As per Intent Market Research, the Warehouse Management System Market was valued at USD 3.2 Billion in 2024-e and will surpass USD 9.4 Billion by 2030; growing at a CAGR of 19.5% during 2025 - 2030.

The Warehouse Management System (WMS) market plays a pivotal role in streamlining and optimizing the storage, retrieval, and movement of goods within warehouses. As global supply chains expand, the need for effective inventory control and distribution has driven the adoption of advanced WMS solutions. These systems provide real-time tracking, increased accuracy, and significant cost savings, which are crucial for industries dealing with large volumes of goods. WMS solutions are becoming essential for businesses across sectors, including retail, healthcare, and logistics, to ensure efficient operations and improve customer service levels. With the continued growth of e-commerce and the increasing demand for faster delivery times, the warehouse management system market is projected to grow significantly in the coming years.

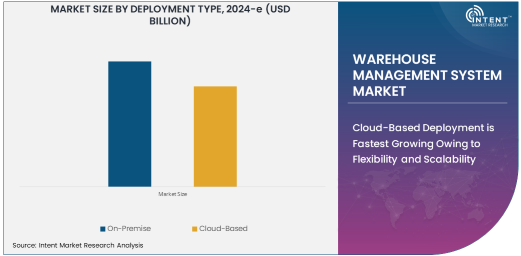

Cloud-Based Deployment is Fastest Growing Owing to Flexibility and Scalability

Cloud-based warehouse management systems are becoming the fastest-growing segment in the WMS market. The primary driver for this growth is the increasing demand for flexibility and scalability that cloud solutions offer. Unlike on-premise systems, cloud-based solutions enable real-time data access from any location, reducing IT overhead costs and improving system updates and maintenance. These systems allow businesses to scale up or down according to their requirements without significant upfront investments. The rapid shift towards digital transformation, combined with the rising adoption of cloud computing across industries, positions cloud-based WMS as a game-changer for modern warehouses.

Inventory Management Functionality is Largest Due to Operational Efficiency

In terms of functionality, inventory management is the largest subsegment within the WMS market. Efficient inventory management is critical for businesses to minimize stockouts, reduce excess inventory, and ensure optimal warehouse operations. As companies strive to maintain lean operations, the ability to track and manage stock in real-time has become indispensable. The integration of WMS with other enterprise systems like Enterprise Resource Planning (ERP) further enhances the effectiveness of inventory management, providing businesses with a comprehensive view of their supply chain. With the increasing focus on operational efficiency and cost reduction, the demand for robust inventory management functionalities continues to rise across all industries.

Retail and E-Commerce End-Use Industry is Largest Due to Expanding Online Shopping

Retail and e-commerce is the largest end-use industry for warehouse management systems. The surge in online shopping has placed immense pressure on retailers to meet consumer demands for faster deliveries. WMS solutions help retailers manage large volumes of inventory, streamline order fulfillment, and ensure timely deliveries. As consumer preferences shift towards online and omni-channel shopping experiences, the demand for advanced WMS in retail and e-commerce is expected to continue to rise. This sector’s rapid growth in the digital space, driven by the increasing use of smartphones and digital payment methods, is propelling the market for WMS solutions tailored to e-commerce fulfillment.

North America is the Largest Region Owing to Technological Advancements

North America holds the largest share of the warehouse management system market, driven by technological advancements and the increasing adoption of automation in logistics and supply chain management. The United States, in particular, has seen significant investments in the development of smart warehouses and the integration of WMS with emerging technologies such as artificial intelligence, the Internet of Things (IoT), and robotics. The presence of major WMS solution providers and the strong retail, automotive, and logistics sectors in the region further contribute to its dominance. North America’s early adoption of cloud-based solutions and warehouse automation continues to drive growth in the WMS market.

Competitive Landscape and Key Players

The Warehouse Management System market is highly competitive, with several key players shaping its growth trajectory. Companies like SAP SE, Oracle Corporation, Manhattan Associates, and Blue Yonder are prominent players in the market, offering a range of cloud-based and on-premise WMS solutions. These companies focus on providing comprehensive, integrated solutions that help businesses optimize inventory, streamline order fulfillment, and improve overall warehouse efficiency. Other notable players, including JDA Software, Infor, and IBM, also contribute to the market’s growth by innovating in areas like artificial intelligence and data analytics. The competition is intensifying as companies continue to enhance their offerings with advanced features such as real-time tracking, predictive analytics, and machine learning, making the WMS market a dynamic and fast-evolving industry.

Recent Developments:

- SAP SE launched a new version of its warehouse management system designed to integrate more seamlessly with IoT-enabled devices and AI for better decision-making.

- Oracle Corporation expanded its cloud-based warehouse management solutions with enhanced automation features, aimed at improving efficiency in e-commerce and retail sectors.

- Manhattan Associates, Inc. unveiled a next-gen WMS platform that incorporates advanced AI and machine learning for smarter inventory management.

- Epicor Software announced the launch of a warehouse management module tailored for the manufacturing industry, enhancing real-time tracking and warehouse performance.

- 3PL Central introduced a new WMS solution that focuses on third-party logistics providers, allowing for better real-time visibility and control over warehouse operations.

- SAP SE, Oracle Corporation, Manhattan Associates, Inc., Infor, Inc., JDA Software Group, Inc., Epicor Software Corporation, IBM Corporation, 3PL Central, Körber AG, Blue Yonder, Hardis Group, Tecsys Inc., Ecomdash, ,

List of Leading Companies:

- SAP SE

- Oracle Corporation

- Manhattan Associates, Inc.

- Infor, Inc.

- JDA Software Group, Inc.

- Epicor Software Corporation

- HighJump Software

- IBM Corporation

- 3PL Central

- Körber AG

- Blue Yonder

- Hardis Group

- Tecsys Inc.

- Systems Limited

- Ecomdash

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.2 Billion |

|

Forecasted Value (2030) |

USD 9.4 Billion |

|

CAGR (2025 – 2030) |

19.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Warehouse Management System Market by Deployment Type (On-Premise, Cloud-Based), by Functionality (Inventory Management, Order Fulfillment, Warehouse Optimization, Labor Management, Shipping and Receiving), by End-Use Industry (Retail and E-Commerce, Manufacturing, Healthcare and Pharmaceuticals, Food and Beverage, Logistics and Third-Party Logistics, Automotive) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

SAP SE, Oracle Corporation, Manhattan Associates, Inc., Infor, Inc., JDA Software Group, Inc., Epicor Software Corporation, IBM Corporation, 3PL Central, Körber AG, Blue Yonder, Hardis Group, Tecsys Inc., Ecomdash |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Under Eye Serum Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Anti-Aging |

|

4.2. Dark Circle Treatment |

|

4.3. Puffiness Reduction |

|

4.4. Hydration |

|

5. Under Eye Serum Market, by Ingredients (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Peptides |

|

5.2. Vitamin C |

|

5.3. Retinol |

|

5.4. Hyaluronic Acid |

|

5.5. Others |

|

6. Under Eye Serum Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Beauty Salons |

|

6.2. Spa & Wellness Centers |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Under Eye Serum Market, by Product Type |

|

7.2.7. North America Under Eye Serum Market, by Ingredients |

|

7.2.8. North America Under Eye Serum Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Under Eye Serum Market, by Product Type |

|

7.2.9.1.2. US Under Eye Serum Market, by Ingredients |

|

7.2.9.1.3. US Under Eye Serum Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Estée Lauder Companies Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. L'Oréal Group |

|

9.3. Shiseido Company, Limited |

|

9.4. Procter & Gamble Co. |

|

9.5. Unilever PLC |

|

9.6. Johnson & Johnson Consumer Inc. |

|

9.7. Beiersdorf AG |

|

9.8. Kiehl's Since 1851 |

|

9.9. Avon Products, Inc. |

|

9.10. Clarins Group |

|

9.11. La Roche-Posay |

|

9.12. Dermalogica |

|

9.13. The Ordinary |

|

9.14. Murad, Inc. |

|

9.15. Olay (Procter & Gamble) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Warehouse Management System Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Warehouse Management System Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Warehouse Management System Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA