As per Intent Market Research, the Vortex Turbine Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 4.4 Billion by 2030; growing at a CAGR of 26.0% during 2025-2030.

The vortex turbine market is witnessing steady growth as industries focus on harnessing renewable energy and improving the efficiency of energy systems. Vortex turbines operate by capturing the energy from fluid flow (wind, water, etc.) and converting it into usable mechanical or electrical energy. These turbines are becoming increasingly popular in diverse applications due to their unique design that allows for efficient energy conversion even in low-flow conditions. The market is driven by the rising demand for sustainable energy solutions, particularly in small-scale and off-grid power generation.

Technological advancements in vortex turbine design, including the development of crossflow, helical, and vertical axis turbines, are playing a crucial role in expanding the market. These innovations aim to optimize energy output while minimizing environmental impact. With the growing focus on sustainable development, vortex turbines are being deployed in a variety of sectors, including renewable energy, wastewater treatment, and marine energy systems.

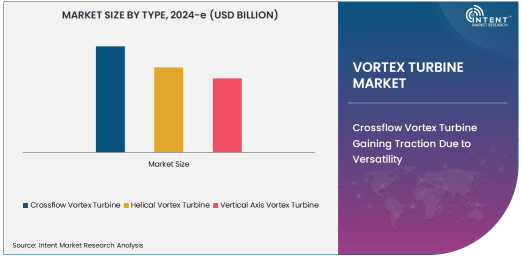

Crossflow Vortex Turbine Gaining Traction Due to Versatility

The crossflow vortex turbine is the largest sub-segment in the vortex turbine market, owing to its versatility and efficiency in various applications. The crossflow turbine's design allows it to operate in low-velocity conditions and with a variety of fluid types, making it suitable for small-scale power generation, water pumping systems, and even wastewater treatment applications. This type of turbine is particularly beneficial in locations with limited water flow or wind speed, where other turbine designs may not be effective.

Its relatively simple structure and ease of maintenance also contribute to its widespread adoption. Crossflow vortex turbines are increasingly being used in both industrial and residential applications, as they offer a cost-effective solution for generating power and optimizing water flow. As the demand for small-scale renewable energy solutions grows, the adoption of crossflow vortex turbines is expected to continue expanding.

Renewable Energy Sector Leads Demand for Vortex Turbines

The renewable energy sector is the primary end-user industry for vortex turbines, particularly in small-scale power generation. With the global shift towards renewable energy sources and the growing need for off-grid power solutions, vortex turbines are being increasingly deployed in remote areas, agricultural settings, and small communities. Their ability to generate electricity from low-flow water or wind makes them ideal for locations where traditional power generation infrastructure is not feasible.

Vortex turbines in the renewable energy sector are utilized for both water-based power generation (such as hydropower) and wind energy conversion. As governments and organizations continue to push for sustainable energy solutions and carbon reduction, vortex turbines are seen as an effective technology to contribute to these goals. Their low environmental footprint and efficient energy conversion capabilities make them a preferred choice for renewable energy projects.

Small-Scale Power Generation Drives Vortex Turbine Adoption

In the small-scale power generation application, vortex turbines are increasingly being used to generate electricity in off-grid locations, particularly in remote or rural areas. Small-scale vortex turbines offer a cost-effective and environmentally friendly solution for providing power to communities and industries that do not have access to centralized electricity grids. These turbines can be used in a variety of settings, including residential homes, agricultural operations, and remote industrial sites, where they can efficiently convert fluid flow into electrical energy.

The growing trend toward distributed energy generation and the increasing need for reliable, off-grid power solutions are expected to drive the demand for vortex turbines in small-scale power generation applications. Their low maintenance requirements, ease of installation, and ability to operate in low-flow conditions make vortex turbines an ideal solution for these purposes.

Low Power Output Vortex Turbines Most Common for Small-Scale Applications

Low power output vortex turbines (below 1 kW) are the most commonly used in small-scale applications, such as residential energy systems and remote power generation. These turbines are well-suited for areas with limited energy needs, where large-scale power generation is not necessary. Low-power vortex turbines are often used in water pumping systems, small hydropower installations, and for charging batteries in off-grid locations.

Their small size, cost-effectiveness, and ability to generate enough power for individual or small community use make them the preferred choice in these applications. As the demand for clean and decentralized energy solutions continues to rise, the adoption of low-power vortex turbines is expected to increase, especially in rural and off-grid regions.

Marine Energy Systems Propel Growth in Vortex Turbines

Marine energy systems are another rapidly growing application for vortex turbines, driven by the increasing interest in offshore renewable energy sources. The use of vortex turbines in marine energy generation is gaining traction due to their ability to capture energy from ocean currents, tides, and waves. Marine environments offer an abundant source of renewable energy, and vortex turbines are well-suited to convert this energy into usable power.

These turbines offer advantages over traditional marine energy generation technologies, such as lower maintenance requirements and the ability to generate power in low-flow environments. As marine energy systems continue to develop, vortex turbines are expected to play a significant role in helping to meet global renewable energy targets, making the marine energy sector a key growth driver for the vortex turbine market.

Stainless Steel Dominates Vortex Turbine Material Choice

Stainless steel is the dominant material used in the manufacturing of vortex turbines due to its durability, resistance to corrosion, and ability to withstand harsh environmental conditions. Vortex turbines are often deployed in outdoor environments, such as rivers, oceans, and industrial settings, where exposure to moisture and chemicals can degrade materials. Stainless steel provides a robust and long-lasting solution, ensuring that vortex turbines remain operational for extended periods with minimal maintenance.

Additionally, stainless steel offers the necessary strength and flexibility to withstand the mechanical stresses associated with fluid flow in turbine applications. As the demand for durable and reliable vortex turbines increases, stainless steel will continue to be the preferred material in the production of these energy-generating devices.

North America Leads Vortex Turbine Market in Renewable Energy Deployment

North America is the largest region for the vortex turbine market, driven by the strong focus on renewable energy and the increasing adoption of small-scale power generation technologies. In the U.S. and Canada, there is a growing emphasis on decentralized energy solutions, particularly in rural and remote areas where access to the centralized grid is limited. Vortex turbines offer an ideal solution for these regions, providing reliable power generation from local fluid resources such as wind or water.

Additionally, the region is home to several key players in the renewable energy industry, which further drives the development and deployment of vortex turbines. As North America continues to invest in renewable energy infrastructure, the vortex turbine market is expected to maintain strong growth, particularly in the small-scale and marine energy sectors.

Competitive Landscape of the Vortex Turbine Market

The vortex turbine market is competitive, with several key players vying for market share through technological innovation, cost-effective solutions, and strategic partnerships. Leading companies in the market include QED Naval Ltd., Verdant Power, and Turbine Technology Services, which focus on developing advanced vortex turbine technologies for renewable energy, marine, and industrial applications. These companies are investing in research and development to enhance the efficiency and reliability of vortex turbines, with a particular emphasis on making the turbines more cost-effective for small-scale power generation.

The competitive landscape is also influenced by the increasing trend toward sustainability and the adoption of green energy technologies, which is prompting both established players and new entrants to explore opportunities in the vortex turbine market. With the demand for renewable energy solutions growing globally, companies that can provide innovative, high-performance vortex turbines for various applications will be well-positioned to succeed in this evolving market.

Recent Developments:

- In December 2024, General Electric Company announced the development of a new vortex turbine for offshore wind energy applications.

- In November 2024, Siemens Gamesa Renewable Energy launched a partnership with marine energy developers to test a new vortex turbine for tidal energy generation.

- In October 2024, Turbine Generation Services LLC secured a contract for the installation of vortex turbines in a small-scale industrial water pumping system.

- In September 2024, Andritz AG unveiled a new vortex turbine design optimized for low-head hydropower applications.

- In August 2024, Acciona S.A. committed to investing in vortex turbine technology for waste-to-energy projects

List of Leading Companies:

- Andritz AG

- Turbine Generation Services LLC

- Siemens Gamesa Renewable Energy

- Nordex SE

- General Electric Company

- Acciona S.A.

- Envision Energy

- Suzlon Energy Limited

- Vestas Wind Systems

- Suzlon Energy Limited

- MHI Vestas Offshore Wind

- GE Renewable Energy

- Sinovel Wind Group

- Siemens Energy

- Siemens AG

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 4.4 Billion |

|

CAGR (2025 – 2030) |

26.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vortex Turbine Market by Type (Crossflow Vortex Turbine, Helical Vortex Turbine, Vertical Axis Vortex Turbine), Material (Stainless Steel, Aluminum, Composite Materials), End-User Industry (Renewable Energy, Wastewater Treatment, Industrial Applications, Marine Energy Systems), Application (Small-Scale Power Generation, Water Pumping Systems, Marine Energy Generation, Wastewater Processing), Power Output (Low Power Output, Medium Power Output, High Power Output) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Andritz AG, Turbine Generation Services LLC, Siemens Gamesa Renewable Energy, Nordex SE, General Electric Company, Acciona S.A., Envision Energy, Suzlon Energy Limited, Vestas Wind Systems, Suzlon Energy Limited, MHI Vestas Offshore Wind, GE Renewable Energy, Sinovel Wind Group, Siemens Energy, Siemens AG |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vortex Turbine Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Crossflow Vortex Turbine |

|

4.2. Helical Vortex Turbine |

|

4.3. Vertical Axis Vortex Turbine |

|

5. Vortex Turbine Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Stainless Steel |

|

5.2. Aluminum |

|

5.3. Composite Materials |

|

6. Vortex Turbine Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Renewable Energy |

|

6.2. Wastewater Treatment |

|

6.3. Industrial Applications |

|

6.4. Marine Energy Systems |

|

7. Vortex Turbine Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Small-Scale Power Generation |

|

7.2. Water Pumping Systems |

|

7.3. Marine Energy Generation |

|

7.4. Wastewater Processing |

|

8. Vortex Turbine Market, by Power Output (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Low Power Output (below 1 kW) |

|

8.2. Medium Power Output (1 kW–10 kW) |

|

8.3. High Power Output (above 10 kW) |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Vortex Turbine Market, by Type |

|

9.2.7. North America Vortex Turbine Market, by Material |

|

9.2.8. North America Vortex Turbine Market, by End-User Industry |

|

9.2.9. North America Vortex Turbine Market, by Application |

|

9.2.10. By Country |

|

9.2.10.1. US |

|

9.2.10.1.1. US Vortex Turbine Market, by Type |

|

9.2.10.1.2. US Vortex Turbine Market, by Material |

|

9.2.10.1.3. US Vortex Turbine Market, by End-User Industry |

|

9.2.10.1.4. US Vortex Turbine Market, by Application |

|

9.2.10.2. Canada |

|

9.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Andritz AG |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Turbine Generation Services LLC |

|

11.3. Siemens Gamesa Renewable Energy |

|

11.4. Nordex SE |

|

11.5. General Electric Company |

|

11.6. Acciona S.A. |

|

11.7. Envision Energy |

|

11.8. Suzlon Energy Limited |

|

11.9. Vestas Wind Systems |

|

11.10. Suzlon Energy Limited |

|

11.11. MHI Vestas Offshore Wind |

|

11.12. GE Renewable Energy |

|

11.13. Sinovel Wind Group |

|

11.14. Siemens Energy |

|

11.15. Siemens AG |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vortex Turbine Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vortex Turbine Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vortex Turbine Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA