As per Intent Market Research, the Voltage Transducer Market was valued at USD 1.9 Billion in 2024-e and will surpass USD 3.5 Billion by 2030; growing at a CAGR of 10.3% during 2025-2030.

The voltage transducer market is growing steadily, driven by the increasing demand for accurate voltage measurement and monitoring across various industries. Voltage transducers are crucial for converting electrical voltages into proportional electrical signals, enabling real-time monitoring, protection, and control of electrical systems. With industries becoming more reliant on automation, efficient power management, and system optimization, the need for accurate and reliable voltage transduction has escalated. The rise in industrialization, advancements in power generation technologies, and the expansion of smart grids are further pushing the market toward innovation.

As electrical systems become more complex, the demand for voltage transducers has evolved, requiring solutions that can handle a wide range of voltage levels while ensuring precise performance. These devices are integral to applications like power metering, voltage monitoring, and electrical system control, contributing to safer, more efficient power systems. Furthermore, increasing awareness around energy conservation and the integration of renewable energy sources is influencing market growth, as voltage transducers play a critical role in system efficiency and grid management.

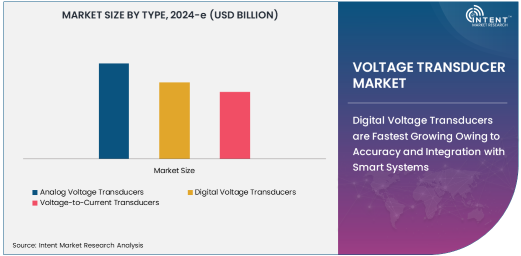

Digital Voltage Transducers are Fastest Growing Owing to Accuracy and Integration with Smart Systems

Among the various types of voltage transducers, digital voltage transducers are experiencing the fastest growth, driven by their high accuracy, integration with smart systems, and ease of use. Digital voltage transducers convert electrical voltages into a digital signal, providing precise voltage measurements with minimal error. Their ability to provide real-time monitoring, paired with enhanced compatibility with modern automation systems and smart grids, makes them increasingly popular in industries such as power generation, industrial automation, and electrical utilities.

These transducers offer several advantages over their analog counterparts, including better signal quality, reduced noise interference, and easier integration with digital control systems. As industries continue to adopt digital technologies and the Internet of Things (IoT) for smarter operations, the demand for digital voltage transducers is expected to grow rapidly. This trend is particularly evident in applications such as voltage monitoring, power metering, and industrial equipment monitoring, where real-time data and high accuracy are critical.

Electrical Utilities Industry is Largest End-User Owing to High Demand for Grid Stability and Monitoring

The electrical utilities industry is the largest end-user of voltage transducers, driven by the increasing need for efficient power generation, distribution, and monitoring. Voltage transducers are essential in ensuring the smooth operation of power grids, providing utilities with accurate measurements of voltage levels to maintain system stability, prevent overloads, and ensure the protection of sensitive equipment. As the demand for electricity continues to rise globally, the role of voltage transducers in grid management and electrical system control becomes more crucial.

Additionally, with the rise of renewable energy sources, electrical utilities require more sophisticated systems to monitor and manage varying power inputs. Voltage transducers enable better integration of renewable energy into the grid by providing real-time data on voltage fluctuations, ensuring the safe and efficient operation of power systems. The need for precise voltage monitoring in electrical utilities is expected to remain strong, making it the largest end-user sector for voltage transducers.

Low Voltage Transducers are Largest Owing to Widespread Use in Consumer Electronics and Industrial Automation

Within the voltage range segment, low voltage transducers hold the largest share due to their widespread use across various applications, particularly in consumer electronics and industrial automation. These transducers are designed to monitor and measure voltages in the low-voltage range (typically below 1,000 volts), which is commonly found in residential and commercial electrical systems, as well as industrial equipment. Their ability to provide accurate voltage measurements in these settings is critical for maintaining system efficiency and preventing damage to electrical components.

The growing demand for energy-efficient solutions in consumer electronics, such as home appliances, smart devices, and electric vehicles, is contributing to the expansion of the low voltage transducer market. Additionally, in industrial automation, low voltage transducers are used to monitor equipment, prevent overcurrent situations, and ensure optimal system performance. As both consumer electronics and industrial automation continue to expand, the need for low voltage transducers will remain robust, ensuring their dominance in the market.

Voltage Monitoring Application is Largest Owing to Critical Role in System Safety and Efficiency

Among the various applications, voltage monitoring is the largest owing to its critical role in ensuring the safety, reliability, and efficiency of electrical systems. Voltage monitoring is essential for detecting abnormal voltage levels, which can indicate potential faults or inefficiencies in electrical systems. In industries such as power generation, electrical utilities, and industrial automation, continuous monitoring of voltage is necessary to prevent damage to equipment, avoid system failures, and optimize power consumption.

Voltage transducers used for voltage monitoring help to maintain stable operating conditions and provide early warnings in case of voltage fluctuations or surges. This is particularly important in industries where system downtime can result in significant financial losses or safety hazards. The growing emphasis on preventive maintenance, system reliability, and energy efficiency ensures that voltage monitoring remains a vital application, driving continued demand for voltage transducers across multiple sectors.

Asia Pacific is Fastest Growing Region Owing to Industrial Growth and Electrification in Emerging Economies

Asia Pacific is the fastest-growing region for the voltage transducer market, fueled by rapid industrialization, increasing power generation capacity, and the ongoing electrification of emerging economies. Countries such as China, India, and Southeast Asian nations are experiencing significant infrastructure development, leading to higher demand for voltage monitoring and control systems. The growing focus on industrial automation, renewable energy integration, and smart grid technologies in this region further boosts the demand for voltage transducers.

Moreover, the increasing adoption of consumer electronics in the region, driven by rising disposable incomes and urbanization, is contributing to the growth of low voltage transducers. As these economies continue to invest in infrastructure and advanced technologies, the demand for precise voltage measurement solutions will only intensify, positioning Asia Pacific as a key growth region in the global voltage transducer market.

Leading Companies and Competitive Landscape

Leading companies in the voltage transducer market include Siemens AG, ABB Ltd., Schneider Electric, Eaton Corporation, and Honeywell International Inc. These companies offer a broad range of voltage transducers, covering various voltage ranges and applications, from industrial automation to electrical utilities. Their product offerings include analog, digital, and voltage-to-current transducers, with a focus on innovation, reliability, and efficiency. Companies are investing in R&D to develop more advanced, energy-efficient voltage transducers that can cater to the evolving needs of industries like power generation, automotive, and consumer electronics.

The competitive landscape of the voltage transducer market is dynamic, with key players competing on the basis of product quality, technological advancements, and customer support. Strategic collaborations, mergers, and acquisitions are common as companies seek to expand their market share and enhance their product portfolios. Furthermore, the growing trend toward digitalization and automation across industries is prompting vendors to focus on providing integrated voltage monitoring and control solutions, ensuring that they remain competitive in a rapidly evolving market.

Recent Developments:

- In December 2024, Siemens AG launched a new line of digital voltage transducers for real-time power monitoring in industrial applications.

- In November 2024, Schneider Electric introduced an advanced voltage-to-current transducer optimized for smart grid applications.

- In October 2024, Honeywell expanded its portfolio with a high-precision voltage transducer for automotive and electric vehicle applications.

- In September 2024, ABB Ltd. unveiled a new series of analog voltage transducers for power generation monitoring.

- In August 2024, Yokogawa Electric introduced a compact voltage transducer for consumer electronics voltage measurement.

List of Leading Companies:

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- Emerson Electric Co.

- Texas Instruments Incorporated

- General Electric Company

- Rishabh Instruments

- Ametek, Inc.

- OsiSense (Schneider Electric)

- Yokogawa Electric Corporation

- Phoenix Contact GmbH & Co. KG

- ABB Ltd.

- Fluke Corporation

- National Instruments Corporation

- Omron Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.9 Billion |

|

Forecasted Value (2030) |

USD 3.5 Billion |

|

CAGR (2025 – 2030) |

10.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Voltage Transducer Market by Type (Analog Voltage Transducers, Digital Voltage Transducers, Voltage-to-Current Transducers), Voltage Range (Low Voltage Transducers, Medium Voltage Transducers, High Voltage Transducers), End-User Industry (Power Generation, Industrial Automation, Electrical Utilities, Automotive, Consumer Electronics), Application (Voltage Monitoring, Power Metering, Overcurrent Protection, Electrical System Control, Industrial Equipment Monitoring) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Schneider Electric SE, Siemens AG, Honeywell International Inc., Emerson Electric Co., Texas Instruments Incorporated, General Electric Company, Rishabh Instruments, Ametek, Inc., OsiSense (Schneider Electric), Yokogawa Electric Corporation, Phoenix Contact GmbH & Co. KG, ABB Ltd., Fluke Corporation, National Instruments Corporation, Omron Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Voltage Transducer Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Analog Voltage Transducers |

|

4.2. Digital Voltage Transducers |

|

4.3. Voltage-to-Current Transducers |

|

5. Voltage Transducer Market, by Voltage Range (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Low Voltage Transducers |

|

5.2. Medium Voltage Transducers |

|

5.3. High Voltage Transducers |

|

6. Voltage Transducer Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Power Generation |

|

6.2. Industrial Automation |

|

6.3. Electrical Utilities |

|

6.4. Automotive |

|

6.5. Consumer Electronics |

|

7. Voltage Transducer Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Voltage Monitoring |

|

7.2. Power Metering |

|

7.3. Overcurrent Protection |

|

7.4. Electrical System Control |

|

7.5. Industrial Equipment Monitoring |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Voltage Transducer Market, by Type |

|

8.2.7. North America Voltage Transducer Market, by Voltage Range |

|

8.2.8. North America Voltage Transducer Market, by End-User Industry |

|

8.2.9. North America Voltage Transducer Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Voltage Transducer Market, by Type |

|

8.2.10.1.2. US Voltage Transducer Market, by Voltage Range |

|

8.2.10.1.3. US Voltage Transducer Market, by End-User Industry |

|

8.2.10.1.4. US Voltage Transducer Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Schneider Electric SE |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Siemens AG |

|

10.3. Honeywell International Inc. |

|

10.4. Emerson Electric Co. |

|

10.5. Texas Instruments Incorporated |

|

10.6. General Electric Company |

|

10.7. Rishabh Instruments |

|

10.8. Ametek, Inc. |

|

10.9. OsiSense (Schneider Electric) |

|

10.10. Yokogawa Electric Corporation |

|

10.11. Phoenix Contact GmbH & Co. KG |

|

10.12. ABB Ltd. |

|

10.13. Fluke Corporation |

|

10.14. National Instruments Corporation |

|

10.15. Omron Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Voltage Transducer Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Voltage Transducer Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Voltage Transducer Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA