As per Intent Market Research, the Webtoons Market was valued at USD 3.1 billion in 2023 and will surpass USD 6.4 billion by 2030; growing at a CAGR of 10.8% during 2024 - 2030.

The webtoons market has experienced rapid growth in recent years, driven by the increasing popularity of digital comics and a shift towards online platforms for entertainment consumption. Webtoons, a format of webcomics that originated in South Korea, have gained global traction due to their accessibility on mobile apps, web platforms, and social media. With a wide array of genres, from comedy and romance to fantasy and thriller, webtoons offer something for everyone, appealing to diverse audiences worldwide. As technology evolves, webtoons are also evolving, with improvements in artwork quality, interactive storytelling, and user engagement features that enhance the overall reading experience.

The global webtoons market is further propelled by the rise of new monetization models, such as subscription-based services, advertising, and pay-per-chapter systems, which allow creators to generate revenue and expand their reach. As more readers turn to digital content, webtoons have carved a niche in the entertainment industry, offering readers an alternative to traditional comics and graphic novels. With growing support from global webtoon platforms like LINE Webtoon, Tapas, and others, the market is poised for continued growth, especially as the demand for bite-sized entertainment and culturally diverse content increases.

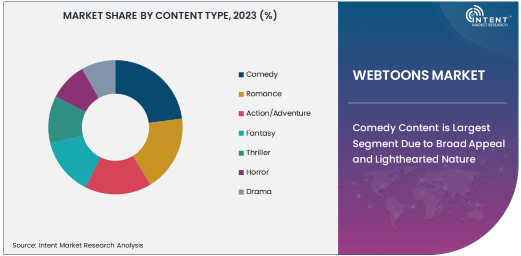

Comedy Content is Largest Segment Due to Broad Appeal and Lighthearted Nature

Comedy is the largest content type in the webtoons market, owing to its universal appeal and ability to attract a wide range of readers. Comedy webtoons typically feature lighthearted, humorous storylines that offer readers a break from everyday life. These webtoons are particularly popular among younger audiences who seek quick, entertaining reads during their leisure time. The ease of accessibility and short-form nature of webtoons make them an ideal medium for comedy, with many webtoons delivering punchy jokes and witty dialogues in a format that’s easy to consume on mobile devices or web platforms.

The popularity of comedy webtoons is also fueled by their adaptability, as they often blend with other genres such as romance, slice of life, and fantasy, creating cross-genre stories that appeal to a wide variety of readers. The comedic tone makes it easier to connect with audiences from diverse backgrounds, leading to a larger readership. As the demand for light entertainment continues to grow, comedy webtoons will maintain their dominance in the market, particularly as they evolve to include more interactive and engaging storytelling elements.

Subscription-Based Monetization Model is Largest Due to Predictable Revenue and Loyalty

The subscription-based monetization model is the largest in the webtoons market, thanks to its ability to generate consistent and predictable revenue while fostering reader loyalty. Platforms that offer subscription services, such as LINE Webtoon and Tapas, allow readers to access a broad range of webtoons for a fixed monthly fee. This model benefits both creators and platforms, as it provides a steady income stream for webtoon creators while offering readers access to exclusive content, early releases, and a seamless reading experience.

Subscription-based models also build a dedicated fanbase, with readers being more inclined to engage with the platform regularly to read new chapters of their favorite webtoons. This model incentivizes creators to publish new content consistently, ensuring continuous engagement from their audience. The predictability of revenue and the creation of a loyal community make the subscription-based model an attractive choice for both emerging and established webtoon creators. As more platforms embrace this model, it is expected to remain the dominant method of monetization in the webtoons market.

Mobile Apps Platform is Largest Due to Accessibility and Convenience

Mobile apps dominate the platform segment of the webtoons market, driven by the widespread use of smartphones and the need for easy, on-the-go access to digital content. Mobile apps such as LINE Webtoon, Tapas, and KakaoPage offer readers the convenience of accessing webtoons anywhere, anytime, making them the preferred platform for webtoon consumption. Mobile platforms also allow for enhanced user engagement, including features like notifications for new releases, personalized recommendations, and social sharing options, all of which increase user retention and interaction with the content.

The rise of mobile apps has also been accompanied by advancements in user interface (UI) and user experience (UX) design, improving the overall reading experience. With the ability to read webtoons in a scrollable, vertical format that is optimized for smartphones, mobile apps have revolutionized how people consume comics. As mobile devices continue to dominate the digital entertainment space, the mobile app platform will remain the largest segment in the webtoons market, offering both readers and creators an accessible, convenient space to engage with content.

Asia Pacific Region is Largest Market Due to High Digital Content Consumption

The Asia Pacific region is the largest market for webtoons, driven by the region's high digital content consumption and the origin of webtoons in South Korea. Countries like South Korea, Japan, China, and Southeast Asian nations have embraced digital comics, with webtoons becoming a prominent form of entertainment. South Korea, in particular, is the birthplace of webtoons, and its platforms such as LINE Webtoon and Naver Webtoon have set the standard for the global webtoons industry.

The region's strong mobile penetration, coupled with a tech-savvy population, has made mobile apps the preferred platform for reading webtoons. Moreover, the growing popularity of digital entertainment and the increasing adoption of smartphones among younger populations in the region contribute to the dominance of Asia Pacific in the webtoons market. As the demand for webtoons continues to rise in the region, with more localized content being created to cater to regional tastes and languages, Asia Pacific is expected to remain the largest market for webtoons globally.

Leading Companies and Competitive Landscape

The webtoons market is highly competitive, with numerous platforms and content creators vying for market share. Key players in the market include LINE Webtoon, Tapas, KakaoPage, and Lezhin Comics, which dominate the platform segment by offering a vast library of webtoons across various genres. These platforms attract both amateur and professional creators, providing them with a space to monetize their content through various models, including subscriptions, advertising, and pay-per-chapter.

The competitive landscape is marked by the increasing emphasis on user experience, platform innovation, and global content expansion. Companies are continually upgrading their platforms to enhance user engagement and expand their reach to international markets. The rise of independent webtoon creators and the availability of tools for self-publishing have further democratized the industry, encouraging a diverse range of content to flourish. As the market continues to grow, the competition will intensify, with platforms focusing on exclusive content, regional adaptations, and innovative monetization strategies to stay ahead in the rapidly evolving webtoons landscape.

Recent Developments:

- In November 2024, Naver Corporation launched a new feature allowing users to create and share their own webtoon content on the LINE Webtoon platform.

- In October 2024, Kakao Entertainment partnered with a major publishing house to expand its webtoon offerings internationally.

- In September 2024, Tapas Media introduced a new subscription service offering exclusive access to premium webtoon content.

- In August 2024, Lezhin Entertainment expanded its reach into Latin America with localized webtoon content.

- In July 2024, Webcomics introduced a new advertising-based revenue model, allowing creators to earn through platform-based ads.

List of Leading Companies:

- Naver Corporation (LINE Webtoon)

- Kakao Entertainment (KakaoPage)

- Tappytoon

- Lezhin Entertainment

- Toomics

- Webcomics

- Comico

- Tapas Media

- Marvel Comics (Webtoon Collaborations)

- DC Comics (Webtoon Collaborations)

- VIZ Media (Shonen Jump Webtoon)

- Bilibili

- Tencent Comics

- KakaoPage (Kakao)

- MangaToon

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.1 billion |

|

Forecasted Value (2030) |

USD 6.4 billion |

|

CAGR (2024 – 2030) |

10.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Webtoons Market By Content Type (Comedy, Romance, Action/Adventure, Fantasy, Thriller, Horror, Drama, Slice of Life), By Monetization Model (Subscription-Based, Advertising-Based, Pay-per-Chapter, Freemium), By Platform (Mobile Apps, Web Platforms, Social Media) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Naver Corporation (LINE Webtoon), Kakao Entertainment (KakaoPage), Tappytoon, Lezhin Entertainment, Toomics, Webcomics, Comico, Tapas Media, Marvel Comics (Webtoon Collaborations), DC Comics (Webtoon Collaborations), VIZ Media (Shonen Jump Webtoon), Bilibili, Tencent Comics, KakaoPage (Kakao), MangaToon |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Webtoons Market, by Content Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Comedy |

|

4.2. Romance |

|

4.3. Action/Adventure |

|

4.4. Fantasy |

|

4.5. Thriller |

|

4.6. Horror |

|

4.7. Drama |

|

4.8. Slice of Life |

|

5. Webtoons Market, by Monetization Model (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Subscription-Based |

|

5.2. Advertising-Based |

|

5.3. Pay-per-Chapter |

|

5.4. Freemium |

|

6. Webtoons Market, by Platform (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Mobile Apps |

|

6.2. Web Platforms |

|

6.3. Social Media |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Webtoons Market, by Content Type |

|

7.2.7. North America Webtoons Market, by Monetization Model |

|

7.2.8. North America Webtoons Market, by Platform |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Webtoons Market, by Content Type |

|

7.2.9.1.2. US Webtoons Market, by Monetization Model |

|

7.2.9.1.3. US Webtoons Market, by Platform |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Naver Corporation (LINE Webtoon) |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Kakao Entertainment (KakaoPage) |

|

9.3. Tappytoon |

|

9.4. Lezhin Entertainment |

|

9.5. Toomics |

|

9.6. Webcomics |

|

9.7. Comico |

|

9.8. Tapas Media |

|

9.9. Marvel Comics (Webtoon Collaborations) |

|

9.10. DC Comics (Webtoon Collaborations) |

|

9.11. VIZ Media (Shonen Jump Webtoon) |

|

9.12. Bilibili |

|

9.13. Tencent Comics |

|

9.14. KakaoPage (Kakao) |

|

9.15. MangaToon |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Webtoons Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Webtoons Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Webtoons Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA