Waterproofing Membranes Market By Application (Residential, Commercial, Industrial), By Type (Bituminous Membranes, EPDM Membranes, PVC Membranes, TPO Membranes), By Form (Liquid Membranes, Sheet Membranes), By End-Use Industry (Construction, Infrastructure, Oil & Gas, Mining, Agriculture), and By Region; Global Insights & Forecast (2023 – 2030)

As per Intent Market Research, the Waterproofing Membranes Market was valued at USD 27.2 billion in 2024-e and will surpass USD 49.9 billion by 2030; growing at a CAGR of 9.1% during 2025 - 2030.

The global waterproofing membranes market is witnessing significant growth, driven by the increasing need for building protection, enhanced durability, and moisture control. Waterproofing membranes are integral in safeguarding structures from water damage, which is particularly essential in construction, infrastructure, and industrial applications. These membranes are available in various forms, types, and applications to meet diverse customer needs. Their widespread use is expected to continue growing due to factors like urbanization, climate change, and the growing emphasis on sustainable construction practices. The market is competitive, with numerous established players offering an array of solutions to cater to the rising demand across different sectors.

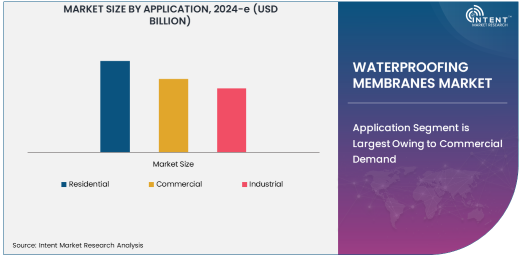

Application Segment is Largest Owing to Commercial Demand

Among the application segments, the commercial sector holds the largest share in the waterproofing membranes market. Commercial buildings, including offices, malls, and hotels, require high-performance waterproofing solutions to ensure structural integrity, enhance durability, and protect against water damage. These buildings often feature large roofs, basements, and foundations, where water ingress can cause substantial issues like mold growth, rust, and weakening of the structure. As commercial construction continues to expand globally, the demand for waterproofing membranes, particularly those that provide reliable and long-lasting protection, remains strong.

The commercial segment’s growth is also supported by increased awareness about the importance of sustainable and energy-efficient building practices. Many commercial projects now incorporate eco-friendly materials and technologies to meet building codes and regulations, including those focused on energy efficiency and environmental impact. As commercial construction activity continues to rise, particularly in emerging markets, the commercial application segment is expected to maintain its position as the largest segment in the waterproofing membranes market.

Type Segment is Fastest Growing Owing to TPO Membranes

In the type segment, TPO membranes are emerging as the fastest-growing subsegment. Thermoplastic Olefin (TPO) membranes are gaining popularity due to their excellent weather resistance, energy efficiency, and environmental benefits. TPO membranes are particularly suitable for roofing applications in both residential and commercial buildings, offering superior protection against ultraviolet rays, ozone, and temperature fluctuations. Their energy-efficient properties also contribute to reducing cooling costs, making them an attractive option for building owners looking to lower energy consumption.

The rapid growth of the TPO segment can be attributed to the increasing demand for sustainable and cost-effective roofing solutions. As building codes and standards become more stringent regarding energy efficiency and environmental impact, TPO membranes offer an optimal solution. Their ability to reflect heat and reduce energy consumption is driving adoption across commercial buildings, particularly in regions with hot climates. With the rising demand for green building solutions, TPO membranes are expected to continue their rapid growth and gain market share in the coming years.

Form Segment is Largest in Sheet Membranes

In the form segment, sheet membranes dominate the market, holding the largest share. Sheet membranes, which are typically pre-manufactured and applied as large sheets to form a continuous waterproof barrier, are preferred in large-scale construction and infrastructure projects. They offer ease of installation and enhanced protection against water infiltration. Sheet membranes are widely used in applications such as foundation walls, basements, and roofs, where long-lasting, durable protection is critical.

The dominance of sheet membranes in the market can be attributed to their robust performance, ease of handling, and quick installation. These membranes are often used in conjunction with other waterproofing solutions to provide a complete waterproofing system. The increasing adoption of sheet membranes in large-scale commercial and infrastructure projects is expected to continue as demand for long-lasting, effective waterproofing solutions grows. Their use in both new construction and renovation projects is anticipated to further fuel their market dominance in the coming years.

End-Use Industry Segment is Fastest Growing in Construction

The construction sector is the fastest-growing end-use industry segment for waterproofing membranes. As urbanization accelerates and construction activity continues to increase globally, the demand for reliable waterproofing solutions in residential, commercial, and mixed-use buildings is on the rise. The construction industry is also increasingly focusing on sustainable building practices and energy-efficient materials, which has further accelerated the demand for high-quality waterproofing membranes that provide long-term protection and contribute to the overall sustainability of the building.

In addition, the construction industry’s growing focus on disaster-resistant structures and climate-resilient buildings has spurred the need for high-performance waterproofing membranes that can withstand extreme weather conditions. With ongoing infrastructure development projects worldwide, the construction industry remains the key driver of demand for waterproofing membranes, solidifying its position as the fastest-growing sector in this market.

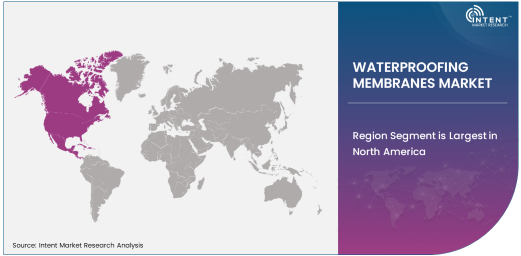

Region Segment is Largest in North America

Regionally, North America holds the largest share of the waterproofing membranes market. This is due to the significant construction activities in the region, along with the strict building codes and regulations that prioritize moisture protection and structural integrity. The United States, in particular, is a major market for waterproofing membranes, driven by the high demand for commercial and residential buildings that require effective waterproofing solutions. The emphasis on sustainability and energy-efficient construction has also contributed to the growing adoption of high-performance waterproofing products in the region.

North America is home to several key players in the waterproofing membranes market, and the region benefits from a well-established construction industry with a focus on innovation and the use of advanced materials. Additionally, the region’s ability to quickly adopt new technologies, such as eco-friendly and energy-efficient membranes, ensures its continued dominance in the market. As building projects continue to rise in the region, North America will remain a key player in the waterproofing membranes market.

Leading Companies and Competitive Landscape

The waterproofing membranes market is highly competitive, with several global companies dominating the landscape. Leading players such as Sika AG, BASF SE, Carlisle Companies Incorporated, Firestone Building Products, and GAF Materials Corporation are continually advancing their product offerings through research and development. These companies focus on providing high-quality waterproofing solutions that meet the evolving demands of sustainability, durability, and energy efficiency. Mergers, acquisitions, and partnerships are common strategies used by these companies to expand their market presence and diversify their product portfolios.

The competitive landscape is also shaped by the presence of regional players who specialize in specific types of membranes or cater to niche markets. To stay competitive, companies are investing in technological innovations, sustainability initiatives, and expanding their distribution networks globally. The focus is not only on product performance but also on offering solutions that align with stricter environmental regulations and building standards. As the market continues to grow, these leading companies are expected to maintain their dominance while also addressing emerging market needs and trends

Recent Developments:

- Sika AG launched an innovative, environmentally friendly waterproofing membrane designed for commercial and residential buildings, focusing on enhanced durability and sustainability.

- BASF SE acquired a leading manufacturer of high-performance waterproofing membranes to expand its product portfolio in the construction sector.

- Carlisle Companies Incorporated introduced a new line of EPDM-based roofing membranes designed to offer superior UV resistance and long-term performance in harsh climates.

- GAF Materials Corporation received regulatory approval for their new TPO roofing membranes, aimed at improving energy efficiency and environmental performance in large-scale commercial buildings.

- Firestone Building Products entered into a strategic partnership with a major international supplier to enhance its distribution network and expand its market presence for waterproofing solutions

List of Leading Companies:

- Sika AG

- BASF SE

- GAF Materials Corporation

- Carlisle Companies Incorporated

- Firestone Building Products

- Johns Manville

- Saint-Gobain Group

- Mapei S.p.A.

- Dow Chemical Company

- IKO Industries Ltd.

- Soprema Inc.

- Owens Corning

- Geberit AG

- Hankuk Rubber Industry Co., Ltd.

- Tegola Canadese S.p.A.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 27.2 Billion |

|

Forecasted Value (2030) |

USD 49.9 Billion |

|

CAGR (2025 – 2030) |

9.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Waterproofing Membranes Market By Application (Residential, Commercial, Industrial), By Type (Bituminous Membranes, EPDM Membranes, PVC Membranes, TPO Membranes), By Form (Liquid Membranes, Sheet Membranes), By End-Use Industry (Construction, Infrastructure, Oil & Gas, Mining, Agriculture) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sika AG, BASF SE, GAF Materials Corporation, Carlisle Companies Incorporated, Firestone Building Products, Johns Manville, Saint-Gobain Group, Mapei S.p.A., Dow Chemical Company, IKO Industries Ltd., Soprema Inc., Owens Corning, Geberit AG, Hankuk Rubber Industry Co., Ltd., Tegola Canadese S.p.A. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Waterproofing Membranes Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Residential |

|

4.2. Commercial |

|

4.3. Industrial |

|

5. Waterproofing Membranes Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Bituminous Membranes |

|

5.2. EPDM Membranes |

|

5.3. PVC Membranes |

|

5.4. TPO Membranes |

|

5.5. Others |

|

6. Waterproofing Membranes Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Liquid Membranes |

|

6.2. Sheet Membranes |

|

7. Waterproofing Membranes Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Construction |

|

7.2. Infrastructure |

|

7.3. Oil & Gas |

|

7.4. Mining |

|

7.5. Agriculture |

|

7.6. Resin-based |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Waterproofing Membranes Market, by Application |

|

8.2.7. North America Waterproofing Membranes Market, by Type |

|

8.2.8. North America Waterproofing Membranes Market, by Form |

|

8.2.9. North America Waterproofing Membranes Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Waterproofing Membranes Market, by Application |

|

8.2.10.1.2. US Waterproofing Membranes Market, by Type |

|

8.2.10.1.3. US Waterproofing Membranes Market, by Form |

|

8.2.10.1.4. US Waterproofing Membranes Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Sika AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. BASF SE |

|

10.3. GAF Materials Corporation |

|

10.4. Carlisle Companies Incorporated |

|

10.5. Firestone Building Products |

|

10.6. Johns Manville |

|

10.7. Saint-Gobain Group |

|

10.8. Mapei S.p.A. |

|

10.9. Dow Chemical Company |

|

10.10. IKO Industries Ltd. |

|

10.11. Soprema Inc. |

|

10.12. Owens Corning |

|

10.13. Geberit AG |

|

10.14. Hankuk Rubber Industry Co., Ltd. |

|

10.15. Tegola Canadese S.p.A. |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Waterproofing Membranes Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Waterproofing Membranes Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Waterproofing Membranes Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats