As per Intent Market Research, the Wave Energy Converter Market was valued at USD 19.4 million in 2024-e and will surpass USD 26.5 million by 2030; growing at a CAGR of 4.5% during 2025 - 2030.

The wave energy converter market is part of the growing renewable energy sector, aiming to harness the power of ocean waves to generate electricity. As countries seek to diversify their energy sources and reduce dependence on fossil fuels, wave energy has emerged as a promising solution. The market is driven by advancements in technology, government support for clean energy initiatives, and the increasing need for sustainable energy solutions. With various types of wave energy converters and applications, the market is evolving rapidly, attracting both private sector investments and public sector projects worldwide. The segments within the market include product types, technologies, applications, and end-users, each offering unique growth opportunities and challenges.

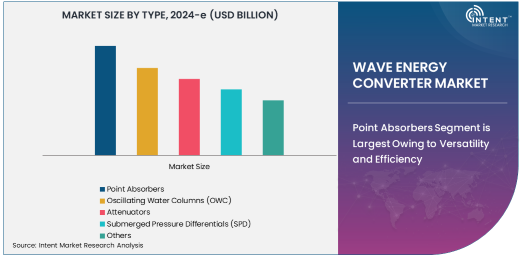

Point Absorbers Segment is Largest Owing to Versatility and Efficiency

Among the product types of wave energy converters, Point Absorbers are the largest subsegment in terms of market share. Point absorbers are buoy-like structures that move with wave motion, capturing energy from multiple directions. They are widely regarded as efficient due to their ability to generate energy from both small and large waves, making them versatile and suitable for deployment in various marine environments. Point absorbers are capable of generating a substantial amount of power with relatively simple and cost-effective designs compared to other wave energy technologies. This has contributed to their widespread adoption across different regions, particularly in countries with favorable coastal conditions for wave energy generation.

In addition to their versatility, point absorbers are also known for their relatively low maintenance and operational costs, further solidifying their position as the leading technology in the wave energy converter market. Companies are increasingly investing in research and development to improve the efficiency and durability of point absorbers, making them even more attractive to energy utilities and investors. As the technology matures, point absorbers are expected to play a significant role in the global energy transition toward renewable resources.

Offshore Wave Energy Converters Grow Rapidly Due to High Energy Potential

In the technology segment, Offshore Wave Energy Converters are the fastest growing due to their high energy generation potential. Offshore wave energy converters are typically deployed in deeper waters, where wave energy is stronger and more consistent. These technologies are capable of capturing large amounts of energy and converting it into electricity, making them ideal for large-scale power generation projects. The offshore environment offers significant advantages over onshore solutions, including the ability to harness more powerful waves and reduce the impact on local ecosystems.

The rapid growth of offshore wave energy is driven by increased investments in marine renewable energy projects, as well as advancements in floating and submerged technologies that allow for more efficient energy capture. As governments and energy utilities focus on offshore wind and wave energy to meet their renewable energy targets, offshore wave energy converters are expected to experience significant growth in the coming years. This growth is supported by collaborations between public and private sectors, as well as technological innovations that enhance the scalability and reliability of offshore systems.

Power Generation Application is Largest Owing to Energy Demand

In terms of application, Power Generation is the largest subsegment, driven by the global demand for clean and sustainable energy sources. Wave energy, with its predictability and high energy density, is increasingly seen as a viable option for generating electricity on a large scale. Power generation from wave energy not only helps reduce reliance on fossil fuels but also contributes to energy security by diversifying the energy mix. Many countries with long coastlines, such as the UK, Portugal, and Japan, have invested heavily in wave energy projects to tap into this renewable resource.

The demand for power generation through wave energy is expected to accelerate as technological advancements improve efficiency and cost-effectiveness. Additionally, supportive policies and incentives from governments around the world, such as feed-in tariffs and renewable energy targets, are fueling the growth of wave energy-based power generation projects. The ability of wave energy systems to operate continuously, unlike intermittent renewable sources such as solar and wind, makes it an attractive option for ensuring a stable and reliable energy supply.

Energy Utilities End-User is Largest Owing to Renewable Energy Focus

Among the end-users, Energy Utilities represent the largest subsegment in the wave energy converter market. Energy utilities are at the forefront of adopting wave energy technologies to diversify their energy portfolios and reduce carbon emissions. As global energy demand continues to rise, utilities are increasingly looking toward renewable energy sources, such as wave energy, to meet sustainability goals. Wave energy offers utilities a stable and continuous power source, making it an attractive alternative to traditional fossil fuel-based generation.

Energy utilities are investing heavily in wave energy projects, driven by the need to meet regulatory requirements and public pressure for cleaner energy solutions. Many utilities are also exploring partnerships with private companies to develop large-scale wave energy farms that can provide electricity to local grids. As the technology matures and becomes more commercially viable, energy utilities are expected to be the primary drivers of market growth.

Europe Leads the Wave Energy Converter Market Owing to Strong Government Support

In terms of region, Europe is the largest market for wave energy converters, owing to its strong government support for renewable energy initiatives. Countries such as the United Kingdom, Portugal, and France have been at the forefront of investing in wave energy technologies, driven by their commitment to reducing carbon emissions and increasing the share of renewables in their energy mix. Europe's favorable marine conditions, such as strong and consistent waves, make it an ideal location for wave energy development.

European governments have been instrumental in promoting the development of wave energy through funding programs, incentives, and favorable regulations. The European Union has set ambitious targets for renewable energy generation, including a significant share from ocean energy sources like waves. As the market continues to grow, Europe is expected to remain the leading region for wave energy deployment, with increasing investments in both offshore and onshore wave energy projects.

Leading Companies and Competitive Landscape in the Wave Energy Converter Market

The wave energy converter market is competitive, with several key players leading the development and commercialization of wave energy technologies. Leading companies in the market include Ocean Power Technologies Inc., Carnegie Clean Energy, AW-Energy, Eco Wave Power, and Seabased AB. These companies are focusing on technological innovations to improve the efficiency, scalability, and cost-effectiveness of wave energy systems. They are also partnering with governments, utilities, and other private sector entities to deploy large-scale wave energy projects.

The competitive landscape is characterized by ongoing research and development efforts, as well as strategic partnerships aimed at accelerating the commercialization of wave energy. As the technology matures and becomes more economically viable, the market is expected to attract more players, increasing competition and driving further innovation. Companies that can overcome technical challenges, reduce costs, and scale their solutions will be well-positioned to capitalize on the growing demand for renewable energy sources.

Recent Developments:

- Ocean Power Technologies Inc. secured a contract for its PB3 PowerBuoy® system, contributing to offshore wave energy conversion in the United States.

- Carnegie Clean Energy announced the successful testing of its wave energy converter prototype off the coast of Australia, demonstrating improved energy conversion efficiency.

- Waves4Power signed a partnership agreement with a leading European energy provider to deploy its innovative wave energy technology for commercial power generation.

- Eco Wave Power received regulatory approval for its wave energy project off the coast of Israel, marking a significant milestone for its commercialization plans.

- Minesto entered into a strategic alliance with a renewable energy consortium to deploy its Deep Green technology for sustainable offshore energy production.

List of Leading Companies:

- Ocean Power Technologies Inc.

- Carnegie Clean Energy

- Waves4Power

- AW-Energy

- Seabased AB

- Pelamis Wave Power

- Eco Wave Power

- Dresser-Rand

- Aquamarine Power

- BARD Engineering

- Cavitus

- Ocean Energy

- Minesto

- Hydro Air

- Wave Rollers

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 19.4 Million |

|

Forecasted Value (2030) |

USD 26.5 Million |

|

CAGR (2025 – 2030) |

4.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wave Energy Converter Market By Type (Point Absorbers, Oscillating Water Columns, Attenuators, Submerged Pressure Differentials), By Technology (Offshore Wave Energy Converters, Onshore Wave Energy Converters, Hybrid Wave Energy Converters), By Application (Power Generation, Desalination, Coastal Protection, Ocean Research), By End-User (Energy Utilities, Industrial Sector, Government & Municipalities, Research & Development) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Ocean Power Technologies Inc., Carnegie Clean Energy, Waves4Power, AW-Energy, Seabased AB, Pelamis Wave Power, Eco Wave Power, Dresser-Rand, Aquamarine Power, BARD Engineering, Cavitus, Ocean Energy, Minesto, Hydro Air, Wave Rollers |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Wave Energy Converter Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Point Absorbers |

|

4.2. Oscillating Water Columns (OWC) |

|

4.3. Attenuators |

|

4.4. Submerged Pressure Differentials (SPD) |

|

4.5. Others |

|

5. Wave Energy Converter Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Offshore Wave Energy Converters |

|

5.2. Onshore Wave Energy Converters |

|

5.3. Hybrid Wave Energy Converters |

|

6. Wave Energy Converter Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Power Generation |

|

6.2. Desalination |

|

6.3. Coastal Protection |

|

6.4. Ocean Research |

|

6.5. Others |

|

7. Wave Energy Converter Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Energy Utilities |

|

7.2. Industrial Sector |

|

7.3. Government & Municipalities |

|

7.4. Research & Development |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Wave Energy Converter Market, by Type |

|

8.2.7. North America Wave Energy Converter Market, by Technology |

|

8.2.8. North America Wave Energy Converter Market, by Application |

|

8.2.9. North America Wave Energy Converter Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Wave Energy Converter Market, by Type |

|

8.2.10.1.2. US Wave Energy Converter Market, by Technology |

|

8.2.10.1.3. US Wave Energy Converter Market, by Application |

|

8.2.10.1.4. US Wave Energy Converter Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Ocean Power Technologies Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Carnegie Clean Energy |

|

10.3. Waves4Power |

|

10.4. AW-Energy |

|

10.5. Seabased AB |

|

10.6. Pelamis Wave Power |

|

10.7. Eco Wave Power |

|

10.8. Dresser-Rand |

|

10.9. Aquamarine Power |

|

10.10. BARD Engineering |

|

10.11. Cavitus |

|

10.12. Ocean Energy |

|

10.13. Minesto |

|

10.14. Hydro Air |

|

10.15. Wave Rollers |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Wave Energy Converter Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Wave Energy Converter Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Wave Energy Converter Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA