As per Intent Market Research, the Wearable Computing Market was valued at USD 11.3 billion in 2024-e and will surpass USD 32.2 billion by 2030; growing at a CAGR of 19.1% during 2025 - 2030.

The wearable computing market has witnessed substantial growth in recent years, driven by the increasing adoption of smart devices that combine functionality with convenience. These devices, ranging from smartwatches to fitness trackers, have become essential tools for individuals seeking to improve their health, track personal fitness metrics, and stay connected with their digital ecosystem. Technological advancements in sensors, battery life, and wireless connectivity have significantly enhanced the performance of wearables, making them more appealing to consumers across various demographics. Additionally, the integration of AI and machine learning is allowing wearables to offer more personalized and data-driven experiences.

Wearable computing has also found applications in various industries, with healthcare, fitness, and military sectors leading the way. These devices are increasingly being used to monitor health conditions, track physical activities, and provide real-time data to both users and medical professionals. As consumer awareness of wearable technologies grows, and as the demand for connected, personalized devices rises, the wearable computing market is expected to expand further in the coming years.

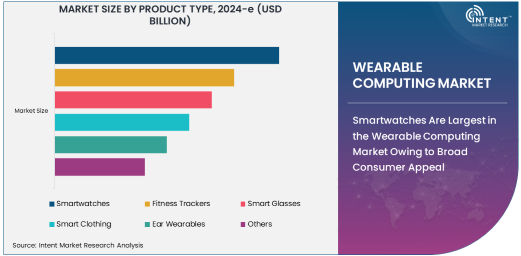

Smartwatches Are Largest in the Wearable Computing Market Owing to Broad Consumer Appeal

Smartwatches are the largest segment within the wearable computing market, owing to their broad consumer appeal and versatility. These devices combine traditional watch functionality with advanced computing capabilities, such as fitness tracking, message notifications, heart rate monitoring, and even health monitoring features like ECG and blood oxygen levels. The popularity of smartwatches is further bolstered by their ability to seamlessly integrate with other smart devices, such as smartphones and tablets, offering a truly connected experience.

The continuous advancements in smartwatch technology, including improved battery life, better sensors, and more sophisticated user interfaces, have contributed to the growing demand for these devices. Leading brands like Apple, Samsung, and Fitbit have solidified their positions in the market by offering smartwatches that cater to both everyday consumers and fitness enthusiasts. This widespread adoption, along with the increasing trend of wearable technology becoming an essential part of daily life, has made smartwatches the dominant product type in the wearable computing market.

Bluetooth Technology Drives Growth in the Wearable Computing Market

Bluetooth technology is a key driver of growth in the wearable computing market, enabling seamless connectivity between wearables and other smart devices. Bluetooth allows wearables to sync with smartphones, tablets, and other devices, facilitating data transfer, remote control functionalities, and interaction with apps and services. The ability to connect wearables with multiple devices has made Bluetooth a core feature in many popular wearable products, including smartwatches, fitness trackers, and smart glasses.

The technology’s power efficiency, ease of use, and broad compatibility with a wide range of devices have further fueled its adoption in the wearable computing sector. As Bluetooth continues to evolve, with newer versions offering greater range, speed, and lower energy consumption, it is expected to remain a dominant connectivity technology, supporting the growing demand for wearables that provide a seamless, interconnected experience.

Healthcare Industry Leads the Way in Wearable Computing Adoption

The healthcare industry is a major end-user of wearable computing devices, with these products increasingly being used for monitoring patient health, tracking vital signs, and providing real-time data to medical professionals. Wearable devices such as smartwatches, fitness trackers, and specialized health wearables are being used to monitor conditions like heart disease, diabetes, and sleep disorders. The ability to collect data continuously and provide immediate feedback has made wearables an indispensable tool for both preventive care and chronic condition management.

As healthcare providers and patients increasingly recognize the value of real-time health monitoring, the demand for wearable computing devices in healthcare is expected to grow. Furthermore, the integration of wearables with telemedicine platforms and electronic health records (EHR) systems is enhancing their utility in clinical settings. The growing shift toward patient-centered care and personalized health solutions is driving the widespread adoption of wearable technologies in healthcare, positioning the sector as a key contributor to the growth of the wearable computing market.

North America Leads the Wearable Computing Market Owing to High Consumer Demand and Technological Advancements

North America is the largest region in the wearable computing market, primarily driven by high consumer demand and technological advancements. The United States, in particular, is home to some of the leading companies in the wearable technology space, including Apple, Fitbit, and Garmin, which have solidified the region’s dominance in the market. The rapid adoption of smartwatches, fitness trackers, and other wearable devices among consumers in North America, coupled with strong retail and e-commerce platforms, has led to increased sales and market penetration.

Additionally, the region benefits from significant investments in wearable technology research and development, with both private companies and government entities working to advance the capabilities of wearables. As the demand for health-focused wearables and smart devices continues to grow, North America is expected to maintain its leading position in the wearable computing market in the coming years.

Leading Companies and Competitive Landscape

The wearable computing market is highly competitive, with several leading companies striving to innovate and capture market share. Companies like Apple, Samsung, Fitbit, Garmin, and Huawei dominate the wearable space, offering a range of devices from smartwatches to fitness trackers and health monitoring tools. These companies are investing heavily in research and development to improve the functionality, design, and user experience of their products, as well as to expand their ecosystems and integrate wearables with other smart technologies.

The competitive landscape also includes a growing number of startups and smaller companies focused on niche applications of wearable computing, such as smart clothing and medical wearables. As the market continues to grow, companies are increasingly focusing on product differentiation, customer experience, and partnerships with other tech firms, healthcare providers, and fitness organizations. The competition within the wearable computing market is expected to intensify, with companies striving to stay ahead of technological trends and consumer demands.

Recent Developments:

- In November 2024, Apple introduced a new line of smartwatches with advanced health monitoring capabilities.

- In October 2024, Garmin launched a new fitness tracker designed specifically for athletes, featuring advanced performance metrics.

- In September 2024, Xiaomi unveiled a smart clothing line that integrates fitness tracking sensors for a personalized experience.

- In August 2024, Huawei announced the release of a new wearable AR device for immersive entertainment experiences.

- In July 2024, Fitbit (Google) launched a new wearable device that combines fitness tracking with AI-driven health insights.

List of Leading Companies:

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Garmin Ltd.

- Fitbit (Google LLC)

- Sony Corporation

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Fossil Group, Inc.

- Nike, Inc.

- LG Electronics Inc.

- Intel Corporation

- Whoop, Inc.

- Oura Health Ltd.

- Amazfit (Huami Corporation)

- Jabra (GN Group)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 11.3 billion |

|

Forecasted Value (2030) |

USD 32.2 billion |

|

CAGR (2025 – 2030) |

19.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wearable Computing Market By Product Type (Smartwatches, Fitness Trackers, Smart Glasses, Smart Clothing, Ear Wearables), By Technology (Bluetooth, Wi-Fi, GPS, Near-Field Communication (NFC)), By End-Use Industry (Healthcare, Fitness and Sports, Consumer Electronics, Retail and E-commerce, Military and Defense) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit (Google LLC), Sony Corporation, Xiaomi Corporation, Huawei Technologies Co., Ltd., Fossil Group, Inc., Nike, Inc., LG Electronics Inc., Intel Corporation, Whoop, Inc., Oura Health Ltd., Amazfit (Huami Corporation), Jabra (GN Group) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wearable Computing Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Smartwatches |

|

4.2. Fitness Trackers |

|

4.3. Smart Glasses |

|

4.4. Smart Clothing |

|

4.5. Ear Wearables |

|

4.6. Others |

|

5. Wearable Computing Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Bluetooth |

|

5.2. Wi-Fi |

|

5.3. GPS |

|

5.4. Near-Field Communication (NFC) |

|

5.5. Others |

|

6. Wearable Computing Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Healthcare |

|

6.2. Fitness and Sports |

|

6.3. Consumer Electronics |

|

6.4. Retail and E-commerce |

|

6.5. Military and Defense |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Wearable Computing Market, by Product Type |

|

7.2.7. North America Wearable Computing Market, by Technology |

|

7.2.8. North America Wearable Computing Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Wearable Computing Market, by Product Type |

|

7.2.9.1.2. US Wearable Computing Market, by Technology |

|

7.2.9.1.3. US Wearable Computing Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Apple Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Samsung Electronics Co., Ltd. |

|

9.3. Garmin Ltd. |

|

9.4. Fitbit (Google LLC) |

|

9.5. Sony Corporation |

|

9.6. Xiaomi Corporation |

|

9.7. Huawei Technologies Co., Ltd. |

|

9.8. Fossil Group, Inc. |

|

9.9. Nike, Inc. |

|

9.10. LG Electronics Inc. |

|

9.11. Intel Corporation |

|

9.12. Whoop, Inc. |

|

9.13. Oura Health Ltd. |

|

9.14. Amazfit (Huami Corporation) |

|

9.15. Jabra (GN Group) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wearable Computing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wearable Computing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wearable Computing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA