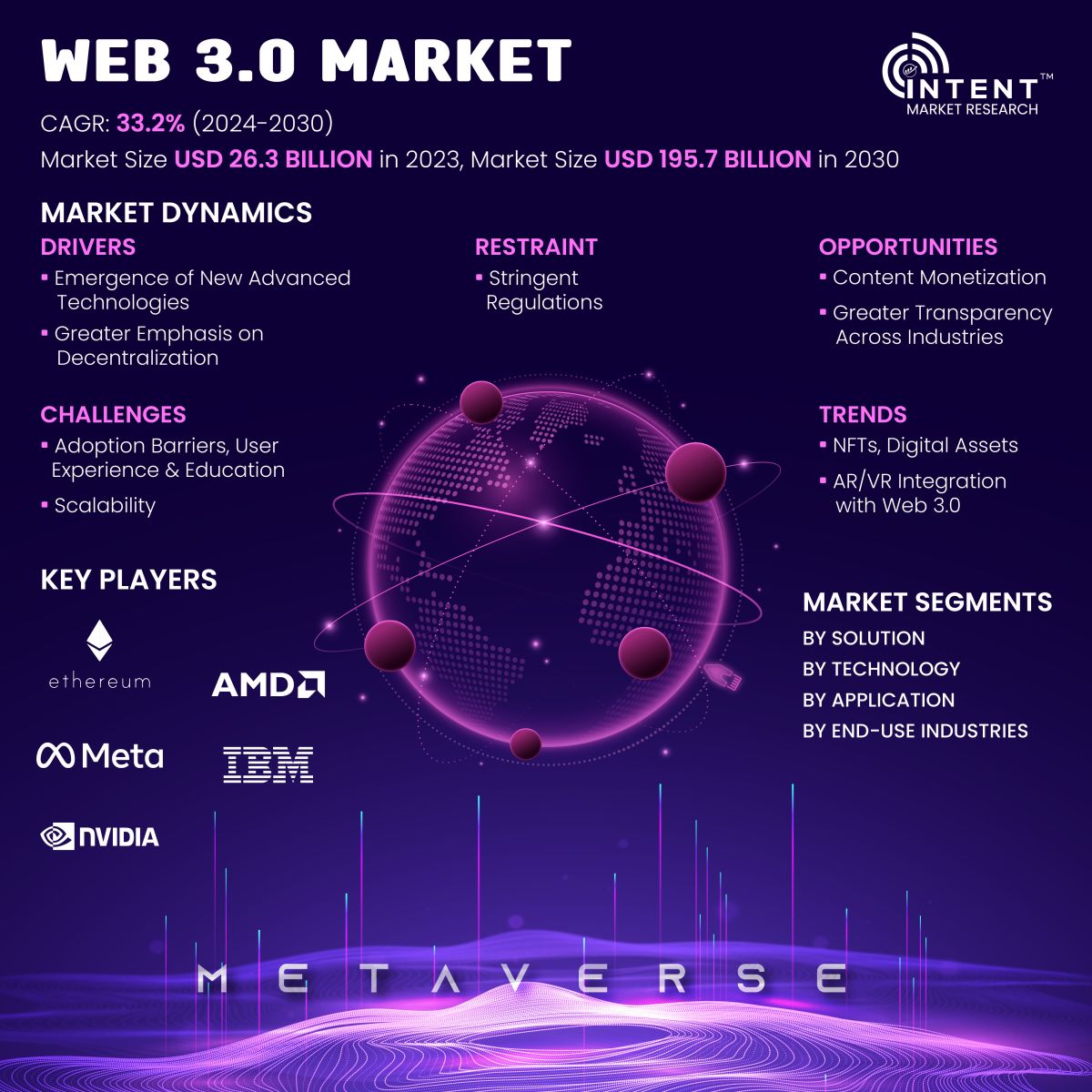

As per Intent Market Research, the Web 3.0 Market was valued at USD 26.3 billion in 2023-e and will surpass USD 195.7 billion by 2030; growing at a CAGR of 33.2% during 2024 - 2030. Web 3.0 is the next generation of the internet that emphasizes decentralized and interconnected systems, enhanced user experiences, and the integration of emerging technologies. It comprises a set of cutting-edge web applications that incorporate emerging technologies such as blockchain, AI, IoT, and augmented and virtual reality (AR/VR) as integral components of their foundational technology stack. These advancing technologies will define the user interactions within Web 3.0.

Click here to: Get FREE Sample Pages of this Report

The advancement in new & advanced technologies such as blockchain, AI/ML, and Metaverse. are finding applications in Web 3.0. Their integration in Web 3.0 is evolving with several applications in the field of BFSI, supply chain, and e-commerce which in turn driving the Web 3.0 market.

Emergence of Advanced Technologies Driving the Web 3.0 Market

Blockchain is foundational to the principles of decentralization, trust, and security in Web 3.0. Its features, such as smart contracts, tokenization, and decentralized identity, empower users and pave the way for innovative and secure digital experiences in the next generation of the web. AI is used to analyze user behavior and preferences, enabling personalized content and recommendations in Web 3.0 applications. AI-powered analytics processes vast amounts of decentralized data, extracting valuable insights and improving decision-making.

Edge computing brings computation closer to the data source, reducing latency and improving the performance of decentralized applications. It is particularly relevant for real-time and responsive applications. Integration of AR and VR technologies into the web, providing immersive and interactive experiences. These technologies can be applied in gaming, virtual meetings, and e-commerce.

These advanced technologies collectively contribute to the evolution of the Web 3.0 ecosystem, creating a more decentralized, intelligent, and user-centric internet. The ongoing development and integration of these technologies are driving innovation across various industries and use cases within the Web 3.0 market.

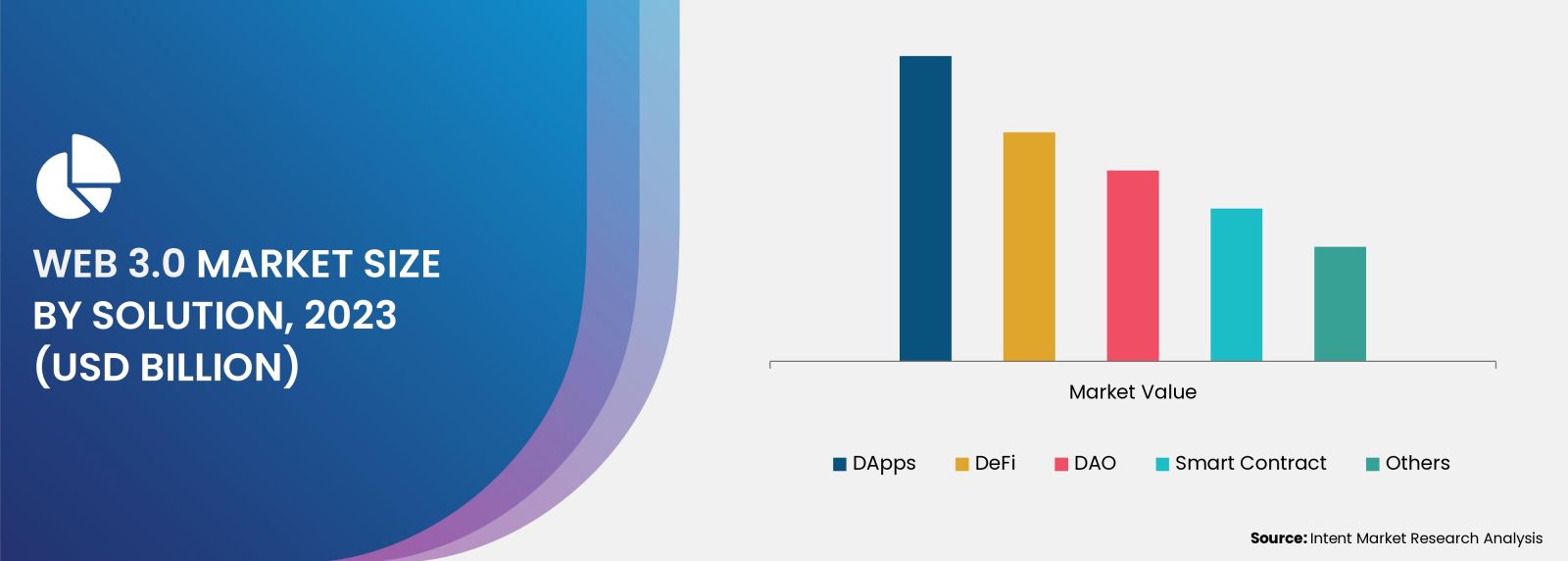

Web 3.0 Market Segment Insights

Shift Towards Decentralized, Open, and Inclusive Financial Systems Promoting DeFi

Decentralized Finance (DeFi) is experiencing significant growth within the context of Web 3.0. DeFi platforms operate on decentralized blockchain networks, aligning with the core principle of reducing reliance on centralized entities. This resonates with the broader decentralization goals of Web 3.0. It also provides permission-less access to financial services, allowing anyone with an internet connection to participate. This inclusivity aligns with the open and accessible nature of Web 3.0.

DeFi relies on smart contracts, which are self-executing contracts with predefined rules. This programmable nature enables automated and trustless financial transactions, contributing to the efficiency and innovation of Web 3.0. It leverages tokenization to represent real-world assets digitally. This aligns with the token economy and the broader concept of representing ownership of assets on blockchain within Web 3.0. DeFi platforms empower users by giving them control over their funds, private keys, and financial decisions. This user-centric control resonates with the broader emphasis on empowering individuals in Web 3.0.

The growth of DeFi within Web 3.0 reflects a shift toward decentralized, open, and inclusive financial systems. As the Web 3.0 ecosystem continues to evolve, DeFi is likely to remain a prominent and transformative force in reshaping traditional finance.

Focus on Decentralization is Driving the Blockchain Technology Adoption

Blockchain technology enables the creation of decentralized networks by distributing data and processing across a network of nodes. This reduces reliance on centralized entities and enhances network resilience. It also provides a secure foundation for decentralized identity solutions, allowing users to have greater control over their digital identities. This aligns with the principles of privacy and user empowerment in Web 3.0.

Smart contracts, powered by blockchain, allow for the creation of self-executing contracts with predefined rules. This automation eliminates the need for intermediaries, streamlining processes and increasing efficiency. It also enables the creation and management of digital tokens, facilitating new economic models within Web 3.0. This includes tokenization of assets, non-fungible tokens (NFTs), and decentralized finance (DeFi) applications.

Blockchain is foundational to the principles of decentralization, trust, and security in Web 3.0. Its features, such as smart contracts, tokenization, and decentralized identity, empower users and pave the way for innovative and secure digital experiences for the next generation of the internet. In 2023, the blockchain technology has recorded significant share in the global Web 3.0 market.

Benefits Offered by Automated Transaction are Driving the Segment Growth

Smart contracts enable the creation of self-executing agreements. These contracts automatically execute predefined rules and conditions, facilitating trustless and automated transactions. Automated transactions align with the decentralization principle of Web 3.0 by reducing reliance on centralized intermediaries. Participants can engage in peer-to-peer transactions without the need for third-party oversight.

Automated transactions streamline processes by removing manual intervention. This leads to faster and more efficient execution of agreements, benefiting industries such as finance, supply chain, and logistics. Considering the benefits offered by automated transactions, a growing number of end-use industries are estimated to adopt it.

Higher Adoption from BFSI, Driving the Market Growth

Web 3.0 technologies are increasingly finding applications in the Banking, Financial Services, and Insurance (BFSI) sector, transforming the way financial transactions, services, and data are managed. Web 3.0 enables decentralized identity solutions, enhancing security and privacy in identity management. Users can have greater control over their data, and Know Your Customer (KYC) processes can be streamlined.

Smart contracts in Web 3.0 facilitate automated claims processing in insurance. Claims can be automatically triggered and executed based on predefined conditions, reducing processing time and improving efficiency. It also streamlines loan agreements, automating the disbursement and repayment processes. This reduces the need for manual paperwork and speeds up loan processing. The adoption of Web 3.0 in BFSI is driven by a demand for increased efficiency, security, transparency, and inclusivity. Increasing adoption of Web 3.0 technology will further boost the BFSI sector over the projected period.

Asia-Pacific to Grow Exponentially in the Coming Years

Asia-Pacific countries are actively pursuing digital transformation initiatives. Governments and businesses are embracing new technologies, including blockchain and decentralized solutions, to enhance efficiency and innovation. The Asia-Pacific region has become a hotbed for FinTech innovation. Countries such as Singapore, Hong Kong, and South Korea are fostering FinTech ecosystems, experimenting with blockchain and decentralized finance (DeFi) applications.

Countries such as China, Japan, South Korea, and Singapore have shown a growing interest in blockchain and cryptocurrencies. These technologies are being explored for various applications, from financial services to supply chain management. Economic growth in countries such as China and India, coupled with a growing middle class, attracts investment in technology and innovation. This includes funding for startups and projects exploring Web 3.0 technologies.

Major Industry Players Are Enhancing their Market Positions by Adopting Several Growth Strategies

Major players operating in the global Web 3.0 market are AMD, Apple, Binance, Block, Ethereum, IBM, Meta, NKN, NVIDIA, and Unity Software, among others. In addition, several prominent start-ups are working in the market. Braintrust, Chainalysis, Chainlink, Coinbase, Consensys, Gemini, Helium, OpenSea, Polygon, and Ripple are the leading start-ups in the Web 3.0 market.

The market is fragmented with the presence of several small, medium and large players operating in the market. Major market players have started adopting strategies such as new product launches, mergers & acquisitions, and partnerships & collaboration to tap the potential market share. Some of the significant developments are mentioned below

- In November 2023, Binance launched Web3 Wallet. It aims to provide an easy, safe, and straightforward way for millions of users to interact with the Web 3.0 universe.

- In July 2023, Hong Kong’s local government announced the formation of the Task Force on Promoting Web 3.0 development, citing the potential benefits to many industries of the low cost and transparency in blockchain technology that underpins the idea of a decentralized internet.

Click here to: Get your custom research report today

Web 3.0 Market Coverage

The report provides key insights into the web 3.0 market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting market growth. It analyses key players as well as the competitive landscape within the global market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 26.3 billion |

|

Forecast Revenue (2030) |

USD 195.7 billion |

|

CAGR (2024-2030) |

33.2% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

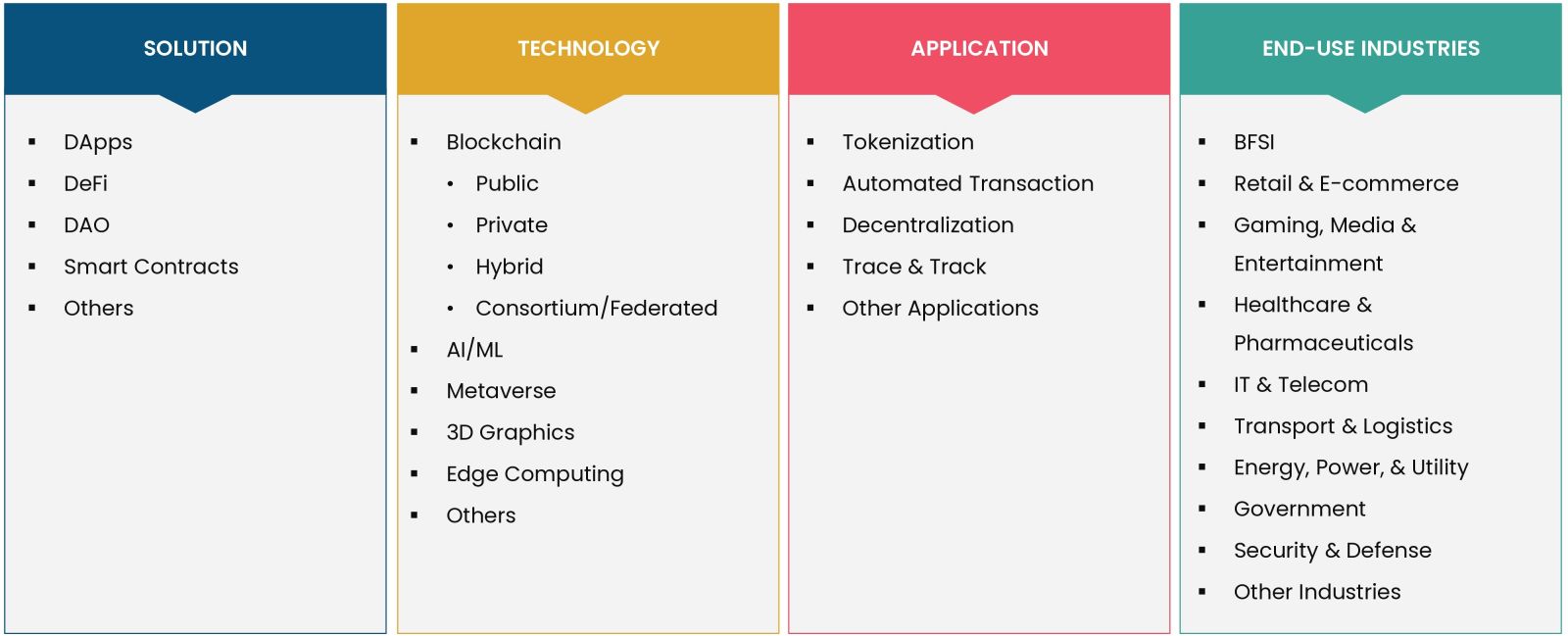

Segments Covered |

By Solution (DApps, DeFi, DAO, Smart Contracts, Others); By Technology (Blockchain (Public, Private, Hybrid, Consortium/Federated), AI/ML, Metaverse, 3D Graphics, Edge Computing, Others); By Application (Tokenization, Automated Transaction, Decentralization, Trace & Track, Other Applications); By End-use Industries (BFSI, Retail & E-commerce, Gaming, Media & Entertainment, Healthcare & Pharmaceuticals, IT & Telecom, Transport & Logistics, Energy, Power, & Utility, Government, Security & Defense, Other Industries) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India, Singapore), Latin America and Middle East & Africa |

|

Competitive Landscape |

AMD, Apple, Binance, Block, Ethereum, IBM, Meta, NKN, NVIDIA, and Unity Software, Braintrust, Chainalysis, Chainlink, Coinbase, Consensys, Gemini, Helium, OpenSea, Polygon and Ripple |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions & Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.Emergence of New Advanced Technologies |

|

4.1.2.Greater Emphasis on Decentralization |

|

4.2.Restraints |

|

4.2.1.Stringent Regulations |

|

4.3.Opportunities |

|

4.3.1.Content Monetization |

|

4.3.2.Greater Transparency Across Industries |

|

4.4.Challenges |

|

4.4.1.Adoption Barriers, User Experience and Education |

|

4.4.2.Scalability |

|

4.5.Trends |

|

4.5.1.NFTs, Digital Assets |

|

4.5.2.AR/VR Integration with Web 3.0 |

|

5.Market Outlook |

|

5.1.Web 3.0 Stack |

|

5.2.Green Web 3.0 |

|

5.3.Web3 Vs. Web 3.0 |

|

5.4.Case Studies |

|

5.5.PORTER’S Five Forces Analysis |

|

5.6.PESTLE Analysis |

|

5.7.Case Studies |

|

6.Market Size by Solution (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.DApps |

|

6.2.DeFi |

|

6.3.DAO |

|

6.4.Smart Contracts |

|

6.5.Others |

|

7.Market Size by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Blockchain |

|

7.1.1.Public |

|

7.1.2.Private |

|

7.1.3.Hybrid |

|

7.1.4.Consortium/Federated |

|

7.2.AI/ML |

|

7.3.Metaverse |

|

7.4.3D Graphics |

|

7.5.Edge Computing |

|

7.6.Others |

|

8.Market Size by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Tokenization |

|

8.2.Automated Transaction |

|

8.3.Decentralization |

|

8.4.Trace & Track |

|

8.5.Other Applications |

|

9.Market Size by End-use Industries (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.BFSI |

|

9.2.Retail & E-commerce |

|

9.3.Gaming, Media & Entertainment |

|

9.4.Healthcare & Pharmaceuticals |

|

9.5.IT & Telecom |

|

9.6.Transport & Logistics |

|

9.7.Energy, Power, & Utility |

|

9.8.Government |

|

9.9.Security & Defense |

|

9.10. Other Industries |

|

10.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1. North America |

|

10.1.1. US |

|

10.1.1.1. US Market Outlook by Solution |

|

10.1.1.2. US Market Outlook by Technology |

|

10.1.1.3. US Market Outlook by Application |

|

10.1.1.4. US Market Outlook by End-use Industries |

|

Note: Similar Cross-segmentation for each country will be covered as shown above |

|

10.1.2. Canada |

|

10.2. Asia-Pacific |

|

10.2.1. China |

|

10.2.2. Japan |

|

10.2.3. South Korea |

|

10.2.4. India |

|

10.2.5. Singapore |

|

10.3. Europe |

|

10.3.1. UK |

|

10.3.2. Germany |

|

10.3.3. France |

|

10.3.4. Italy |

|

10.4. Latin America |

|

10.5. Middle East & Africa |

|

11.Competitive Landscape |

|

11.1. Key Market Growth Strategies |

|

11.2. Company Strategy Analysis |

|

11.3. Competitive Benchmarking |

|

12.Company Profile |

|

12.1. AMD |

|

12.2. Apple |

|

12.3. Binance |

|

12.4. Block |

|

12.5. Ethereum |

|

12.6. IBM |

|

12.7. Meta |

|

12.8. NKN |

|

12.9. NVIDIA |

|

12.10. Unity Software |

|

13.Start-up Analysis |

|

13.1. Braintrust |

|

13.2. Chainalysis |

|

13.3. Chainlink |

|

13.4. Coinbase |

|

13.5. Consensys |

|

13.6. Gemini |

|

13.7. Helium |

|

13.8. OpenSea |

|

13.9. Polygon |

|

13.10. Ripple |

|

14.Appendix |

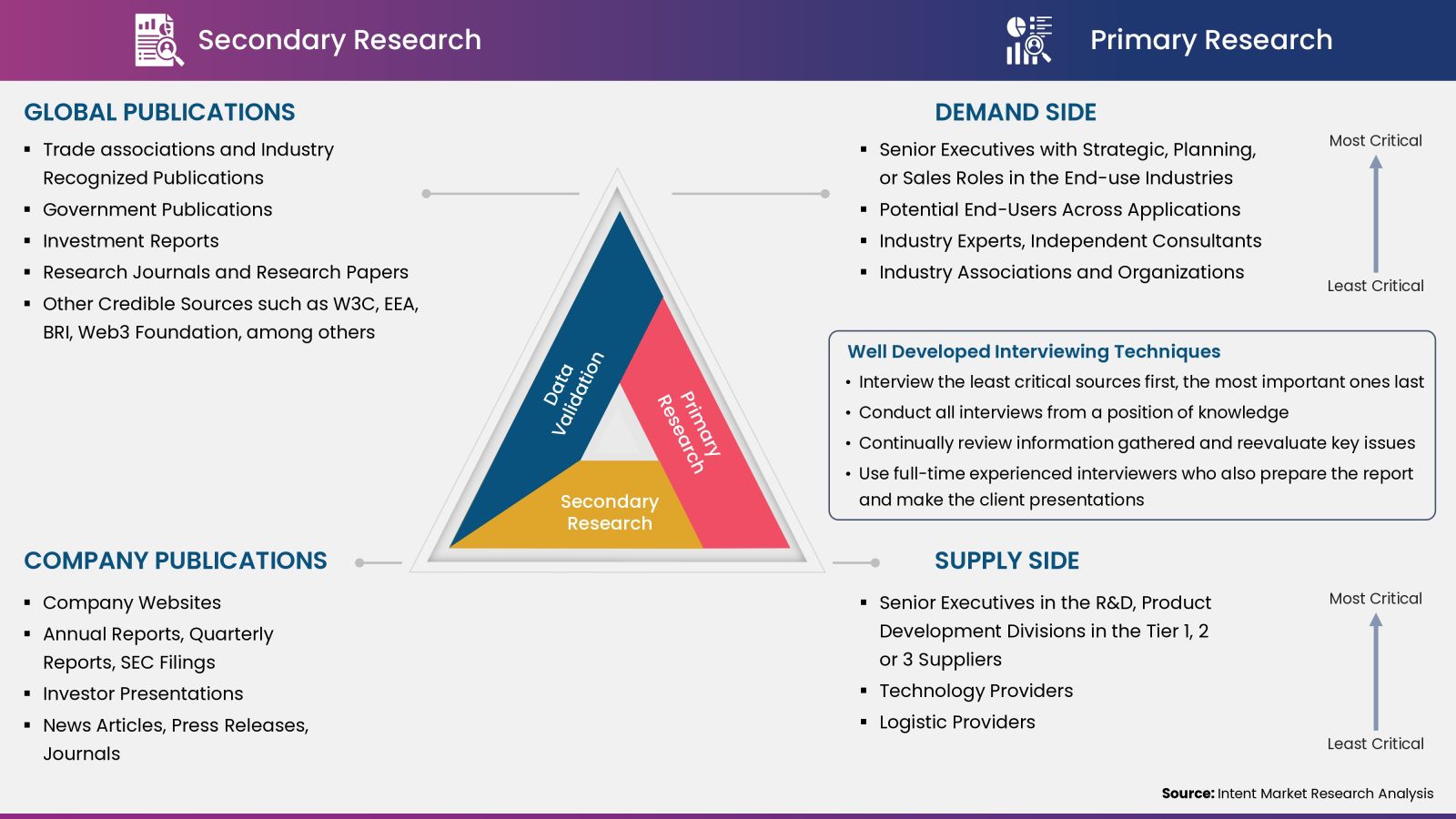

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.