As per Intent Market Research, the Web Content Filtering Market was valued at USD 3.1 billion in 2024-e and will surpass USD 6.2 billion by 2030; growing at a CAGR of 12.0% during 2025 - 2030.

The web content filtering market has become a cornerstone of cybersecurity in the digital age. With increasing dependence on internet-based applications and the proliferation of cyber threats, organizations are prioritizing web content filtering solutions to safeguard their data and users. These solutions help monitor, control, and restrict access to web content based on pre-defined criteria, offering enhanced security for businesses and individuals alike. Growing awareness about the risks associated with unregulated internet usage and compliance with stringent data protection laws have further fueled market growth.

The adoption of advanced web filtering technologies, especially in industries like BFSI, healthcare, and education, reflects a strong demand for robust security infrastructure. As businesses strive to meet evolving cybersecurity challenges, the web content filtering market is witnessing continuous innovation, with enhanced customization and AI-driven solutions gaining prominence. The market is poised for steady expansion as organizations worldwide prioritize secure digital environments.

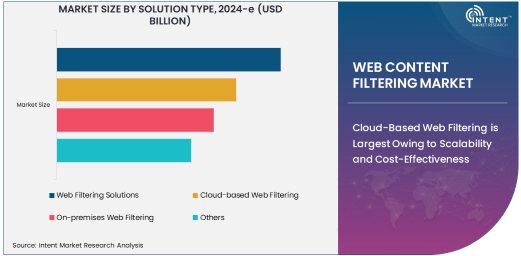

Cloud-Based Web Filtering is Largest Owing to Scalability and Cost-Effectiveness

Among the solution types, cloud-based web filtering holds the largest share, driven by its scalability, easy deployment, and cost-effectiveness. Cloud-based solutions eliminate the need for on-premises infrastructure, making them particularly appealing for small to medium-sized businesses. These solutions also offer remote accessibility, allowing organizations to enforce web filtering policies across dispersed workforces, a feature that has become critical in the era of remote and hybrid work models.

Additionally, the seamless integration of cloud-based web filtering with other cybersecurity tools enhances its appeal. Features such as real-time threat detection, automatic updates, and customizable filtering options cater to the diverse needs of organizations. With businesses increasingly adopting cloud-first strategies to streamline operations and reduce overhead costs, the dominance of cloud-based web filtering is expected to continue in the foreseeable future, further solidifying its position in the market.

BFSI Sector Leads Adoption Owing to Stringent Security Requirements

In terms of end-use industries, the BFSI sector dominates the web content filtering market. Financial institutions face constant threats from cybercriminals, necessitating comprehensive measures to protect sensitive data and ensure regulatory compliance. Web filtering solutions provide an essential layer of defense against phishing, malware, and other online threats, securing customer information and safeguarding critical transactions.

Moreover, the rise in digital banking, mobile payments, and remote work within the BFSI industry has amplified the demand for web filtering tools. Financial institutions are also investing in robust security frameworks to maintain customer trust and meet stringent compliance mandates. This trend is expected to sustain as the financial sector continues to embrace digital transformation and fortify its cybersecurity measures against evolving threats.

North America Dominates Due to Technological Advancements

Geographically, North America is the largest market for web content filtering solutions, supported by the region's advanced technological infrastructure and strong focus on cybersecurity. The presence of leading technology providers, coupled with high awareness of data protection regulations, has driven adoption in sectors such as government, healthcare, and retail. The growing reliance on digital technologies and the proliferation of cloud-based applications have further solidified North America's dominance in this market.

The U.S., in particular, has been a hub for cybersecurity innovation, with extensive investments in research and development to counteract sophisticated cyber threats. Canada's growing focus on enhancing its cybersecurity framework complements the regional growth. As regulatory frameworks like CCPA and GDPR influence business practices, North America is expected to maintain its leadership position in the web content filtering market.

Competitive Landscape: A Blend of Innovation and Strategic Alliances

The web content filtering market is characterized by intense competition, with key players focusing on innovation and partnerships to enhance their offerings. Companies like Cisco Systems, McAfee, and Symantec are at the forefront, leveraging advanced technologies like artificial intelligence and machine learning to improve filtering accuracy and threat detection capabilities.

Collaborations with cloud service providers, strategic acquisitions, and expanding portfolios to address emerging cybersecurity challenges remain critical strategies for players aiming to sustain their market position. As the demand for advanced web filtering solutions continues to rise, the competitive landscape is expected to evolve, marked by continuous innovation and a growing focus on customer-centric solutions.

Recent Developments:

- In November 2024, Cisco Systems announced the launch of its new cloud-based web filtering solution designed to enhance threat intelligence and reduce false positives.

- In October 2024, Palo Alto Networks introduced an AI-powered web content filtering system that improves malware detection and blocks high-risk websites in real time.

- In September 2024, McAfee, LLC launched a new solution combining web filtering and firewall protection for small and medium-sized businesses to bolster cybersecurity.

- In August 2024, Trend Micro unveiled a partnership with major healthcare providers to integrate web content filtering solutions into their secure networks for enhanced data protection.

- In July 2024, Fortinet expanded its web filtering services to include real-time protection against evolving threats in the retail sector, offering increased security measures for online transactions.

List of Leading Companies:

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Barracuda Networks, Inc.

- McAfee, LLC

- Symantec Corporation (Broadcom Inc.)

- Zscaler, Inc.

- Trend Micro Incorporated

- Sophos Group plc

- Webroot, Inc.

- Forcepoint LLC

- SonicWall Inc.

- Check Point Software Technologies Ltd.

- ContentWatch, Inc.

- TitanHQ

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.1 billion |

|

Forecasted Value (2030) |

USD 6.2 billion |

|

CAGR (2025 – 2030) |

12.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Web Content Filtering Market By Solution Type (Web Filtering Solutions, Cloud-based Web Filtering, On-premises Web Filtering), By End-Use Industry (BFSI (Banking, Financial Services, and Insurance), Healthcare, Education, Government, Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Barracuda Networks, Inc., McAfee, LLC, Symantec Corporation (Broadcom Inc.), Zscaler, Inc., Trend Micro Incorporated, Sophos Group plc, Webroot, Inc., Forcepoint LLC, SonicWall Inc., Check Point Software Technologies Ltd., ContentWatch, Inc., TitanHQ |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Web Content Filtering Market, by Solution Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Web Filtering Solutions |

|

4.2. Cloud-based Web Filtering |

|

4.3. On-premises Web Filtering |

|

4.4. Others |

|

5. Web Content Filtering Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. BFSI (Banking, Financial Services, and Insurance) |

|

5.2. Healthcare |

|

5.3. Education |

|

5.4. Government |

|

5.5. Retail |

|

5.6. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Web Content Filtering Market, by Solution Type |

|

6.2.7. North America Web Content Filtering Market, by End-Use Industry |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Web Content Filtering Market, by Solution Type |

|

6.2.8.1.2. US Web Content Filtering Market, by End-Use Industry |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Cisco Systems, Inc. |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Palo Alto Networks, Inc. |

|

8.3. Fortinet, Inc. |

|

8.4. Barracuda Networks, Inc. |

|

8.5. McAfee, LLC |

|

8.6. Symantec Corporation (Broadcom Inc.) |

|

8.7. Zscaler, Inc. |

|

8.8. Trend Micro Incorporated |

|

8.9. Sophos Group plc |

|

8.10. Webroot, Inc. |

|

8.11. Forcepoint LLC |

|

8.12. SonicWall Inc. |

|

8.13. Check Point Software Technologies Ltd. |

|

8.14. ContentWatch, Inc. |

|

8.15. TitanHQ |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Web Content Filtering Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Web Content Filtering Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Web Content Filtering Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA