As per Intent Market Research, the Water Vending Machine Market was valued at USD 1.4 billion in 2024-e and will surpass USD 3.2 billion by 2030; growing at a CAGR of 15.2% during 2025 - 2030.

The water vending machine market is expanding rapidly, driven by increasing demand for clean and convenient drinking water solutions in residential, commercial, and public spaces. Water vending machines are becoming a preferred choice for consumers seeking on-demand access to purified water. These machines utilize advanced filtration and purification technologies such as reverse osmosis (RO) and UV water purification to ensure high-quality water. With rising awareness about water quality and safety, particularly in urban areas and public places, the market is experiencing significant growth. The need for accessible, affordable, and eco-friendly water dispensing solutions is expected to drive the adoption of water vending machines across various segments.

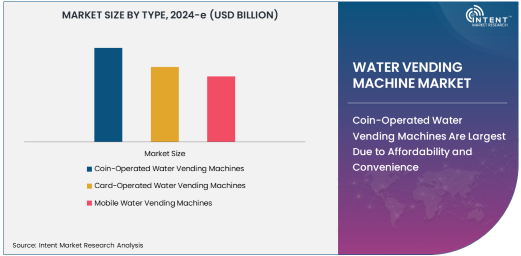

Coin-Operated Water Vending Machines Are Largest Due to Affordability and Convenience

The coin-operated water vending machine segment is the largest in the market, owing to its widespread use in public places such as parks, bus stations, and shopping centers. These machines are popular because they offer an affordable and convenient way for people to access purified drinking water without requiring advanced payment systems or subscriptions.

Coin-operated machines are low-cost, easy to maintain, and simple to operate, making them a practical solution for municipalities and businesses looking to provide accessible drinking water in public areas. With urbanization increasing the demand for public water access, coin-operated machines remain a dominant choice due to their reliability and ease of use.

Card-Operated Water Vending Machines Are Fastest Growing Segment Due to Cashless Transactions

The card-operated water vending machine segment is the fastest-growing due to the rising preference for cashless transactions and the increasing adoption of smart technologies. These machines provide added convenience by allowing users to pay with cards, mobile wallets, or other electronic payment methods. The cashless feature makes them ideal for commercial spaces and busy urban areas where speed and ease of payment are crucial.

As the demand for contactless solutions accelerates, especially post-pandemic, the card-operated segment is gaining momentum. This technology appeals to tech-savvy consumers and businesses looking to modernize their payment systems. Furthermore, card-operated vending machines often come with advanced features like water quality monitoring, enabling real-time data collection and better user experience.

Reverse Osmosis Water Dispensing Technology is Dominant Due to High Purification Efficiency

The reverse osmosis (RO) technology is the dominant water dispensing technology in the market due to its high efficiency in purifying water and removing contaminants. RO water purification systems are capable of filtering out a wide range of impurities, including salts, bacteria, and viruses, ensuring that water dispensed from these machines meets the highest quality standards.

RO technology is commonly used in both commercial and residential settings where water quality is of paramount importance. The growing concern over waterborne diseases and contamination in urban areas is a key factor driving the adoption of RO-based water vending machines. As public health awareness increases, the demand for RO water dispensing solutions is expected to continue its upward trajectory.

Commercial Application is Largest Due to High Demand from Businesses and Offices

The commercial application segment is the largest in the water vending machine market, driven by the need for businesses, offices, and commercial complexes to provide clean and convenient water to employees, customers, and clients. Companies and office buildings are increasingly installing water vending machines to improve employee welfare, meet sustainability goals, and reduce reliance on bottled water.

In addition to workplaces, water vending machines are also popular in malls, restaurants, hotels, and other commercial establishments. The convenience of easily accessible purified water boosts customer satisfaction and promotes eco-friendly initiatives. As commercial establishments continue to prioritize health and sustainability, the commercial application segment will continue to dominate the market.

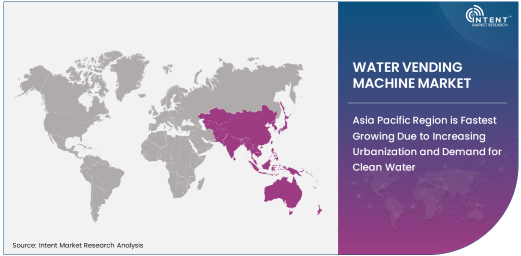

Asia Pacific Region is Fastest Growing Due to Increasing Urbanization and Demand for Clean Water

The Asia Pacific (APAC) region is the fastest-growing market for water vending machines, driven by rapid urbanization, population growth, and rising demand for clean drinking water. Countries like India, China, and Southeast Asian nations are seeing significant infrastructure development, which includes the installation of water vending machines in public spaces, transport hubs, and commercial establishments.

In addition, the increasing concern over water contamination and the need for safe drinking water in developing regions are pushing the demand for water vending solutions. The affordability and convenience offered by water vending machines, particularly in urban centers, make them an attractive option for both consumers and businesses. As these trends continue, APAC is expected to remain the fastest-growing region in the global water vending machine market.

Competitive Landscape

Key players in the water vending machine market include Vending Concepts, Pure Water Vending, Waterlogic, Crystal Clear Water Vending, and Icee Vending. These companies are focusing on innovation, such as integrating advanced purification technologies and cashless payment systems, to cater to the evolving needs of consumers and businesses.

The market is highly competitive, with players constantly developing new features and enhancing the user experience. Companies are also expanding their geographic footprint, especially in emerging markets in Asia Pacific, to tap into the growing demand for clean and accessible drinking water. Strategic partnerships, acquisitions, and collaborations are common strategies among leading companies to strengthen their position in the market.

Recent Developments:

- Waterlogic launched a new card-operated water vending machine with advanced filtration and IoT capabilities.

- Aqua Free expanded its market presence by installing a network of mobile water vending machines in high-traffic areas.

- Culligan International introduced a smart water vending solution to provide real-time water quality monitoring.

- NAYAX partnered with local water providers to introduce cashless payment systems in vending machines.

- Vero Water unveiled a new line of water vending machines with enhanced UV purification for superior water quality.

List of Leading Companies:

- Waterlogic

- Aqua Free

- Culligan International

- Crystal Mountain

- NAYAX

- H2O Vending

- Waterfillz

- Clean Water Vending Inc.

- Vero Water

- Aquafirst

- Cactus Vending

- Aquabest Vending

- PHS Group

- Waterlogic USA

- Pure Water Vending

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.4 Billion |

|

Forecasted Value (2030) |

USD 3.2 Billion |

|

CAGR (2025 – 2030) |

15.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Water Vending Machine Market by Type (Coin-Operated Water Vending Machines, Card-Operated Water Vending Machines, Mobile Water Vending Machines), by Water Dispensing Technology (Reverse Osmosis, UV Water Purification, Filtration Systems), by Application (Residential, Commercial, Public Places) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Waterlogic, Aqua Free, Culligan International, Crystal Mountain, NAYAX, H2O Vending, Clean Water Vending Inc., Vero Water, Aquafirst, Cactus Vending, Aquabest Vending, PHS Group, Pure Water Vending |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Water Vending Machine Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Coin-Operated Water Vending Machines |

|

4.2. Card-Operated Water Vending Machines |

|

4.3. Mobile Water Vending Machines |

|

5. Water Vending Machine Market, by Water Dispensing Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Reverse Osmosis |

|

5.2. UV Water Purification |

|

5.3. Filtration Systems |

|

6. Water Vending Machine Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential |

|

6.2. Commercial |

|

6.3. Public Places |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Water Vending Machine Market, by Type |

|

7.2.7. North America Water Vending Machine Market, by Water Dispensing Technology |

|

7.2.8. North America Water Vending Machine Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Water Vending Machine Market, by Type |

|

7.2.9.1.2. US Water Vending Machine Market, by Water Dispensing Technology |

|

7.2.9.1.3. US Water Vending Machine Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Waterlogic |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Aqua Free |

|

9.3. Culligan International |

|

9.4. Crystal Mountain |

|

9.5. NAYAX |

|

9.6. H2O Vending |

|

9.7. Waterfillz |

|

9.8. Clean Water Vending Inc. |

|

9.9. Vero Water |

|

9.10. Aquafirst |

|

9.11. Cactus Vending |

|

9.12. Aquabest Vending |

|

9.13. PHS Group |

|

9.14. Waterlogic USA |

|

9.15. Pure Water Vending |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Water Vending Machine Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Water Vending Machine Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Water Vending Machine Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA