As per Intent Market Research, the Weight Loss and Weight Management Market was valued at USD 257.6 billion in 2024-e and will surpass USD 446.2 billion by 2030; growing at a CAGR of 9.6% during 2025 - 2030.

The weight loss and weight management market has been witnessing substantial growth, driven by increasing obesity rates, rising awareness about healthy lifestyles, and growing interest in fitness. The market encompasses a broad range of products and services aimed at helping individuals manage body weight through dietary, behavioral, and surgical interventions. As obesity and related chronic diseases such as diabetes, hypertension, and cardiovascular diseases continue to rise globally, consumers are increasingly seeking effective solutions to manage weight and improve overall health. This has led to a surge in demand for weight loss supplements, devices, meal replacements, food products, and even bariatric surgery.

With growing health consciousness and an expanding middle class, particularly in emerging markets, the demand for effective weight management solutions is expected to continue growing. Additionally, the rise of e-commerce platforms and increasing availability of weight loss products through digital channels have made it easier for consumers to access weight management tools. As personalized and holistic approaches to weight loss and management gain popularity, the market is expected to diversify, with a range of offerings tailored to different consumer needs and preferences.

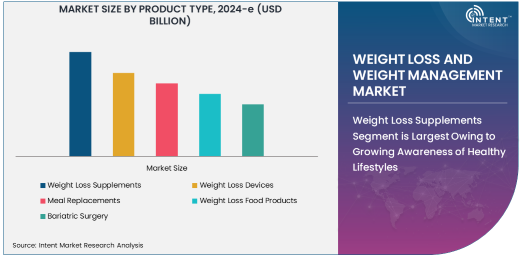

Weight Loss Supplements Segment is Largest Owing to Growing Awareness of Healthy Lifestyles

The weight loss supplements segment is the largest in the weight loss and weight management market, driven by increasing awareness of the link between diet, exercise, and weight management. Supplements such as fat burners, appetite suppressants, and metabolism boosters are commonly used by individuals looking to lose weight effectively. They offer convenience and are often marketed as natural, easy-to-use alternatives to more invasive treatments. As more people become aware of the health risks associated with obesity, the demand for weight loss supplements has increased, with consumers looking for ways to complement their exercise and dietary routines.

The increasing popularity of dietary supplements that promise quick and effective weight loss is one of the key drivers of growth in this segment. With a growing trend towards wellness and self-care, many consumers are opting for weight loss supplements as part of their daily routine. The market for weight loss supplements is further fueled by innovations in ingredient formulations and the rise of plant-based, organic, and clinically proven products. As more consumers seek safe and effective solutions for weight management, this segment is expected to remain the dominant contributor to the overall market.

Bariatric Surgery Segment is Fastest Growing Owing to Rising Obesity Rates

The bariatric surgery segment is the fastest growing in the weight loss and weight management market, driven by the increasing prevalence of severe obesity and the need for surgical interventions. Bariatric surgery, including procedures like gastric bypass, sleeve gastrectomy, and adjustable gastric banding, is often considered when lifestyle changes and weight loss medications have failed to produce significant results. As the global obesity epidemic continues to worsen, bariatric surgery has become a popular and effective solution for long-term weight loss and the management of obesity-related comorbidities, such as diabetes and hypertension.

The rise in the number of individuals with morbid obesity, coupled with increasing healthcare access and improvements in surgical techniques, is contributing to the rapid growth of this segment. The success rates of bariatric procedures, along with their ability to induce significant weight loss and improve quality of life, are encouraging more individuals to opt for these surgeries. With advancements in minimally invasive techniques and enhanced post-surgical care, bariatric surgery is expected to become an increasingly important part of the weight management landscape.

Obesity Treatment Application is Largest Owing to Growing Health Concerns

The obesity treatment application is the largest in the weight loss and weight management market, owing to the rising global prevalence of obesity and the associated health risks. Obesity is a major risk factor for numerous chronic conditions, including diabetes, heart disease, stroke, and certain cancers. As a result, individuals are increasingly seeking medical and non-medical interventions to help manage their weight and reduce the risk of developing these chronic conditions. This has led to an increase in the demand for obesity treatment solutions, ranging from weight loss supplements and devices to bariatric surgery and medical consultations.

Healthcare providers, including doctors, nutritionists, and dietitians, are playing an important role in treating obesity, offering personalized plans that include dietary adjustments, exercise routines, and medical interventions. With the focus shifting towards treating obesity as a medical condition, healthcare professionals are driving the adoption of more comprehensive weight loss and management solutions, making obesity treatment the largest application in the market. The growing recognition of obesity as a critical health issue is expected to further drive demand for weight management services and products.

North America is Largest Region Owing to High Obesity Rates and Access to Healthcare

North America is the largest region in the weight loss and weight management market, largely due to high obesity rates and advanced healthcare systems. The United States, in particular, has one of the highest obesity rates globally, which has driven the demand for various weight loss and management products, including supplements, meal replacements, bariatric surgery, and fitness programs. Furthermore, the region has a well-established healthcare infrastructure that provides easy access to a wide range of weight loss treatments, including medical, surgical, and lifestyle management options.

Additionally, North America benefits from high consumer spending power and increasing health awareness, with many individuals prioritizing weight management as part of their overall wellness routine. The presence of leading companies offering weight loss products, along with growing access to online platforms for purchasing weight management solutions, makes North America a dominant region in the market. The trend of personalized and technology-driven weight loss solutions is further boosting growth in the region, with North America expected to continue its leadership position in the global weight loss and weight management market.

Competitive Landscape

The weight loss and weight management market is highly competitive, with numerous companies offering a wide range of products and services targeting different segments of the population. Key players include Nutrisystem, Weight Watchers International, Johnson & Johnson, and Abbott Laboratories, which offer weight loss supplements, meal replacements, and fitness programs. These companies are focusing on product innovation, expanding their portfolios to include personalized weight loss solutions, and increasing their online presence to tap into the growing e-commerce trend.

In addition to established players, numerous startups and emerging companies are entering the market with innovative solutions such as wearable weight loss devices, app-based weight management programs, and new formulations of weight loss supplements. As consumer preferences continue to evolve, companies are investing in research and development to create more effective and safer weight management products. Partnerships with fitness centers, healthcare providers, and digital platforms are also helping companies expand their reach and enhance customer engagement. As the market becomes more crowded, competition is expected to intensify, with players focusing on offering comprehensive, personalized solutions to meet the diverse needs of consumers.

Recent Developments:

- Nutrisystem, Inc. announced the launch of a new personalized weight loss plan that uses artificial intelligence to create tailored nutrition and exercise strategies.

- Herbalife Nutrition Ltd. expanded its weight management offerings by launching a new range of protein shakes and meal replacements for consumers seeking healthier lifestyle solutions.

- Abbott Laboratories partnered with health clubs to provide advanced fitness trackers and nutritional plans to enhance weight management programs.

- Medifast, Inc. introduced a new line of high-protein meal replacement snacks aimed at promoting weight loss for busy professionals.

- The Coca-Cola Company unveiled a new line of low-calorie beverages, positioned to support weight loss and healthier lifestyles in partnership with nutrition experts.

List of Leading Companies:

- Weight Watchers International, Inc.

- Nutrisystem, Inc.

- Herbalife Nutrition Ltd.

- Atkins Nutritionals, Inc.

- Medifast, Inc.

- Slimming World

- Johnson & Johnson (Janssen Pharmaceuticals)

- Abbott Laboratories

- Coca-Cola Company (Full Circle)

- H.J. Heinz Company (Heinz Weight Loss Solutions)

- The Kellogg Company (Special K)

- Nestlé S.A. (Nestlé Health Science)

- International Sports Sciences Association (ISSA)

- Shaklee Corporation

- Ideal Shape LLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 257.6 Billion |

|

Forecasted Value (2030) |

USD 446.2 Billion |

|

CAGR (2025 – 2030) |

9.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Weight Loss and Weight Management Market by Product Type (Weight Loss Supplements, Weight Loss Devices, Meal Replacements, Weight Loss Food Products, Bariatric Surgery), by Application (Obesity Treatment, Weight Management, Sports Nutrition, Cosmetic Weight Loss, Chronic Disease Management), by End-Use Industry (Healthcare Providers, Fitness Centers, Retailers, Online Platforms) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Weight Watchers International, Inc., Nutrisystem, Inc., Herbalife Nutrition Ltd., Atkins Nutritionals, Inc., Medifast, Inc., Slimming World, Abbott Laboratories, Coca-Cola Company (Full Circle), H.J. Heinz Company (Heinz Weight Loss Solutions), The Kellogg Company (Special K), Nestlé S.A. (Nestlé Health Science), International Sports Sciences Association (ISSA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Weight Loss and Weight Management Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Weight Loss Supplements |

|

4.2. Weight Loss Devices |

|

4.3. Meal Replacements |

|

4.4. Weight Loss Food Products |

|

4.5. Bariatric Surgery |

|

5. Weight Loss and Weight Management Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Obesity Treatment |

|

5.2. Weight Management |

|

5.3. Sports Nutrition |

|

5.4. Cosmetic Weight Loss |

|

5.5. Chronic Disease Management |

|

6. Weight Loss and Weight Management Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Healthcare Providers |

|

6.2. Fitness Centers |

|

6.3. Retailers |

|

6.4. Online Platforms |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Weight Loss and Weight Management Market, by Product Type |

|

7.2.7. North America Weight Loss and Weight Management Market, by Application |

|

7.2.8. North America Weight Loss and Weight Management Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Weight Loss and Weight Management Market, by Product Type |

|

7.2.9.1.2. US Weight Loss and Weight Management Market, by Application |

|

7.2.9.1.3. US Weight Loss and Weight Management Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Weight Watchers International, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Nutrisystem, Inc. |

|

9.3. Herbalife Nutrition Ltd. |

|

9.4. Atkins Nutritionals, Inc. |

|

9.5. Medifast, Inc. |

|

9.6. Slimming World |

|

9.7. Johnson & Johnson (Janssen Pharmaceuticals) |

|

9.8. Abbott Laboratories |

|

9.9. Coca-Cola Company (Full Circle) |

|

9.10. H.J. Heinz Company (Heinz Weight Loss Solutions) |

|

9.11. The Kellogg Company (Special K) |

|

9.12. Nestlé S.A. (Nestlé Health Science) |

|

9.13. International Sports Sciences Association (ISSA) |

|

9.14. Shaklee Corporation |

|

9.15. Ideal Shape LLC |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Weight Loss and Weight Management Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Weight Loss and Weight Management Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Weight Loss and Weight Management Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA