale have significantly boosted the demand for well stimulation materials. Hydraulic fracturing, in particular, has become the go-to method for unlocking the potential of these unconventional reserves, leading to a surge in the need for proppants, fracturing fluids, and other stimulation materials. With operators in North America continually pushing the limits of hydraulic fracturing technology, the region is expected to maintain its leadership in the global market.

In addition to shale oil and gas, North America is home to several mature oilfields that require ongoing stimulation to maintain production levels. This has led to a steady demand for well stimulation materials across both conventional and unconventional oil and gas operations. As the North American market continues to prioritize energy independence and increased production, the region's dominance in the well stimulation materials market is expected to persist.

Leading Companies and Competitive Landscape

The well stimulation materials market is highly competitive, with several key players leading the charge in product innovation and market share. Major companies such as Schlumberger, Halliburton, Baker Hughes, and Weatherford International dominate the market, offering a wide range of well stimulation products and services, including proppants, fracturing fluids, and acidizing chemicals. These companies are constantly investing in research and development to create more efficient, cost-effective, and environmentally friendly solutions for well stimulation. Additionally, many companies are expanding their service offerings through mergers and acquisitions to increase their footprint in key markets such as North America, the Middle East, and Asia-Pacific.

The competitive landscape is also influenced by regional players, particularly in emerging markets where oil and gas exploration is on the rise. As the industry evolves, companies are focusing on sustainability and regulatory compliance, particularly concerning environmental concerns such as water usage and chemical disposal. This shift towards environmentally responsible practices is expected to drive future innovations and partnerships in the well stimulation materials market, enabling companies to stay ahead of the competition.

Recent Developments:

- Halliburton introduced an innovative fracturing fluid technology that improves well productivity while reducing environmental impact. This new technology is expected to lower water usage and enhance sustainability in stimulation operations.

- Schlumberger and Chevron formed a strategic partnership to explore advanced well stimulation techniques in offshore fields, with a focus on improving recovery rates from aging wells.

- Baker Hughes acquired a leading reservoir engineering company to enhance its well stimulation services, particularly in the area of chemical stimulation and enhanced oil recovery.

- Weatherford announced its expansion into Latin America, focusing on well stimulation technologies to meet the region’s growing demand for oil and gas production solutions, particularly in offshore operations.

- Sinopec has made significant investments in new fracturing materials and technologies aimed at improving efficiency and reducing environmental impact in well stimulation operations across China’s shale fields.

List of Leading Companies:

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International

- National Oilwell Varco (NOV)

- Di-Corp

- FTS International

- Tenaris

- The Weir Group PLC

- Sinopec Limited

- Petrofac Limited

- Cargill, Inc.

- NexTier Oilfield Solutions

- Linde Group

- China National Petroleum Corporation (CNPC)

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 20.5 Billion |

|

Forecasted Value (2030) |

USD 35.9 Billion |

|

CAGR (2024 – 2030) |

8.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Well Stimulation Materials Market By Type (Acidizing Materials, Fracturing Materials, Proppants, Gels, Surfactants), By Application (Onshore, Offshore), By End-User Industry (Oil & Gas, Energy & Utilities, Chemical Processing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International, National Oilwell Varco (NOV), Di-Corp, FTS International, Tenaris, The Weir Group PLC, Sinopec Limited, Petrofac Limited, Cargill, Inc., NexTier Oilfield Solutions, Linde Group, China National Petroleum Corporation (CNPC) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Well Stimulation Materials Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Acidizing Materials |

|

4.2. Fracturing Materials |

|

4.3. Proppants |

|

4.4. Gels |

|

4.5. Surfactants |

|

4.6. Other Types |

|

5. Well Stimulation Materials Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Onshore |

|

5.2. Offshore |

|

6. Well Stimulation Materials Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Oil & Gas |

|

6.2. Energy & Utilities |

|

6.3. Chemical Processing |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Well Stimulation Materials Market, by Type |

|

7.2.7. North America Well Stimulation Materials Market, by Application |

|

7.2.8. North America Well Stimulation Materials Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Well Stimulation Materials Market, by Type |

|

7.2.9.1.2. US Well Stimulation Materials Market, by Application |

|

7.2.9.1.3. US Well Stimulation Materials Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Schlumberger Limited |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Halliburton Company |

|

9.3. Baker Hughes Company |

|

9.4. Weatherford International |

|

9.5. National Oilwell Varco (NOV) |

|

9.6. Di-Corp |

|

9.7. FTS International |

|

9.8. Tenaris |

|

9.9. The Weir Group PLC |

|

9.10. Sinopec Limited |

|

9.11. Petrofac Limited |

|

9.12. Cargill, Inc. |

|

9.13. NexTier Oilfield Solutions |

|

9.14. Linde Group |

|

9.15. China National Petroleum Corporation (CNPC) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Well Stimulation Materials Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Well Stimulation Materials Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Well Stimulation Materials Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA