Waterborne Adhesives Market By Resin Type (Acrylic, Polyurethane, Epoxy, Vinyl Acetate), By End-Use Industry (Packaging, Automotive, Construction, Furniture, Electronics), By Technology (Solvent-Based, Water-Based, Solvent-Free), By Application (Labeling, Bonding, Laminating, Coating, Sealing), and By Region; Global Insights & Forecast (2023 - 2030)

As per Intent Market Research, the Waterborne Adhesives Market was valued at USD 37.8 billion in 2024-e and will surpass USD 83.0 billion by 2030; growing at a CAGR of 14.0% during 2025 - 2030.

The waterborne adhesives market is experiencing significant growth as industries shift toward environmentally friendly and sustainable solutions. These adhesives, which primarily use water as a carrier fluid instead of toxic solvents, offer a safer alternative for both manufacturers and end-users. Driven by growing environmental regulations and consumer demand for green products, waterborne adhesives are widely used in packaging, automotive, construction, and other industries. Their eco-friendly nature and versatile applications are expected to maintain their strong growth trajectory, especially in regions where sustainability is a key focus.

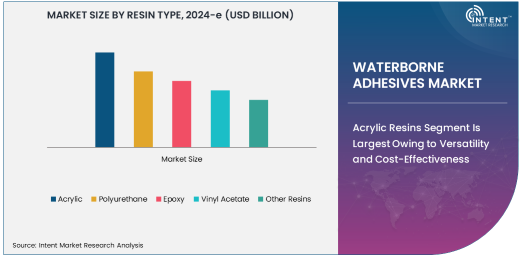

Acrylic Resins Segment Is Largest Owing to Versatility and Cost-Effectiveness

Among the various resin types used in waterborne adhesives, acrylic resins hold the largest market share. Acrylic resins offer excellent adhesive properties, such as strong bonding, clarity, and durability, making them suitable for a wide range of applications. These resins are particularly valued in industries like packaging, automotive, and construction, where performance and cost-effectiveness are crucial. Acrylic-based adhesives are also known for their resistance to UV light and weathering, which makes them highly desirable in outdoor and long-lasting applications. The versatility of acrylic resins in various formulations further supports their dominance in the market.

The application of acrylic resins spans multiple industries, from automotive parts assembly to high-performance packaging solutions. Their ability to bond efficiently with diverse substrates, such as metals, plastics, and composites, has made them a preferred choice across industries. As demand for lightweight, durable materials increases, especially in the automotive sector, acrylic resins are expected to maintain their position as the leading resin type in the waterborne adhesives market.

Packaging Segment Is Largest Owing to Rising Demand for Sustainable Solutions

The packaging industry is the largest end-use industry for waterborne adhesives, driven by the increasing demand for sustainable packaging solutions. As consumers and regulators push for more eco-friendly packaging, waterborne adhesives provide a safer and more sustainable alternative to solvent-based adhesives. Packaging applications require adhesives that are strong, flexible, and resistant to various environmental conditions, all of which waterborne adhesives can provide. The shift towards recyclable and biodegradable materials in packaging is boosting the adoption of waterborne adhesives, which offer low toxicity and a reduced environmental footprint.

The global trend toward reducing plastic waste has intensified the demand for waterborne adhesives in the packaging industry. Manufacturers are also increasingly focused on the recyclability and sustainability of their packaging materials, which aligns with the properties of waterborne adhesives. As regulations around single-use plastics become stricter, the growth of waterborne adhesives in packaging is expected to accelerate, further solidifying their dominance in the market.

Water-Based Technology Is Fastest Growing Owing to Environmental Benefits

Water-based technology is the fastest-growing segment in the waterborne adhesives market due to its significant environmental advantages. Water-based adhesives contain little to no volatile organic compounds (VOCs), making them a safer and more eco-friendly choice for manufacturers and consumers alike. As governments around the world implement stricter environmental regulations, the demand for water-based adhesives continues to rise. They are commonly used in applications such as packaging, labeling, and bonding, where low emissions and high-performance standards are crucial.

The growth of water-based adhesives is also driven by their ability to cater to a wide range of end-use industries, particularly packaging and automotive. The growing awareness of the environmental impact of solvent-based adhesives has accelerated the adoption of water-based alternatives. As sustainability becomes a priority for businesses, water-based adhesives are set to lead the market in the coming years.

Labeling Application Is Largest Owing to Versatility and Ease of Use

Labeling is the largest application segment for waterborne adhesives, owing to the versatility and ease of use these adhesives offer in various labeling processes. Waterborne adhesives are commonly used in the food and beverage, pharmaceuticals, and consumer goods industries, where product labeling is a critical function. These adhesives provide excellent adhesion, clarity, and flexibility, which makes them ideal for both paper and plastic labels. Additionally, they comply with food safety regulations, making them a preferred choice for packaging and labeling in the food industry.

The rise in demand for eco-friendly packaging and labeling solutions is driving the increased use of waterborne adhesives. As the global packaging industry continues to grow, particularly in emerging markets, waterborne adhesives' role in labeling is expected to expand. Their environmental advantages, combined with the ability to meet the high-performance standards required by industries, ensure their continued dominance in this application segment.

North America Is Largest Region Owing to Regulatory Support and Demand for Eco-Friendly Solutions

North America is the largest region for waterborne adhesives, driven by stringent environmental regulations and a high demand for sustainable solutions. The region has implemented several policies aimed at reducing the use of volatile organic compounds (VOCs), which has significantly increased the adoption of waterborne adhesives. Industries such as automotive, packaging, and construction in North America are increasingly turning to waterborne adhesives due to their environmental benefits and superior performance characteristics.

The United States, in particular, leads the region in the adoption of waterborne adhesives, especially within the automotive and packaging industries. With growing consumer awareness about sustainability and the push for green products, the demand for waterborne adhesives in North America is expected to remain strong. The region's robust manufacturing base and regulatory framework supporting eco-friendly products are key drivers of this growth.

Competitive Landscape and Leading Companies

The waterborne adhesives market is highly competitive, with several key players dominating the space. Companies such as 3M, BASF, Henkel, Dow Chemical, and Sika are leading the market, offering a wide range of waterborne adhesive solutions that cater to various industries, including packaging, automotive, and construction. These companies are investing in R&D to develop innovative, high-performance adhesives that meet the growing demand for sustainability and environmental compliance.

Strategic partnerships, acquisitions, and product innovations are common in this market, as companies strive to strengthen their market position. For example, Henkel and BASF have recently expanded their product portfolios to include advanced waterborne adhesives that provide superior bonding and environmental benefits. As the market continues to evolve, these companies will likely focus on developing next-generation adhesives that offer higher performance while minimizing environmental impact.

Recent Developments:

- Henkel announced the launch of a new range of water-based adhesives designed for sustainable packaging solutions. This new product line is aimed at reducing carbon footprints while providing superior bonding for the packaging industry.

- BASF introduced a new line of waterborne adhesives that focus on sustainability for the automotive and construction sectors. The new products are compliant with EU and global regulations on VOC emissions.

- In a strategic move, 3M acquired a waterborne adhesive solutions company to strengthen its position in the packaging and construction industries. The acquisition is expected to expand its product portfolio and market reach.

- Huntsman Corporation launched a next-generation waterborne adhesive technology that is designed for improved performance in electronics and automotive applications, meeting both safety and environmental standards.

- Sika AG has expanded its waterborne adhesive production facility in Europe to meet growing demand in the construction and automotive sectors. The investment supports the company’s sustainability goals by offering low-emission adhesive products.

List of Leading Companies:

- 3M

- BASF SE

- Dow Chemical Company

- Henkel AG & Co. KGaA

- Sika AG

- Arkema Group

- H.B. Fuller Company

- Avery Dennison Corporation

- Wacker Chemie AG

- DSM

- Bostik

- Huntsman Corporation

- RPM International Inc.

- Ashland Inc.

- Mapei S.p.A.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 37.8 Billion |

|

Forecasted Value (2030) |

USD 83.0 Billion |

|

CAGR (2025 – 2030) |

14.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Waterborne Adhesives Market By Resin Type (Acrylic, Polyurethane, Epoxy, Vinyl Acetate), By End-Use Industry (Packaging, Automotive, Construction, Furniture, Electronics), By Technology (Solvent-Based, Water-Based, Solvent-Free), By Application (Labeling, Bonding, Laminating, Coating, Sealing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

3M, BASF SE, Dow Chemical Company, Henkel AG & Co. KGaA, Sika AG, Arkema Group, H.B. Fuller Company, Avery Dennison Corporation, Wacker Chemie AG, DSM, Bostik, Huntsman Corporation, RPM International Inc., Ashland Inc., Mapei S.p.A. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Waterborne Adhesives Market, by Resin Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Acrylic |

|

4.2. Polyurethane |

|

4.3. Epoxy |

|

4.4. Vinyl Acetate |

|

4.5. Other Resins |

|

5. Waterborne Adhesives Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Packaging |

|

5.2. Automotive |

|

5.3. Construction |

|

5.4. Furniture |

|

5.5. Electronics |

|

5.6. Other Industries |

|

6. Waterborne Adhesives Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Solvent-Based |

|

6.2. Water-Based |

|

6.3. Solvent-Free |

|

7. Waterborne Adhesives Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Labeling |

|

7.2. Bonding |

|

7.3. Laminating |

|

7.4. Coating |

|

7.5. Sealing |

|

7.6. Other Applications |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Waterborne Adhesives Market, by Resin Type |

|

8.2.7. North America Waterborne Adhesives Market, by End-Use Industry |

|

8.2.8. North America Waterborne Adhesives Market, by Technology |

|

8.2.9. North America Waterborne Adhesives Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Waterborne Adhesives Market, by Resin Type |

|

8.2.10.1.2. US Waterborne Adhesives Market, by End-Use Industry |

|

8.2.10.1.3. US Waterborne Adhesives Market, by Technology |

|

8.2.10.1.4. US Waterborne Adhesives Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 3M |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. BASF SE |

|

10.3. Dow Chemical Company |

|

10.4. Henkel AG & Co. KGaA |

|

10.5. Sika AG |

|

10.6. Arkema Group |

|

10.7. H.B. Fuller Company |

|

10.8. Avery Dennison Corporation |

|

10.9. Wacker Chemie AG |

|

10.10. DSM |

|

10.11. Bostik |

|

10.12. Huntsman Corporation |

|

10.13. RPM International Inc. |

|

10.14. Ashland Inc. |

|

10.15. Mapei S.p.A. |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Waterborne Adhesives Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Waterborne Adhesives Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Waterborne Adhesives Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats